How To Get Life Insurance If Skydiving | Your Guide To Finding the Lowest Cost Life Insurance For Your Skydiving Hobby

Updated: April 12, 2024 at 9:39 am

Let me guess. You like to skydive, are a skydiving instructor, or are a skydiving enthusiast, and you think you can’t obtain life insurance because of your hazardous hobby?

Let me guess. You like to skydive, are a skydiving instructor, or are a skydiving enthusiast, and you think you can’t obtain life insurance because of your hazardous hobby?

Yes, that is right. My agent told me his carrier would decline me.

Well, there is good news. You can obtain life insurance if you enjoy skydiving. Moreover, you can even obtain life insurance if you are a skydiving instructor.

How great is that?

Yes, John. But another agent told me I could exclude death from skydiving from my policy.

You could, but why do you want to do that?

We will discuss that situation in more detail.

Nevertheless, you can obtain life insurance if skydiving is a hobby of yours.

First, however, I need to get something out of the way. Your life insurance will generally cost more than someone who doesn’t skydive.

I think you understand that, but it is something to bring up first.

So, if you want the same rate as the person who doesn’t skydive…well, that just isn’t going to happen.

The good news is that nearly all our skydiving clients obtain life insurance with us.

Moreover, we typically find our skydiving clients the lowest rates possible based on their unique situations.

And, their policies include death from skydiving.

Here is what we will discuss in this guide for skydivers looking for life insurance:

- Life Insurance Underwriting

- Life Insurance Options

- Our Application Process

- FAQs About Life Insurance

- Final Thoughts

Let’s jump in and discuss life insurance underwriting.

Life Insurance Underwriting For Skydivers And Skydiving Enthusiasts

We start with underwriting first because it is the foundation of obtaining life insurance.

Underwriting is the process of analyzing your situation and determining if you are an insurable risk. Every carrier does this, even homeowners and auto insurers.

For skydivers, there are really 2 parts to underwriting. There is the typical life insurance underwriting process which looks at your:

- health, family history, bankruptcies, driving history

- skydiving habits

Let’s discuss #1 first.

How Your Health, Family History, Bankruptcies, And Driving History Play A Factor

Obviously, your health history is an important factor in the underwriting process.

If you are generally healthy with a good BMI, then the health part of the underwriting process shouldn’t be an issue for you.

But, let’s say you had cancer, have multiple sclerosis, have rheumatoid arthritis, or have bipolar disorder.

Then, the carrier will want more information about your health situation.

They will order your doctor’s records and may even require a paramedical exam with a blood and urine sample.

As for family history, that is important as well. Not many people know that.

For example, with one carrier we work with, if a parent passed away from any cardiovascular disease prior to the age of 60, the best health class with them is standard only.

In other words, you can be the healthiest person on earth, but the best rate available is a standard rate.

Finally, any bankruptcies and driving history are factors, too.

Why are bankruptcies considered? Those have nothing to do with my health.

True, they don’t. However, you still have to pay the bills, right? Carriers want you to pay your life insurance bill so you are covered.

Additionally, carriers have data that show people who are going through bankruptcies aren’t good applicants. You have to wait until your bankruptcy has been discharged. The longer the time period between your discharge and application, the lower the premium (generally speaking), all things being equal.

How Does Skydiving Affect Life Insurance Underwriting And Rates?

Let’s discuss how skydiving affects the underwriting process and ultimately your premium.

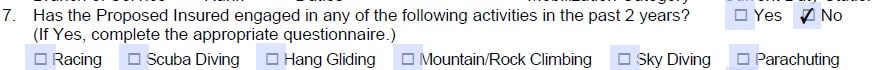

When you apply for life insurance, the application has a question like this:

As I said before, expect to pay a higher premium compared to someone who doesn’t skydive.

As I said before, expect to pay a higher premium compared to someone who doesn’t skydive.

Carriers are going to want to know the following:

- If you are a member of a club

- The number of skydives each year

- If you are a skydiving instructor

- If you want a skydiving exclusion

Most carriers are going to offer a standard rate as your best health class. However, If you are a member of a skydiving club, you will (generally) pay lower life insurance rates compared to someone who is not a member of a club.

The number of skydives also matter. The more skydives you make, the higher the premium. Be honest here. Lying on a life insurance application is fraud. The carrier will find out if you lie. Doing so will likely lead to a declined application or worse, a denied life insurance claim!

Skydiving instructors pay an additional fee as well.

Some carriers offer a skydiving exclusion. This means that you can request the carrier to exclude your skydiving from coverage. In other words, if you die from a skydiving accident, then your family doesn’t receive the death benefit. Correspondingly, your rate would be based on what we discussed in section #1 above.

Do you want that? While I don’t recommend excluding skydiving from coverage, it is an option.

Now’s a good time to discuss how skydivers calculate their life insurance rates.

