Ultimate Guide: Guaranteed Issue Life Insurance

Updated: April 12, 2024 at 9:39 am

If you are like most people, you probably wonder if guaranteed issue life insurance is right for you.

If you are like most people, you probably wonder if guaranteed issue life insurance is right for you.

You’ve heard about it. It sounds good. You just fill out a simple form and you have life insurance. No health questions. You apply, pay the first month’s premium, and then you have life insurance.

Easy, right?

But, you need to know more to make sure this life insurance is right for you.

In this guide, you will learn the:

- facts about guaranteed issue life insurance

- top guaranteed issue life insurance carriers

- advantages of guaranteed issue life insurance

- disadvantages of guaranteed issue life insurance

After reading our guide, you should be able to decide if guaranteed issue life is right for you.

Let’s start our journey with the facts about guaranteed issue life insurance.

Guaranteed Issue Life Insurance Facts

Guaranteed issue life insurance is a simple product. Here are the facts:

- The policy is guaranteed to be approved and issued.

- It is a whole life insurance product, usually. Remember that whole life is designed to last your lifetime. (Provided you pay the premiums, of course.)

- Usually, the application ages are 40 to 80, give or take. That means young people can’t apply. (Although we have some options for those who are under age 40 and need guaranteed issue life insurance.)

- A simple application, maybe a couple of pages at most. These applications may take 10 minutes to fill out.

- Usually a small death benefit. Up to $25,000 usually; however, one carrier goes up to $40,000.

- All carriers are not available in every state. Be sure to check the options in your state.

Here’s an important point: Most carriers that offer guaranteed issue life do not allow someone other than the insured to own the policy. This can be a major detriment if you have a loved one who is incapacitated and needs life insurance. (However, we work with a couple of carriers that allow someone else or entity to own the policy. Read on to learn more.)

Underwriting Process

The underwriting process is simple because there is no underwriting.

The carrier does not look up your application history through the MIB or a prescription drug check.

There are no health questions. Usually, there are a couple of administrative questions.

Because there are no health questions, the carrier knows, generally, unhealthy people apply for this life insurance. The carrier must mitigate its mortality risk. In other words, the risk of paying a death benefit too early. It does this 2 ways:

- Implements a waiting period on the death benefit. Depending on the carrier, the waiting period can be 2 years or 3 years. If you die by illness or other natural causes within the waiting period, which begins at the start date of the policy, your beneficiaries receive the premiums you paid + interest. After the waiting period, the death benefit is paid in full 100%. At any point, if you die by accident, the death benefit pays 100% in full.

- A higher premium. You will pay much more each month compared to an underwritten life insurance policy, all things being equal.

There’s no getting around the waiting periods or the higher premiums. The carrier does not know its risk makeup with the applicants, so it places these limitations.

All you need to remember is that the policy is guaranteed to be issued and approved. Because of the ease of acceptance, carriers limit the death benefit amount, incorporate a waiting period, and charge a higher premium compared to other similar policies.

The Different Names Of Guaranteed Issue Life Insurance

Guaranteed issue life insurance sounds simple, right? Not confusing at all. It shouldn’t be.

What makes it confusing is that many carriers call this insurance different things. They call it different names for, essentially, marketing purposes. You may see guaranteed issue life insurance as the following. These are all the same:

- guaranteed acceptance life insurance

- guaranteed issue whole life insurance

- no-question life insurance

- guaranteed burial insurance

- guaranteed life insurance

Again, all of these names mean the same as guaranteed issue life insurance. Don’t get confused. Here’s a tip. Anything that has “no-question” or “guaranteed” in the name is likely guaranteed issue.

Just contact us if you have any questions or use the form at the end of this article. We can help clear up any confusion.

Who Can Use Guaranteed Issue Life Insurance

Guaranteed issue life insurance is not for everyone. It sounds easy, and it is, but there are limitations to the product. We addressed those limitations above and in a few sections later under “Disadvantages…”

I’ll state this; we can help a great majority of people without these limitations. In other words, most people will qualify for more affordable life insurance, even if they have significant health conditions. You just need to answer a few health questions to see if you can obtain better coverage.

However, guaranteed issue life can be important if you or your loved one has:

(1) drug and alcohol abuse

(2) probation or criminal offense, including DWIs

(3) Alzheimer’s Disease or Dementia

(4) disabled and does not work

(5) severe Autism

(6) Down Syndrome

(7) Huntington’s disease

(8) serious heart conditions or issues

(9) kidney disease; on dialysis

(10) severe obesity

(11) recent cancer

(12) AIDS or HIV

These conditions and many more could warrant the need for this type of life insurance.

If any of the above conditions apply to you, keep reading. Now is a good time to discuss the more popular guaranteed issue life insurance carriers next.

