2 Solid Life Insurance Options For People With Huntington’s Disease | We Discuss 2 Guaranteed Issue Options & Possibly More Options Available

Updated: April 12, 2024 at 9:38 am

Did you know that people with Huntington’s Disease can obtain life insurance?

Did you know that people with Huntington’s Disease can obtain life insurance?

It is true.

However, life insurance options are really limited. Are they the best life insurance for you? Well, depending on your specific situation with Huntington’s disease, they might be.

In this article, we discuss life insurance options for people with Huntington’s Disease.

Here is what we will discuss:

- Why Is Life Insurance Difficult To Obtain

- Life Insurance Underwriting

- 2 Life Insurance Options

- Possibly Additional Life Insurance Options

- Life Insurance On Children

- FAQs About Life Insurance And Huntington’s

- Final Thoughts

Let’s jump in and discuss why is it hard for people with Huntington’s disease to obtain traditional life insurance.

Why Is It Difficult To Obtain Life Insurance With Huntington’s Disease?

People with Huntington’s Disease have a hard time finding traditional life insurance coverage.

Why?

Huntington’s Disease (also known as Huntington’s Chorea) is an inherited medical condition and neurodegenerative disorder marked by a breakdown of healthy brain nerve cells. It is caused by a gene mutation in the brain. There is no known cure. Moreover, limited treatment options exist, although medication is available to relieve symptoms of the disease.

As you can imagine, this degeneration leads to all sorts of health problems including, but not limited to

- dementia,

- mental disorders,

- slurred speech,

- and physical ailments like involuntary movements (similar to Parkinson’s)

The life expectancy of someone with Huntington’s Disease is around age 60. Life insurance carriers don’t like that. They know this shortened life expectancy. This is why life insurance companies always decline a traditional life insurance application for someone with Huntington’s Disease. The person inflicted with Huntington’s will likely, unfortunately, die within the term of the policy.

Nothing is certain, of course. However, the probability of death is much greater.

The reason why, in layman’s terms, is the term life insurance carrier covers you for an unexpected death. Sure, we all will die, however, term life insurance is best for IF we die, not WHEN we will die.

However, people living with Huntington’s disease do have a documented, shortened life expectancy, and life insurance companies just want to stay away from that. This is why they decline people with Huntington’s disease.

However, as we mentioned, people with Huntington’s disease can obtain life insurance. Other types are available.

Before we discuss the life insurance options available for people living with Huntington’s disease, let’s discuss life insurance underwriting in more detail.

Life Insurance Underwriting For People With Huntington’s Disease

Underwriting is the foundation of an application decline or approval. Life insurance underwriters review your health information, medical information, and background. They will review:

(1) your medical claim history in the MIB

(2) prescription drug history

(3) answers to the application itself

(4) medical records

(5) results of a medical exam including blood and urine sample

(6) anything else they feel is material to making a decision on your application

People with health conditions think they can just “hold back” their information. They can’t. Carriers nowadays have so many ways to confirm the information answered on the application versus available information. Moreover, the carrier may construe your omission as lying and automatically decline your application. It is always best to be upfront and transparent on life insurance applications.

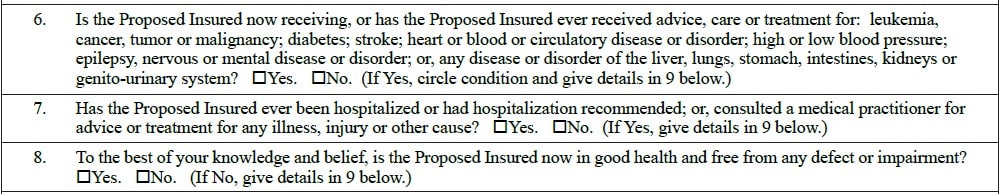

Here’s the thing with traditional life insurance applications. They always ask about Huntington’s disease in one way or another.

