4 Life Insurance Options For People With Substance Abuse (Drug & Alcohol Abuse) | We Discuss Available Plans And Estimated Costs

Updated: April 12, 2024 at 9:39 am

If you’ve struggled with substance abuse, you probably think you can’t get life insurance.

If you’ve struggled with substance abuse, you probably think you can’t get life insurance.

Thankfully, that is not true.

That’s right. If you have struggled with substance abuse – that is, drug or alcohol abuse – you can obtain life insurance.

Of course, obtaining life insurance will likely be more difficult. That’s true. We discuss that in more detail later in the article.

But, you can get it. Your options depend on your specific situation.

The best part, though, is that you probably won’t get denied by working with us. Even if you’ve been declined, we can likely get you life insurance.

In this article, we discuss 4 life options for people who have a history of substance abuse.

Specifically, we will discuss:

- Why Is It Hard To Obtain Life Insurance?

- How Carriers Underwrite Substance Abuse

- 4 Life Insurance Options Available

- Case Studies Where We Have Helped

- FAQs About Substance Abuse

- Final Thoughts About Life Insurance

Let’s jump in and discuss why it is hard for people with substance abuse to obtain life insurance.

Why Is It Hard (But Possible) For People With Substance Abuse To Obtain Life Insurance

The reason boils down to one word: risk.

If you have a history of substance abuse, you present a higher risk to the life insurance carrier.

Risk, in this context, is the risk of passing away sooner than expected for your demographic.

For example, a healthy, African American 35-year-old female might have a life expectancy of 87.

However, if she experiences substance abuse, her life expectancy might drop to age 70.

So, carriers adjust for this risk.

They adjust by assigning a table rating. Table ratings increase your premium to offset this risk. If you’ve had a history of substance abuse, expect a table rating.

Table ratings aren’t a bad thing. Sure, your premiums are higher compared to those in your demographic. However, life insurance is still available. You’ll just pay a higher amount.

So, it’s not hard per se. What is hard is that you will pay a higher amount.

Well, John, I am just going to lie on the application.

Yeah, I know what you are thinking. The carrier can’t find out, right?

Wrong. It is nearly impossible nowadays to fool a life insurance carrier.

When you apply and sign the application, you give the carrier the right to review your:

- MIB file

- Prescription drug history

- Driving records

- Public records

- Other databases and records

So, if you had a DUI, the carrier would know.

If you were arrested for drug possession, the carrier will know.

They will know, so it is best to be honest with us and on the application. It’ll save a lot of time for everyone and avoid a hard discussion later.

Moreover, lying on a life insurance application is fraud. Carriers take deliberate misinformation seriously.

How Life Insurance Carriers Underwrite Substance Abuse

What we touched on in the previous section is underwriting. The underwriting process assesses your specific situation and risk. The carrier then decides to accept your application or deny it.

Being upfront and honest saves time for everyone. We ask for an underwriting assessment from the carriers. They will then tell us if they can accept an application with an estimated table rating.

Again, generally speaking, expect a rating from the carrier. Carriers know that a history of substance abuse can lead to lower mortality. Carriers know this, and this is why they apply a table rating.

When it comes to substance abuse, we are talking about:

- Alcohol abuse

- Marijuana

- Hard, illicit drugs like opioids, barbiturates, cocaine, etc.

Let’s jump into the specifics.

Specific Questions About Substance Abuse

If you have a history of substance abuse, carriers will want to know:

- If you’ve had alcohol abuse, drug abuse, or both?

- Any current use of alcohol or drugs

- Dates of past abuse

- Are you a current member, or have you been a member, of AA, NA, or another support group?

- Have you had any DUIs, arrests, or convictions during the last 10 years?

- Results of your last liver function test

- Are you presently taking Antabuse, suboxone, or another medication to control drug use?

- Are you or have you had a history of opiates/narcotics?

- Any hospitalizations related to substance abuse?

- Have you ever been arrested?

- Do you have any DUI/DWIs?

- Are you working full-time in gainful employment?

- Are you married?

- What medication are you currently on?

- Do you have other health conditions or co-morbidities?

- Have you applied for life insurance before? If so, when and what was the result?

They take all this information and then decide if they should offer you coverage or not.

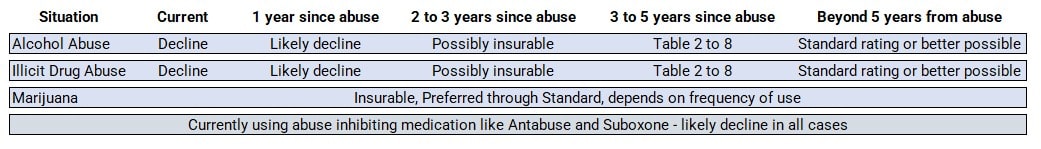

Here’s a snapshot of how carriers may underwrite your application, based on your substance abuse history. Please note that this is only a guide; your application is on a case-by-case basis.

