Step-by-Step Guide to Understanding How Life Insurance Tables And Table Ratings Affect Your Cost

Updated: April 12, 2024 at 9:38 am

We aren’t talking about kitchen tables. In your search for affordable life insurance, you may have heard of the terms “life insurance tables” or “table rating”.

We aren’t talking about kitchen tables. In your search for affordable life insurance, you may have heard of the terms “life insurance tables” or “table rating”.

Or, maybe you applied for life insurance, and the life insurance company offered a “table rating”. You probably have no idea what this means.

Yeah, John. I am confused. They want to charge me a higher premium!

No problem. In this article, we discuss the importance of understanding life insurance tables and table ratings (hint: it saves you money!).

Knowing the difference and knowing how the life insurance tables and ratings work among the many life insurance companies can save you thousands over your lifetime.

I am not kidding.

Here is what we will discuss:

- What Are Life Insurance Tables?

- Why Do Life Insurance Companies Use Tables?

- The Parts Of A Life Insurance Table

- Life Insurance Table And Ratings Example

- Life Insurance Underwriting And Table Ratings

- What To Do If You Are Offered A Table Rating

- Heath Conditions Or Situations Which May Yield A Table Rating

- Case Studies Of People We Have Saved Money

- FAQs About Life Insurance Tables And Ratings

- Final Thoughts About Life Insurance Tables

We also discuss how to improve your table rating if you are offered a rating. We provide examples of clients we have helped save thousands over their policy’s lifetime.

What Are Life Insurance Tables?

When you submit a life insurance application, the carrier’s underwriting department reviews your application. This review is called underwriting.

The life insurance underwriters then takes your information and places it in a “table”. The table is based on actuarial science, life expectancy, mortality rates, health issues, etc.

Specifically, the underwriters look at:

- information from the MIB: shows your medical claim history as well your medical conditions and application history

- prescription drug history,

- driving records,

- bankruptcy and credit history,

- doctor’s records: to confirm the severity of a medical condition (for example) and medical history,

- felony/criminal records,

and anything else material to your application.

As we stated earlier, the underwriter takes all of this information and places your information in a “table”.

The premiums you pay for life insurance correspond to where you land in the table. Where you land in the table is based on risk factors. The risk factors comprise of everything we described above. The underwriters look at these risk factors and assign points.

Underwriters start your application at standard rates. You can think of standard rates as someone in average health – not in bad health, but not in super good health, either. Carriers deduct points from the standard rates for good situations like good health.

Conversely, carriers add points above the standard rating for bad situations like severe sleep apnea or a recent heart attack.

The lower your table classification, the lower life insurance premiums you pay. In other words, the lower your table classification, the lower rates you’ll pay. Conversely, the higher your table classification, the higher rates you’ll pay.

Why Do Life Insurance Companies Use Tables And Table Ratings?

Why do life insurance carriers use tables and table ratings? The reason is to create a standardized and equitable way of analyzing risk.

Stated another way, a healthy person shouldn’t pay the same premium as an unhealthy person right?

Right, John. That makes sense.

Right. The healthy person pays a lower rate. Conversely, the unhealthy person pays a higher rate.

Let’s get into the specifics and the parts of a life insurance table and table ratings.

The Parts Of A Life Insurance Table

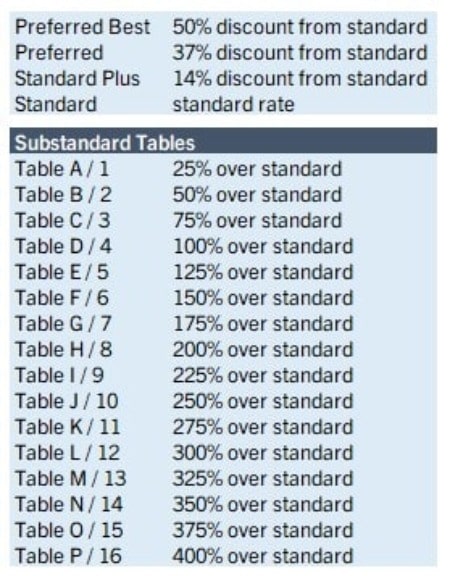

There are really two parts of the life insurance tables: standard health classification and then the substandard risk (table rating) classification.

