Life Insurance Options For Undocumented Immigrants [Yes, You Can Obtain It & Easily, Affordably, Too!]

Updated: April 12, 2024 at 9:40 am

If you are an undocumented immigrant (i.e. considered illegal) living here in the United States, you may wonder about the future. You love your family. You may worry if something happened to you, what could happen to them? Thankfully, you don’t have to worry about life insurance. Undocumented immigrants can obtain life insurance here in the United States.

If you are an undocumented immigrant (i.e. considered illegal) living here in the United States, you may wonder about the future. You love your family. You may worry if something happened to you, what could happen to them? Thankfully, you don’t have to worry about life insurance. Undocumented immigrants can obtain life insurance here in the United States.

There is a process to follow, but no worries It is possible. We have helped many.

In this article, we discuss how undocumented immigrants can obtain life insurance.

Be careful of what you read elsewhere. Many other websites suggest that life insurance is available with many carriers. That isn’t true. Only a handful of carriers will insure undocumented immigrants. Not to worry as we work with just about all of them.

Feel free to click on a link to learn more.

- Requirements For Undocumented Immigrants

- Types Of Insurance For Undocumented Immigrants

- Application Process For Undocumented Immigrants

- Premium Costs For Life Insurance

- Underwriting of Undocumented Immigrants

- Can An Undocumented Immigrant Be A Beneficiary?

- Other Options For Undocumented Immigrants

- Now You Know Undocumented Residents Can Obtain Life Insurance

Let’s start off by telling you the requirements for life insurance if you are undocumented.

The Life Insurance Requirements For Undocumented Immigrants

There is a process you need to follow if you want to obtain life insurance. It is not, by any means, difficult. As we stated earlier, there are a handful of carriers that will provide life insurance for undocumented immigrants.

not, by any means, difficult. As we stated earlier, there are a handful of carriers that will provide life insurance for undocumented immigrants.

The following is the general process. Carriers may have specific, and different, requirements.

- Need to reside in the United States – you already do. You don’t need to own a home. You just need to live here. (So, renting is just fine.)

- Need an ITIN – Since you don’t have a social security number, you will need an ITIN. What is an ITIN? An ITIN is an individual taxpayer identification number. The IRS issues ITINs. If you don’t have an ITIN, you can apply for an ITIN through form W-7 from the IRS.

- Have a US bank account – you will need a US bank account to draft the premiums.

Then there are some “nice-to-haves” that will help us place your life insurance with the carrier:

- a driver’s license if you have one

- your doctor’s information and last seen

- your employment history and how much money you make / net worth

- a current, valid passport from your home country

These are the general requirements. After that, we determine your needs, death benefit amount, and type of life insurance. We go over all that and make sure what you are covered based on your needs and situation.

There are a few types of life insurance available to undocumented immigrants, and we discuss these types next.

Types of Life Insurance Available For Undocumented Immigrants

You will have all types of life insurance available to you, provided the carrier accepts ITINs. That means you will have access to:

- term life

- permanent life policies, including whole life, universal life, and indexed universal life

- simplified issued plans

- non-medical/no exam insurance policies

Not All Life Insurance Carriers Accept Undocumented Immigrants

As we said earlier, there are a few life insurance carriers that insure undocumented immigrants. Please be careful what you read elsewhere as other sites suggest that life insurance availability is plentiful. Unfortunately, it is not.

However, as we said, we work with nearly all of the carriers that insure undocumented immigrants.

However, as we said, we work with nearly all of the carriers that insure undocumented immigrants.

First, a few of them have limitations. For example, a couple of them allow up to $50,000 or $100,000 of death benefit. That isn’t really much, especially if you have a family to protect. We don’t really focus on those carriers unless we have to.

There’s another insurance plan that is simplified issue term, up to $250,000 of death benefit. It’s probably the easiest life insurance application I’ve ever seen. There are only 4 health questions. You can apply online through us; applying is very easy. You can also include your spouse and/or children on the application.

Finally, there are a few more carriers that will insure you for well above the $250,000 death benefit. We’ve insured undocumented immigrants for well over $1,000,000. The underwriting process can, potentially, be a bit longer since they potentially insure you for a larger death benefit amount.