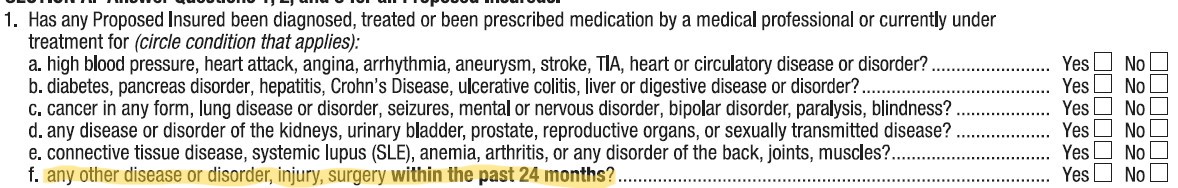

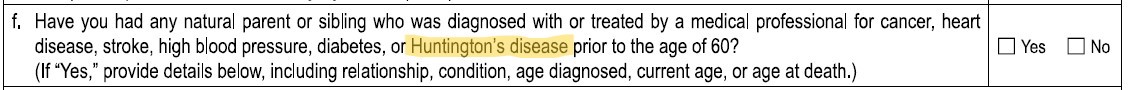

For example, an individual term life insurance application might have a sentence that goes something like this:

During the past 10 years, have you had or been treated for Epilepsy, Alzheimer’s, Huntington’s…

This question is essentially a “knockout” question. If you answer “yes”, you are likely “knocked out” (not literally) from the application.

Your application is then declined.

Here are some excerpts taken from real term life insurance applications. You can read they always ask about Huntington’s disease either directly or indirectly.

Nevertheless, life insurance options do exist for people with Huntington’s disease.

Nevertheless, life insurance options do exist for people with Huntington’s disease.

Wait, John. My dad has Huntington’s. I, however, have not been diagnosed. I am good, right?

Good question. Not necessarily. Let’s discuss this next.

Life Insurance Underwriting If A Parent Or Sibling Has Huntington’s Disease

If a parent, sibling, or some other close family member has Huntington’s disease, but you don’t (either officially or unofficially), you aren’t out of the woods yet if you yourself want life insurance.

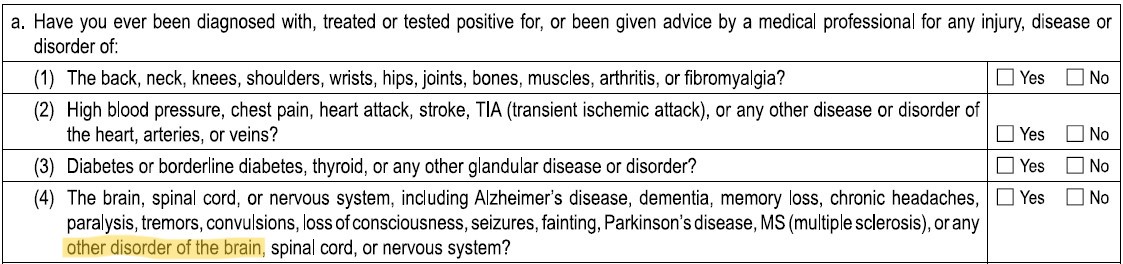

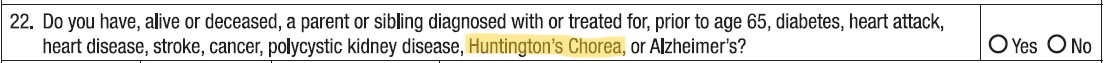

Every application has some type of question asking if a close family member has Huntington’s disease. Just look at these 2 excerpts:

Sure, you could lie, but that isn’t right. As I said before, carriers will find out, and lying on a life insurance application construes fraud.

Sure, you could lie, but that isn’t right. As I said before, carriers will find out, and lying on a life insurance application construes fraud.

So, what happens next? Well, if you submit the application, the carrier will likely put your application on hold. They will then tell you that you need a genetic test. The genetic test (a blood test) will show if you have the gene present for Huntington’s disease. If you do, then they will likely decline your application.

Having the genetic test is not an easy decision. If you have a family member with Huntington’s, you may not want to know if you have the gene. Conversely, you may want to know so you can plan and prepare your family. Genetic counseling services are available to assist in this decision.

If you have any questions about this, please contact us. Let’s now discuss 2 life insurance options available for people with Huntington’s disease.

2 Life Insurance Options Available For People With Huntington’s Disease

Two life insurance options exist for people with Huntington’s Disease.

However, before we jump into these options, please know that other life insurance options may exist as well. We discuss those other options later.

I am not going to mention them now because acceptance involves underwriting. We just discussed life insurance underwriting. Acceptance really depends on your situation with Huntington’s disease.

So, let’s jump in and discuss these 2 options first.