How Skydivers Calculate Their Life Insurance Rate

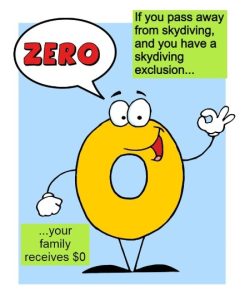

Carriers like to use a fee called “flat extras”. This is an extra fee applied to your rate. The flat extra fee is usually expressed as $ per thousand of coverage. An example will make this clear. We will use a carrier that allows exclusions.

Let’s say you skydive 75 times per year and belong to a skydiving club. You are in great health and lifestyle. If you didn’t skydive, you’d be a preferred best rating. You are a male age 30, looking for $500,000, 30-yr term.

Let’s say you skydive 75 times per year and belong to a skydiving club. You are in great health and lifestyle. If you didn’t skydive, you’d be a preferred best rating. You are a male age 30, looking for $500,000, 30-yr term.

If you want the exclusion, your rate is $29.55 per month.

However, with your plan including skydiving death, the life insurance costs $260.94 per month!!!

The carrier pushes you to standard plus instead of preferred best. They also place a $5 per thousand “flat extra” on the policy. In other words, $500,000 X $5/1000 = $2,500 extra that is added to your policy. (In addition to the increase in the health class.)

John, this makes no sense. Why does this cost so much? Only like 15 people died from skydiving last year!

Yep. You are right. In 2021, there were only 10 skydiving deaths out of 3.6 million records jumps. It’s the lowest death per thousand fatality rate on record.

People have a better chance of dying from cancer or even dying from a car accident.

So, if the fatality rate is so low, why the huge premium increase?

Well, namely because skydiving deaths aren’t factored into the base rates like cancer deaths, car accident deaths, etc. that are common to all of us. That’s right; carriers factor all those events into their actuarial tables.

Moreover, even though the skydiving fatality rate is low, it is an inherently dangerous activity. Carriers are going to simply increase rates on that fact alone.

Life Insurance Options For Skydiving Enthusiasts

Plenty of life insurance options exist for skydivers.

As discussed earlier, underwriters are going to look at your:

- Health history, motor vehicle records, etc

- Skydiving activity

The most common type of life insurance is term life insurance.

It provides a level premium for a set number of years (i.e. the “term”) like 20 years or 30 years.

If you pass away within the term, your family receives the death benefit. If not, then they receive nothing.

Term offers the lowest cost of life insurance per thousand of coverage. The reason is the carrier only pays a benefit IF you die within the TERM. See how that works? If the carriers have the actuarial tables correct, they know, on average, when someone in your situation will pass away.

Crazy, right? But that is how they set up their premiums and why premiums are low.

A few term carriers offer living benefits. Living benefits add flexibility to your policy. They allow you to advance the death benefit sooner for certain covered situations. I always recommend life insurance with living benefits when it is available.

If you want to estimate your rate, feel free to input your information below. To be conservative, I would select “standard” from the health class. I would also place a $3 per thousand flat extra to your death benefit amount as we did in the example above.

Permanent Insurance Available, Too

On the other end of the spectrum, we have permanent insurance.

The two most common types of permanent insurance are whole life and universal life.

These types of insurance generate cash value. However, they are going to be more expensive because they are designed to pay a benefit no matter when you pass away. That could be 1 year from now or at age 95.

I wrote that whole life insurance can be a bad idea. It can. Conversely, it could work well in your situation and is a good idea to purchase.

Am I speaking out of both sides of my mouth? Not really.

Whole life works well if your situation demonstrates the need for it. I won’t get into all the details here, but contact us if you think whole life can be useful in your situation.

Then, we have universal life. More specifically, we have indexed universal life (IULs, for short).

IULs have been all the rage for a number of years.

Many people want to use these products for tax-deferred cash value growth and, ultimately, income tax-free cash distribution for retirement.

It sounds great, but there are many disadvantages of IULs that agents don’t speak of (but, we do).

Like whole life insurance, IULs work when your situation dictates it.

Contact us if you have questions about whole life or indexed universal life.

Burial Insurance For Skydivers

Another option is burial insurance.

Burial insurance is a whole life insurance plan with a small death benefit like $25,000 or $50,000.

The death benefit is used to fund your burial, funeral, and end-of-life needs. Hence, the name “burial insurance”.

The great thing about burial insurance is that it is very easy to apply for.

Moreover, nearly all burial insurance carriers don’t care about your skydiving experiences.

Nope, none of that “flat extra” stuff exists.

They aren’t going to ask you about your hazardous activities, either.

You can review rates here:

These carriers focus more on your health as described above.

You just answer questions from a health questionnaire like the example here. If you can say “no” to the questions, then you will likely have burial insurance.

