Can You Have Life Insurance While On SSDI? Yes, Here’s How | We Discuss 3 Life Insurance Options Available To SSDI Recipients

Updated: April 12, 2024 at 9:38 am

Every day, someone asks me if they can buy life insurance if they receive SSDI benefits.

Every day, someone asks me if they can buy life insurance if they receive SSDI benefits.

The answer is, yes, you can.

No, John. Another broker told me I couldn’t!

I hear that a lot. Unfortunately, you were misinformed, and the broker is incorrect.

If you are receiving SSDI benefits, you can obtain life insurance. That is a fact.

Now, however, some life insurance options could be unavailable depending on the nature and reason for being on SSDI.

We’ll get into all that in this article. For now, just know that you can buy life insurance while receiving SSDI benefits.

Here’s what we will discuss.

- What Is SSDI vs. Medicaid

- Overview Of Underwriting For SSDI Recipients

- 3 Life Insurance Options For People On Social Security Disability

- FAQs For People Receiving SSDI Benefits

- Case Studies Where We Have Helped SSDI Recipients

- Final Thoughts

Let’s jump in and give a quick discussion about SSDI versus Medicaid. This is the main source of confusion for many people.

What Is The Difference Between SSDI and Medicaid?

The difference between SSDI and Medicaid is the main source of confusion among recipients looking for life insurance. Additionally, many advisers, brokers, and agents get this wrong, too, to the detriment of the insured applicant.

However, I have been helping both SSDI and Medicaid recipients obtain life insurance for years. I can tell you the difference. Please reach out to an attorney in your state if you have any specific questions as Medicaid has nuances in each state.

SSDI means Social Security Disability Income. You receive this benefit if:

- you are hurt or sick,

- the SSA deems you totally disabled, and

- you can no longer work any occupation.

You earn this benefit through your work history. I am not getting in the weeds here, but SSDI recipients receive full disability benefits if they have worked 10 years with earned, reported income.

Approval for SSDI benefits depends on your inability to do any job at all. Having said that, the SSA declines many people for SSDI benefits in their first year – and beyond. Why? Because most people can do some type of job, even disabled (at least the government says you can).

One misinformed opinion shared by many is that SSDI has a resource and asset test when determining eligibility. This is untrue and misinformation.

The eligibility is if you can’t work any job (among other requirements). Upon approval, and after a 5-month waiting period, SSA pays your SSDI benefit.

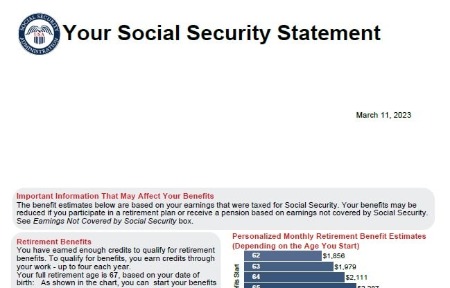

SSDI is government-provided disability insurance. SSDI benefits replace a percentage of your income, and you can see what that amount is on your social security statement.

Having said this, SSDI recipients can obtain any type of life insurance.

So, What Is Medicaid Then?

Medicaid is another government program. The federal and state level funds Medicaid. While the federal government establishes overall guidelines for the Medicaid program, the states manage those guidelines and can tweak its program. This is why I recommend you speak to a qualified attorney in your state if you have specific questions about Medicaid.

However, Medicaid eligibility depends on the assets and income you earn. It is a program designed for the:

- elderly

- disabled

- poor

- and other groups (see a general list here)

Receiving Medicaid benefits depends on the amount of assets you have and the income you make. If you are below this threshold, then you are eligible for Medicaid benefits (generally speaking).

The threshold is, generally, $2,000 of assets and $1,200 of monthly income. As you can see, it is not much. You are essentially destitute.

Medicaid benefits come in many forms; however, the most popular one is SSI.

SSI means Supplemental Security Income. This is extra income the government pays to you so you can essentially live.

You have to be aware here. Many other websites, agents, and brokers refer to SSI as Social Security Income. This is absolutely incorrect. Social Security Income is, essentially, the retirement benefit you’ve earned. You claim this anywhere between ages 62 and 70. The longer you wait, the higher your monthly benefit.

The problem is many agents and brokers think you are receiving your Social Security Retirement Benefit or SSDI, but you are not. You are receiving SSI, which is a Medicaid benefit. Medicaid has rules about assets and income. If you earn above or receive more than this threshold, Medicaid generally penalizes you and possibly terminates your aid.

What Do SSDI And Medicaid Have To Do With Life Insurance Then?

This is what SSI / Medicaid has to do with life insurance. If you are on Medicaid, your life insurance options. Most Medicaid / SSI recipients are eligible for simple, whole life policies called burial insurance. They are also called final expense, end-of-life insurance, final needs insurance, etc.

