5 Disadvantages of Indexed Universal Life Insurance [Unbiased Review] | Know The Disadvantages, How This Product Works, And Your Options

Updated: April 12, 2024 at 9:40 am

Did you know there are disadvantages to indexed universal life insurance (IUL)?

Did you know there are disadvantages to indexed universal life insurance (IUL)?

It is true. There are advantages and disadvantages to every type of insurance, and this includes indexed universal life insurance.

Indexed universal life insurance is a very popular type of life insurance. I am sure you have heard the accolades that you can withdraw the cash value income tax-free (which is true – more on that in a minute).

However, there are disadvantages, too. Many agents don’t speak about them. If you are going to purchase an IUL, you need to know these disadvantages and level set on expectations.

Here’s what we will discuss:

- The Hook With Indexed Univeral Life Insurance

- 5 Disadvantages Of IULs

- Real Reason To Buy Indexed Univeral Life

- Who Can Use An IUL?

- Now You Know The Disadvantages Of IULs

Let’s begin with a discussion on IULs and a “hook” that draws people into this type of life insurance.

There Is A “Hook” With Indexed Universal Life Insurance

We recently wrote a balanced article about indexed universal life insurance for our fellow readers. We discuss many of the advantages. I even believe an IUL can work as part of an overall portfolio.

Yes, that is true.

However, you don’t hear about the disadvantages. The broker you speak with hooks you into the concept of using an IUL for income tax-free money.

Here is how the hook develops…

You are at a meeting or maybe you are at a member event with your chamber of commerce. Gosh, maybe you are standing in line at the supermarket! You end up speaking to a local insurance agent and get to talking about the stock market.

Invariably, the discussion leads to why you (both) hope there isn’t a market correction because you don’t want to see your retirement portfolio take a hit as it did in 2008-2009. Or, even as I update this article, in the thick of the coronavirus.

This is the insurance agent’s runway for the next question. “Well, (insert your name). How would you feel if you could have upside market potential without any downside loss risk?”

Of course, you want that. Who doesn’t? “Yes, that does sound good,” you say.

Then, a follow-up. “When is a good time to meet..” The agent then asks about your availability.

Problem With The “Hook”

We have a problem with the hook. This statement implies that you will have

- 100% upside,

- investment in the stock market, or

- zero risk of loss

We know this because we asked those people who bought an indexed universal life insurance policy what was the driving factor behind their purchase. It was one of the above three (more so on #1 and #3).

Look, we don’t have a problem with agents who sell indexed universal life insurance. We provide it, too…in the right situations. Just see our guide on indexed universal life insurance. There are many advantages, but there are many disadvantages of indexed universal life insurance.

Let’s talk about those disadvantages in detail now.

The 5 Disadvantages of Indexed Universal Life Insurance

Let’s discuss the disadvantages of indexed universal life insurance, in no particular order.

#1 It Is Still Life Insurance

Here is one of the major disadvantages of indexed universal life insurance…it still is life insurance!!!! And, it is a type of universal life insurance as well.

Surely, the agent ultimately tells you it is life insurance (at your meeting, of course). Before the agent does so, however, you are probably thinking this is some type of investment, right?

Right…

Universal life insurance is a hard one for the everyday person to understand. All of its components are unbundled, meaning, in the simplest terms, you have flexible premiums. You can pay a lower amount if you want. You can even skip a payment if you want to, provided there is sufficient cash value in the policy.

of its components are unbundled, meaning, in the simplest terms, you have flexible premiums. You can pay a lower amount if you want. You can even skip a payment if you want to, provided there is sufficient cash value in the policy.

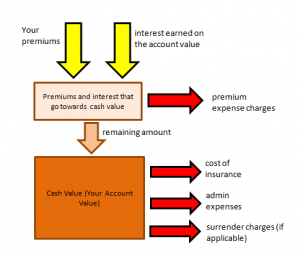

Flexibility becomes a double-edged sword. If the IUL costs become too great, and there is insufficient cash value in the policy, the carrier will require you to increase your premium – sometimes substantially – to keep the policy in force. This is clear from the diagram below:

An IUL is an expensive product for life insurance.

In other words, if you simply need life insurance for life insurance, you don’t need an indexed universal life insurance policy. You just need term life insurance. With commitment, you can buy term life insurance and invest the difference. In fact, in my guide to indexed universal life, I provide a performance example, looking back 27 years (with the Great Recession, tech bubble, and many corrections included). An investment always came out ahead.

