Do you have schizophrenia and are looking for life insurance? However, do you feel you are at a dead end because life insurance companies decline you?

Do you have schizophrenia and are looking for life insurance? However, do you feel you are at a dead end because life insurance companies decline you?

Yes, John. I’ve applied and been declined. I don’t know what to do next.

I understand. You’ve come to the right place. We have helped many people with schizophrenia obtain life insurance.

Even to those who have been declined?

Yes, even to those people who have been declined. I am happy to say we have helped many people with schizophrenia obtain life insurance.

However, one major thing to understand is that schizophrenia is a serious mental health condition. Carriers know this and they underwrite your situation accordingly. We will discuss more about this in the article.

First, let’s give an overview of what we will discuss in this article:

- Can People With Schizophrenia Get Life Insurance?

- Your Severity And Life Insurance Coverage Matters

- Underwriting Process For People With Schizophrenia

- How We Administer The Application Process

- 3 Life Insurance Options For People With Schizophrenia

- FAQs About Life Insurance And Schizophrenia

- How We Can Help You Obtain Life Insurance

Let’s answer the question, “Can people with Schizophrenia obtain life insurance?”

Can People With Schizophrenia Obtain Life Insurance?

Yes, people with Schizophrenia can obtain life insurance. The types of life insurance available to them include:

- term life insurance,

- whole life insurance,

- universal life insurance,

- simplified issue policies, and

- guaranteed issue policies

We will discuss all of these options in the article. We have helped people with schizophrenia obtain life insurance in all of these aforementioned plans.

What kinds of life insurance are available to you? That depends on how much coverage you want as well as the severity of your schizophrenia. We discuss this intersection next.

Your Severity Matters To How Much Coverage You Want

Let me first say that if you want life insurance, it won’t be perfect. You have to understand that.

What, John? Other websites say that I can get life insurance easily!

I am aware of that. Unfortunately, those articles tend to misrepresent the underwriting process (which we discuss next). What I mean is that you will generally have to pay higher premiums than someone who doesn’t have schizophrenia. Moreover, depending on the severity of your condition, life insurance companies may limit the type of life insurance available, the death benefit, or some combination of both.

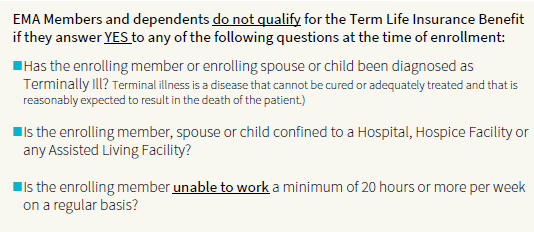

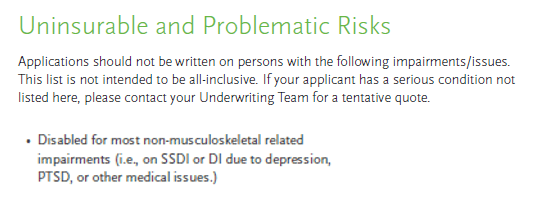

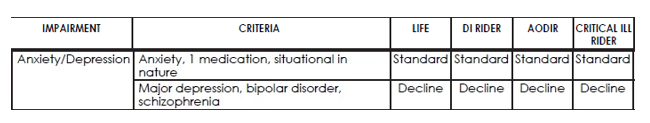

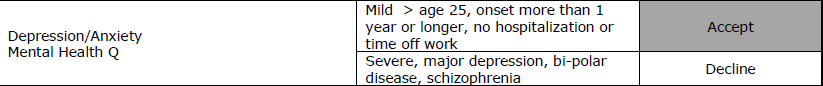

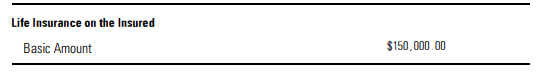

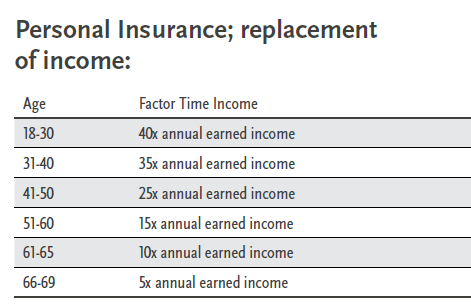

For example, a person on SSDI for schizophrenia will not be able to obtain $500,000 of term life insurance. He or she probably won’t be able to get $100,000 of term life, either. Just look at this real excerpt from an underwriting guide. Schizophrenia is a mental illness and a serious medical condition at that.