You can see, generally speaking, that carriers will accept an application 2 to 3 years after your substance abuse.

You can see, generally speaking, that carriers will accept an application 2 to 3 years after your substance abuse.

Carriers nowadays are more relaxed when it comes to life insurance and marijuana use. If you use marijuana, contact us so we can give you your options.

However, as we said before, getting life insurance for someone with past substance abuse, like drugs or alcohol, is on a case-by-case basis. The best thing to do is contact us and submit the substance abuse form.

4 Life Insurance Options For People With Substance Abuse

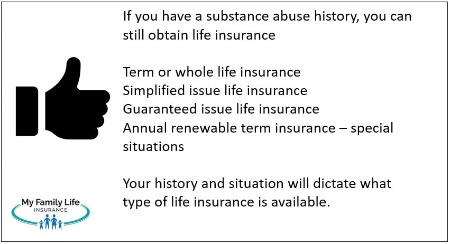

So far, you’ve learned how life insurance carriers underwrite people with substance abuse. Now is a good time to discuss the 4 life insurance options available to people with a history of substance abuse.

substance abuse. Now is a good time to discuss the 4 life insurance options available to people with a history of substance abuse.

As we said earlier, getting life insurance for someone with substance abuse is on a case-by-case basis. So, the below information is a general summary. Available options will really depend on your situation.

Term And Permanent Life Insurance

If you’ve been clean with no relapse for 3 years or more, term and permanent life insurance (like whole life, indexed universal life) are available.

So, for instance, if you need $500,000 to cover your mortgage, you can apply.

How great is that?!

However, expect a full underwriting process as we indicated earlier.

Carriers will likely want a paramedical exam with a blood and urine sample to check for any drugs or alcohol in your system.

Moreover, as we indicated, expect a table rating.

In our experience, the rating could be between a table 2 and a table 6.

However, it could be lower or higher.

The longer you’ve been clean with no relapse, with a stable life situation, the better your chances for a lower premium rate.

If you have additional co-morbidities and health conditions, those conditions may increase your premium rate.

If you want to check out term costs, feel free to search for quotes below in our quoting engine.

The best thing to do is contact us, use the form at the end of this article, or call / text us so we can understand your situation.

Simplified Issue Life Insurance

Have you ever heard of simplified issue life insurance? It is typically a whole life insurance plan with a small death benefit, like $50,000. But, there are some simplified term insurance policies available.

These types of plans are good for final expenses like burial and funeral needs.

As such, these types of plans are called final expense insurance, burial insurance, or end-of-life insurance.

Underwriting is simplified (hence the name). You just answer a health questionnaire. Nowadays, carriers look up your information in the MIB and prescription drug databases. If all checks out, you then have life insurance.

The good news is that most carriers will accept people with a substance abuse history. Moreover, some carriers don’t even ask about drug or alcohol abuse on the application!

If the application doesn’t ask about any substance abuse, then the carrier likely does not consider it an important underwriting point.

In order to qualify, you’ll have to be at least 12 months clean from substance abuse.

At that point, you may be eligible for a graded benefit policy or, in some cases, an immediate benefit.

As we wrote in our burial insurance types article, a graded policy pays a percentage of the death benefit in the first 2 years.

Graded benefit policies aren’t bad; however, here at My Family Life Insurance, we try for immediate benefit plans.

But, sometimes we revert to a graded benefit plan. If you’d like to get an understanding of costs, feel free to search for premiums below. Just input “decent health” in the health classification box.

Guaranteed Issue Life Insurance For People With Substance Abuse

Are you currently abusing alcohol or drugs?

Or, maybe you are currently on parole associated with substance abuse?

Do you currently take suboxone, Antabuse, or another type of medication that prohibits abuse?

If so, then, it is unlikely carriers will offer a traditional term policy or even a simplified issue policy we described earlier.

No worries, however; a guaranteed issue policy is available.

With guaranteed issue life insurance policies, the carrier automatically approves you. In other words, the carrier performs no underwriting. You just fill out an application and voilà, you have life insurance.

That sounds great, John.

It is. You have life insurance.

A couple of things, though.

- Carriers don’t underwrite, so they don’t know your health history. To protect themselves against a quick death benefit payout, they place a 2-year benefit period on the death benefit on illness or natural causes only. I think you’ll agree that makes sense.

- They limit the death benefit to $25,000 or $50,000.

We at My Family Life Insurance offer many guaranteed issue life insurance plans for you.

We offer a guaranteed issue term life insurance up to $50,000, depending on state availability. You can enroll on your own here: https://protectionpluslife.com/m/jbarnes

We also offer many guaranteed issue whole life plans, many that other brokers and agencies do not offer.