These plans all mean the same thing. They pay a benefit to a funeral home or your loved ones for your burial and funeral needs.

These types of plans work well for Mediciaid / SSI recipients because of the easy underwriting. Additionally, most carriers insure a slew of health conditions like COPD, diabetes, bipolar disorder, cancer, you name it.

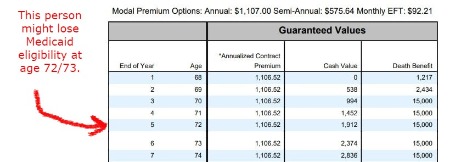

However, the big problem is these plans contain cash value. Cash value is like a savings account.

Oh yeah, John. My broker told me about this and not to worry.

I hear that many times. That can be a big mistake. The cash value can grow, and it can grow rapidly to the point where it exceeds the asset threshold. Look at this easy example.

it can grow rapidly to the point where it exceeds the asset threshold. Look at this easy example.

Do you know what happens next?

Possibly, you lose aid.

You might be able to transfer ownership to someone else, but you risk possible penalties as well.

Term life insurance has no cash value, and would not affect your aid (generally – talk to a lawyer in your state to confirm), but you have to pass away within the term in order for your loved ones to receive the death benefit.

If you know someone on Medicaid, we can get them life insurance. We have many options and strategies, including a guaranteed issue term insurance. You can self-enroll here.

However, since there is no asset/income threshold with SSDI, SSDI recipients can obtain life insurance.

Overview Of Life Insurance Underwriting For SSDI Recipients

So, we know people who receive SSDI benefits can obtain life insurance. (If you are on Medicaid, contact us, and we can discuss your options.)

However, as we mentioned, the life insurance options available really depends on your situation.

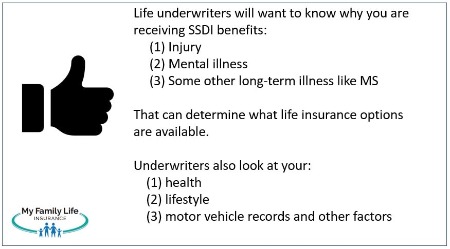

Consequently, underwriting determines what life insurance options are available.

Life insurance underwriting includes the review of your:

- health

- lifestyle

- motor vehicle records

- public records

- anything else that is material to a decision

We’ve discussed life insurance underwriting before, so we won’t go into the weeds on each of these.

weeds on each of these.

However, I will state what the life insurance underwriter is really wanting to know.

They want to know why you are receiving SSDI benefits.

Moreover, once they know, they will then decide if you are an insurable risk.

People receive SSDI benefits for many reasons. If you are receiving SSDI benefits because of an injury, you have a better chance of obtaining any type of life insurance. (Still, no guarantees on approval.)

Available life insurance options really depend if your SSDI approval is based on:

- An injury

- A chronic illness

We will discuss these situations in more detail in our next section. Let’s jump in and discuss 3 life insurance options available for SSDI recipients.

3 Life Insurance Options Available For SSDI Recipients

We are going to review 3 life insurance options available for SSDI recipients.

People who receive SSDI benefits do so for 2 main reasons. Either they are

- Injured, or

- Sick/ill, and…

…their injury or illness prevents them from doing any job of gainful employment.

Again, people who receive SSDI benefits can obtain life insurance. The reason for the SSDI approval mainly determines available life insurance options. Note that many other websites give a blanket answer and say, “Sure, you can obtain any type of life insurance at any amount!” You then work with the broker, and they take you down a rabbit hole. You don’t get what you expect.

We are transparent from the beginning, and I want to set your expectations correctly. We discuss these options next.

#1 Term Life Insurance For SSDI Recipients

Term life insurance is available to SSDI recipients.

However, when I say “term” life in this section, I am talking about fully underwritten policies with death benefits of $100,000 or greater.

Fully underwritten term life insurance is not available to all SSDI recipients. (See the underwriting section for what “fully underwritten” means.)

We have had some success with recipients who receive SSDI because of an injury.

If you are receiving SSDI because of an injury, term life insurance may be available. Usually, depending on the injury, the carriers will cover you between a standard rating to a table 4.

We have had some success with people who are receiving SSDI benefits because of an injury. Injuries like back issues, work injuries, etc. See our case studies section for more detail.

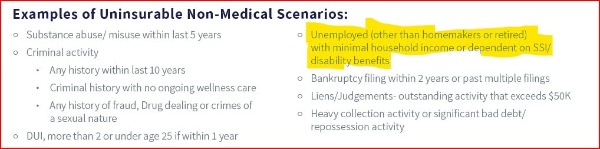

However, some term life insurance carriers simply won’t cover anyone receiving SSDI benefits. See the excerpt here.

However, some term life insurance carriers simply won’t cover anyone receiving SSDI benefits. See the excerpt here.

But, there are some who will, provided your situation is an insurable risk.