However, he or she should be able to get some amount of life insurance, like $25,000 or $50,000. We discuss more in the article.

That is what I mean when I say that life insurance may not be “perfect”. If you have a severe medical history, then life insurance carriers will limit your coverage one way or another. They will increase the life insurance rates, the type of life insurance, the death benefit amount, or some combination.

Now is a really good time to discuss the underwriting process for someone with schizophrenia. Underwriting is the foundation of the life insurance decision process.

Life Insurance Underwriting Process For Someone With Schizophrenia

Many other websites and agents overlook the underwriting process. However, underwriting, hands down, has to be the most important step in this whole process.

Yes, John. I am aware of that. I was declined for life insurance recently.

Yes, John. I am aware of that. I was declined for life insurance recently.

Unfortunately, that is what I hear from many people with schizophrenia. However, as I said before, we can get you life insurance, even if you have been declined before. And, it all has to do with underwriting.

As I mentioned before, you have to understand that, because you have schizophrenia, the life insurance won’t be perfect. Life insurers will adjust your policy one way or another by:

- increasing your life insurance rates (known as table rating),

- limiting your death benefit,

- limiting the type of life insurance available, or

- some combination

You might be asking yourself why they do this. You are healthy every other way, but you have a schizophrenia diagnosis, right? Here is why. While studies vary, they all conclude that people with schizophrenia have a life expectancy of about 15 years less than someone who doesn’t.

Life insurance companies know this. They know the comorbidities associated with schizophrenia, which include potential heart issues, substance abuse, cognitive impairment, etc.

This is a formidable reason why. However, as I said, that doesn’t mean you can’t get life insurance.

One thing to remember is that some carriers simply and automatically decline people with schizophrenia. While you may think that is discriminatory, it isn’t. Carriers that do are just unsure of the risk (i.e. the risk of dying too soon). So, they err on the side of caution and decline applications from people with schizophrenia.

Because the underwriting process is so important to your approval, we will discuss the process in detail and what carriers look for.

What Life Insurance Underwriters Look For In An Application From Someone With Schizophrenia

We are going to discuss in detail what life insurance underwriters look at in an application from someone who has schizophrenia. Note that the information is generalized and not specific to any one particular carrier. Carriers may have additional requirements.

The Severity Of Your Schizophrenia & History Of Mental Illness

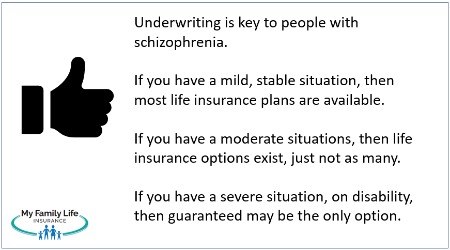

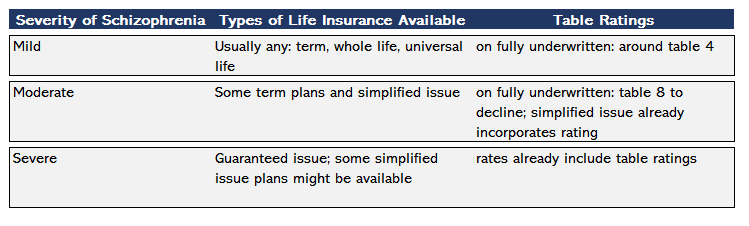

The first thing is that carriers want to know the severity of your schizophrenia. Please reference the graph below. If your schizophrenia is mild, is managed well with a doctor, and has been stable, then you should have many life insurance options available. If it is moderate, then expect fewer options. Additionally, if it is severe, then expect very few life insurance options available.

Guidelines

What is mild, moderate, and severe in terms of schizophrenia? Here is a general guideline:

- Has your medication been stable for the last several years? If yes, then mild. If there have been many changes, then could be a moderate to severe situation.

- Do you routinely see your doctor or psychiatrist for care? If yes, great. Carriers like that. It shows you are dedicated to your care. However, if you do not routinely see your doctor or you do not follow his or her treatment plan, expect a severe situation.

- Have you had any hospitalizations due to your schizophrenia? Favorable underwriting attributes include: your hospitalization (if any) occurred 10 years ago or more, was a one-time event, and hasn’t reoccurred since. If you have had recent hospitalizations and/or suicide attempts, then that is a severe situation.