Note: there are some people who might benefit from this type of policy, and we will get to those people in a minute.

The disadvantages of indexed universal life insurance abound. Here are some more…

#2 Many Fees And Can Be Very High

Indexed universal life insurance (and universal life insurance, for that matter) has a lot of fees. Just look at the above. There are fees for:

- premium expenses

- cost of insurance

- administrative expenses

- surrender charges

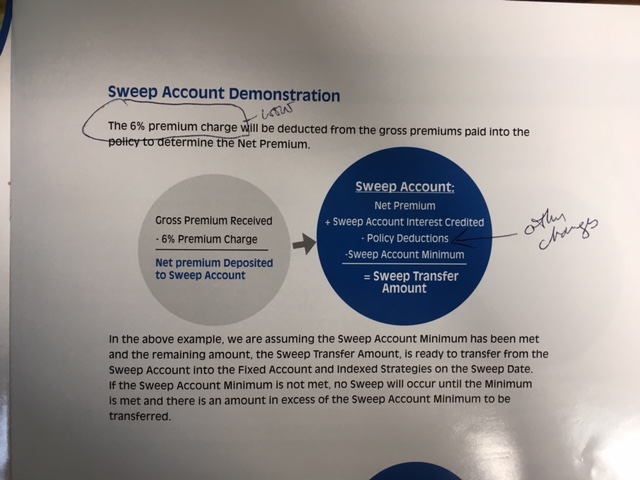

The life insurance agent will rebuke and say professional wealth and money management contain many fees. We say, yes, but probably not as much. As we mentioned here, the average family doesn’t need to spend a lot on professional money management. This real life example has a 6% premium charge! (I took this right out of a brochure – I am happy the carrier is upfront!) What does this mean? Let’s say your premium is $100 per month. That means $6 goes to the premium expenses, excluding the other expenses outlined above. (In other words, you still have fees to pay on top of the 6%.)

The life insurance agent will rebuke and say professional wealth and money management contain many fees. We say, yes, but probably not as much. As we mentioned here, the average family doesn’t need to spend a lot on professional money management. This real life example has a 6% premium charge! (I took this right out of a brochure – I am happy the carrier is upfront!) What does this mean? Let’s say your premium is $100 per month. That means $6 goes to the premium expenses, excluding the other expenses outlined above. (In other words, you still have fees to pay on top of the 6%.)

We don’t see that level of fees with wealth management. In fact, we rarely do.

A good habit: when you are reviewing an IUL quote, make sure you obtain the estimated costs and fees. That page can tell the story of where the premium money goes.

#3 You Don’t Fully Participate In The Market And You Can Lose Money

The following disadvantages are rolled into one because they all deal with returns.

Unlike the cash value returns in a traditional universal life policy, the cash value returns in an indexed universal life insurance policy are pegged to the performance of a stock market index. Common indices are the S&P 500, the DOW, or the NASDAQ.

This is an advantage of IULs: you can potentially earn a higher amount in cash value because the IUL tracks a stock market index.

You won’t fully participate in the index returns, though.

Huh?

Wait, you thought you would? No, you don’t.

The carriers limit your returns. They do this by using caps, spreads, and participation rates.

They provide these limits because of the downside risk element. It is true; indexed universal life insurance does provide limited downside risk. That is, no loss (i.e. 0 return). That is a great advantage, no doubt. In order to provide zero downside loss, however, the carrier has to limit the upside.

But, your cash value will lose money IF you withdraw the money during the surrender charges. These surrender charges lock your money in for as long as 15 years in some cases!! Additionally, IULs charge other expenses, as we outlined above. Those continue no matter how the index and your IUL perform.

Also, another case is popular alternative crediting strategies that cost money, yet don’t produce savory returns. You’ll lose money in this case, for sure.

#4 The Good Times Don’t Roll

Many carriers have high caps, spreads, and participation rates. But, don’t think the good times can roll forever. Carriers stipulate they can change these rates as market conditions change.

It’s true, and I am seeing this even today.

Back in 2016, one strategy on a popular IUL credited 13.5%. Today, it is 9.5%.

I write this update in the middle of the Coronavirus. However, from 2016 to February 2020, I think you could agree that the stock market performed very well.

Why, then, the cut in the crediting rate?

Without getting into the weeds, carriers need to make money. Life insurance carriers feed off of healthy interest rates. They invest their own portfolios (what they use to pay out death benefits) conservatively. Additionally, the costs of implementing an IUL strategy rise, too. This is all passed on to you, the policy holder.