Our costs are competitive, too, versus other agencies. For example, for a 55-year-old woman wanting $25,000:

Our go-to carrier: $84.68 per month Their go-to carrier: $96.25 per month

You can search for rates yourself below. Just select “poor health” in the health classification. Of course, it may make more sense to contact us as we offer more carriers than shown on the quoting engine:

Annually Renewable Term Life insurance – Special Situations

In certain situations, we have an annually renewable term life insurance available for people who have had a substance abuse history.

Wait, John, is this any different than the term insurance options you described earlier?

Yes. For one, not just anyone can apply. You can apply IF you (including, but not limited to):

- Are in need of a business loan

- Must satisfy a divorce decree

- Are a key person in a business or similar situation

- Need to purchase a business or similar situation

If these types of situations are similar to yours, then we can get you life insurance, even if you’ve been declined through traditional term life insurance routes.

The great news is that it gives you coverage until you qualify for a traditional type of policy.

We give an example next.

Case Studies Where We Have Helped People With Substance Abuse Obtain Life Insurance

Here are 4 case studies where we have helped people obtain life insurance with a history of substance abuse.

Again, availability depends on your specific situation. However, I hope the case studies below give you an idea of what is possible.

Term Life Insurance For Someone With Alcohol Abuse & DUI

Male, age 43, non-tobacco user. Healthy every other way.

Male, age 43, non-tobacco user. Healthy every other way.

He was looking for $2,000,000.

He had an alcohol addiction and 4 DUIs over a 10-year period.

There was no additional history of substance abuse, no inpatient treatment, and an otherwise clean driving record.

We were able to get him an offer of $2,000,000 term insurance at table 2.

Drug Abuse Situation

Female, age 28.

Tested for cocaine on an insurance exam 2 years ago.

No other substance abuse history. Clean since.

We were able to get her $250,000 term life insurance at table 6.

Marijuana Usage

Male age 38 with daily marijuana usage.

No additional substance abuse or psychological issues in his history.

$2,000,000 guaranteed universal life at standard non-tobacco class.

Current Substance Abuse

A 35-year-old woman currently dealing with substance abuse.

Able to enroll her in a $50,000 guaranteed issue term life insurance as well as $25,000 whole life insurance.

Business Owner Needing Life Insurance To Satisfy Bank Requirements

Female business owner needing a $500,000 bank loan. Her lender required a life insurance policy to secure the loan.

Denied term life insurance through traditional routes because of substance abuse within the last year. No traditional carriers would insure her.

We got her 1-year annual renewable term. (Got her the loan and bought her time until she qualified with a traditional carrier.)

Frequently Asked Questions About Life Insurance And Substance Abuse

Here are some questions and answers we receive about life insurance and substance abuse, including drug and alcohol abuse and addiction.

Can I Obtain Life Insurance If I Have A DUI or DWI?

Yes, if you have a DUI or DWI on your record, you can obtain life insurance. I would say a minimum of 3 to 5 years since the DUI/DWI conviction, but some carriers have lower timeframes to apply.

See our case study above where we worked with a professional with 4 DUIs in 10 years and still got them life insurance.

However, remember, all of this is on a case-by-case basis. Contact us and let us help you.

I was addicted to opioids. I no longer am, but I take suboxone to manage my addiction. Can I obtain life insurance?

Drug inhibitors like Antabuse and suboxone reduce drug cravings and addiction reoccurrence.

If you are prescribed these, then carriers will deny your application for the traditional term or whole life.

Currently, the guaranteed issue life insurance options we described above are the only available options.

I was just declined by a carrier for my drug abuse history. Can I reapply?

We receive many inquiries from people who’ve applied for life insurance, but they were declined because of past drug abuse or alcohol abuse.

To answer your question, yes, you can reapply.

However, keep some things in mind.

Some carriers simply won’t cover people with a substance abuse history. You may have applied with one of these carriers.

Additionally, some agents just aren’t skilled in finding life insurance in these situations.

Moreover, as we outlined earlier, you have to show stability since your addiction.

Nevertheless, yes, you can reapply. Contact us to learn more and how we can help.

Final Thoughts About Getting Life Insurance After Substance Abuse

If you have a substance abuse history, you can obtain life insurance.

In this article, we outlined 4 life insurance options available to those with a substance abuse history. These options include:

- Traditional term and whole life insurance

- Simplified issue life insurance

- Guaranteed issue life insurance

- A special annual renewable term available in certain cases

If you are looking for life insurance, you have come to the right place. We at My Family Life Insurance can help.

Contact us or use the form below.

We know this is a personal situation. As such, we always work in your best interest. (We have to, anyway, since I am a CFP® Professional.)

There’s no risk in contacting us. If we can’t help you, we will point you in the right direction as best we can.

You can always reach back out if your situation changes.

Send us an email or you can text us if you prefer communicating that way, too.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".