Life Insurance For Women: A Comprehensive Guide To Approval

Updated: June 25, 2024 at 8:42 am

Women don’t often think about purchasing life insurance on themselves, but they should.

Women don’t often think about purchasing life insurance on themselves, but they should.

Women play a pivotal role in the family dynamics. Moreover, the family relies on them more than ever before.

If you are a woman, have you thought about proper life insurance on yourself?

It’s hard to think of your mortality, but death does happen to all of us. Even unexpectedly and the most healthy.

While nothing and no one can replace a “mom” or you, the protection and financial security behind a life insurance policy for your spouse, children, or loved ones goes way further than words can express.

In this comprehensive guide, we discuss all things life insurance for women. However, unlike other websites, we go into way more detail. We discuss how life insurance works, how to apply, what if you have health conditions, and the types of plans available. You can even apply for a direct, instant-decision policy on your own here on this page (at the end of the article).

We also discuss 10 reasons why women need life insurance. As you will read, some reasons resonate more than others.

Here’s what we will discuss.

- What Is Life Insurance For Women And How Does It Work?

- Types Of Life Insurance For Women

- 3 Facts About Life Insurance For Women

- 10 Reasons Women Need Life Insurance

- Life Insurance Underwriting 101 For Women: How To Get Approved The Right Way

- Life Insurance Application Process For Women

- 4 Life Insurance Considerations For Women

- What Women Can Get Life Insurance?

- Cost Of Life Insurance

- Are You Generally Healthy? You Can Apply For Term Life Insurance Here

- Final Thoughts About Life Insurance For Women

Let’s jump in and discuss what life insurance is and how it works.

What Is Life Insurance For Women And How Does It Work?

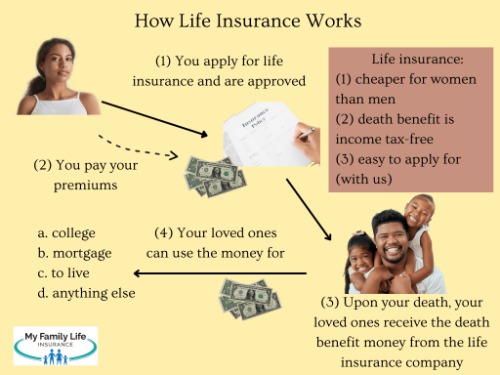

Life insurance is a type of insurance policy that will pay a monetary benefit to another person or entity upon your death. This other person is called a beneficiary. Usually, the beneficiary is your spouse, loved ones, children, etc.

When you pass away, your beneficiaries can use this money benefit (called the death benefit) for their needs.

For example, if you unexpectedly pass away, your spouse can use the death benefit money (typically a lump sum, but we have carriers that will pay installments over time) to pay off outstanding debts like a home mortgage, pay off student loans, or save for college.

Life insurance:

- protects your family’s future.

- is a financial safety net.

- works the same way as your male counterparts

John, I know what life insurance is. But, I am not the primary breadwinner. My spouse is. I don’t need life insurance.

I hear this from a lot of women. This is completely false thinking. Even if you are a stay-at-home parent, you still need life insurance on yourself. Unforeseen circumstances happen all the time, even to the best and most healthy people.

Think about it. We all know stay-at-home moms (dads, too) are the backbone to keeping the house in order, homework help, driving kids to school, etc., etc. While ranges vary, many websites say that stay-at-home moms make $130,000 to $180,000 annually!

This financial value happens when you factor in all the things your family would have to pay for if you didn’t exist! How would your surviving spouse make ends meet if you passed away?

Even if you do work, you do understand the limitations around the life insurance policy you have through work, right? We will get to this in a minute.

