5 Differences Of Participating Vs. Non-Participating Life Insurance | We Discuss The Differences And Which One Is Right For You

Updated: April 12, 2024 at 9:38 am

Have you heard of participating vs. non-participating life insurance and wonder what the hubbub is all about?

Have you heard of participating vs. non-participating life insurance and wonder what the hubbub is all about?

If so, you are not alone.

Yeah, John. All I need is a life insurance policy death benefit to cover me in case of my unexpected death.

If that is the case, then you should read this article because you could apply for something that doesn’t fit your needs.

In this article, we discuss 5 differences between participating and non-participating life insurance policies. After reading this article, you will be able to make an informed decision between participating and non-participating life insurance plans.

I also dispel much incorrect information that you may read elsewhere on the internet.

Here is what we will discuss:

- What Is The Main Difference Between A Participating vs. Non-Participating Policy?

- The 5 Differences Between A Participating And Non-Participating Life Insurance Policy

- Advantages Of Participating Life Insurance Policies

- Which One Is Better For You?

- What Are The Ways I Can Receive My Dividend?

- FAQs About Participating Vs. Non-Participating Life Insurance Plans

- Final Thoughts About Participating vs. Non-Participating Life Insurance

Let’s jump in and discuss the main difference between participating and non-participating life insurance.

What Is The Main Difference Between Participating Vs. Non-Participating Life Insurance Plans?

The main difference between participating vs. non-participating life insurance is dividends. A participating insurance policy receives dividends from the life insurance company. A non-participating life insurance policy does not receive any dividends.

Dividends are similar (but not the same) to that of dividends offered by publicly traded companies, except:

- the dividend from the life insurance company is not taxable as (per IRS rules) it is considered a return of your premium (i.e. a “refund”)

- only offered on whole life insurance policies

So, what are participating life insurance policies? As you can surmise, they are whole life insurance policies. A whole life insurance policy is a type of permanent life insurance policy. It is designed to last the insured’s lifetime. Life insurance companies pay dividends on whole life insurance policies only.

Non-participating life insurance policies, as you can guess, include everything else: term life insurance, universal life insurance, and other types of life insurance. If the life insurance doesn’t receive a dividend, it is non-participating. That simple.

Additionally, whole life insurance can also be non-participating. Yes, that is right. The life insurance company can offer whole life insurance and simply not pay a dividend on it. Burial insurance is a type of non-participating whole life insurance.

This is why you may hear whole life insurance policies as:

- participating whole life policy – companies pay a dividend on the policy

- non-participating whole life policy – companies do not pay a dividend on the policy (sometimes also called “zero refund” whole life or a “non-par” policy)

Recap Of Participating Vs. Non-Participating Life Insurance

So, to recap:

A participating life insurance policy “participates” in the life insurance company’s dividend. Technically, this dividend is a “return of premium” even though it can be construed as coming out of the company’s profits. Only whole life insurance policies that participate in the company’s return of premium/refunds receive dividends.

Non-participating life insurance policies do not receive any dividends. These policies include:

- term life

- universal life

- non-participating whole life (zero refund whole life)

- other types of life insurance

5 Differences Of Participating Vs. Non-Participating Life Insurance

Let’s discuss 5 key differences between participating vs. non-participating life insurance policies.

#1 Dividend

We already discussed this as the main difference between participating and non-participating. The carrier pays policy dividends on an annual basis. Like a dividend paid to shareholders of company stock, the life insurance company doesn’t guarantee the dividend payment. Again, per IRS rules, a policy dividend is a return of premium and therefore not taxable.

Only participating whole life insurance policies receive dividends.

#2 Higher Premiums

You will pay higher premiums on participating whole life insurance vs. non-participating whole life insurance. Compare the premium rate for these two policies of a 35-year-old woman, standard health, for $150,000 whole life:

- Participating Whole Life: $151 per month

- Non-participating Whole Life: $127 per month

You can see the participating whole life insurance policy costs $24 more per month. We will discuss this further in the article.

#3 Non-Guaranteed Benefits

Non-participating policies are, what I say, “what you see is what you get”. (With the exception of universal life insurance, which is outside the scope of this article.)

Non-par policies like term plans, non-par whole life policies, and guaranteed universal life all have guaranteed benefits. Their

- premium payments,

- cash value (if any), and

- death benefit / face amount

are all guaranteed by the insurance provider.

You pay the guaranteed insurance premium, the carrier guarantees the cash value and death benefit.

Pretty simple and easy.

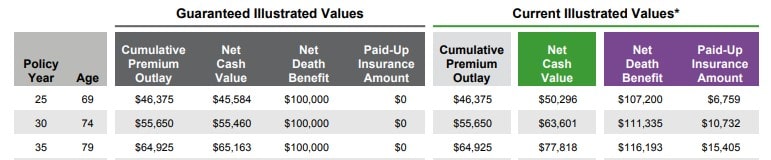

Participating whole life contains non-guaranteed benefits. In other words, while the carrier guarantees the premium, it also allows for a potentially higher (i.e. non-guaranteed) cash value and death benefit. The potentially higher cash value and death benefit comes from the annual dividend.

