Burial Insurance For AIDS Or HIV | We Offer Affordable Guaranteed Issue Life Insurance, Some Less Expensive Compared To Other Agencies

Updated: April 12, 2024 at 9:39 am

If you have AIDS or HIV, you probably think you can’t get burial insurance.

If you have AIDS or HIV, you probably think you can’t get burial insurance.

That isn’t true.

I’m here to tell you if you have AIDS or HIV, you can obtain burial insurance.

Moreover, rather easily, too!

I’ll first start off and say that advances in medical treatment mean that people who follow treatment plans can live a normal life.

However, many carriers will still decline burial insurance applications from people who have AIDS, HIV, or ARC (AIDS-related complex).

You can still obtain burial insurance, though. You just have to know how and where.

In this article, we discuss burial insurance for people with AIDS or HIV. Here’s what we will discuss:

- Brief Introduction: What Is Burial Insurance

- Burial Insurance Underwriting

- A Couple Of Burial Insurance Options Available

- Cost Of Burial Insurance

- How To Apply

- Now You Know You Can Obtain Burial Insurance

Let’s jump in and discuss what is burial insurance.

What Is Burial Insurance

We receive phone calls from people wanting burial insurance. However, they usually have some type of misunderstanding on what is burial insurance.

Here’s a secret.

Burial insurance is simply life insurance.

What, John?

Yes, burial insurance is a life insurance policy, typically whole life insurance, with a small death benefit like $25,000.

The intention of “burial insurance” is to pay off your funeral, burial, and other final expenses.

Hence, the name. Sometimes carriers and agents call it:

- Final expense insurance

- Funeral insurance

- End-of-life insurance

- Cremation insurance

These all mean the same thing: a life insurance policy that pays for your funeral and final expenses. Additionally, you can leave some money for your loved ones.

John, then why don’t I just set up a plan with the funeral home?

You really don’t want to do that if you can help it.

You see, if you buy burial insurance, you’ve already completed your funeral plan.

Let’s say you have a $25,000 policy that costs $50 per month. You could die 3 years from now (36 months), paid $1,800 ($50 X 36) and the carrier pays the $25,000.

Contrast this with a plan made directly with the funeral home…you may have paid up to $1,800 and then your loved ones have to pay the rest.

With burial insurance, you are in control. The death benefit pays for your funeral.

How great is that?

Moreover, as mentioned, you are in control. You can go to any funeral home in the US and set up your funeral.

With a plan tied directly to a funeral home, you typically have to be buried through them.

Burial Insurance Underwriting For People With AIDS Or HIV

Before we get into the burial insurance options for people with AIDS or HIV, let’s talk about underwriting.

Underwriting for burial insurance is much different than that for term life insurance, IUL, and even large-case whole life insurance.

If you need term life insurance, there are a handful of carriers that will provide term life insurance for someone with HIV. These carriers are going to want paramedical exams, doctor records, and other things. They are going to want to know your CD4 and viral count. Additionally, they will want to know if you have other underlying health issues.

Getting burial insurance isn’t like that. (If you have an interest in term life insurance, please contact us.)

With burial insurance, you just fill out an application. There are no health exams or doctor records.

You just fill out an application with us over the phone.

A couple of available plans look up your medical claim history through the MIB and your prescription drug history.

Now is a good time to discuss the types of burial insurance available to people with HIV or AIDS. It’ll help you understand burial insurance underwriting in more detail.

Types Of Burial Insurance Available For People With AIDS Or HIV

Types Of Burial Insurance Available For People With AIDS Or HIV

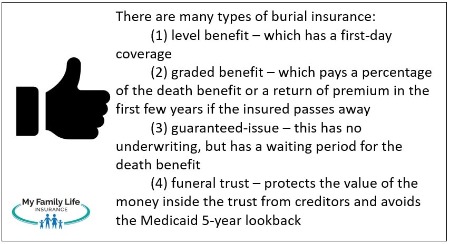

A few types of burial insurance exist. However, people with AIDS or HIV can only get “graded benefit” or guaranteed issue burial insurance. Nearly all carriers ask about HIV or AIDS on their application. Most carriers will decline applications if you have HIV or AIDS.