- Are you gainfully employed? This is huge. You won’t hear this from any other agent or broker. If you are gainfully employed and have been without missing work due to schizophrenia, carriers like that. It shows you can maintain relationships and have the mindset to earn an income. If you are on SSDI due to schizophrenia, we still have life insurance options, but fewer options exist.

- What type of medication are you on? That matters. We discuss that separately next.

- Do you have other mental health issues, like PTSD?

- Can you perform activities of daily living? Does your condition affect your daily life?

Does this give you a good idea of what life insurance underwriters are looking for? Again, if you are in a severe situation, do not worry; we can still get you life insurance.

Carriers will order your medical records from your doctor to gauge your mental health history. Your medical records will confirm the stability and severity of your schizophrenia.

What Medication Are You Taking?

The medication you are taking matters.

Are you taking antipsychotic medication like Clozapine, Haldol, Latuda, etc? If so, the use of antipsychotic medication can lead to lower mortality compared to someone who doesn’t take these kinds of medications. Again, carriers know this, and they will adjust their approval offer accordingly (see above).

Are you taking antipsychotic medication like Clozapine, Haldol, Latuda, etc? If so, the use of antipsychotic medication can lead to lower mortality compared to someone who doesn’t take these kinds of medications. Again, carriers know this, and they will adjust their approval offer accordingly (see above).

However, studies have shown that the use of antipsychotic medication yields longer lifespans for people with schizophrenia and can make a positive impact on their lives. Again, if you are taking antipsychotic medication, stable, and gainfully employed, then carriers generally see that as a mild situation.

If you are only on mood stabilizers like Lamictal, that could be better for underwriting. Same with first-line anxiety and/or depression medication.

Other Health Issues

Life insurers factor in other health conditions to the decision-making / underwriting process. Do you have other mental health disorders? Many times, people with schizophrenia have an overlap of bipolar disorder, anxiety disorder, or depression.

If these situations are also stable with first-line medication treatment, then that is generally a positive for your underwriting outcome.

However, if you have severe anxiety, clinical depression / severe depression, or serious mental illnesses like post-traumatic stress disorder, then carriers may limit your coverage one way or another.

Additionally, other health conditions like substance abuse, sleep apnea, overweight issues, etc. play an important role in the underwriting process.

You must disclose all health conditions, even those conditions you feel are immaterial to your situation. Carriers look up your medical background through the MIB and prescription drug database anyway. Moreover, in your situation, they will order doctor records, so it is better to be truthful upfront about your overall health situation. Often, if you disclose your overall situation and severity upfront, we can get a good estimate of what your underwriting outcome could be. This saves a lot of time and effort for everyone.

Other Issues Material To The Application

Life insurers look at other factors in your application, including:

- your driving history

- any felonies or misdemeanors

- hazardous activities like skydiving

- bankruptcies and credit issues

- smoking, substance abuse, or marijuana use

Again, no matter your situation, we can get you life insurance.

Let’s talk about our application process next.

How We Administer The Life Insurance Application Process

We are a little different than other brokers and agents. First, we have helped many people with schizophrenia obtain life insurance, so we have a good idea of what carriers look for in an application. Second, we don’t like to waste your time. Have you gone through the entire underwriting and application process, only to get declined right at the end of it?

Yes, John. It stunk. I even went through the paramedical with blood and urine tests.

Unfortunately, that is a comment I hear often from my clients with schizophrenia.

Life Insurance Application Process

They went through the entire process, only to get declined. These people could have had a good idea of their estimated underwriting outcome at the beginning of the process.

Here’s how we administer the application process:

#1 Contact us – Please reach out to us either through phone, text, or our contact us link

#2 Tell us your schizophrenia situation – be honest with us and tell us the severity of your schizophrenia, hospitalizations, employment, etc.

#3 Tell us your overall health situation – including other mental disorders, height and weight, etc.

#4 We contact the favorable life insurance carriers on your behalf – if we need to, we will send out a risk assessment to the life insurance companies favorable for people with schizophrenia

#5 Review – we review the estimated premium results with you and discuss the specific underwriting steps

#6 Apply – when you are ready, apply with us

#7 Approval (hopefully) – if you were upfront and honest with your condition and background, you should get approved. Looking back at the people who were unfortunately declined through this process, they either:

- did not disclose other material issues

- misdiagnosed their condition (i.e. said they were mild when the underwriter deemed them moderate or severe after medical records review)

- forgot to mention other issues that they thought were immaterial, but the carrier deemed them important

As I mentioned, it is best to be upfront and honest so we know, going into a potential life insurance application, what the outcome could be.