Check out this diagram of guaranteed and non-guaranteed elements (i.e. current illustrated values) in this whole life illustration.

How does the dividend create non-guaranteed benefits? Well, we will get into this in more detail later, but you can use the dividend to buy more life insurance. This use of the annual dividend is called “paid-up additions”. The paid-up addition buys “paid-up insurance”.

Paid-up insurance describes life insurance that is fully paid (i.e. you don’t pay any more). The carrier adds the paid-up insurance to the death benefit. They add the dividend (the paid-up addition) to the cash value. The dividend / paid-up addition also earns an interest rate and dividends itself, creating a compounding investment effect.

#4 Flexibility Of Policy Premiums

The dividend payouts allow policyholders of participating whole life policies to adjust their premium payments, if needed, and keep the policy in force.

The reason is the dividend payment can increase the cash value, and therefore provide a buffer for the guaranteed premiums.

I don’t recommend that you pay less in premiums because of the dividend, but know that you can adjust your premium payments if needed.

With non-participating policies, with the exception of universal life, you need to pay the guaranteed premiums to keep the policy in force.

#5 The Dividend Is Non-Taxable

Per IRS rules, dividends paid on participating life insurance policies are non-taxable. They are considered a “return of your premium”. We discuss this concept more in the article.

Per IRS rules, dividends paid on participating life insurance policies are non-taxable. They are considered a “return of your premium”. We discuss this concept more in the article.

Many other websites state otherwise; however, these websites could be located in other countries that do not share the same tax rules as the US. They will say that the dividend is a “form of bonuses” paid by the life insurance company. In the US, dividends aren’t a bonus. They are technically a return of premium.

Moreover, many websites even here based in the US get this wrong, stating a participating whole life policy is one “with profits”. It is not.

This non-taxable status is an advantage over other types of dividend-paying financial instruments and wealth accumulation products like dividend-paying stocks. Dividends paid on stocks are taxable at ordinary income tax rates because dividends coming from stock companies come from profits.

Let’s discuss some of the advantages of participating life insurance policies.

Advantages Of Participating Life Insurance Policies

I think there are many advantages of participating vs. non-participating life insurance.

The main advantage is the annual dividend.

As I discussed, the dividend creates a lot of flexibility. We will discuss this flexibility in more detail, but one advantage is how you can use participating whole life insurance policies as your own “bank”.

You may have heard of this concept as “infinite banking”, “bank on yourself”, or “be your own bank”.

A lot of consumers denigrate this concept, but it does work. (I’ve employed it on my own.)

Essentially, you build up your cash value “bank” through dividend-paying, participating whole life insurance policies. You then can borrow from this cash value to use to pay for things.

For example, I borrowed from my participating whole life insurance policy to pay for a car. I negotiated with the car dealer based on cash. I then paid myself back (not the bank).

My wife borrowed from her policy to buy out her partner’s business share. (And, then paid her loan back.)

Of course, there is the strategy of “saving the difference”. Moreover, funding your “bank” can take a long time. You either need to make large annual premiums or start this strategy when you are young.

Additionally, the compounding effect of using “paid-up additions” (described earlier) is an advantage. This option allows you to grow your cash value and death benefit with a compounding effect.

Of course, there are plenty of other options which we touch on later in the article.

Which Is Better For You? Participating Vs. Non-Participating Life Insurance Policies

OK, John. So, which one is better for me?

That is a hard question to answer. Only you can answer that, but look at your individual needs, financial goals, and financial needs.

If all you need is a death benefit, financial protection, and insurance coverage, then a term life insurance policy works just fine.

If all you need is a death benefit, financial protection, and insurance coverage, then a term life insurance policy works just fine.

Yes, that is right. There is no need to spend additional premiums on a permanent plan.

The one disadvantage of term policies is that they last only a set term (fixed period). Once the policy term concludes, you have no more life insurance (generally speaking).

If you want life insurance coverage to last your lifetime (i.e. your entire life until you pass away), but don’t want to pay whole life premiums, then a guaranteed universal life insurance plan is a good option.

Contrary to what others say, the concept of “investing the difference” between whole life and term life does work. However, many people simply won’t take that premium savings and invest the difference.

If that is you, then whole life insurance becomes a “forced savings” method. I know people don’t like to hear that, but that is what it becomes.

In that case, whole life insurance can be a good idea.

As discussed earlier, part of your premium goes towards the cash value. You then earn an interest rate on the cash value (the carrier defines a guaranteed rate in the contract). Usually, the interest rate offered by life insurance companies is higher than the going market interest rates (i.e. treasury bills, etc.).

Advantage Of Cash Value

While many Americans are in need of emergency savings, you can build these savings through a participating whole life insurance policy. Yes, you can.