Generally speaking, carriers have the following standard risk classifications in their life insurance tables.

Preferred Best – you are really healthy. Great height and weight ratio, no medication, great vitals

Preferred – very healthy. Maybe a vital is off (such as moderate cholesterol), but nothing major. Maybe you are on 1 medication and the condition is stable

Standard Plus – could be moderately overweight or a family member death before age 60

Standard – this is normal, average health. Could have a moderate health condition like anxiety which is stable with medication.

Preferred Tobacco – you are pretty healthy, but otherwise smoke or use some type of nicotine alternative, like an e-cigarette. In other words, if you DID NOT use nicotine, carriers would classify you at the preferred rate or better.

Standard Tobacco – you have normal health, but like a preferred smoker, you smoke or use some type of nicotine alternative, like an e-cigarette.

Again, these 6 risks are sometimes known as the standard health classifications.

We now discuss the substandard life insurance tables (i.e. table ratings).

How The Substandard Life Insurance Tables Work

After this group, carriers have substandard life insurance tables for people with increased health or lifestyle risks.

These are the “ratings” you hear about. Depending on the carrier, they are tables A through P or 1 through 16. Each alpha letter corresponds to a number. In other words, Table A = Table 1, Table B = Table 2, etc.

The most important aspect here, with substandard table ratings, is that carriers generally assess an additional 25% fee for each rating from the standard health rate (or standard tobacco if you use tobacco).

For example, Table 1 or A means the carrier assesses a 25% increase from the standard rate.

Table 2 or B means a 50% increase from the standard rate.

Table 3 or C means a 75% increase from the standard rate, And so on.

Take a look at the example life insurance table in this section.

Let’s get into some examples so you know how the life insurance tables and ratings work.

Life Insurance Tables And Ratings Example

Let’s get into some easy examples to show how these life tables work.

Stephanie is a healthy 35-year-old woman. She exercises regularly, has a good BMI ratio, and regularly visits her doctor for checkups. She has no medication history, other than for antibiotics for illnesses here and there. Additionally, she has no lifestyle issues, a good driving record, etc.

She applies for $500,000 of term life insurance. Her agent thinks she could qualify for preferred best, but states that the estimate is subject to underwriting.

$500,000 at standard rates costs $31.79 per month. The underwriter reviews her MIB, prescription drug history, etc. The underwriter concludes that Stephanie is healthy and falls into the “preferred best” rating. Stephanie now pays $17.26 per month instead of $31.79 per month!

Let’s look at Rachel, another 35-year-old woman. She also applies for $500,000. Rachel isn’t quite in the best health. She was diagnosed with bipolar disorder 3 years ago, is a bit overweight, and has sleep apnea (controlled).

Rachel’s agent tells her to expect a table rating because of her health and medical history.

The underwriter starts at standard rating and analyzes Rachel’s information. He reviews her MIB, receives her medical records, and analyzes other information.

Based on the information, the underwriter offers a table rate of table J. This means, instead of paying $31.79 per month, Rachel will pay $85.79 per month.

People with bipolar disorder generally have a shorter life expectancy (this doesn’t mean they are uninsurable). The life insurance carrier would potentially have some big problems if Rachel paid the same rate as Stephanie.

How Does Underwriting Work With Life Insurance Tables?

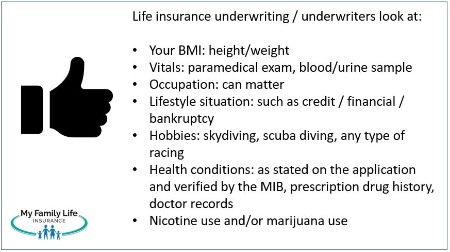

As you can conclude, underwriting and the tables go hand-in-hand. When an underwriter reviews your application for your life risk assessment, he or she places you in one of the classifications we talked about.