Your Loved Ones Receive The Death Benefit Money

So, the life insurance policy is in your name as the insured (and owner, usually). Upon your passing, the life insurance company pays your beneficiaries (i.e. your loved ones who you care about the most) the death benefit that they can use to continue their lifestyle. Sure, nothing will ever replace YOU. However, receiving a life insurance benefit eases the pain and allows your loved ones to grieve without worrying about money. It gives them some peace of mind, especially if you ARE the breadwinner.

Let’s discuss the types of life insurance available to women next.

Types Of Life Insurance Available To Women

Many types of life insurance policies exist in the United States. Here are 3 common life insurance policies available to women.

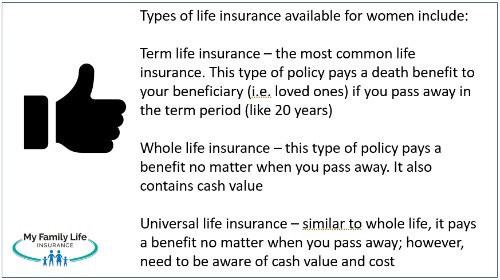

Term Life Insurance For Women

Term life insurance is a common type of life insurance. Many employers offer term life insurance as a worksite benefit. Additionally, hundreds, if not thousands, of life insurance companies here in the United States offer term life insurance.

Term life insurance costs less compared to other types of life insurance (more on those next). The reason is that the insured must pass away within the policy “term” for the beneficiary to receive any death benefit.

For example, if Jane has a $500,000, 20-year term, her beneficiaries receive a $500,000 death benefit if she passes away within those 20 years. If not, her beneficiaries receive nothing (unless, of course, she has additional life insurance).

Underwriters will analyze your situation including your health and lifestyle. Based on actuarial factors and your situation, they determine the probability of your passing within the term period you applied for. That is why term life insurance rates are so cheap. You have to pass away within the term period. If you have moderate to serious health conditions, underwriters apply a table rating.

Note: a few life insurance companies provide a “decreasing term” plan. This type of term life insurance works very well for mortgage protection (i.e. you use the death benefit to pay the remaining mortgage on your loan.) or some other type of loan. Contact us if you have any questions.

Whole Life Insurance For Women

Whole life insurance is a type of permanent life insurance. It is called “permanent” life insurance because it is designed to last your entire lifetime (i.e. your “whole” life). As long as you pay the premiums, the life insurance company pays the death benefit upon your death. That could be 1 year from now or when you are 95.

Whole life insurance is a type of permanent life insurance. It is called “permanent” life insurance because it is designed to last your entire lifetime (i.e. your “whole” life). As long as you pay the premiums, the life insurance company pays the death benefit upon your death. That could be 1 year from now or when you are 95.

As you can imagine, since we all die, whole life insurance costs more compared to a term life insurance plan. The carriers already earmark paying your death benefit. As long as you make the premium payments, the life insurance company pays the death benefit.

This is why whole life insurance costs more and has higher premiums compared to term life insurance.

For example, a healthy, 35-year-old woman wanting $500,000 might pay $30 per month for a term life insurance policy. However, a $500,000 whole life insurance policy might cost 389 per month!

Many people think whole life insurance is a waste of money. It isn’t. It can be a bad idea to purchase if it doesn’t fit into your needs and situation. For example, whole life insurance works well when you need to pay estate taxes or fund a special needs trust, for example. It also works well if you want a safe CD alternative to growing your money. (It’s true.)

Additionally, it can be a good idea to purchase if the plan contains living benefits. We will discuss life insurance with living benefits later in the article.

Universal Life Insurance For Women

Universal life insurance is another type of permanent life insurance. However, it operates much differently than whole life.

For one, universal life has a different policy structure. No guarantees exist (although many of the policies today do have some guarantees for a set number of years, for example, 10 years).

Because of its structure, universal life potentially allows a higher cash value growth compared to whole life insurance. You may have heard of indexed universal life.