The Top Guaranteed Issue Life Insurance Carriers

Not all carriers offer guaranteed issue life. Some of the more popular ones you will see and offered are the following:

- Mutual of Omaha

- AIG

- Gerber

- Great Western

- Vantis

We will discuss these carriers next as well as other options.

You will see that, with the exception of a few nuances, these plans are generally the same.

Mutual of Omaha

Application Ages: 45 to 85

Ineligible States: CT, MT, OR

Death Benefits Available: $2,000 to $25,000

Waiting Period: 2 years

About: Probably the most popular brand name of the bunch, Mutual of Omaha has a plan that can only be purchased directly from the carrier itself. They have an online application, or you can call Mutual of Omaha directly. A benefit is that they are available for residents in NY.

AIG

AIG

Application Ages: 50 to 80

Ineligible States: NY

Death Benefits Available: $5,000 to $25,000

Waiting Period: 2 years

About: AIG is American International Group, which owns American General. They have an interesting feature on their guaranteed issue life insurance. That feature is you can advance part of the death benefit early for any covered critical illness or chronic care. Honestly, I am not sure if that makes a difference as the death benefit is low. However, this feature is automatically included and nice to have.

You must work with an independent agent like My Family Life Insurance in order to obtain their plan.

Gerber

Application Ages: 50 to 80

Ineligible States: MT

Death Benefits Available: $5,000 to $25,000

Waiting Period: 2 years

About: Gerber isn’t just about baby food. They have a slew of insurance products available for children, young adults, and older adults including guaranteed issue life insurance. Their product is similar to others.

Great Western

Application Ages: 40 to 80

Ineligible States: AK, CT, DE, HI, ME, NY, VT

Death Benefits Available: $1,000 to $40,000

Waiting Period: 2 years

About: Great Western is a unique carrier. They have pre-burial services as well as many other burial expense options, including this guaranteed issue life plan. Additionally, a major benefit of this plan is that a Guardian or Power of Attorney can own the policy provided the correct paperwork is in place (for the estate of the insured). This option makes it an ideal plan for those families who want some life insurance coverage on incapacitated individuals and those who mentally can’t enter into an insurance contract.

Their plan actually has three questions. If you can answer “no” to all three and provide your doctor’s information, you may qualify for their level benefit plan and have a 25% death benefit increase with no change in premium. Otherwise, the plan remains a guaranteed issue life insurance plan with a 2 year waiting period.

Vantis

Application Ages: 50 to 80

Ineligible States: NY, WA, MT

Death Benefits Available: $5,000 to $20,000

Waiting Period: 2 years

About: Vantis offers a guaranteed issue life plan called “Guaranteed Golden”. It is a similar plan to that of Gerber, AIG, etc.

Other Guaranteed Issue Life Options

Other carriers offering guaranteed issue life insurance exist. They include, but not limited to:

- Kemper

- United Home Life

- Fidelity Life

- Americo

Why don’t we include them with the above? Well, they are additional options; however, they are not (in our opinion) as favorable as the ones we identified above. They might be much more in premiums for the same death benefit or have a longer waiting period. For example, Fidelity Life’s guaranteed issue plan has a 3 year waiting period instead of 2 years.

But, these are good options if they are your only availability.

However, in my opinion, the ones we described aren’t necessarily “the best”. Next, we are going to discuss another carrier that we like in nearly all cases when available.

Very Affordable And Flexible Guaranteed Issue Life Insurance Plan

We’ve outlined several guaranteed issue life plans.

As we discussed, they are all generally the same.

Personally, I like Great Western because of its flexible plan.

Let me introduce another one to you, too. It is our “go to” for guaranteed issue life.

It offers up to $25,000 with a 2 year waiting period. Sounds like all the others above, right?

Well, it’s not.

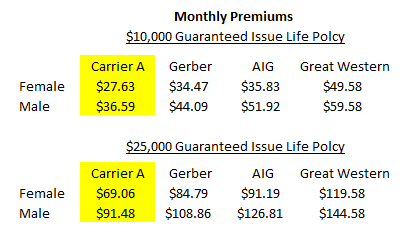

For one, the premiums are much cheaper compared to those we outlined earlier. Take a look at this for a 50 year old male and female:

Next, it will insure individuals ages 0 to 85.

Yes, starting at age 0.

Do you know how important that is? Look at the above carrier options. They all start out at age 40 minimum.

This means the carrier will insure children and young adults who need guaranteed issue life insurance. The 0 to age 40 range can be hard to find insurance. Look at the ones we described above. See any that offer to a young adult, let’s say with cerebral palsy? Nope…he or she would have to wait.

It also allows the guardianship, power of attorney, and trust ownership designations if your loved one does not possess the mental capacity to sign a financial document. With the exception of Great Western, the other carriers do not. That is huge.

