Yes, Marijuana Users Can Obtain Life Insurance | Easily Attainable, Too

Updated: April 12, 2024 at 9:40 am

Years ago, marijuana users couldn’t obtain life insurance. No way!

Years ago, marijuana users couldn’t obtain life insurance. No way!

However, the marijuana industry has changed in the last several years. No longer is the stigma that smoking marijuana is a dirty, criminal activity (although use is still illegal at the federal level). TV shows such as High Profits attracted record viewers. More importantly, as of this writing, many states have legalized both the medical and recreational use of marijuana.

The life insurance industry has changed as well. If you thought you could not obtain life insurance (or any other type, for that matter) because of your marijuana use, you should be happy to know that you absolutely can. However, like anything else, there is a process.

In this article, we will discuss how marijuana users obtain life insurance. Specifically, we will discuss:

- Your Goal For Life Insurance For Marijuana Users

- Application Process

- The Life Insurance Carriers That Provide Non-Smoker Rates For Marijuana Users!

- Possible Life Insurance Premiums For Marijuana Users

- FAQs About Marijuana Users And Life Insurance

- Now You Know Marijuana Users Can Get Life Insurance

You can skip around and go directly to a section or contact us for assistance.

This Is The Goal For Marijuana Users To Obtain Life Insurance

Marijuana users have a #1 goal when it comes to obtaining life insurance. It is:

Get A Non-Smoking Health Status

You see, many carriers will rate marijuana users as a smoker. Smokers pay premiums as high as the atmosphere! You don’t want that, right? Well, the good news is that some carriers won’t! The right carrier for you depends on your answer to 3 questions:

- How Often Do You Smoke / Use Marijuana?

- Why?

- What Are Your Other Health & Lifestyle Situations?

We will discuss these questions now.

How Often Do You Smoke / Use Marijuana?

How often you smoke or use marijuana is a very important question to answer. Moreover, it is important that you answer this question truthfully.

Lying on an life insurance application is fraud. If you lie, your application may not be approved. If it is, and death occurs, your beneficiaries may not receive the death benefit.

It is that simple.

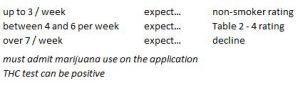

Your life insurance options are directly proportional to your use. It gives us the starting point. Here’s the guideline from one popular life insurance carrier that insures marijuana users. If you smoke or use marijuana:

Sounds good, John, you say. The goal is obtaining a non-smoker rating. However, I ingest marijuana instead of smoking. Does that make a difference, you ask?

That’s a great question, and one we have been asked before.

Some agents will say it makes a difference. I am aware of the different THC levels between smoking marijuana and ingesting marijuana. However, in my dealings with placing marijuana users with the right life insurance carrier, not so much. Why?

You can say you ingest, but the carrier won’t know if you really smoke marijuana. It will all depend on the THC level in your urine test (more on that soon).

Why? Recreational Versus Medicinal Marijuana Use

The carrier is going to want to know why you use marijuana. Can you blame them?

If you smoke or use marijuana for medicinal use, then your health classification and life insurance premiums will be based on your underlying health condition., not your marijuana use.

For example, if you have multiple sclerosis, have approval from your neurologist and doctor, with a medical card, then smoking marijuana is not going to be a problem on the life insurance application. The carrier underwrites your application based on your Multiple Sclerosis.

Recreational use is a different story, even if use is legal in your state.

The carrier going to want to know your frequency of use. They will also require, likely, your THC level tested through a paramedical exam.

This is where having an independent agent like My Family Life Insurance helps. We know who to go to or not go to based on your situation.

We describe the carriers below.

But, using marijuana is only one piece of the puzzle. Life insurance carriers want to know everything about you.

That’s what we discuss next.

What Are Your Other Health Conditions Or Lifestyle Situations?

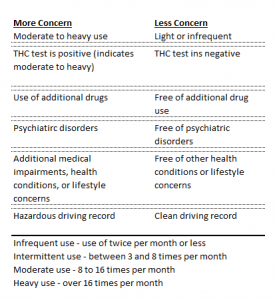

Other health conditions and lifestyle situations play an important role in the underwriting process. Honestly, in our experience, these other situations were the deciding factor rather than the marijuana use itself! Why, because, as we said, using marijuana isn’t really a decline with the carriers listed in this article. It’s the other health conditions or situations which lead to the decline.

For example, living on social security disability income, not working, and use marijuana? All the carriers will decline you because you are on social security and not working.

Are you a type 2 diabetic with an rather moderate to high A1C who likes to smoke marijuana a handful times per month? The carrier is going to evaluate your application more so on your diabetes rather than on your marijuana use.

So, you see how these other situations play a part, more so than your marijuana use.

Here’s a chart we created which outlines the general direction of life insurance carriers:

Application Process For Marijuana Users

The life insurance application process is straightforward. You can apply with us, over the phone, and it is really simple.

There are two significant process modifications for marijuana users, however.

The first is you need to disclose your marijuana use on the life insurance application. If you don’t, and the carrier finds THC levels, they will decline you.

The second is you’ll have to go through a paramedical exam which includes a blood draw and urine sample. Other websites and agencies state that no-exam policies are available. That’s not true. Marijuana use is still illegal at the federal level. Carriers want to test your THC level because a high level indicates high usage. Carriers will confirm what you say on the application. If you say you use marijuana only 2 times per week, but your THC level is 500 ng/ml (high), that’s a problem for you.

Life Insurance Carriers That Will Insure Marijuana Users

Not every carrier will insure marijuana users. What’s your goal again? That is right – to obtain non-smoking rates!

However, even if you use marijuana once or twice per year, you must state so on the application.

Here are the carriers that allow marijuana usage and a positive THC test where indicated. Note: I did not say they allow a high test.