Here are some health and lifestyle factors that underwriters look at:

- Height and Weight Combination – your BMI ratio

- Vital readings – your blood pressure and cholesterol levels, for example

- Serious issues – previous diagnosis or current treatment for cancer, heart disease, diabetes for instance

- Family history – yes, many health complications can be passed down, such as high blood pressure and even Huntington’s Disease

- Occupation – it’s true, some occupations are riskier and therefore command a substandard rating than others

- Hobbies – if you like to sew in your spare time, a life insurance underwriter isn’t going to care about that. But, if you like to rock climb, jump out of airplanes, or scuba dive greater than 100 feet, you’ll likely have a table rating

- Smoking, tobacco use, or drug use – yes, these all matter. If you smoke marijuana, your rating depends on the frequency of use

So, the underwriter takes all this information in, assesses it, and then assigns you a risk classification. It could be one of the standard health classifications. Or, it could be one of the substandard table ratings.

To accurately assess your health classifications, carriers require a paramedical exam which consists of a blood draw, urine sample, and height/weight check among other things. Although, nowadays, many carriers are moving away from the paramedical exam and, instead, to a phone interview. Moreover, carriers will also request your doctor’s records if they need more information.

Life Insurance Tables Come In All Shapes And Sizes

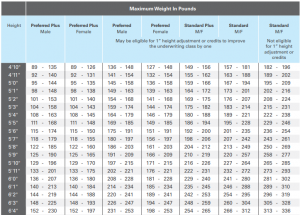

Many life insurance carriers have tables for height and weight and to outline what characteristics are considered preferred health, standard health, etc. Take a look at the tables below.

We receive a lot of phone calls from people who are healthy, but they are a bit overweight. Well, that overweight factor will likely knock them into a table rating, even if they are healthy every other way. You can see above if Joe, who is healthy, but just “big-boned” and weighs 320 at a height of 6’0″, a carrier will likely assign a table 1 substandard rating.

You might be thinking, “Geez, John. Is there any way I can improve my life insurance table rating?”

Yes, there is. We discuss these options next.

What To Do If Offered A Table Rating?

Let’s do a quick review to make sure we are all on the same page. Carriers have life insurance tables to properly assess your risk.

That risk is your chance of early, unexpected death.

Without underwriting and the aid of these tables, the entire insurance industry could not exist. Sick people would purchase life insurance at healthy, preferred or standard rates, and then die too early. Carriers would then have to pay the death benefit way too early. The carriers could not invest the premiums within a proper timeframe to create adequate financial reserves. The whole industry would go bankrupt. We would not want that to happen.

Having said that, you don’t want to pay any more than you have to. We at My Family Life Insurance are big believers in maximizing your hard-earned money.

If you work with us, we do field underwriting on the front-end (i.e. before) of the application, so you know what kind of rate to expect. We reach out to all of the carriers we work with, send them your information, and ask for a “risk assessment”. They come back to us with an estimated rate. We then decide with you which life insurance carrier would be your best option.

The best part of all this is that we set your expectations early so there are no surprises.

But, let’s say you didn’t work with us, and you unexpectedly are offered a table rating by a life insurance carrier. What should you do? Here is what we recommend.

So let’s discuss how you can improve your health classification or table rating and save you some money.

Take And/Or Modify Your Policy

If you are presented with a substandard life insurance offer, it is likely in your best interest to take the offer. How is this a strategy?

Simple.

Some life insurance coverage is better than no coverage.

Some life insurance coverage is better than no coverage.

Let’s say you have had type 2 diabetes for a couple of years and are overweight. Well, this scenario might be an expensive proposition for you. However, you are committed to improving your health, and then letting time serve its course. Underwriters like time. A longer timeframe gives them more information to assess your health. Let us explain.

If you really wanted a 30-year term policy, but have the health complications we described above, the policy is likely costly depending on other factors.

If you are committed to improving your lifestyle, then why not take the policy? You have coverage for your loved ones and family in case of your unexpected death. If you are committed to improving your health, you can reapply in 3 or 5 years and see if better options exist.

Or, you can simply modify the offer. Many carriers allow you to modify the policy if you are offered a table rating. They will allow you to reduce:

- the death benefit and/or

- term period

to meet your budget. For example, modify the term to 15 years and take the policy. When you lose weight and keep it off, that will improve your health. Moreover, time allows you to manage your diabetes better. Coupled with the weight loss, you could be in a good position to reapply in 2 or 3 years.

