A Term Life Insurance Plan That Doesn’t Impact Medicaid Eligibility | We Discuss A Viable Option For You And Your Family

Updated: April 12, 2024 at 9:39 am

In this article, I am going to tell you about a term life insurance plan that works well for Medicaid recipients.

In this article, I am going to tell you about a term life insurance plan that works well for Medicaid recipients.

John, I heard term life insurance isn’t a good purchase because of underwriting and the term itself.

Well, that can be true. Hear me out.

As we discussed in a previous article, life insurance can negatively impact a Medicaid recipient’s benefits. The issue has to do with asset value and ownership.

If there is too much asset value in life insurance, the Medicaid recipient potentially loses his or her Medicaid benefits.

However, not all life insurance is created equal. Term life insurance can be a solution; however, not all term life insurance fits Medicaid situations nicely.

All except for one.

In this article, we discuss a term life insurance plan that won’t impact your Medicaid eligibility or benefits. It fits well for many Medicaid beneficiaries.

Here’s what we will discuss:

- Basics Of Term Life Insurance

- What Makes Term Life Insurance Ideal

- An Introduction To Term Life Insurance Plan That Works Well

- Potential Premiums

- More Detail About The Term Plan

- Final Thoughts About The Term Life Insurance Plan

Let’s jump right in and discuss some basics about term life insurance.

Basics Of Term Life Insurance

Term life insurance is the simplest and most “pure form” type of life insurance.

What do I mean by “pure-form”?

Simply, you have life insurance coverage and nothing more.

In other words, if you pass away within the term, your beneficiary receives the death benefit. (The term is a set number of years you select at application, like 10 years, 20 years, or 30-year term.)

If you don’t pass away within the term period, then your beneficiary receives nothing.

That is what insurance is all about.

Think about your homeowners or auto insurance. You can go years – maybe never – filing a claim on those. Then, you only do so if damage occurs to your home or auto.

Term life insurance contains the same premise: your beneficiary receives a claim if you pass away within the term. If not, then he or she receives nothing.

This “pure-form” term life insurance is the cheapest of all the types of life insurance. This brings us to our next section.

What Makes Term Life Insurance Ideal For Medicaid Recipients

The first reason, term life insurance is cheap compared to other options like whole life insurance.

There are a couple of reasons for this:

- You have to pass away during the term period for the carrier to pay a death benefit, and

- There’s no cash value associated with term life insurance

We’ve addressed the first bullet point in the previous section. All term life insurance, generally speaking, have a fixed life. If you die within the term period, your beneficiaries receive the death benefit. If not, they receive nothing.

In regards to the second bullet point, term has no cash value. As we discussed heavily in our article about life insurance and Medicaid, the cash value is considered an asset for Medicaid eligibility. Moreover, while many agents say not to worry about the cash value, we give a real example of how cash value can grow rather quickly.

In regards to the second bullet point, term has no cash value. As we discussed heavily in our article about life insurance and Medicaid, the cash value is considered an asset for Medicaid eligibility. Moreover, while many agents say not to worry about the cash value, we give a real example of how cash value can grow rather quickly.

Other types of life insurance like whole life and universal life have cash value. This value is what can disqualify a Medicaid recipient from his or her benefits or eligibility.

Since term has no cash value, Medicaid can’t disqualify your life insurance. This is why term life insurance can be a great fit for those on Medicaid.

How great is that?!

However, there is an issue with term life insurance. It’s not a deal breaker – as you will see. However, we discuss this next.

An Issue With Term Life Insurance

Here’s the issue with term life insurance. (It’s also a reason why it is cheaper compared to permanent insurance like whole life or universal life.)

You have to pass away within the term period in order for your beneficiary to receive the death benefit. However, if you don’t, then your beneficiary receives nothing (unless you obtain additional life insurance elsewhere, of course).

If you pass away during the term, then your beneficiaries receive the death benefit. If not, they receive nothing.

For example, let’s say you have a 30-year term policy in which the level premiums end at age 70. If you pass away, say, at age 72, your beneficiary receives nothing.

Well, John. I want life insurance for life, you say. I want to leave my family with something. But, I don’t want whole life insurance to affect my Medicaid eligibility.

I hear you.

That’s why we at My Family Life Insurance do our homework. We have a term life insurance plan that exists for life (almost) and is likely a right for you. We discuss it next.

