What Is The Face Amount Of Life Insurance? We Explain What It Is And How To Obtain The Right Face Amount For You

Updated: April 12, 2024 at 9:38 am

Many people get confused about the face amount of a life insurance policy.

Many people get confused about the face amount of a life insurance policy.

The reason is that there are other names for the face amount. For example, some people think the cash surrender value is the face amount of a life insurance policy, but it’s not.

Coverage amount is another name for the face amount.

Moreover, the face amount really depends on the type of life insurance you have.

It’s important to understand the face amount of a life insurance policy, so you know what your beneficiaries will receive upon your death.

In this article, we are going to discuss:

- What Is The Face Amount Of A Life Insurance Policy?

- The Type Of Life Insurance Matters

- Understand What Is Life Insurance Face Value Vs Cash Value

- What Is The Face Amount Vs. Death Benefit?

- How Do You Determine The Right Face Amount For You?

- How Do Life Insurance Companies Determine The Face Amount Of Life Insurance?

- FAQs About The Face Amount Of Life Insurance

- How We Can Help

Let’s jump in and discuss and answer the question, “What is the Face Amount of a Life Insurance Policy?”

What Is The Face Amount Of A Life Insurance Policy?

The face amount of a life insurance policy is the amount of money a life insurance carrier pays to your beneficiaries when you, as the insured, pass away.

It is that simple. For example, if your policy says you have a $250,000 death benefit, then that’s the amount your beneficiaries receive upon your death.

The face amount of a life insurance policy is the amount of money a life insurance carrier pays to your beneficiaries when you, as the insured, pass away.

Sometimes, the face amount is known as the:

- face value

- coverage amount

- death benefit amount

While these all mean, generally, the same thing, sometimes they can be different.

What, John? Sounds like you are talking out of both sides of your mouth!

Sorry. Let’s go deeper. The face value of a life insurance policy really depends on the type of life insurance you have. Let’s discuss more.

The Face Amount Depends On The Type Of Life Insurance You Have

A policy’s death benefit or face amount really depends on the type of life insurance you have. The three main types of life insurance include:

A policy’s death benefit or face amount really depends on the type of life insurance you have. The three main types of life insurance include:

- term life insurance

- whole life insurance

- universal life insurance

When you apply for life insurance, you apply for the face amount. Upon your death, your beneficiaries receive the death benefit, which may or may not be the face amount.

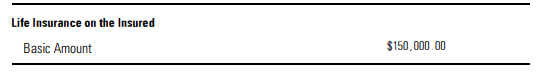

With term life policies, the face amount is the death benefit stated in the contract. See this example:

So, if you have a term life insurance policy with a $1,000,000 death benefit, that is the face amount. If you pass away within the term (let’s say 20 years), then your beneficiary receives $1,000,000.

So, if you have a term life insurance policy with a $1,000,000 death benefit, that is the face amount. If you pass away within the term (let’s say 20 years), then your beneficiary receives $1,000,000.

However, as with all term policies, if you pass away outside the term after your policy expires, your beneficiaries receive $0. Your death benefit is $0.

So, with term insurance, the face amount is the amount that is stated on the contract.

The face amount is different when it comes to permanent life insurance policies. We discuss those next.

What Is The Face Amount On A Whole Life Insurance Policy?

Whole life insurance is a type of permanent life insurance. Permanent life insurance is designed to last your entire life and pay the death benefit upon your death.

The face amount on whole life policies differs from that of term life policies.

Whole life insurance policies contain guaranteed and non-guaranteed elements in their contract. They guarantee the:

- premium payments

- cash value

- death benefit

Non-guaranteed elements exist. These include:

- premium payments (you can pay more if you want, up to an IRS limit)

- cash value component

- dividends

- death benefit

A non-guaranteed death benefit can exist with whole life insurance. The reason is due to the structure of whole life insurance and if the policy offers dividends.

When you make premium payments to a whole life insurance policy, part of that premium goes to the cash value. Without getting too detailed, as the cash value account grows, the carrier’s “net amount at risk” declines.

However, when the whole life insurance policy offers dividends (i.e. participating whole life insurance) your death benefit potentially increases.