Take A Substandard Policy Makes Sense

It generally makes sense to always take a substandard policy. People say they will shop around instead. You are hurting no one, but your loved ones and family, if you go that route.

Typical human behavior takes over and life insurance goes on the backburner. Suddenly, something happens, and then you really need life insurance. But likely at that point, life insurance is now way too expensive. You just hurt your loved ones.

Of course, utilizing the help of an independent agency like My Family Life Insurance at the beginning of the process helps. As described earlier, we can match the carrier to your needs so you don’t have to pay any more than you have to.

Use An Independent Agency

No two carriers are alike. This goes for their underwriting and life insurance tables as well. For example, one carrier may have a preferred cholesterol ratio at 5.5. Another carrier may have it at 6.0. If you have mildly high cholesterol levels, and are healthy every other way, which carrier would you choose for a preferred rating? That is right…the one who assigns a 6.0 cholesterol level.

How would you know this, though?

I don’t know, John. It would be a guess.

On your part, yes, it would. However, an independent broker knows this and can search the 70+ life insurance carriers to see which one makes better sense in your situation.

You can go on any life insurance website, throw in your basic information, and see a premium number. Unless, however, you are completely healthy, that premium number is meaningless. Most people are not completely healthy.

So, using an independent agency like My Family Life Insurance can save you money on your life insurance. We can search the landscape of over 70 carriers to see who would be the best fit for your situation. Scroll below to read successful placements and estimated annual savings from our work.

Lose Weight Or Stop Smoking

A high BMI and smoking / nicotine use are leading issues of table ratings. Why?

They all lead to other medical issues. A high BMI can lead to diabetes, sleep apnea, and a whole host of other issues.

Same with nicotine use. Smoking and nicotine use can lead to COPD, lung disease, and cancer.

If you are overweight, losing weight is probably the best option to improve your health classification. However, it is “easier said than done.” Trust me, I know. And, I can speak from experience. I was 50 pounds overweight at one point. My cholesterol and blood pressure were all out of whack. Once I lost the weight, these important levels returned to normal.

Losing weight takes time. And, all of the carriers generally have the same requirements for losing weight. It goes something like this: if you lost more than 10 pounds over the last 12 months, the carrier adds back half of the lost weight to your current weight. This is your weight for the application. For example. You used to weigh 300 pounds 12 months ago, but now at 200. Your new weight is 250.

Why do they do this? Because most people gain 50% or more of their weight back. Personally, I don’t think this is right. But, let’s remember the purpose of underwriting: to create a fair premium for all insureds.

Well, John, what do I do if I keep the weight off?

Good question. You can ask the carrier for premium change. They will send a medical examiner to come to your home or office to weigh you. Once the weight is confirmed, you will have a new weight. Honestly, though, depending on other factors, it could make sense to reapply altogether, especially if your vitals and health have improved.

Nicotine Use

The same goes for smoking. Life insurance companies will allow a health classification change to non-smoker standard rates if you’ve quit nicotine use for 12 months or more.

In other words, transitioning to a healthy lifestyle will save you money in the long run.

Health Conditions Which May Yield A Life Insurance Table Rating

The following conditions and situations, not exhaustive, will likely yield a table rating as well as an APS order from the life insurance company (i.e. ordering medical records to confirm the severity of health conditions).

Alcohol abuse and/or treatment

Atrial fibrillation

Bipolar disorder

Cancer history (other than basal and squamous cell skin cancers)

Carotid artery disease

Elevated cholesterol without treatment

Chronic obstructive pulmonary disease (COPD/emphysema)

Crohn’s disease/ulcerative colitis

Diabetes/gestational diabetes

Drug abuse and/or treatment

Emphysema

Epilepsy/seizure

Gastric bypass/lap band

Heart disease/surgery (all types)

Hepatitis B or C

Hypertension (severe, uncontrolled)

Kidney disease

Melanoma

MIB and prescription database results that indicate adverse medical history

Multiple sclerosis (MS)

Peripheral artery disease (PAD)/ peripheral vascular disease (PVD)

Chronic prescription narcotic use

How We Saved Client’s Money On Life Insurance Tables

We have experience in helping people improve their health insurance tables and classification. Check out these real case studies. Names have been changed, obviously.