You don’t have to worry about working with us. We will find you the right policy for your situation.

Why You Should Not Worry

We know the immigration regulations are in flux. You may be worried. Here is why you should not worry about your life insurance application or any death benefit proceeds.

Life insurance carriers still pay a death benefit. We review thousands of insurance contracts with individuals and families. We never had a contract that said proceeds won’t be paid to beneficiaries of undocumented immigrants.

The ITIN isn’t an indication that you are an undocumented immigrant. Many foreign nationals and other legal, non-us residents require an ITIN. Look at the page we linked from the IRS website. It lists many individuals who need an ITIN. Go to the paragraph, “What is an ITIN used for?”. The paragraph states “they (ITINs) are issued regardless of immigration status, because both resident and nonresidents may have a U.S. filing or reporting requirement under the Internal Revenue Code”

We don’t ask questions about your document status. Neither do the carriers. Just go back to the above paragraph. Anyone can receive an ITIN.

Life Insurance Application Process For Undocumented Immigrants

The life insurance application process for undocumented immigrants is generally the same as that for a US citizen or legal resident. So, you don’t need to worry about that.

The life insurance application process for undocumented immigrants is generally the same as that for a US citizen or legal resident. So, you don’t need to worry about that.

Here’s an overview of the process:

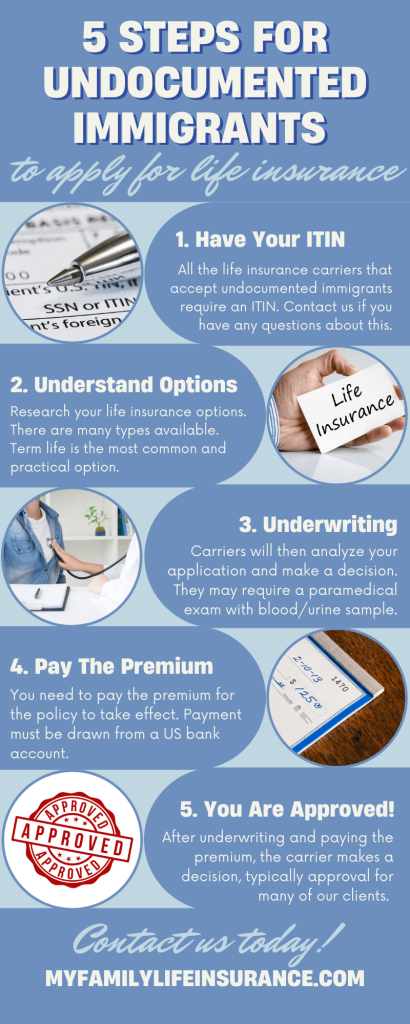

(1) Have your ITIN and home-country passport available: We touched on this earlier. You need at least an ITIN to apply for life insurance. If you don’t, then you can’t apply until you have one.

Having a valid, home-country passport is helpful, too, but it is not required. Not having one may extend the underwriting process (more on that in a minute).

Also, having a driver’s license is a “nice-to-have”, but it is not required as many states do not issue driver’s licenses to undocumented immigrants.

(2) Select A Life Insurance: As discussed, many options exist. However, you most likely will want term life insurance. Although, whole life and indexed universal life are available.

You’ll want to balance needs and goals versus the premiums you want to spend.

(3) Go Through Underwriting: We will touch on this in more detail. However, depending on your situation, you may have to go through a paramedical exam while the underwriter reviews your application. Some applications go through an accelerated process.

(4) Pay Your Premium: Nearly all the life insurance carriers that consider undocumented immigrants for coverage require premiums paid via a US-based bank account.

(5) Approval: Once approved, the policy is placed in force. You now have life insurance.

The process is rather easy, but contact us for any specific questions.

Premium Cost Of Life Insurance For Undocumented Immigrants

Many of the websites have a quoter that you can look at premium rates. Honestly, they won’t do much. You see, as we said before, many of the carriers on that quoter don’t insure undocumented immigrants.