Moreover, carriers still decline people who receive SSDI benefits because of an injury.

How do you determine this? First, don’t go on any online portal and apply. The online carriers will decline you every time, and declined applications show up on your MIB. That’s a bad thing. The best way to know is to contact us. We can reach out to the underwriters about your situation. They will estimate if your situation is an insurable risk.

While this sounds good, don’t expect a large death benefit available to you.

Most term life insurance carriers will offer a maximum of $100,000 to $250,000 to SSDI recipients. The reason for the limitation is the lack of gainful employment.

But, I Work Part-Time!

John, I work part-time under the Social Security guidelines!

While the SSA does have return-to-work programs, part-time jobs really aren’t gainful employment. We have helped several SSDI recipients who work part-time, but the carrier still only offers a limited death benefit like $100,000.

Consider the underwriter’s perspective. If you are working (which is great!), why are you not working full-time?

While there might be legitimate reasons, the lack of gainful earning power limits your death benefit.

You can read our case studies about the bus driver who hurt his back and became eligible for SSDI benefits. He is working. However, he says he can’t work any more than 20 hours per week because his back hurts from driving a bus. Well, from the underwriter’s perspective, why not work in a job that doesn’t hurt your back or prevent you from 20 hours per week?

Do you see this paradoxical situation? You are receiving disability benefits and working. However, you are not gainfully employed to allow a larger death benefit.

The SSA wants you to go back to work. Therefore, if you can and will go back to work full time – and get off SSDI benefits – that will greatly improve your term life insurance options.

If you’d like to see potential term options, feel free to quote below. These rates and options are estimates only and rates will likely be a tad higher.

(Related article: life insurance for people on disability)

#2 Simplified Issue Life Insurance For SSDI Recipients

Simplified issue life insurance is likely the best available option for SSDI recipients.

Simplified issue means that the carrier removes many of the fully underwriting components and makes the process “simple”.

In making the underwriting process simpler, though, they must limit the life insurance another way.

The way they do this is by limiting the death benefit.

So, with most simplif ied issue life insurance plans, the maximum available is $25,000 to $50,000 of life insurance.

ied issue life insurance plans, the maximum available is $25,000 to $50,000 of life insurance.

Simplified issue life insurance options include both term life and whole life.

These policies are great for people who are receiving SSDI benefits for chronic illnesses like schizophrenia, uncontrolled diabetes, heart issues, etc.

But, John, only $25,000?!

Well, let me ask you this? Are you working in gainful employment?

If you are receiving SSDI benefits, the answer is “no”. That is the reason. Your disability prevents you from gainful earnings.

In fact, we have helped many people with many chronic illnesses obtain life insurance, even up to $1,000,000 and beyond. The reason is that their chronic illness is managed and stable. They also work full-time in gainful employment.

But, if you are receiving SSDI benefits, this will be your best option. Moreover, especially if you are receiving benefits because of a mental illness or another type of chronic illness.

Feel free to quote below. The options here are whole life options only and are estimates. We work with many more carriers that do not subscribe to the quoting tool. These other options include term plans.

If simplified issue life insurance makes sense in your situation, the application process is simple. We just fill out an application over the phone and, usually, the carrier makes an instant decision. There is no health exam, etc. It all takes about 30 minutes.

#3 Guaranteed Issue Life Insurance For SSDI Recipients

Finally, there is guaranteed issue life insurance.

Guaranteed issue is just how it sounds. You are guaranteed the policy. You just apply, and then you have life insurance.

Sounds easy, because it is. No underwriting exists with guaranteed issue life insurance. Carriers don’t look up your MIB or prescription drug history. You just apply and have life insurance.

However, because the carrier doesn’t underwrite, it doesn’t know the health status of the applicants. Some people might have a terminal illness and some people may only have a DUI within the last 3 months. A guaranteed issue policy might be their only option.

The lack of underwriting forces carriers to place a waiting period on the death benefit. Usually, the waiting period is 2 years.

How does this affect people receiving SSDI benefits? If your situation is very severe, a guaranteed issue life insurance policy might be your only option.

Similar to simplified issue life, guaranteed issue carriers usually limit the death benefit to $25,000.

Most guaranteed issue life insurance is whole life. You can search carriers below. Just select “poor health” in the health status.

Additionally, we are one of the few brokers that offer a guaranteed issue term life insurance plan.

The best part about this plan is that young adults (starting at age 18) can apply. The plan is through an association.

You can purchase anywhere from $10,000 to $50,000.

Rates are fixed for 5 years. They then increase as you enter age bands. This is similar to how group employer life insurance works.

You can self-enroll here.

FAQs About Life Insurance And SSDI Recipients

In this section, we answer some frequently asked questions about SSDI and life insurance.

Can Someone On SSDI Have A Life Insurance Policy?