Carl came to us from another agent after being approved as a standard health classification. All things suggested that he was more of a preferred classification. One thing stood out – a mildly high cholesterol level. However, BMI and other vitals were fantastic.

We approached several carriers who have liberal cholesterol levels and received a tentative offer for Carl for a preferred health classification. He took the paramedical exam. The results showed and supported his healthy way with low to mild cholesterol levels. The carrier granted him preferred classification. Through our help, Carl saved about $10,800 over the life of the insurance policy ($30 per month premium difference X 12 X 30 years)

Joe was diagnosed with Hepatitis B when he was 14. He came to us after being declined by another carrier. He provided us with key information about his condition, all of which indicated stability. There was no cirrhosis or fibrosis of his liver, either. We reached out to several carriers. Many indicated a table 2 rating, which is not bad, but one tentatively offered standard. Not only were we able to secure life insurance for Joe, but at a standard health classification.

Mary smoked, but not a lot. Really, only a couple of cigarettes a month, if that. Honest on her application, her original carrier and agent classified her as standard tobacco. Reviewing her situation, we were able to find her standard non-tobacco classification because of her limited use of cigarettes, as confirmed through the underwriting and paramedical exam process. The savings for Mary were huge: About $50,000 saved over her 20-year term policy.

Frequently Asked Questions About Life Insurance Tables

Here are some frequently asked questions about life insurance tables and table ratings.

How Are Life Insurance Tables Set?

Carriers use reinsurance guides that contain mortality tables and actuarial tables. Based on these tables, they can set their own tables for a specific situation. For example, one carrier may rate a person with type 1 diabetes at a table 4 while another carrier might rate the same person (all things being equal) at standard rates.

This is why it is important to use an independent broker like My Family Life Insurance which works with over 50 life insurance carriers. We work with many carriers, not just 1 or 2. By working with us, you improve your chances of getting the best rates for your specific situation.

Contact us if you have any questions.

Are Table Ratings Negotiable?

They can be; however, not usually. Once an underwriter makes a decision, usually the decision is set in stone.

However, sometimes they can be. You can always appeal to the underwriter if you have additional details that improve your situation, for example.

Using an independent broker like My Family Life Insurance helps. We can pre-qualify your situation on the front-end and help you get the best and lowest life insurance rates for your situation.

What Is A Life Insurance Table Shave Program?

A life insurance table shave program is a common program with many carriers. It is a program where life insurance companies reduce or lower your life insurance table rating because of a healthy lifestyle. These programs are also known as “healthy lifestyle credit” programs.

For example, let’s say you have bipolar disorder which is typically a table-rated condition. Let’s say a carrier initially rates you at a table 5.

However, you are pretty healthy in other ways. You have normal high blood pressure, and you exercise regularly (as evidenced in your APS).

These are positive attributes. The carrier reduces your table 5 rating to table 3 and offers a better rate now.

Final Thoughts About Life Insurance Tables

We hope now you understand how life insurance tables work. Did you recently apply for life insurance? Have you been table rated? Do you feel you need to improve your table rating or have questions about life insurance tables?

We can help. Feel free to contact us or use the form below. Our team can review your situation and identify your best course of action.

We have helped many people who were declined or faced with a high table rating get life insurance or a lower table rating.

As with anything we do, we only work in your best interest only. You see, many agencies and agents opt for a recommendation that provides the highest commission for them. We can’t work like that. It doesn’t matter to us how much we make. What matters is that you have the right solution for your needs at the lowest possible premium.

We always place your interests before our own. If we can’t help you, then we will point you in the right direction as best we can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

2 thoughts on “Step-by-Step Guide to Understanding How Life Insurance Tables And Table Ratings Affect Your Cost”

Comments are closed.

I am ****** and also *****, ***** and other minor issues and need a simple life insurance policy

Hi Trinity – Thanks for reaching out. We can help. I will email you some additional information shortly.

John