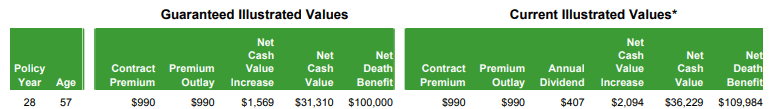

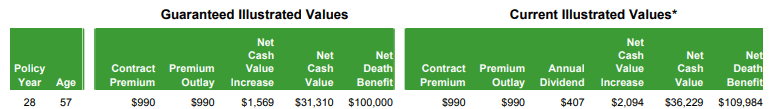

See the comparison below. This is a $100,000 face amount for a 30-year-old man. His guaranteed premium is $82.54 per month (about $990 annually) and a guaranteed death benefit of $100,000. Through the use of dividends and using the dividends to buy more life insurance on himself (also known as paid-up additions) he increases the death benefit to potentially $109,984 at age 57 (for example).

Let’s say he passes away at age 57. His beneficiary could potentially receive the $109,984 with a guaranteed face amount of $100,000.

Let’s say he passes away at age 57. His beneficiary could potentially receive the $109,984 with a guaranteed face amount of $100,000.

What Is The Face Amount On A Universal Life Insurance Policy?

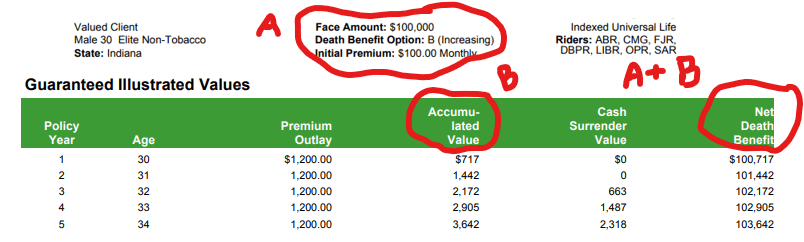

The face amount of a universal life policy is different. It depends on the type of death benefit selected. (Note: I am not going to get into the details on universal life policies. Universal life is structured much differently than whole life. However, if you have any questions, please contact me.)

Most carriers that offer universal life offer 2 types of death benefit:

(1) level death benefit

(2) increasing death benefit

The level death benefit is just how it sounds. Your death benefit remains the same throughout the life of the policy, provided your premium payments are enough to maintain the cost of insurance and other fees. The level death benefit is similar to that of the guaranteed death benefit / face amount on a whole life insurance policy (except, technically, the universal life death benefit isn’t guaranteed – again, a little outside the scope of this article).

The increasing death benefit is different. In this case, the policy’s cash value is added to the face amount (as you apply for on your life insurance application) for a total death benefit. Upon your death, your beneficiaries will receive the policy’s cash value + the face amount (equals the death benefit) – any policy loans and/or withdrawals.

So, for example, let’s say Joe and Tim each have universal life insurance policies of $100,000. Joe has a level benefit and Tim has an increasing death benefit.

At age 50, they both unexpectedly pass away. Joe and Tim each have $50,000 of cash value at the time of their death. Let’s assume no outstanding loans or withdrawals.

Joe’s beneficiaries receive $100,000 (because he has a level death benefit) and Tim’s beneficiaries receive $150,000 (because he has an increasing death benefit).

What Is Face Value Vs. Cash Value?

We just discussed the face amounts for term life insurance, whole life insurance, and universal life insurance. The type of death benefit / face amount available to your beneficiaries really depends on the type of policy you have.

I receive many questions about cash value. As I described earlier, cash value is a key component to the makeup of permanent policies (whole life and universal life). Many people think cash value is the face amount of a life insurance policy.

It is not.

Cash value is simply the build-up or growth of money that builds inside a permanent life insurance policy. Generally speaking, as you pay your premiums, your cash value grows over time. Carriers typically offer an attractive interest rate on the cash value. You technically can’t lose money on the cash value (except to pay for any policy fees or surrender costs). It is a safe way to grow your money. Think of it as a savings account (but it is not).

The policy’s cash value will always be less than the policy’s face value (until, technically, when the insured reaches age 121, then the life insurance “endows”). Look at our whole life excerpt again.

In this example, the guaranteed cash value is $31,310 and the guaranteed death benefit is $100,000. The plan offers a potential cash value of $36,229 with a non-guaranteed death benefit of $109,984.

If at age 57, the policy owner decides to cancel the policy, he will receive the cash value of potentially $36,229 in the policy.

What Is The Face Value Of A Policy Vs. Death Benefit?

We touched on this in our section about the face amount of a universal life insurance policy. A person who owns a universal life insurance policy with an increasing death benefit has both the face amount and a death benefit.