Most, but, not all.

Graded benefit or guaranteed issue means there is a waiting period on 100% of the death benefit.

It means if you pass away via illness or natural causes during the waiting period (usually 2 or 3 years, varies by carrier), your beneficiaries receive the money you paid + interest (or some percentage of the death benefit).

If you pass away via accident, the carrier pays the death benefit 100% (i.e. in full), even if you pass away during the waiting period.

John, I don’t want a waiting period!

Well, no one does. But, what would you do instead?

I don’t know…just work directly with a funeral home.

We already discussed that isn’t the best option. You pass away and then you are no better than if you just purchased the life insurance in the first place.

Well, I’ll just save.

If you buy life insurance, you are already saving. If you pass within the waiting period, then your beneficiary/loved ones receive the money you paid through that point or some percentage of the death benefit.

Moreover, be honest. Are you really going to save? I doubt it.

So, you see, all decisions point to purchasing burial insurance.

Burial Insurance Options For People With AIDS Or HIV

As mentioned, there are two types of burial insurance for people with AIDS or HIV.

Let’s get more into the specifics.

First, there is guaranteed-issue life insurance coverage available. This means just as it sounds: you automatically receive coverage. Just fill out an application and answer a few non-health questions. The carrier does not run your background through the MIB or prescription drug history.

Guaranteed-issue coverage contains a waiting period, usually 2 years. We work with a few different guaranteed-issue carriers. Eligible application ages range from 0 – 90, which means children and young adults are eligible (based on state availability). (Related: see guaranteed issue life insurance for people under the age of 40.)

Guaranteed-issue coverage contains a waiting period, usually 2 years. We work with a few different guaranteed-issue carriers. Eligible application ages range from 0 – 90, which means children and young adults are eligible (based on state availability). (Related: see guaranteed issue life insurance for people under the age of 40.)

There are some other burial insurance options. As we mentioned, a couple of carriers offer graded benefit burial insurance. Graded benefit means your beneficiaries receive a percentage of the death benefit if you pass away during the waiting period.

For example, let’s say a carrier has a graded benefit of 10% of the death benefit in the first year, 70% in the second year, and 100% in the 3rd year.

You purchase a $10,000 policy. Here’s what your beneficiaries receive if you pass way in the:

1st year: $1,000

2nd year: $7,000

3rd year and beyond: $10,000

Here is the kicker: sometimes, the cost of the guaranteed-issue life insurance coverage is less than that of a traditional graded benefit policy!

Here at My Family Life Insurance, we always work in your best interests.

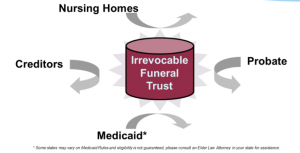

A Funeral Trust Can Work, Too

Here is another type of burial insurance for people with AIDS or HIV. We also utilize a funeral trust.

Funeral trusts pay the death benefit directly to the funeral home. More importantly, they protect your policy from the Medicaid spend-down process. That is right. Whole life insurance, including burial insurance in most cases, is a spendable asset for Medicaid since it contains cash value. That means if you need to go into a nursing home, Medicaid will force you to terminate your life insurance policy and use the cash value for your nursing home care. If that happens, you have lost the initial intention of the life insurance.

importantly, they protect your policy from the Medicaid spend-down process. That is right. Whole life insurance, including burial insurance in most cases, is a spendable asset for Medicaid since it contains cash value. That means if you need to go into a nursing home, Medicaid will force you to terminate your life insurance policy and use the cash value for your nursing home care. If that happens, you have lost the initial intention of the life insurance.