We discuss universal life, and indexed universal life, throughout this article. Two advantages of indexed universal life include:

- tax-deferred cash value growth and possible tax-free income distributions

- living benefits to pay for chronic care (i.e. long-term care) situations when you are older

I speak to women every day about life insurance. Here are 3 facts about women and life insurance that they did not know about. You need to know these facts as they support the reason why you need life insurance.

3 Facts About Life Insurance For Women

Many myths and misrepresentations exist about life insurance on women. We discuss them throughout the article. However, here are 3 facts women should know about life insurance.

It’s Cheaper On Women Than On Men

For one thing, the cost of life insurance is less on women than on men. The reason is life expectancy: women live longer than men.

For example, while that $500,000, 30-year term plan might cost around $30 per month for a woman, it could cost $35 per month for a man, assuming the same health and lifestyle situation.

Additionally, when polled, many women thought term life insurance was way more expensive than they thought.

You can search for estimated life insurance premiums through our quoter at the end of the article.

Women Can Obtain Life Insurance When Pregnant

Contrary to popular belief, women can obtain life insurance when pregnant, provided no gestational diabetes, eclampsia, pre-eclampsia, toxemia, or other medical conditions exist. If none, then life insurance options are available.

It behooves women to get life insurance if they don’t have any and are pregnant.

It behooves women to get life insurance if they don’t have any and are pregnant.

You see, some women run the risk of postpartum depression and other medical conditions after giving birth. In fact, The Lancet Global Health stated that 1 in 3 women experience some type of health condition after giving birth.

These situations can create a table rating or even a declined application depending on the severity of the condition and the timeframe when the woman applies.

If you are pregnant, it can make sense to obtain some level of life insurance coverage before giving birth. Many simplified issue life insurance plans do not ask about pregnancy on the application, either.

Life Insurance Isn’t For Primary Wage Earners

We discussed this incorrect belief earlier in the article. Even if you aren’t the primary breadwinner, you still need life insurance. We discussed how stay-at-home mothers need life insurance just as much as their working spouses. In fact, as we showed before, many studies show that a stay-at-home mom “makes” $130,000 to $180,000 annually with all the things she does.

Whether you are the primary breadwinner or you are a stay-at-home mom, seriously consider ample life insurance on yourself. Many carriers allow a death benefit coverage amount equal to what they would allow on your spouse.

Upon your death, your family receives the death benefit, income tax-free. They use this money to continue their lifestyle and live on. Of course, nothing matters more than you. However, your family can grieve without worrying about what happens next to the home, expenses, etc.

10 Reasons Why Women Need Life Insurance

If what we’ve discussed so far hasn’t spurred you to get life insurance, let’s discuss 10 more reasons why you need life insurance.

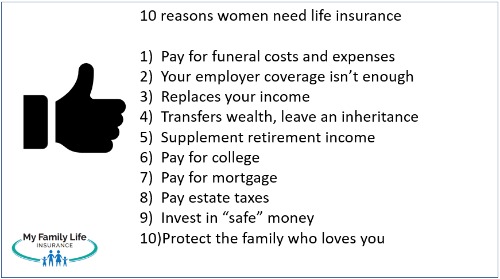

Cover Burial Expenses

A common use for life insurance is to cover burial/funeral expenses and final expenses. Many websites say the average funeral costs around $8,000. However, this isn’t really true. Ask anyone who just buried a loved one, and he or she will say it costs more, like $15,000. (My dad’s funeral cost $16,000.)

In order to fund your funeral expenses, all you need is a whole life insurance policy with a $15,000 to $30,000 death benefit. (Or, more or less – whatever you can afford.) This type of whole life insurance is commonly known as burial insurance.

A $25,000 whole life insurance (i.e. burial insurance) policy costs about $78 per month for a 60-year-old woman, assuming good health.

It is generally easy to apply for. You just answer some health questions. Many carriers have this automated where you will receive a decision instantaneously or within a few days.

Again, this type of policy proves beneficial if you want to pay for your funeral costs and/or leave a little money/inheritance for loved ones.