The face amount is the amount of life insurance the policy owner applied for at the time of application (and, assuming he was approved for said amount).

The death benefit is the cash value in the universal life policy + the face amount (A +B, see below).

Upon a policyholder’s death, assuming no loans or withdrawals, the policyholder’s beneficiary will receive the death benefit (cash value + face amount).

Upon a policyholder’s death, assuming no loans or withdrawals, the policyholder’s beneficiary will receive the death benefit (cash value + face amount).

How To Determine The Right Life Insurance Face Amount For You?

Most people just blindly pull a number out of the air and say, “I need $250,000 of life insurance.”

Obviously, that is the wrong tactic.

For example, if you make $100,000 and are the breadwinner of your family, $250,000 won’t go very far upon your death, depending on your situation.

If you have children, a spouse who doesn’t work, and a mortgage, that $250,000 is gone in a year’s time.

Some agents use the “10 X” rule of thumb. They say that whatever you make, you multiply that number by 10. That is then the right amount of coverage for you.

So, for example, if you make $100,000, then you should have $1,000,000 on yourself.

That is better than the “pulling numbers out of the air approach”, but still isn’t specific enough to meet your family’s needs upon your death.

Some carriers have these life insurance calculators on their websites. Honestly, they just muddle and complicate things with how they present their calculators.

It doesn’t have to be complicated. Look at this life insurance needs worksheet we created. It is straightforward and self-explanatory.

The worksheet is already pre-filled with some “dummy” numbers. Enter your own situation and play around with the death benefit to see what makes sense.

Nevertheless, the attachment helps you determine the right face amount for your particular needs and situation.

How Does A Life Insurance Company Determine The Face Amount?

Some people think they can apply for any amount of life insurance. However, that is not the case.

Carriers limit the face value of life insurance in one way or another.

For example, a 50-year-old man on SSDI won’t ever get approved for $1,000,000 in term life insurance. Why?

He is on SSDI, which means he can’t work. Being gainfully employed and working is an important factor to many life insurance companies.

He could, though, get $50,000 and maybe up to $100,000 if his SSDI is due to an injury.

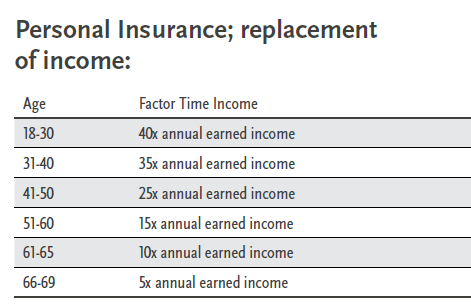

That brings us to our first point. Many life insurance companies limit the face amount based on an income or salary factor. This factor is based on the applicant’s age, type of insurance, and salary/income.

Look at the excerpt below on this carrier’s limit. So, for example, a 30-year-old woman making $100,000 can apply up to $4,000,000 of life insurance.

If she already has $2,000,000 in place with another company, she can only apply for an additional $2,000,000 (for $4,000,000 in total).

However, salary isn’t the only factor. Companies also limit the life insurance death benefit through underwriting.

They look at your health, lifestyle, credit history, and other situations they deem material to your risk (i.e. risk of dying too soon). If one of these factors is too adverse, carriers may limit the face amount or decline your application altogether.

Contact us if you have any questions. We are one of the few brokers that can get anyone life insurance. It may not be the face amount you are looking for, but we usually can get people some amount of life insurance in nearly all cases.

Frequently Asked Questions About The Face Amount Of Life Insurance?

We answer frequently asked questions about the face amount of life insurance.

What Is the Face Amount Of A Life Insurance Policy?

The face amount of a life insurance policy is the dollar amount of money that will be paid out to a beneficiary upon your death. This amount differs based on the type of life insurance you have. Term life insurance provides the same face amount as the death benefit. For example, if you purchased a policy with a face amount of $250,000 and pass away during the term period, your beneficiaries receive a $250,000 death benefit.

The face amount or death benefit amount is different with permanent policies. With whole life, the death benefit amount is the face value/face amount you applied for + any paid-up insurance – any outstanding loans. For universal life with an increasing death benefit, the death benefit contains the face amount applied for + any cash value – any loans or withdrawals.

How Is The Face Amount Determined For Life Insurance Coverage?