These 2 options are both guaranteed issue life insurance policies. What that means is that the life insurance company does not underwrite. There are no:

(1) health questions to answer

(2) prescription drug lookup

(3) exam, blood, urine sample

(4) MIB lookup

You just apply and you have life insurance.

It sounds great, but 2 drawbacks exist with guaranteed issue life insurance:

(1) limited death benefit like $25,000

(2) usually a 2-year waiting period on the death benefit

These drawbacks make sense when one understands the reasoning. Since carriers that offer guaranteed issue life insurance don’t underwrite, they mitigate their risk in these 2 ways. They limit the death benefit and they have a waiting period on payment of the death benefit.

The waiting period isn’t as severe as you might think. If you pass away from illness or natural causes in the first 2 years of the policy, the carrier either pays your beneficiary the premiums you paid (get your money back) or some percentage of the death benefit. We discuss more in our guaranteed issue guide. After 2 years, the carrier pays the death benefit 100%. At any point, if you pass away from an accident, the carrier pays 100%.

Here are the 2 guaranteed issue options.

Guaranteed Issue Term Life Insurance Policy

We are one of the few brokers able to offer a guaranteed issue term life insurance policy.

This policy is through an association and available for people ages 18 to 75.

You can purchase between $10,000 and $50,000 in $10,000 increments.

The term period terminates at age 80.

The plan is not available in every state. You can self-enroll here: https://protectionpluslife.com/m/jbarnes

Premiums are fixed for 5 years and then they increase as you enter age bands, about 10 years apart.

Contact us if you have any questions. For people inflicted with Huntington’s disease, this plan is a viable option.

Guaranteed Issue Whole Life Insurance Policy

A guaranteed issue whole life insurance policy is another option.

Guaranteed issue whole life works the same as the guaranteed issue term policy we described.

However, rates are fixed. They don’t change. Moreover, guaranteed issue whole life costs more because it will pay out during your lifetime.

Nevertheless, we work with many guaranteed issue life insurance carriers.

Required application ages are 40 to 80.

You can search for rates here if you wish. Just select “poor health” in the health status field.

Please note the following articles for more information about guaranteed issue life insurance:

(1) $100k

(2) under 40

Let’s discuss additional life insurance options possibly available for people with Huntington’s disease.

Possibly Other Life Insurance Options Available For People With Huntington’s Disease

Possibly, other life insurance options exist.

The operative word here is, possibly.

Options really depend on your situation with Huntington’s disease and:

(1) what’s in your MIB

(2) what medication you are on

(3) health questions asked on the application

(4) answers to previously submitted life insurance applications

Remember that carriers can find out anything nowadays. You can order your MIB and your prescription drug history and see what they contain. I recommend your doing this.

Let’s say a parent has Huntington’s disease. You as the child have not been tested and don’t plan to. You are otherwise healthy and employed full-time.

Can you obtain life insurance other than a guaranteed issue policy?

The answer, probably, is “yes”.

Now, you wouldn’t be eligible for any of those fully underwritten plans I described earlier. Why? They all pretty much ask about your family’s medical history and if any close family member has Huntington’s disease.

However, some plans, including some term life plans, don’t ask about family history.

So, without further delay, let’s talk about other, possible life insurance options for people with Huntington’s disease.

Burial Insurance Options For People With Huntington’s Disease

Burial insurance is an option for people with Huntington’s disease.

It is a whole life insurance policy with a small death benefit like $25,000.

You might say, John, I heard that whole life is bad!

You might say, John, I heard that whole life is bad!

Not really. It is only bad when it doesn’t fit your situation. In this case, whole life works nicely because it pays a benefit to your loved ones when you pass away, whether that is 1 year from now or age 95.

Upon your passing, your beneficiary receives the money for your funeral, etc.

The advantages of burial insurance are many. These plans are easy to apply for. You just answer a health questionnaire. The carrier looks up your medical information in the MIB and prescription drug history. If all checks out, you will have the burial insurance.

If you have Huntington’s disease, your options are rather limited. You may still only qualify for a guaranteed issue life policy or a graded benefit burial insurance policy. What is a graded benefit burial insurance policy? It is a type of burial insurance that has a “step-up” death benefit (as I call it) in the first 2 or 3 years of the policy.

Essentially, if you pass away in the first 2 or 3 years of the policy’s start date, your beneficiary receives some percentage of the death benefit.