Moreover, as I described, you can utilize a “bank on yourself” strategy.

If you have the commitment, then you can invest the difference on your own. However, as a CFP® Professional, I know that many people do not have that kind of commitment.

Ultimately, the right choice depends on your budget, needs, and goals. Contact us if you would like to chat about it. As a CFP® Professional, I will not sway you one way or another. There are advantages and disadvantages to everything insurance-related. I will, however, go through these advantages and disadvantages with you so you can make an informed decision.

Flexibility Of The Dividend In Participating Vs. Non-Participating Life Insurance

You can use the dividend on participating whole life policies in many different ways.

We already discussed the more common use: using the dividend as “paid-up additions” to purchase more life insurance (increases the cash value and death benefit).

- Take the dividend as cash – you can have the carrier mail you a dividend check

- Use the dividend to offset your premium and pay lower premiums – you can instruct the life insurance company to offset the dividend payment against your premium. For example, if your annual premium is $1,200 and the dividend is $400, you would pay $800.

- Keep the dividend in an account with the life insurance carrier – some life insurance companies will place the dividend in a savings account where it earns an interest rate.

Contact us if you have any questions.

FAQs About Participating Vs. Non-Participating Life Insurance Plans

We answer common questions about participating vs. non-participating life insurance.

What Is Cash Value?

Cash value is like a savings account. It is part of a permanent life insurance policy and grows over time, earning a fixed interest rate or a variable crediting rate (if an indexed universal life policy).

The policy’s cash value is an important component of the policy itself. It helps balance premiums. Moreover, it can be used to pay for premiums themselves.

You can borrow the cash value for your needs (see my examples above). If you terminate your permanent policy, the carrier writes you a check for your cash value, less any policy loans or surrender costs.

What Type Of Life Insurance Carriers Offer Participating Whole Life Insurance Plans?

Mutual companies, stock companies, and fraternal benefits societies offer participating whole life insurance policies. A mutual company is a company that is owned by its policyholders. MassMutual, Penn Mutual, and Mutual of Omaha are examples of mutual companies.

A stock company is owned by its stockholders and typically publicly traded on a stock exchange. You don’t need to be a policy holder to be a stockholder. However, stock companies will pay a dividend to their policyholders of participating whole life insurance. Prudential is an example of a stock company.

Finally, fraternal benefits societies offer dividends if they offer participating whole life insurance. Fraternal benefit societies are similar to mutual companies. However, fraternal benefit societies offer “certificates” instead of “policies”. These carriers are owned by their certificate holders and are not-for-profit. They exist for a greater purpose. For example, a Christian fraternal carrier may use the profits they make to support Christian charities and give to the poor.

How Do Participating Life Insurance Companies Make Money Vs. Non-Participating Life Insurance Companies?

There is no difference in how participating vs. non-participating life insurance companies make money. However, as we discussed, tax benefits exist with dividends paid by life insurance carriers. Dividends are typically not taxed.

With the exception of fraternal benefit societies, all life insurance companies are in business to make money and profits. (Moreover, you can say that fraternal carriers are in business to make money to be able to meet their charitable mission.)

Here is generally how life insurance carriers make money and why the dividend is considered a return of premium (and not taxable).

Life insurance companies must be conservative with their estimates and their management of their cash reserves. You want your life insurance carrier to pay the death benefit to your family upon your death, right? Of course, you do! If they have a good year managing their expenses and have a good investment year, then they will offer dividends. As shown above, you can see this is why the dividend is a return of premium and non-taxable. It is like the life insurance company is saying, “We did pretty good this year and didn’t need all of your premium. So, here is some of it back.”

Life insurance companies must be conservative with their estimates and their management of their cash reserves. You want your life insurance carrier to pay the death benefit to your family upon your death, right? Of course, you do! If they have a good year managing their expenses and have a good investment year, then they will offer dividends. As shown above, you can see this is why the dividend is a return of premium and non-taxable. It is like the life insurance company is saying, “We did pretty good this year and didn’t need all of your premium. So, here is some of it back.”

I am very aware of other articles stating the dividend comes from profits. These articles could be written overseas where the tax structure is different than here in the US. If you read an article based in the US that refers to a participating whole life insurance policy as a “with-profits” policy, that is technically incorrect.

Now You Know The Difference Between Participating Vs. Non-Participating Life Insurance

You should have a good idea now about participating vs. non-participating life insurance.

We discussed 5 differences of participating vs. non-participating life insurance. These differences include:

- dividends received by participating whole life policies

- higher premiums

- the flexibility of the dividend

- non-guaranteed death benefit

- non-taxable dividend

Is a participating policy or non-participating life insurance policy right for you? Let us know. Contact us or use the form below.

We only work in your best interests, so we are happy to discuss advantages and disadvantages and what is right for you.

There is no risk of contacting or speaking with us. If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your situation changes.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".