Employer-Provided Coverage May Not Be Enough

Employers typically provide group term life insurance coverage as an employee benefit. One of the advantages of group term life insurance is that the employer typically pays a portion of the premium. Additionally, group-term carriers usually don’t require any health or lifestyle underwriting.

However, a major disadvantage is that coverage usually isn’t enough.

I hear from women that they are “all set” with their life insurance through their job. When I ask them how much they have, they usually don’t know.

When they do research and find out, they tell me the death benefit is like $100,000. Honestly, it’s not enough. If they passed away, that $100,000 would vanish in a few months, considering funeral expenses (above) among other things your surviving family would have to pay for.

Group term life plans usually have 2 structures. Either the plan provides a multiplier of your salary or a flat death benefit amount, all up to a maximum. (The plan must meet ERISA regulations, which are outside the scope of this article.)

For example, a group term life plan might provide “3 X of salary up to $250,000”.

Again, when you peel back the onion layers, a $250,000 death benefit probably isn’t enough for your loved ones.

Let’s say you have a $500,000 mortgage. Well, right there, you are underinsured if your group term life insurance is $250,000.

A second disadvantage is that many group term policies end upon your employment termination.

Any way you look at it, it makes sense to add individual life insurance coverage with any group term insurance plans.

Replaces Your Income

If you unexpectedly pass away, life insurance replaces your income. Your loved ones can use this money to pay for things and support the household.

As we stated before, even stay-at-home mothers have financial value. Your surviving spouse can use the death benefit to pay for child care, household help, etc.

While nothing will ever replace you, having this money truly eases the pain and burden of how to pay for things and what to do next.

Moreover, if you are a stay-at-home mom, your loved ones can use this death benefit money to pay for child care and figure out Plan B.

That is really what life insurance is. It gives your loved ones some financial support and “breathing room” on what to do next. They can mourn and grieve without worrying about what to financially do next.

Transfers Wealth, Leave An Inheritance, Leave For A Charity

Honestly, there is no better way to leave money to a loved one, leave an inheritance, or support a favorite charity than life insurance.

Why?

Because, currently, the life insurance death benefit bypasses probate and goes right to your named beneficiary.

Moreover, currently, your beneficiary receives this death benefit income tax-free.

In other words, let’s say you have $100,000 earmarked for your son. You pass away. Your son receives the $100,000 directly from the life insurance company. He can do anything he wants with it: buy a home, invest, save, etc. The death benefit is income tax-free. He does not report the money to the IRS.

Supplement Retirement Income

Although I believe better ways to save exist, you can use the policy’s cash value (permanent plans only) to supplement your retirement. Advocates of using permanent life insurance as a retirement plan say that you can receive the cash value income tax-free. No IRS rules exist for distributions, either. You can remove as little or as much as you want or none at all.

Although I believe better ways to save exist, you can use the policy’s cash value (permanent plans only) to supplement your retirement. Advocates of using permanent life insurance as a retirement plan say that you can receive the cash value income tax-free. No IRS rules exist for distributions, either. You can remove as little or as much as you want or none at all.

While advantages exist, know that the policy’s cash value is a safe asset. What this means is that don’t expect extraordinary returns. Regarding whole life insurance, the cash value is a safe place to grow your money (if that is what you want to do), and it is a better alternative to CD rates. This is true.

However, you want to weigh your needs and goals carefully here. For example, indexed universal life is a popular alternative to investing in the stock market. You likely have heard about them. You probably have heard that an IUL is better than sliced bread. Superlatives galore. Many agents won’t stop glorifying this product, but they then gloss over the disadvantages, how universal life works, what the fees are, and that, at the end of the day, it’s still life insurance. Carriers can change their “cap” rates anytime and returns depend on a successful stock market combined with better-than-average cap rates.

Nevertheless, these permanent insurances can work for supplemental retirement income. You just want to measure your goals and needs first. Additionally, you need to set your expectations correctly.