Now is a good time to discuss the 3 life insurance options for people with schizophrenia.

3 Life Insurance Options Approved For People With Schizophrenia

We will now discuss the 3 life insurance options available for people with schizophrenia. I know other websites tout the “best life insurance” for people with schizophrenia. While favorable carriers exist for people with schizophrenia, there is not one “best”. The best one is the one that approves your application at the best rates available.

Fully Underwritten Life Insurance

If you have a stable situation, are following your doctor’s treatment plan, are gainfully employed, and your schizophrenia has not caused any disruption or disability in your life, then fully underwritten life insurance is available. What is “fully underwritten”? It means that carriers will apply the “full” underwriting process in your situation.

If you have a stable situation, are following your doctor’s treatment plan, are gainfully employed, and your schizophrenia has not caused any disruption or disability in your life, then fully underwritten life insurance is available. What is “fully underwritten”? It means that carriers will apply the “full” underwriting process in your situation.

That means, underwriters will (along with your application):

- review your medical information in the MIB

- confirm medication through the prescription drug database

- order your doctor’s records to confirm the status of your condition

- require a paramedical exam (like a medical examination) with a blood sample and urine sample (i.e. medical underwriting)

- require anything else material to your application like legal databases, driving history, etc.

What types of life insurance qualifies for fully underwritten life insurance? You are eligible for these types:

- term life insurance

- whole life insurance

- universal life insurance like indexed universal life

Because you are going through a complete underwriting process, a fully underwritten process yields the most affordable rates. However, remember, that carriers will likely charge a table rating.

John. Another website said I would be eligible for standard rates!

I’ve seen that, too. While that is possible, it is very improbable. Generally speaking, just being on antipsychotic medication yields a table rating. If you were only taking first-line medication treatment for depression or a mood stabilizer, then a standard rate may be possible. However, it is highly unlikely.

If your situation is stable, then expect a table rating around table 4.

Feel free to check out term life insurance rates here. Just know that the rates you will see will likely be higher because the quoting tool does not adjust for table ratings.

Simplified Issue Life Insurance

Simplified issue life insurance is available for moderate situations. What is simplified issue life insurance? Simply, carriers that offer simplified issue life insurance have removed several components of the underwriting process to make it more “simple”. For example, it is very common for simplified issue carriers to NOT require a paramedical exam with blood and urine tests. Others don’t require an MIB or prescription drug database.

On the one hand, that sounds great. However, on the other, limitations exist. For one, simplified issue plans cost comparatively more than their fully underwritten counterparts. Why? Because fully underwritten plans have detailed underwriting.

Simplified issue life insurance includes whole life insurance with small death benefits like $50,000. These plans are typically known as burial insurance or final expense insurance. They are designed to fund your funeral and leave some money behind for your loved ones.

The Benefit Of Simplified Issue Life Insurance

The benefit of final expense insurance is the application process. It is extremely easy. Most times, you just get on the phone with me. I prequalify you and select a favorable carrier that insures people with schizophrenia. You apply with me over the phone. I fill out the application, which is then emailed to you for your electronic signature. The carrier underwrites the application. If all checks out, the carrier approves your application, and you have life insurance. Moreover, your premium already factors in your health conditions. The process is simple.

John, my friend says he got simplified issue term life insurance. Is that available?

While simplified issue term plans are available, they are likely not available for people with schizophrenia. Simplified issue term plans tend to automatically decline people with serious mental health conditions like bipolar disorder, PTSD, and schizophrenia. Just look at these excerpts from underwriting guides:

As we mentioned, simplified issue plans usually are whole life insurance plans. If you’d like to search rates, feel free to quote below.

Note: fully underwritten term life insurance plans might be available for moderate situations. However, expect a table rating of around 8 or more.

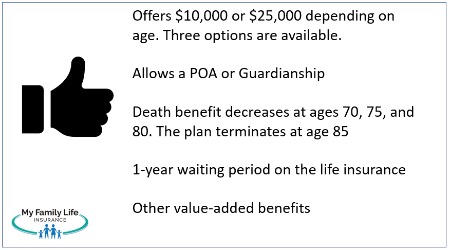

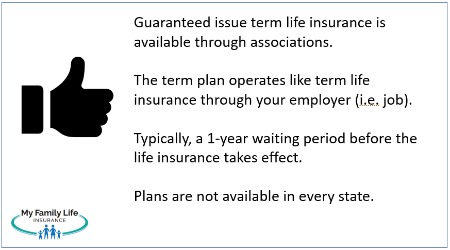

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is available for severe schizophrenia situations. It is simply life insurance without any underwriting. That means the carrier doesn’t look up your medical history or prescription drug usage. It also doesn’t require a paramedical exam or anything like that. You just apply, and you then have life insurance.