If you don’t qualify for burial insurance, then there is guaranteed issue life insurance available. Honestly, if you don’t qualify health-wise with either traditional term, permanent insurance, or burial insurance, then you are unlikely to be able to skydive anyway. A guaranteed issue policy is then your only option. Contact us as we work with many guaranteed issue life insurance carriers, including guaranteed issue term life insurance.

How To Apply For Life Insurance With Us

It’s easy to apply for life insurance with us. All you need to do is:

- Give us a call, send us an email through our contact us, or use the form below

- When we chat, tell us your health history as well as your skydiving history/activity

- We reach out to the carriers on your behalf and accumulate estimated rates based on your situation. This could take a few days. We do this to obtain a “preliminary” approval based on what you tell us.

- We reach back out to you and discuss your options.

- You then apply with us over the phone. Underwriting could take a few weeks. Approval is the usual outcome for our skydiving clients.

If you are applying for traditional term life or permanent insurance, the underwriting process could take a few weeks to complete. The reason why is that the death benefit is much larger, so carriers administer greater underwriting due diligence.

As we stated before, approval is the typical outcome for our skydiving clients. If you are truthful to us about your health history and skydiving activity, then the carrier you apply with should approve you.

Frequently Asked Questions About Skydiving And Life Insurance

Here are some common questions we receive from skydivers about their skydiving activity and life insurance.

Feel free to contact us with any questions you have.

I Bought Life Insurance 10 Years Ago. I Started Skydiving 3 Years Ago. Will My Policy Pay If I Die From Skydiving?

Yes. Because you purchased your life insurance policy before you started skydiving, the policy will cover you if you die from skydiving. Additionally, there is no rate increase or flat extra like we discussed. The reason is that at the time of your application, you were not skydiving.

For example, I bought many policies years ago. If I decide to skydive and unfortunately die, the policies pay the death benefit to my spouse.

What Types Of Life Insurance Are Available For Skydivers?

As we discussed, skydiving activity doesn’t necessarily preclude you from life insurance. You will have to pay extra based on your skydiving activity. Your health and other factors like driving history play an important role as well.

Here are the types of life insurance available for skydivers:

- Term life insurance

- Permanent life insurance like whole life and universal life

- Burial insurance plans which are whole life plans with a small death benefit amount

- Guaranteed issue life insurance

As we mentioned, it is nearly impossible for skydivers to qualify for guaranteed issue life policies only. These types of plans are reserved for the uninsurable.

Can I Just Lie On The Life Insurance Application?

You could. But, here is what happens:

Lying on a life insurance application is fraud. If the carrier finds out, they could deny coverage upon your death. Do you want that to happen?

Moreover, the carrier will likely flag the lie in your MIB report, making it harder for you to qualify for life insurance in the future. This is if they catch you during the underwriting process and decline your application because of your lie.

You may face fines and penalties from your state’s insurance commission.

Do you want any of this to happen? The sensible answer is, of course, no.

Sure, you have to pay a higher premium compared to someone who doesn’t. However, do you want to run the risk of potentially not having life insurance or, worse, having a claim denied because of your lie?

So, just be honest and pay the extra premium. The benefit of working with a broker like My Family Life Insurance is that we are not beholden to one carrier. We have access to many life insurance companies (last count, around 60 if you can believe that). We can find the lowest-cost life insurance for your situation.

One more point here. Every policy issued in the US contains a contestability clause. This is usually a 2-year period. If you pass away within the 2-year period, then the carrier can open an investigation to make sure the application contained no fraud or misrepresentation.

Can I Elect The Exclusion?

Can I Elect The Exclusion?

Yes, if the carrier allows it, you can exclude your skydiving activity from your life insurance coverage.

By doing so, your rate is based on your health class, driving history, etc. (essentially, everything but your skydiving activity.)

However, do you want to risk the chance if you do unexpectedly pass away from skydiving, your family receives $0?

My recommendation is to keep a skydiving death included in your policy. Sure, you have to pay more, but you have peace of mind knowing you are covered no matter what.

However, ultimately, the decision is up to you and your family.

Final Thoughts About Skydiving And Life Insurance

We hope you learned a lot about how skydiving affects life insurance applications and rates. If you are a skydiver and generally healthy, you can obtain life insurance.

However, as we discussed, expect to pay a higher rate. Even though the skydiving fatality rate is low, skydiving is inherently a risky activity that is not factored into the life insurance rates for every man and woman.

Many life insurance options exist for skydivers.

Are you ready to get started or learn more? Feel free to contact us or use the form below.

As an independent broker, I am happy to go over your options.

Additionally, we only work in your best interests. We have to. That means we put your interests first and foremost before our own.

There’s no risk of contacting us. We won’t call you 1,000 times a day. If we can’t help you, we will point you in the right direction as best we can.

If your situation changes, you can always reach back out to us.