Pay For College

A common use for life insurance is to pay for college. Upon your unexpected death, your loved ones can use the death benefit money to save and pay for college.

Pay Your Mortgage

Mortgage payment is another common use for life insurance. Unfortunate as it sounds, it is common for a surviving family to lose their home upon the death of a parent. In fact, it is a top reason why families lose their homes (medical debt and illnesses/disabilities – unable to work – usually take the top 2 spots).

As we said before, even if you are a stay-at-home mom, it makes sense to have enough life insurance coverage that will pay off the mortgage.

Moreover, we work with a couple of carriers that truly offer “mortgage” life insurance protection. If you are generally healthy, you’ll pay 20% to 40% less compared to a traditional term life insurance plan.

Contact us for more information.

Pay Estate Taxes

Since life insurance bypasses probate, it can be a great way to pay for estate taxes (if you feel that your family will be subject to estate taxes).

The payment of estate taxes is outside the scope of this article. If you have questions about estate taxes, please contact us.

Invest In “Safe” Money

I mentioned this before. The cash value in a permanent life insurance policy is a conservative, safe savings vehicle. The life insurance carrier backs the cash value account.

The cash value in a permanent life insurance policy can be a great CD alternative because life insurance carriers generally offer a much higher interest rate. Moreover, the cash value grows tax-deferred. That doesn’t happen in a CD. You pay tax annually. Additionally, if structured correctly, you can remove the cash value income tax-free.

John, I am not putting my money with some life insurance company!

I know what you mean. I hear this all the time. People are generally afraid that they will lose money in their life insurance policy, but that isn’t the case. Moreover, carriers that exist today have A ratings (AM Best). Additionally, many of these carriers have been around since the 1800s and have witnessed, and survived, every type of economic meltdown this country has had.

If you are looking for an alternative and safe place for your money, life insurance is an option. Additionally, it can be an alternative for emergency savings.

As I mentioned earlier, however, you want to analyze your needs and situation to make sure purchasing permanent insurance for the cash value makes sense.

You Have A Family Who Loves You

This is the most important reason to buy life insurance. It is rather obvious. You have a family who loves you. If you unexpectedly pass away, you wouldn’t want them to be burdened by financial constraints, right? They will already be mourning your loss. Life insurance eases the pain. Sure, it won’t take the pain away, but your loved ones will live on without any financial constraints or burdens.

Even if you are a single woman, you have parents, siblings, or nieces/nephews who care and love you. Their

Now that you know the 10 reasons for women to buy life insurance, let’s discuss how underwriting works.

Life Insurance Underwriting 101 For Women

John, you make great points. I am ready to apply.

Sounds good, but first, we need to discuss underwriting.

Underwriting is the process of analyzing an insurance application and determining if it is an acceptable risk for the company. This is where they decide whether to approve your application or not.

If the risk is, the life insurance company (the underwriters) accepts the application and makes an insurance offer. If the risk is higher than anticipated, they may assign a table rating to the application. Moreover, if the risk is too great, they will decline the application altogether.

Underwriters analyze several areas of your background including your:

- health – analyze your medical history including your medical records

- lifestyle – like hazardous hobbies such as skydiving, scuba diving, or frequent, international trips

- driving records – like reckless driving including DUI

- public records – felonies, misdemeanors, or substance abuse

- anything else material to your application

Sometimes, the underwriters require a paramedical exam, which is a “mini-physical”. This step includes blood work and a urine sample. They are looking for HIV, high blood sugar, drugs, nicotine, THC, etc. in your blood and urine. However, because of medical technology today, many life insurance companies are moving away from the paramedical exam step.

If you want ample life insurance, you are going to have to go through underwriting. There is no avoiding it. Depending on your health and situation, many underwriters will “accelerate” the life insurance underwriting process. If you are in good health with no serious health conditions or lifestyle situations, then you can even apply for instant-decision term life insurance. This is “on-the-spot” decision. Computers review your:

- MIB report

- prescription drug history

- databases through Lexis Nexis

If all checks out, carriers will approve your application immediately.