If this sounds like the guaranteed issue plans, you are right. It contains a similar “waiting period”. However, graded benefit burial insurance plans usually are cheaper than their guaranteed issue counterparts. Moreover, higher death benefit amounts are available.

Example Burial Insurance Rates For People Who Have Huntington’s Disease

Feel free to check on the rates below. Rates are subject to change. Moreover, we work with many other carriers that do not subscribe to the quoting tool.

We work with a few carriers that do not check the MIB, so as long as you are not on any “knockout” medication, we could get you burial insurance, even with Huntington’s disease.

Additionally, if you are a child of a parent with Huntington’s, burial insurance options work great. They typically do not ask about any family history, family members, or close relatives having Huntington’s disease.

Simplified Issue Term Life Insurance For People With Huntington’s Disease

Simplified issue term life insurance is an option, provided you can answer the health questions, pass the MIB, and have a clear prescription drug check.

It removes the medical exam and a bunch of other things with underwriting.

Depending on the health questions and any MIB and prescription drug, we may have options for you.

Additionally, if you are a child who has a parent with Huntington’s disease, these plan options we work with usually don’t ask questions about the parent.

Group Life Insurance

Group life insurance is an option. Obviously, if you are an employee, you can get some through work if your work offers it.

Group life insurance is different than an individual term life policy. One major reason is you typically lose your life insurance if you leave or job or are let go.

But, it is better than nothing.

Moreover, if you are a business owner, did you know you can obtain life insurance through your company? It is true.

We work with a carrier that will take a minimum of 2 employees at guaranteed issue.

So, if you have at least one other employee, you can obtain life insurance (through your company) at guaranteed issue.

We’ve helped many business owners with health conditions establish life insurance through their businesses. We most recently helped a fundraising consulting firm and a husband/wife independent trucking company obtain life insurance this way.

Contact us if you’d like to learn more.

Children, Life Insurance, And Huntington’s Disease

We mentioned before that Huntington’s Disease is inherited. There is a great chance that your children could develop the condition as well.

Many financial advisors will say that life insurance on children is a waste of money. They will say, “Don’t do it!” Just do a Google search for, “Is life insurance on children a good idea” and read all the negative articles. Or, if you have a financial advisor, ask him or her. I can almost guarantee they will say it is a bad idea.

But it is a great idea. I discuss all the advantages in my own article about life insurance on children. However, it is a no-brainer if your family has a history of Huntington’s disease.

You want to establish life insurance on your children now so they have coverage in the future, especially if there is a chance they are diagnosed with Huntington’s. At that point, obtaining life insurance coverage at that point (as we have discussed) will be nearly insurmountable.

Many life insurance applications for children don’t include questions about the parents. Look at this excerpt from a juvenile life insurance application:

Contrary to what you will read elsewhere, life insurance on children isn’t expensive or a waste of money.

Contrary to what you will read elsewhere, life insurance on children isn’t expensive or a waste of money.

We can provide term life insurance on children for as low as $25 per year. That is right.

We also provide indexed universal life on children which is a great way to save for their future.

Frequently Asked Questions About Life Insurance And Huntington’s Disease

We discuss some frequently asked questions about life insurance and Huntington’s disease.

Is Huntington’s Disease A Terminal Illness?

Technically, no. However, people living with Huntington’s Disease have a life expectancy of around 60. Life insurance companies know this and limit available options.

Can Someone With Huntington’s Disease Obtain Life Insurance?

Yes, but life insurance options are limited. We discussed several possible life insurance options in this article.

If A Family Member Has Huntington’s Disease, But I Don’t, Can I Obtain Life Insurance?

If you’ve taken the genetic test, and the results are negative, you can obtain any type of life insurance available.

However, if you haven’t taken the test yet, carriers will want you to.

If you’ve taken it, and you have a positive test result, then the life insurance options we discussed in this article are available.

Now You Know People With Huntington’s Disease Can Obtain Life Insurance

We hope you now understand your life insurance options for people with Huntington’s Disease. If you currently have Huntington’s Disease, guaranteed-issue life insurance policies (whole life and term) are available.

Other life insurance options may be available, depending on your situation, what’s in the MIB, previous applications, etc.

Do you need assistance or have questions? That is why we are here. As with anything we do, we always have your best interests first and foremost.

Contact us or use the form below. We would be very happy to help you with the life insurance you need and give you and your family peace of mind.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".