While that sounds great, be aware of the following:

- premiums rates are much higher because no underwriting exists. Carriers know people who purchase guaranteed issue life insurance are in serious situations where they don’t qualify for other types of life insurance. They are higher risk, so carriers charge more.

- a waiting period exists. Remember, the carrier doesn’t underwrite. To prevent death benefit payouts on quick deaths, carriers implement a waiting period. The waiting period can be 1 year or 2 years depending on the carrier. If you pass away during this timeframe, carriers will generally pay back the premiums you paid.

We work with both guaranteed issue term life and guaranteed issue whole life. Moreover, we work with a few carriers that offer life insurance for those people under the age of 40.

We offer many guaranteed issue life insurance options, even a term plan that you can self-enroll here.

Feel free to check out the guaranteed issue whole life insurance plans below. Please contact us if you have any questions.

Frequently Asked Questions About Life Insurance And Schizophrenia

We discuss and answer several questions about life insurance for people with schizophrenia.

What Are the Options for Life Insurance for Individuals with Schizophrenia?

The life insurance options for people with schizophrenia depend on the severity of the person’s condition (see our underwriting section above). Generally speaking, the types of life insurance policies available are:

- term life insurance other fully underwritten plans – people with a mild and stable history

- simplified issue life insurance – people with a moderate history and limited stability

- guaranteed issue life insurance – people with a severe history and are disabled on SSDI

We have helped many people with schizophrenia obtain life insurance. Feel free to contact us with any questions.

Can People with Schizophrenia Qualify for Traditional Life Insurance Policies?

Yes, people with a mild condition, healthy lifestyle, and stable history can obtain traditional life insurance policies. Moreover, people with a moderate history can obtain traditional life insurance, but likely at much higher premium rates. Note: carriers will likely charge a higher rate through a table rating.

How Does the Underwriting Process Differ for Individuals with Schizophrenia?

If you want a fully underwritten life insurance policy, expect a complete underwriting process which includes a paramedical exam with blood/urine sample, MIB and prescription drug lookup, doctor records review, etc.

If you want something more simple, then simplified issue and guaranteed issue life insurance plans are available.

What Information is Required During the Application Process?

The information depends on the type of life insurance you want, the death benefit amount, and the severity of your condition.

If you want a fully underwritten life insurance policy with, say, a death benefit of $100,000 or more, then life insurers will want:

- paramedical exam with blood and urine sample

- medical records review

- MIB and prescription drug history lookup

- Application

- Anything else material to the decision like bankruptcies, hazardous hobbies, driving record (etc)

If you want a simple life insurance policy with, say, a $25,000 death benefit, then carriers want:

- the application

- MIB and prescription drug look up (some don’t require that)

- phone interview (not very common anymore)

You can see the simplified issue plans are very “simple” to apply for. However, the double-edged sword is that carriers will only offer $25,000 to $50,000 maximum coverage.

Then, if you don’t want the carrier to look up any of your health history or answer any health questions (some people don’t), we have many guaranteed issue life insurance plans. Just know that guaranteed issue plans come with a waiting period because the carrier does not underwrite.

Can Medication and Treatment History Impact Life Insurance Approval?

Yes. Generally speaking, the prescription of antipsychotic medication will yield a table rating if you want a fully underwritten policy. Taking too much antipsychotic medication could mean a severe situation. Carriers will decline fully underwritten applications in those situations. However, simplified issue and/or guaranteed issue life insurance might be available.

How Do Mental Health Records Affect the Life Insurance Application?

If you apply for a fully underwritten life insurance policy, carriers will always order your mental health records. They do this to confirm the stability of your condition.

As we discussed earlier, simplified issue underwriting won’t obtain your medical records. Moreover, guaranteed issue life insurance has no underwriting, so carriers won’t ask for medical records in those cases as well.

How Does Family Medical History Influence Life Insurance Premiums for Those with Schizophrenia?

Not so much. Having family members or a family history of schizophrenia doesn’t impact the life insurance approval decision. Carriers want to know about your situation. Moreover, most carriers don’t ask about a family history of schizophrenia or mental illness on the application.

Below is a real excerpt from an application. You can see the carrier asks about heart disease, cancer, Huntington’s disease, etc.

Are There Waiting Periods or Restricted Coverage for Individuals with Schizophrenia?