Several factors are involved when determining the face amount of life insurance. These factors include:

- your age

- salary or income you make

- what your needs are

Additionally, underwriting comes into play. Ultimately, your face amount depends on:

- your health

- any lifestyle situations like hazardous hobbies like skydiving

- citizenship status

- anything material to the underwriting decision. like felonies

These all affect your life insurance premium which may affect the face amount. For example, let’s say you applied for $500,000, 30-year term for $75 per month. However, because of past health issues, the underwriter determined your rate should be $150 per month for $500,000. You’d like to stick with a budget of $75 per month, so you ask the carrier to modify the face amount to $250,000.

Can I Adjust The Face Amount Of My Life Insurance Policy Over Time?

Not necessarily. Some types of life insurance allow you to adjust the face amount over time. Additionally, some term life insurance policies exist where the face amount decreases over time (to follow the declining balance on a loan or mortgage). However, most face amounts remain fixed over time. This is particularly true with term life insurance.

With permanent policies, the death benefit can adjust with increases in cash value or decreases with loans.

How Does My Age Impact The Face Amount I Should Select?

It can. Generally speaking, the older you are, the higher your monthly premiums (all things being equal). If you are on a budget, then your budget may limit the amount of life insurance.

For example, you are 55 and want $250,000 of term life which costs $100 per month. But, you can only afford $50 per month. Therefore, you apply for a lower face amount.

As we mentioned earlier, many carriers limit the face amount based on your age and the income you make.

What Is the Difference Between Face Amount And Cash Value In Permanent Life Insurance?

The face amount is, generally speaking, the amount of money your beneficiaries receive upon your death. Cash value applies with permanent life insurance policies. The cash value really starts at $0 and grows over time as you make premium payments and as the cash value earns a return. Even when your cash value is $0, you still have a death benefit.

For example, Joe applies for $100,000 universal life insurance. He makes the first premium payment. His cash value is $0 right now, but if he passes away tomorrow, his beneficiary will receive a $100,000 death benefit.

How Does Your Health Conditions Influence The Face Amount I Can Secure?

Health conditions can affect the face amount. If you have a moderate to severe health condition, carriers may limit the death benefit to limit their risk. Alternatively, they may keep the face amount the same, but they increase the premiums through table ratings to offset their risk.

What Happens If The Face Amount Is Insufficient To Cover My Beneficiaries’ Needs?

If the face amount is insufficient for your beneficiaries upon your death, then you need to purchase additional life insurance. You don’t want to wait on this. If you develop a serious health condition or unexpectedly pass away before the additional insurance, then your beneficiaries might face a tough financial situation.

How Often Should I Review and Potentially Adjust the Face Amount of My Policy?

You should review your life insurance situation at least every few years and make sure your current life insurance policies fulfill your beneficiary needs. The following situations likely lead to a change in life insurance needs:

- an increase in your lifestyle

- a new baby

- a death in the family

- divorce

- loan agreement

- purchase of a business

How Does the Purpose of the Policy Affect the Face Amount Selection?

One advantage of life insurance is the flexibility of its use. The purpose of the life insurance affects the face amount. For example, if you want life insurance to pay for your funeral, you can apply for burial insurance. Burial insurance is a whole life policy with a low face amount, like $30,000. Upon your death, your beneficiary can use this money to pay for your funeral. Moreover, some carriers allow you to assign part of the death benefit, or all of it, to a funeral home of your choice.

As you can see, needing life insurance to pay for your funeral is different than needing it to pay for your unexpected death. This is where a term life policy shines. It is common to see life insurance face amounts of $1,000,000; $2,000,000; or even more if the applicant has a young family, a significant mortgage, and/or the main provider of the family.

Likewise, it is common for banks or lenders to require life insurance on a borrower. In this case, if the borrower passes away during the loan repayment period, the lender receives the death benefit money that makes them whole.

How We Can Help With The Face Amount Of Life Insurance

I hope you learned more about the face amount of a life insurance policy. As you read, the face amount is much more involved than at first glance. We answered what the face amount is as well as contrasted the face amount and death benefit for permanent insurance policies. We also discussed what is involved in determining the face amount and how carriers can limit the face amount.

Do you have any questions or need assistance? Do you feel like you need more life insurance, but don’t know where to start?

Contact us or use the form below. I am happy to assist and answer any questions you have.

We have helped many people obtain life insurance, placing their needs before our own. Isn’t that how a trusted relationship is supposed to be? We have your best interests first. We also don’t contact you 1,000 times per day. If you ever feel like you don’t need our help, just tell us. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".