See below for 2 instant-decision application links.

Guaranteed Issue Life Insurance For Women

Only one type of life insurance, guaranteed issue life insurance, does not require underwriting. The carrier “guarantees” issuing the policy. However, because no underwriting exists, the life insurance company places a “waiting period” on the death benefit.

Additionally, they limit the death benefit to a small amount, like $25,000.

Guaranteed issue life insurance is appropriate for people with severe medical conditions or risky lifestyle situations.

If you feel you need a guaranteed issue policy, contact us. We have helped many people who thought they were only eligible for guaranteed issue life insurance to obtain better coverage.

We Help Many Women With Health Conditions Obtain Life Insurance

John. It all sounds good, but I have a few health conditions. I don’t qualify.

Not true. We have helped many women with health conditions obtain life insurance. Contrary to what you may think, you don’t need to have the health of an Olympic athlete to obtain affordable life insurance.

Here is a list (not exhaustive) of where we have helped women:

- bipolar disorder

- schizophrenia

- substance abuse

- DUI

multiple sclerosis

multiple sclerosis- rheumatoid arthritis

- hazardous hobbies and occupations

- kidney disease

- liver disease

- heart attacks and heart issues

- cancer

- HIV/AIDS

- felonies and criminal history

- and more

Contact us. We can help.

The Life Insurance Application Process For Women

In recent years, with the assistance of technology, life insurance carriers have made it easier for women to apply for life insurance.

In recent years, with the assistance of technology, life insurance carriers have made it easier for women to apply for life insurance.

For the most part, gone are the days of a long wait before you hear a decision. Only in the most serious situations do life insurance providers take their time analyzing an application.

For many of us, after we apply, the decision could be a few days to a couple of weeks.

Additionally, as we stated before, if you are generally healthy with no risky health conditions or lifestyle situations, you can apply for instant-decision term life insurance.

I can’t comment on how the life insurance process is with other agents and brokers. However, here is what to expect if you decide to work with us.

- We review your background and health situation. If you are in good health with no issues, you can apply for instant-decision term life insurance (if that is what you want).

- If you have moderate-to-severe health conditions or a risky lifestyle situation, we prequalify you with underwriters. This gives us an idea of what your life insurance premium could be.

- We review your options and have you apply when you are ready. Depending on the carrier, they will email you the application directly or we fill out an electronic application together over the phone.

- We consistently update you during the underwriting process. As mentioned before, sometimes carriers require a paramedical exam, blood, and urine sample. We can set that up on your behalf.

- If all checks out, then underwriters approve your application, and you have life insurance.

Applying for life insurance with us is a simple process. Moreover, we keep your information and data secured (honestly, we don’t keep any of your personal information except your name, phone number, and email address).

What Should Women Consider In A Life Insurance Policy?

What is the right life insurance policy for you? Here are 4 factors women should consider in a life insurance policy.

The Type Of Policy

You need to select the right type of life insurance policy. I like to use the types of life insurance akin to the types of vehicles.

If you live in the city, a big vehicle may not serve your purpose well. Maybe a smaller vehicle with good gas mileage does. However, this same small vehicle probably won’t do so well in a snowstorm on the highway! In that case, you need something with 4-wheel drive. Additionally, if you haul many materials and things, then a truck works, but a car…probably not…

The type of life insurance is no different. Women need to make sure they select the right life insurance policy right from the start. Otherwise, you will just waste your money.

If you need life insurance coverage to cover your unexpected death, term life insurance is the best option. It pays a death benefit to your loved ones that they can use to live on. I would suggest that nearly all of us need some amount of term life insurance. Moreover, it is cheap. Term life insurance is cheap because it only pays a benefit if you pass away within the term period.