Obviously, this carrier is our “go-to” for guaranteed issue life when available.

Premium Cost Of Guaranteed Issue Life

As we discussed, guaranteed issue life insurance is more expensive than comparable whole life insurance policies.

Rather than have list after list of premiums for a given death benefit, feel free to search on our website quoter. Just make sure you select “Poor Health” for health classification. The available carriers will populate.

The Advantages Of Guaranteed Issue Life Insurance

We’ve talked a lot so far. Let’s recap. Here are the advantages of guaranteed issue life insurance:

*simplicity

*easy application

*guaranteed coverage!

*available if you really need it

However, there are many disadvantages, and let’s talk about those next.

Disadvantages of Guaranteed Issue Life Insurance

Search the internet, and you will find many agents and agencies tell you to not buy guaranteed issue life insurance.

Well, they are partly right and partly wrong. Often, you can likely find life insurance with no waiting period and at a cheaper premium.

We’ve helped many with moderate to serious medical conditions find affordable, no-waiting life insurance plans. Additionally, they pay a lower premium.

So, that’s really the disadvantage: waiting periods, higher premiums compared to underwritten policies, and a higher premium compared to other similar policies.

Is guaranteed issue life really that bad, though? If it’s your only option; no, it is not.

Additionally, we just showed you that we work with a very affordable carrier in the guaranteed life insurance space.

But, if you decide to work with us in your quest for life insurance, asking you questions about your situation helps us better. We can then figure out if guaranteed issued life is indeed the best solution for you or an underwritten policy (which, will likely save you more money).

Is Guaranteed Issue Life Insurance Right For You?

Guaranteed issue life could be the right option for you if you have:

(1) severe aliments

(2) a criminal record

(3) illegal drug use and abuse

(4) hazardous or questionable lifestyle activities

If the above don’t apply to you, then we can likely find a life insurance policy with more coverage, lower premiums, an immediate death benefit, or all of the above.

Not sure about that? We previously wrote about a life insurance policy that has one question (really a 2 part question). If you can truthfully answer this question, you have life insurance up to $100,000 with an immediate death benefit. We at My Family Life Insurance can find the right insurance for you based on your needs and situation.

Frequently Asked Questions About Guaranteed Issue Life Insurance

We answer the more common questions about guaranteed issue life.

Can I Purchase Up To $100,000 In Coverage?

No carrier offers guaranteed issue life insurance up to $100,000. We do work with one carrier that has 1 pseudo-health insurance question. It is a two-part question. If you can answer that question truthfully, you can purchase up to $100,000 without any additional questions asked. It is also immediate death benefit.

What Guaranteed Issue Carriers Are Available In New York?

Not many. If you are a resident of New York, you know that New York has some tough insurance laws. Not many guaranteed issue life carriers exist there except for a few, including Gerber. The carrier we described that offers $100,000 is also available. However, the only life insurance type available is a universal life insurance policy. Again, though, you do have to answer one question. We also work with a small carrier that, from time to time, does offer guaranteed issue life insurance. It is available for New York residents.

Can I Get A Guaranteed Issue Life Plan With No Waiting Period?

Unfortunately, not. As we described earlier, no guaranteed issue life insurance plan has an immediate death benefit. The reason is simple: the carrier does not underwrite and does not know the risk profile of the applicant. It has to institute a waiting period along with higher premiums. Any carrier that says they offer guaranteed issue with no waiting period is lying if they want to remain in business. As we discussed, we do work with one carrier that is “almost” guaranteed issue, but has a two-part question.

What Is The Best Guaranteed Issue Life Insurance Policy?

The answer depends on your situation. Generally speaking, all the carriers are the same, so you will want the one with the best combination of low premium and low waiting period. We also identified 2 carriers that allow another person or entity to own the policy on the insured. This ownership option is extremely important if the insured is incapacitated or does not possess mental capacity to enter an insurance contract. Personally, I feel those carriers are the better options because of flexibility. However, as always, the right decision depends on your situation.

How We Can Help You With Guaranteed Issue Life Insurance

We hope we educated you on guaranteed issue life insurance. You have plenty of options. As we discussed, there are a couple of carriers we like more for guaranteed issue life than others.

Do you need guaranteed issue life? Maybe not? As we discussed, we often help people with moderate to severe health conditions obtain life insurance at a lower price or no waiting period.

It depends on your situation, and we can help determine that. Contact us or use the form below. We would be happy to help. Contacting us is the most risk-free event you’ll make. You won’t receive 10,000 annoying phone calls from us. If we can’t help you, at the very least, you learned something new, and we will part as friends. Seriously! Why are we like this? Well, we have something called duty of care that requires us to put your best interest first before our own. It is a concept we take seriously. If we can’t help you, we will recommend your best course of action and help you the best way we can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".