However, the good thing about them is you can get an idea of how much life insurance could cost. Feel free to search in our quoting tool. Just input your information and be honest about your health. We’ll get a notice that you searched, so you may see an email or a phone call from us to say thanks and see how we can help. No worries. We don’t share your information. Promise.

Honestly, it’s best to contact us if you really are interested in protecting your loved ones and family.

Life Insurance Underwriting Of Undocumented Immigrants

Many undocumented immigrants believe they will pay a higher rate because they are not legal residents.

That isn’t necessarily the case.

The carriers that consider and approve undocumented immigrants look at your:

- health history

- working status

- lifestyle situations such as credit and motor vehicle history

- insurable need

These are similar factors that carriers review for US citizens and legal residents.

Carriers will look at your MIB, driving records, and prescription drug history among other variables.

But, John, you say. My death benefit is limited.

True. Several carriers do limit the death benefit for undocumented immigrants.

However, as we said before, we work with carriers that do not limit the death benefit. Additionally, you can select any type of life insurance such as indexed universal life or whole life.

Can An Undocumented Immigrant Be A Beneficiary?

There is some confusion around this topic. So, let’s give you the details.

As we indicated earlier, yes, an undocumented immigrant can be a beneficiary of a life insurance policy.

There is no stopping that. Moreover, the life insurance carrier pays the beneficiary the death benefit, even if the beneficiary is living in another country.

However, there is a potential issue.

Certainly, US immigration departments could step in and intervene. That’s not the carrier’s fault. You will want to consult an immigration attorney in this case.

Other Options For Undocumented Immigrants

Other life insurance options exist for undocumented immigrants. We discuss these next.

A PreNeed Burial Plan

We work with a pre-need burial plan available to undocumented immigrants. These types of plans are not life insurance.

Here’s how they work.

You pay a monthly cost, like $70 per month. There is a waiting period on the plan, which means any claims during this waiting period are denied. The waiting period depends on age. For example, a 30-day waiting period exists for people under the age of 65.

These plans will pay for your funeral costs, services, etc. They don’t, generally, pay for your plot.

The plan we use will send your body back to your home country if you prefer that. Obviously, air transportation is included in the cost.

You just pay that monthly premium and when you pass away, your loved ones contact the pre-need carrier. They will then take care of everything.

Additionally, the pre-need plan does not require underwriting or a social security number.

Burial Insurance

Burial insurance is simply a life insurance policy with a small death benefit, like $25,000 or $30,000. Nearly all burial insurance policies are whole life policies.

The life insurance industry likes to call them “burial insurance” because these small, whole life policies are typically used to fund funerals and burials.

Unlike the pre-need burial plans we just mentioned, burial insurance policies do require underwriting. However, the underwriting is not as stringent as the larger policies we discussed earlier in the article.

Usually, applicants answer a health questionnaire. Some carriers require a phone interview.

OK, John. What is the advantage of these plans, then?

Good question. Burial insurance provides more flexibility compared to pre-need burial plans. Additionally, burial insurance will help pay for costs pre-need plans don’t pay for (like your plot and tombstone). Moreover, because it is life insurance, you can leave any remaining money to your loved ones.

Now You Know Undocumented Immigrants Can Obtain Life Insurance

We hope you now realize that obtaining life insurance for undocumented immigrants is a rather simple process. Most of the carriers we work with have an online application process. This online portal makes the application process much easier. Regardless of which carrier we recommend, we work with you every step of the way.

If you have a need for life insurance, but without the proper documentation, contact us. Or, use the form below. We can help select the right carrier for your situation. All we will ask is whether or not you have a social security number. If you don’t, we know our starting point. We will then work with those carriers that allow other ways to apply for life insurance.

Again, feel free to contact us with any questions you have. Or, fill out the form below. We will be in touch. We only work in the best interests of you and your family.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

2 thoughts on “Life Insurance Options For Undocumented Immigrants [Yes, You Can Obtain It & Easily, Affordably, Too!]”

Comments are closed.

She is 75 no paper

Hi Manjula,

Likely can help this person who is 75, but that depends on other factors. Feel free to give us a call, and we can see if we can help.

John