Guaranteed issue life insurance typically has 1 or 2-year waiting periods on their death benefit. Essentially, that means if you pass away during the waiting period, your beneficiaries receive either the premiums you paid back or some percentage of the death benefit. The definition of the waiting period varies depending on the carrier. You will want to understand the waiting period before accepting a plan.

Is Group Life Insurance a Viable Option for Individuals with Schizophrenia?

Yes, if you work and qualify for group life insurance, then that is an option. However, know that group life insurance generally terminates if you lose your job or you move on to a new job. Some group plans allow you to take the life insurance with you for a higher price.

Now You Know The Life Insurance Options Available For People With Schizophrenia

Yes, people with schizophrenia can obtain life insurance. Three life insurance options include:

- fully underwritten life insurance, like term and whole life – for mild, stable, and some moderate cases

- simplified issue life insurance – for moderate situations

- guaranteed issue life insurance – for severe cases and where people do not work / are on SSDI

We discussed how the severity of your schizophrenia matters and the underwriting process.

Do you have any questions or would like to see what life insurance plans are available? Contact us or use the form below.

I know people nowadays are hesitant to reach out to insurance brokers or have brokers contact them. People are afraid of getting 1,000 phone calls and emails a day. It’s annoying!

I feel that way, too. We aren’t like that. We respect your privacy. If you don’t want our help, just tell us that. You can always reach back out to us in the future. Many clients do.

Moreover, we only work in your best interests and place you in a plan that benefits you and your family, not us. If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

Have you heard of life insurance with “living benefits”?

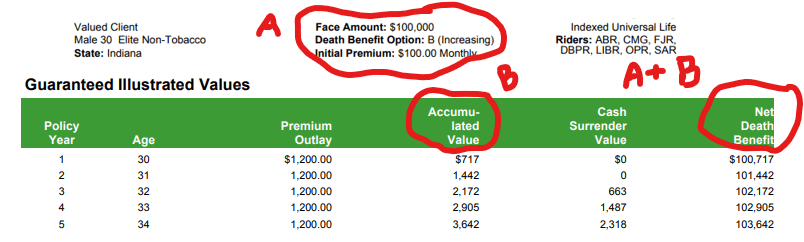

Have you heard of life insurance with “living benefits”? Many people get confused about the face amount of a life insurance policy.

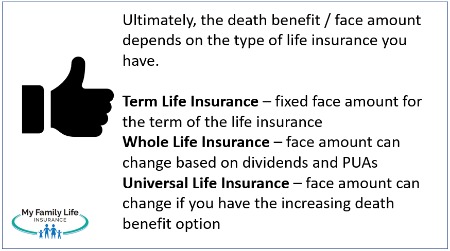

Many people get confused about the face amount of a life insurance policy. A policy’s death benefit or face amount really depends on the type of life insurance you have. The three main types of life insurance include:

A policy’s death benefit or face amount really depends on the type of life insurance you have. The three main types of life insurance include: So, if you have a term life insurance policy with a $1,000,000 death benefit, that is the face amount. If you pass away within the term (let’s say 20 years), then your beneficiary receives $1,000,000.

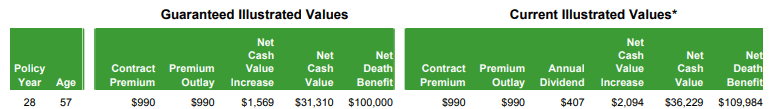

So, if you have a term life insurance policy with a $1,000,000 death benefit, that is the face amount. If you pass away within the term (let’s say 20 years), then your beneficiary receives $1,000,000. Let’s say he passes away at age 57. His beneficiary could potentially receive the $109,984 with a guaranteed face amount of $100,000.

Let’s say he passes away at age 57. His beneficiary could potentially receive the $109,984 with a guaranteed face amount of $100,000. Upon a policyholder’s death, assuming no loans or withdrawals, the policyholder’s beneficiary will receive the death benefit (cash value + face amount).

Upon a policyholder’s death, assuming no loans or withdrawals, the policyholder’s beneficiary will receive the death benefit (cash value + face amount).

Note that the guaranteed issue term life insurance depends on where you live. Not all associations are available in all states.

Note that the guaranteed issue term life insurance depends on where you live. Not all associations are available in all states.

They offer up to $20,000 in term life insurance for a member for a flat $59.95 per month for 1 member.

They offer up to $20,000 in term life insurance for a member for a flat $59.95 per month for 1 member.