That brings us to permanent types of whole life insurance like whole life. Permanent life insurance contains higher life insurance premiums because it will pay a benefit no matter when you die. Since we all die at some point, the life insurance company already factors that event into its premium.

Permanent insurance is good for paying for funeral costs and/or medical expenses (i.e. burial insurance) or safely accumulating cash value.

How Much Death Benefit Do You Need?

You will also want to consider how much death benefit you need.

Some agents just use rules of thumb like “10 X your salary”. So, if you make $50,000, then you need $500,000.

Directionally, this works. However, this process is incorrect.

It doesn’t take into account your specific needs.

Please see our Life Insurance Needs Worksheet.

You can overwrite the numbers in the worksheet. They are there as placeholders.

A couple of things to note:

- on #2, the cost of living factor is really the number of years you would want your surviving family to live on based on your salary or income in #1.

- on #3, if you are generally healthy, we have a term life product that works a little better for mortgage payoff than a traditional term plan. It also costs 20% to 40% less than a traditional term plan.

Life insurance is financial protection. You will want to consider your loved one’s financial needs upon your death.

Who Are Your Dependents / Beneficiaries?

If you have young children, you will want as much life insurance as you can obtain.

However, if your children are grown, your life insurance needs are likely different.

Who your beneficiaries are and where they are in life also plays a role in the amount of life insurance coverage you want.

Additionally, you may leave death benefit to a favorite charity.

Do You Have Any Debts?

Life insurance is a great way to pay off debts such as a mortgage or another type of loan. In fact, many banks and lenders do require life insurance to pay off the loan in case of your unexpected death.

The life insurance worksheet illustrates proper coverage. It is not as simple as “10 X your salary” as many agents or brokers suggest.

What Women Can Get Life Insurance?

Any woman can. That is right.

Employed women: did you know that 4 in 10 women are the primary wage earners for their households? It is true. If you are the primary wage earner in your household, you need life insurance. Even if you have some through work (which isn’t a lot, usually), you can obtain more. If you unexpectedly pass away, your surviving loved ones can use the death benefit for their financial future (i.e. college, pay off a mortgage, savings, etc.). Additionally, if you are the secondary wage earner, your family STILL relies on you and your income.

Stay-at-home mom: I receive many phone calls from stay-at-home moms looking for life insurance on their spouses. When I ask them how much they have, they typically reply that they don’t need any because they don’t make any money. That isn’t true. Stay-at-home moms provide a financial contribution that goes beyond earning a paycheck outside the home. If you died, your loved ones would need money to pay for things like child care, driving, and other household duties. So, don’t devalue yourself. Usually, carriers allow a death benefit up to the family’s overall household income. Use our worksheet for assistance.

Single moms: There were 15 million single-mom households in the US in 2022. If you are a single mom with children who depend on you, you need life insurance it is that simple. A simple and inexpensive term plan will do just fine. You can look up estimated costs below. Remember, we have insured people with many and varying degrees of health conditions and situations. I am sure we can help you out, too.

Other Women Who Need Life Insurance

Single women: Many single women mistakenly think they don’t need life insurance because they don’t have any dependents. That is not true. I hear this from many younger people. Now would be the time to obtain some level of life insurance. Why? It is cheap, for one. You can purchase a 40-year term policy if you wanted to protect your life for that long. Additionally, you could use permanent life insurance like whole life or indexed universal life for the living benefits or to supplement your retirement income.

Business Owners: Are you a small business owner? According to the SBA, women owned 12,000,000 businesses here in the US. If you are a small business owner, did you know life insurance can protect the value of your business that you worked so hard for? Life insurance is a common solution for:

- buy-sell agreements

- key person insurance

- loan agreements

- recruitment (through a group employer policy)

- supplemental executive protection and bonus plans

Contact us if you would like to learn more how life insurance can protect your business, you as a business owner, attract/retain employees, and enhance executive compensation.