We don’t let our clients get to that point. We expedite the transfer of the cash value into the funeral trust. The trust protects that money from the Medicaid spend-down process.

A funeral trust can work well if you have disposable income available of money in an existing annuity, life insurance policy, CD, savings account, or a non-qualified brokerage account. Medicaid considers all of these savings mechanisms as spendable assets.

Cost Of Burial Insurance For People With AIDS Or HIV

There is no reason that you have to pay an arm and a leg for burial insurance. Even if you have additional health complications, we can likely find a policy that will meet your needs and budget.

We mentioned there are a few “graded benefit” carriers available. Other agents and agencies will say that only guaranteed issue life insurance is available for people with HIV or AIDS. That is not true.

We work with a couple of graded benefit carriers that do not ask questions if you have AIDS or HIV.

One plan available is a graded benefit whole-life plan. You can purchase up to $25,000. Also, people between the ages of 18 and 85 can apply. This is a nice option for young adults.

A $25,000 policy on a 30-year old female currently costs $40.27 per month, so not bad at all.

We also work with a graded term policy that is designed to provide coverage up to age 100.

It is only available for people between the ages of 40 and 80.

A $30,000 policy on a 40-year-old woman costs about $97 per month.

Of course, this is all subject to state availability, and premiums are subject to change anytime.

Guaranteed Issue Whole Life Insurance

Guaranteed issue life insurance is the more commonly available burial insurance for people with AIDS or HIV.

Again, you just apply and then you have burial insurance.

Note the waiting period we discussed earlier.

Nearly all guaranteed issue life insurance is whole life insurance. Although, we do work with a guaranteed issue term carrier (more on that in a minute).

Every agency or agent offers some type of guaranteed issue life insurance.

But, we offer many other options.

The main differentiating factor of guaranteed issue whole life insurance is price.

As mentioned, we offer many other options versus other agents and agencies.

For example, for a 52-year-old woman with HIV, $25,000 will cost:

- $84.68 per month with us

- And, $96.25 with them.

You can search the quoter below to get an idea of guaranteed issue whole life insurance.

Just select “poor health” in the health status field, and the quotes will populate.

Remember to contact us if:

- You want guaranteed whole life insurance for someone under the age of 40

- You want more than 1 policy (we typically stack policies for our clients)

Guaranteed Issue Term Life Insurance

Guaranteed issue term life insurance is also available. We are one of the few brokers offering guaranteed issue term life insurance.

The plan is through an association.

The plan is through an association.

You can self-enroll here (subject to state availability).

People 18 and over can apply.

Here’s one thing that is different compared to guaranteed issue whole life insurance. The premium rates on guaranteed issue term increase as you enter age bands. With this particular plan, the rates are fixed for 5 years upon enrollment. Then, the cost will change depending on your age and the corresponding age band.

For example, you buy $20,000 of the guaranteed issue term. You are 42 years old. The current rate is $40 per month. In the age band of 45 to 54, the rate is $55 per month. Because the plan fixes the premium for 5 years, you pay $40 through age 46. After the 5th year, at age 47, the premium increases to $55 per month until age 54. At age 55, you’ll pay whatever is the going rate for that age band.

Hopefully, this makes sense.

You can purchase between $10,000 and $50,000. We have helped many individuals with this guaranteed issue term life insurance. If you have any questions, I recommend contacting us first.

How To Apply

Applying for burial insurance if you have AIDS or HIV is easy.

You just:

(1) Contact us

(2) Tell us your health conditions

(3) We analyze your options

(4) You apply

(5) You are approved

It is really that simple.

Now You Know How People With HIV Or AIDS Can Obtain Burial Insurance

We hope you found this article informative. You can obtain burial insurance if you have AIDS, HIV, or ARC.

Are you ready to get started? Feel free to contact us or use the form below.

We can find the right coverage for you. As with everything we do, we work with your best interests at all times. That means if there is a better option for you than what we can provide, we will help put you in touch with someone who can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".