If the carrier can’t make money, it will raise costs or cut crediting strategies.

#5 There Are No Guarantees

This disadvantage is somewhat implied in our previous reasons. Obviously, with an IUL, there are no guarantees. That means no guaranteed:

- premiums

- cash value

- death benefit

- fees

As we mentioned, these are all “unbundled”. If a guaranteed death benefit is important to you, then an IUL may not be in your best interest.

It is important to note that some carriers have included guarantees on their IULs. For example, many carriers have maximum guaranteed charges and fees.

Nevertheless, if all you need is life insurance, then an IUL likely isn’t in your best interest.

More Disadvantages Of Indexed Universal Life Insurance…

Remember I said indexed universal life insurance is life insurance?

Well, if you are in questionable health, your cost of insurance is much greater.

Look at my diagram above. If the cost of insurance is greater, this greater increase drags your cash value return down. You have to pay a higher premium into the IUL.

Golly, remember that this is life insurance!!!

Finally, be mindful of looking at carrier-provided illustrations. Nearly all the ones we have seen start the illustration in the year 2007/2008, when the market tanked, or at the tech bubble in 2000 that continued into 2003. These illustrations make it appear that indexed universal life insurance is a great, long-term solution. It can be. Yes, it can.

However, if you purchased an indexed universal life insurance policy in 2009/2010, your returns are surely behind that of the market. Or, if you purchased it in 2015.

More often than not, the IUL performance will trail that of the market. Even with recessions and pullbacks, over the long term, and on a tax-free comparison basis.

The Real Reason To Purchase An Indexed Universal Life Insurance Policy

You probably think we are totally against indexed universal life insurance? We are not. In our guide, we make great cases for indexed universal life.

You’ll want to purchase an IUL for the potential tax-free cash value. Additionally, many carriers now offer living benefits. That really makes an IUL attractive.

However, there are a few underlying elements here. You:

- have adequate and affordable term life insurance

- understand the returns are rather limited (currently, some carriers average a 6% return over the last 10 years.)

- need to fund this for the long term

- understand that an IUL, in a way, is a different asset class than stocks and bonds

- are not putting all your eggs in one basket

All I Need Is Life Insurance

Most people, like you and me, simply need term life insurance and then invest any term life savings into your retirement savings account.

You can check out the premiums on term life below. Just enter your information and be honest about your health. Term life insurance is cheap. Take the money you’ll save by NOT investing in an IUL and put that in the market.

However, there is a small subset of people who might need an indexed universal life insurance policy. Read on to find out who.

People Who Might Need An Indexed Universal Life Insurance Policy

While indexed universal life insurance is not for everyone, there is a subset of people who could utilize it.

Indexed universal life insurance may be useful for:

-

- the affluent or very wealthy. These people have a life insurance need. They could use the cash value as tax-free income. You see, the affluent have the money to dump in large amounts of premiums to take full advantage of the insurance. They can mitigate any expense drag from these large premium purchases.

- people who have contributed the maximum to their retirement accounts. They are looking for alternative ways to save. The cash value in an indexed universal life insurance policy is one way to save.

- you want to withdraw the cash value for an IUL income tax-free. This is true. If structured properly, you can indeed withdraw the cash value income tax-free. Personally, I like this. It sounds great. However, be aware of the cap limitations, etc. In other words, you may come out way ahead on an investment account even after paying taxes than what the IUL cash value illustrates.

- using it for living benefits. I think this is a fabulous way to leverage an IUL. Living benefits on life insurance add value, such as critical illness and chronic (nursing home or assisted living) care.

Indexed universal life on children is another option. Because of their young age, fees, costs, and other expenses are generally low.

For everyone else, stick with term life insurance and invest the savings into your retirement accounts.

Now You Know The Disadvantages Of Indexed Universal Life Insurance

While we feel there are many advantages of IULs, there are disadvantages of indexed universal life insurance for the typical individual and family. Just like traditional universal life insurance, indexed universal life insurance requires vigilance. Moreover, if the stock market or index does not rise, or has consistent, mediocre returns, the expense drag might wipe out any cash value within the policy.

If you feel that an indexed universal life insurance policy is right for you, or you want to learn more, contact us or use the form below. We have helped many individuals and families match the right life insurance to their specific situations.

There’s no risk with contacting us. We only work in your best interests. If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your situation changes.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".