The Term Life Insurance Plan That Doesn’t Impact Your Medicaid Eligibility

We work with a term life insurance plan that won’t impact your Medicaid eligibility. It:

- Has no cash value, and

- Exists for nearly your lifetime (we explain more)

Depending on your age, you can apply for up to $150,000 of term life insurance.

People starting age 50 can apply, up to age 70. If you are under the age of 50, we have other options for you.

You can select a 10-year, 20-year, or 30-year term, depending on your age.

All term policies exist the later of age 80 or

- 20 years (if a 10-year level term),

- 25 years (if a 20-year level term), and

- 35 years (if a 30-year level term)

No distinguishment between tobacco and non-tobacco use. In other words, everyone is a non-tobacco user, even people who smoke or use tobacco. How great is that?

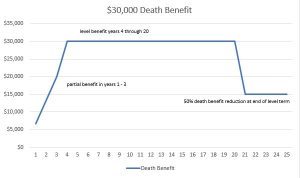

There is a partial benefit if you pass away in the first 3 years of the policy. Starting year 4, the policy pays 100% of the death benefit all the way to the end of the level term.

There is a partial benefit if you pass away in the first 3 years of the policy. Starting year 4, the policy pays 100% of the death benefit all the way to the end of the level term.

BUT, at the end of the level term period, the carrier cuts the death benefit by 50%. However, premiums stay the same. You then have coverage for the remaining life of the policy.

So, this is very unlike traditional term life insurance.

John, I am not understanding how this plan works.

I get it. It’s a lot to understand. Some examples will make this clear.

Examples Of The Term Life Insurance Plan

Let’s say a man, aged 57, a tobacco user, selects a $25,000 term policy, 10 year-level term. The cost is $83 per month.

If he passes away in the first 3 years, his family receives a partial benefit. If he passes in the next 7 years, his family receives $25,000. Then, if he is still living after the 10-year level term, the death benefit reduces to $12,500. He’ll continue to pay the $83 monthly amount until age 80, whereupon the policy expires.

Let’s change things and say he is 64. He wants a 20-year level term of $25,000. Well, of course, the premium will be higher…because he is older and the term is longer. The cost is $149.23 per month.

Again, in the first 3 years, there is a partial benefit if the man passes away. In the next 17 years, his beneficiary receives the death benefit 100% if he passes away. If he is still living at that point – around age 84 – he can keep his policy with a 50% reduction in the death benefit until age 89. He’ll pay $149.23 for $12,500.

What are premiums like compared to other options? Let’s discuss those next.

Premium Comparison

John, you say, these premiums seem rather expensive.

Premiums do matter. However, let’s compare the alternatives.

First thing is, don’t expect, generally, to qualify for traditional term life insurance.

As we said earlier, many carriers offering traditional term life insurance will not cover people on Medicaid. This fact is outside the scope of the article; however, it is a subject I speak to many people about.

Being gainfully employed and able to work does make a difference to life insurance carriers. No one will come right out and say it (except us). For example, we have helped many people with bipolar disorder obtain affordable term life insurance. The reason compared to other options is that these people were gainfully employed, in which their condition did not impact their ability to work and have outside relationships.

Having said that, there are some term life insurance options, albeit not many, that will insure people on Medicaid. The one we are describing in this article is a viable option.

So, how about the premiums? Well, you can’t say something is expensive without looking at a comparable option.

For people on Medicaid, there are some comparable options, namely whole life insurance.

Term Life Insurance Premiums For People On Medicaid

Using our examples from above, let’s compare some premium options.

57 Year Old Man, Tobacco User, $25,000

Our term option was $83 per month for 10 years. Then, the death benefit dropped to $12,500 for $83 per month up to age 80.

A comparable whole life plan would cost the following monthly premiums. (Please read our article on burial insurance types for discussion on the types of benefits listed below.)

- Level: $114 to $140

- Graded: $210 to $240

- Guaranteed Issue: $150 to $180

What about $12,500 at age 67 (if the person is still living)? Here are some comparisons:

- Level: $100 to $120

- Graded: $116 to $160

- Guaranteed issue: $110 to $130

So, it appears the term option is a good option.

Remember, though, the term (in this case) ends at age 80 whereas whole life exists for life. So, you really have to consider if you will live beyond the term. Moreover, as we discussed in our life insurance and Medicaid article, cash value life insurance is an asset for Medicaid purposes. Too much cash value in whole life insurance will impact your Medicaid benefits and aid.