Non-Citizens: Contrary to what you may think, life insurance companies allow non-citizen women living here in the US life insurance. The types and coverage amounts depend on your legal status and your home country, among other variables.

- Green card – nearly all carriers will accept an application

- Immigrant working visa – some carriers will accept an application

- Undocumented status – only a few carriers will accept an application (i.e. you have an ITIN)

We have helped many non-US citizen women, including those undocumented, obtain life insurance. Contact us to learn more.

How Much Does Life Insurance Cost For Women?

John. Great article so far. So, how much does this all cost?

Good question.

Your life insurance premiums are based on everything we talked about in our underwriting section (above).

So, the premiums are based on your:

- age

- health, including your height and weight

- lifestyle situation

- driving record

- nicotine status

- public records

- anything else the underwriter deems material to your situation

In many cases, your policy costs $1 or $2 each day.

Think about that. What frivolous things do you spend your money on each day? Is there anything more important than a life insurance policy rather than the $5 Starbucks drink purchased each day?

No, John. You are right.

Do you want to get an idea of what life insurance costs? Feel free to use our term life insurance quoter below.

The quotes here are estimates only. Be truthful about your health and situation status.

Note: the quoter does not modify your estimated premium for any table-rated health conditions or lifestyle situations.

Remember: these are estimates, and the underwriters make the final premium determination through the underwriting process. Nevertheless, the quoter does give you an idea of how much life insurance costs.

John, I am in good health. Can’t I just apply?

Yes. We discuss instant-decision term life options next.

Instant-Decision Term Life Insurance Options For Women

It’s no secret that technology is changing the life insurance application process. While we did not discuss this in great detail, many of you may qualify for simplified or accelerated underwriting. All that means is that the underwriter removes traditional elements of the underwriting process (namely the paramedical exam, blood sample, and urine sample) and speeds up the decision. It cuts the decision from weeks to a few days.

It’s no secret that technology is changing the life insurance application process. While we did not discuss this in great detail, many of you may qualify for simplified or accelerated underwriting. All that means is that the underwriter removes traditional elements of the underwriting process (namely the paramedical exam, blood sample, and urine sample) and speeds up the decision. It cuts the decision from weeks to a few days.

This happens when women have a recorded, consistent health history (which is typically the case) and have good health.

Additionally, some carriers now have offered “instant-decision” term life insurance. Essentially, you apply through a secured link. The carrier looks up all the underwriting elements in the background. If everything checks out, you have life insurance on the spot. It takes 15 minutes.

If you are in good health, feel free to quote and even apply for term life insurance directly on our platform below (note: the term insurance plans offered here do not contain any living benefits).

Note: we have other instant-decision term life options that are agent-assisted applications.

Please keep in mind that carriers offering instant-decision term life have stringent requirements including, but not limited to:

- BMI between 18-36

- US Citizens and lawful permanent residents

- Valid driver’s license

- Occupation (Employed or student, stay at home/retired)

- Meet financial underwriting guidelines

- No criminal history (felonies)

- Not disabled or receiving disability benefits

- Never been rated or declined for life or disability insurance

- No serious medical impairments

If you have medical impairments or unique lifestyle situations, contact us. We can go over your situation and recommend the best course of action.

Final Thoughts About Women And Life Insurance

Women can obtain life insurance. In this guide, we discussed:

- what life insurance is and how it works

- type of life insurance available for women

- 3 facts about life insurance and women

- 10 reasons why women need life insurance

- life insurance underwriting

- application process

- cost of life insurance and instant-decision term life options

Do you have any questions or need our assistance? No matter your situation, we can help you obtain life insurance.

Contact us or use the form below. We only work in your best interests. That means we put you and your family’s needs first and not our own. This is the only way we know how to work with people.

If we can’t help you out, we will point you in the right direction as best we can. You can always reach back out to us if your situation changes.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".