Yes. As we have discussed so far, SSDI recipients can obtain life insurance. The type of life insurance available really depends on the recipient’s situation.

What Happens To Life Insurance When You Go On SSDI Disability?

If you currently have life insurance, then the answer is nothing. Nothing changes to your life insurance. You’ve already been approved. The carrier can’t go back and re-underwrite you. (Unless it is during the contestability period, which is outside the scope of this article.)

If you don’t have life insurance yet, then your options depend on your specific situation. We discussed the 3 available life insurance options earlier in the article.

Why Can’t Disabled People Get Life Insurance?

They can. People who are disabled can obtain life insurance. In this article, we described 3 life insurance options available to people on disability or receiving SSDI benefits.

Do I Have To Report Life Insurance To Social Security?

If you receive death benefit proceeds (in other words, you are a beneficiary), the proceeds are not considered income. You do not report them to social security. This is straight from the IRS.

How Does An Inheritance Affect My Social Security Disability Benefits?

Generally speaking, inheritance proceeds will not affect your SSDI benefits.

However, if you are receiving SSI, which is supplemental security income through Medicaid, then the receipt of an inheritance may likely affect your aid.

Please contact a lawyer in your state for specific questions about inheritances and SSI or SSDI.

Can A Mentally Disabled Person Receiving SSDI Obtain Life Insurance?

Many brokers and agents here will say, “Of course! Apply with me!” and then take you down a rabbit hole.

However, the right answer is maybe. Moreover, doing so can be difficult.

However, the right answer is maybe. Moreover, doing so can be difficult.

Technically, a mentally disabled person does not have the mental capacity to know what he or she is filling out and signing a life insurance contract. Having mental capacity is a requirement for purchasing life insurance.

If the mentally disabled person has a POA or guardian, then the POA or guardian can possibly apply for life insurance on the mentally disabled person’s behalf. The POA document or guardianship form must state this authority/right.

If that is your case, then a few carriers will accept a POA / guardianship-owned life insurance on guaranteed issue life insurance.

Additionally, be aware of any SSI impacts. The POA/guardian must not be receiving Medicaid if the life insurance is a whole life product. Remember that whole life contains cash value, which is considered a resource for Medicaid determination.

We have helped many people, including those with Down Syndrome, Autism, and Alzheimer’s obtain life insurance. Contact us if you would like to learn more.

Case Studies Where We Have Helped SSDI Recipients Obtain Life Insurance

Here are situations where we have helped people receiving SSDI benefits obtain life insurance.

Your situation is different, but these cases will give you an idea of what is possible.

Bus Driver On SSDI

We mentioned this case earlier. A bus driver receives SSDI benefits because of a bad back; however, he works under the SSDI program.

He wanted $250,000 to cover a mortgage.

We got him pre-qualified with a carrier, but the underwriter wanted to know why he could not work full-time. More specifically, in a job that would not hurt his back. You see, sitting down for an extended period was the problem. Additionally, as I mentioned, gainful employment does matter to carriers.

After some back and forth between the carrier and the bus driver, we were able to secure him $150,000 of term life insurance. That was the maximum limit the carrier would offer.

Person On SSDI For Schizophrenia

A 42-year-old woman contacted us for life insurance. She is receiving SSDI benefits because of schizophrenia.

Now, people with stable cases of schizophrenia and who are working in gainful employment, can obtain term life insurance. Moreover, even at high death benefits like $1,000,000 or more.

However, her being approved for SSDI benefits and unable to work indicates her condition is very severe.

We were able to secure her $30,000 of simplified issue whole life insurance.

Man With Early Onset Alzheimer’s

Alzheimer’s is such a tough, insidious disease. A woman contacted us about her husband, who was diagnosed with early-onset Alzheimer’s. He qualified for SSDI benefits.

This is a guaranteed issue life insurance situation. She possessed proper POA documentation which allowed her to purchase life insurance on her husband’s behalf. Moreover, the carrier allows a trust to own the policy.

We helped her obtain $25,000 of whole life insurance, owned by a trust, at guaranteed issue.

Now You Know People Receiving SSDI Benefits Can Obtain Life Insurance

Yes, people who receive SSDI benefits can obtain life insurance. Moreover, rather easily, too.

As we discussed, the life insurance options available to you depend on the reason for your SSDI approval:

- mental illness

- injury

- other underwriting factors

In some cases, term life insurance is available. However, in most cases, SSDI recipients can obtain simplified issue life insurance.

Additionally, we discussed that no asset or resource test exists for SSDI recipients. That test applies to Medicaid/SSI recipients, which limits the life insurance options available to them.

Do you have any questions? We can help. Contact us or use the form below.

I know many people don’t want to speak to life insurance agents nowadays, but there is no risk in contacting us. We only work in your best interests. That means if there is a better product available to you, and we don’t offer it, we point you in that direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".