Here’s Another Example

Let’s look at the other example. Instead, the 64-year-old is female and a non-tobacco user.

The $25,000, 20-year term policy in this case will cost $87.87 per month.

What are comparable options for this woman?

- Level: $92 to $110

- Graded: $160 to $200

- Guaranteed Issue: $150 to $180

In this case, the level death benefit ends at age 83, where upon it drops to $12,500. The woman can keep the $12,500 for $87.87 per month at that time for 5 more years. So, she will have life insurance until age 88 or so.

Will she live to age 88? Maybe…maybe not. Would a whole life policy be better, considering the potential cash value impact? What about premiums?

Let’s see the premiums for $12,500 for an 83-year-old woman:

- Level: $140 to $160

- Graded: $250 to $270

- Guaranteed Issue: none available due to age

So, you can see this term life insurance option is a great option for those on Medicaid.

Let’s discuss the plan parameters in more detail and how you can apply.

The Term Life Insurance Plan That Works Well With People On Medicaid

Now that you know about this term life insurance plan and the potential premiums, let’s discuss it in more detail.

You have to be a minimum of age 50 to apply. The maximum age to apply is age 70.

You can purchase up to $150,000 of term life insurance on the 10-year term, depending on your age.

Death benefits are determined by age and term. For example, a 68-year old can only apply up to $50,000. Contact us for the specifics.

No premium upcharge for people who use tobacco. This is a significant advantage.

As we discussed earlier, if the insured passes away in the first 3 years, the beneficiary receives a partial benefit. After that, the death benefit pays up to 100% until the end of the term (say 10, 20, or 30 years). At that point, the death benefit reduces 50%, but the premiums stay the same, until age 80 or 5 years beyond the level term, whichever is later.

No paramedical exam, blood draw, or urine sample.

What’s the application like?

Well, it’s simple. All you do is answer a few questions and the carrier looks up your information in the MIB, prescription drug database, and motor vehicle records. Typically, the carrier makes an instant decision. That means you’ll receive approval or decline in minutes or within 48 hours. Sometimes, the application goes to an underwriter for review and/or a phone interview.

The carrier allows payment by checking account or credit card. Direct express drafting is not available at this time.

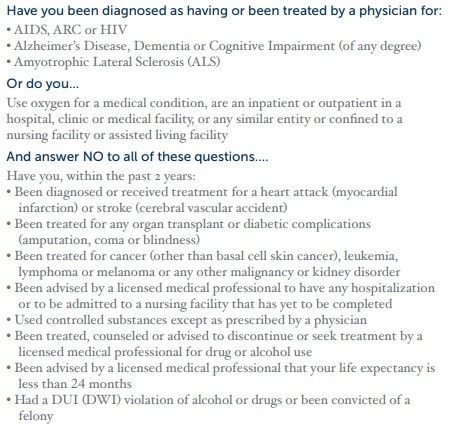

The health questions are the foundation of the application, so let’s go over the heath questions next.

Health Questions

Here are the health questions on the application. As we said, they require simple “yes or no” answers.

If you can say “no” to these questions and everything checks out on the MIB, prescription drug database, and motor vehicle records, then you should be approved for life insurance.

Again, if you can answer “no” to these questions and everything checks out with the rest of the application, you will have life insurance.

Do you qualify? Likely. This term life insurance plan works great if you are on Medicaid and have:

- sickle cell anemia

- type 1 or type 2 diabetes

- kidney disease or disorder

- cancer (no longer on treatment)

- heart disease

- COPD

- heart disorder

- bipolar, schizophrenia, or some other emotional condition

- rheumatoid arthritis

- multiple sclerosis

- muscular dystrophy

- vascular disease or some type of circulatory disease

- atrial fibrillation

- cirrhosis or any type of liver condition

and much more…

Final Thoughts About Term Life Insurance And Medicaid

We hope you enjoyed this article about this term life insurance plan and how it works with Medicaid.

It’s a viable option as it won’t affect your Medicaid benefits and potentially lasts much longer than traditional term policies.

Do you have any questions? Please contact us or use the form below.

Unlike other agents and agencies, we work in your best interest only. That means you come first, not a certain carrier or product. There’s no risk of speaking with us. If we can’t help you, we will point you in the right direction and part as friends. You can always contact us later if your situation changes. Many have.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".