And, again, if you have any health conditions or lifestyle situations, those play an important part in the carrier’s underwriting decision.

American General

If you only smoke or use marijuana once or twice per year, you’ll be eligible for the best rates with AIG. AIG has some of the lowest life insurance premiums in the industry. Again, you must state your usage and test negative for THC. If you test positive, your application will go up in smoke. No pun intended.

Prudential

They are one of the more flexible carriers when it comes to marijuana usage. If you smoke or use marijuana up to 3 X per week, you may get Standard non-smoking rates. That’s great! Moreover, a positive THC test is OK, as long as the test matches what you say on the application.

Mutual Of Omaha

Mutual of Omaha’s stance on marijuana usage is similar to Prudential’s. Up to 12 X month and a positive THC test is OK. Of course, the level must match your frequency use.

Protective

They’ll insure you up to 2 X week of usage at Standard ratings.

Minnesota Life

They are good, too, and insure you with admitted usage of up to 24 X month. However, your THC test must show negative.

Global Atlantic

They are a relatively unknown carrier. Global Atlantic will insure daily usage of marijuana at Standard rates as long as you live in a state where recreational usage is legal. They’ll even consider Preferred class with up to 3 X per week of usage.

So, I think we have you covered, right? And, for non-smoking rates! If you smoke or use marijuana daily, then Global Atlantic might be the choice for you. If you a little bit less than that, Minnesota Life could work. Then, Prudential among the other carriers might work if you use marijuana more frequently. No need to go for smoker rates!

Or course, as we discussed, you still need to qualify in other ways, too. You need to be healthy in other ways and not have health conditions or lifestyle situations. These scenarios would likely change your classification.

Possible Life Insurance Rates For Marijuana Users

Who doesn’t want to have an idea on how much you might spend on life insurance? Below is our life insurance quoting tool. Just enter your pertinent information and submit the quote. Be honest about your health class. Use our guide above. Make sure you select “non-tobacco” since all we care about is getting you the best rate possible!

Again, this is just an estimate since other factors (as we discussed) play an important role in the underwriting process.

FAQs About Life Insurance For Marijuana Users

Here are answers to common questions marijuana users ask us.

Will My Information Remain Private?

Yes. When you apply for life insurance, your health history remains private. This goes for any health conditions or lifestyle concern including marijuana use. Neither law enforcement agents nor anyone else can access your life insurance application. The HIPAA law makes this possible.

Sounds Like I’ll Pay Alot For Life Insurance?

Not necessarily.

If you have limited marijuana use, and are healthy every other way, including not smoking tobacco/cigarettes or other drug use, you can receive preferred or standard non-smoker rates. All things being equal, this means you can save 5 or 6 times than someone who smokes cigarettes. As we discussed, not all carriers offer nonsmoker rates for marijuana users.

The key is to use those companies that favorably rate marijuana users. We discussed those carriers earlier. Only those who smoke marijuana excessively or who have additional health conditions could be rated with a table rating or declined.

I’ll Be Declined Because The Carrier Found Marijuana In My Urine Sample

If you want to qualify for the best life insurance rates, you will have to go through a fully underwritten policy, which means a blood test and urine sample among other requirements. So, a decline could happen if you smoke marijuana excessively, but most carriers will rate you as a smoker status and possibly a rating depending on use if they find traces of THC in your urine.

However, as we said before, it is important to (1) be honest on your usage so (2) we can select a carrier that has favorable underwriting standards for your situation.

Do I Have To Go Through A Paramedical Exam?

If you want the cheapest life insurance option, you will need to go through a fully underwritten process. This includes a urine sample. If your THC test comes back positive, that could mean you are rated from the carrier. Typically, a negative THC test indicates infrequent to low use.

Many other agents and websites state that no-exam policies are available. Maybe, but not many. Marijuana use is still illegal at the federal level. Carriers will want to know your THC level. Again, this is private information that the carrier won’t share.

You will pay more versus a fully underwritten policy because the carrier has already incorporated health conditions and/or lifestyle concerns into these policies. However, if you still want that no-exam policy, we work with one carrier that is (almost) guaranteed issue and might work well for marijuana users.

Easy, No-Exam Life Insurance For Marijuana Users

We work with one carrier that has, essentially, one question to answer. It asks nothing about marijuana use. It is a health / lifestyle question in an indirect manner. The question is:

“Are You Actively At Work And Can You Perform The Normal Activities Of Someone Of Like Age?”

If you can truthfully answer this question (remember what we said about telling the truth), you can have up to $100,000 in either term life insurance or universal life insurance. I call it (almost) guaranteed issue life insurance.

No MIB check, urine sample, paramedical exam, etc.

This can be a very viable option. You can apply for more, up to $500,000, but the carrier will run your application through the MIB and ask about marijuana use. It’ll be a decline if you apply for more than $100,000.

Now You Know Marijuana Users Can Obtain Life Insurance (Easily, Too)

Life insurance for marijuana users is easily obtainable. Here is our recommendation:

Be truthful in the application on your marijuana use. Honesty is the best policy. Be honest, not only on your marijuana use but also on any other conditions. If you don’t disclose your marijuana use, you could be declined for life insurance. And, if you are declined, that information is reported to the MIB. If you do receive life insurance, but did not disclose your marijuana use, and you die within two years of the contestability period, your beneficiaries could be denied the death benefit. So, just be honest.

Work with an independent agency like My Family Life Insurance. We work with over 70 carriers and can select the right carrier for your specific situation. Moreover, we work in your best interest every time, all the time. Your situation might be trickier if you have other health conditions or lifestyle concerns. So, contact us or use the form below, and we would be happy to help. Above all, using marijuana is no longer a reason that you can’t obtain life insurance, so don’t let that be a reason to keep you from applying.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".