5 Important Differences Of Group vs. Individual Life Insurance | Understand These Key Differences So You Can Make An Educated Decision

Updated: April 12, 2024 at 9:39 am

If you are an employee of a company, you likely have employer-sponsored (i.e. group) insurance benefits. One of the most common benefits offered to employees is group term life insurance. Many people sign up for this benefit and then forget about it. They think they are all set, or their group plan will always be there for them. However, you might be doing a disservice to yourself and your family if you think this way. In this article, we compare group vs. individual life insurance and explain 5 key differences.

If you are an employee of a company, you likely have employer-sponsored (i.e. group) insurance benefits. One of the most common benefits offered to employees is group term life insurance. Many people sign up for this benefit and then forget about it. They think they are all set, or their group plan will always be there for them. However, you might be doing a disservice to yourself and your family if you think this way. In this article, we compare group vs. individual life insurance and explain 5 key differences.

- What is Group Life Insurance And How Does It Work?

- Benefits Of Group Life Insurance

- The 5 Differences Between Group Life Insurance And Individual Life Insurance

- Do You Need Both?

- Final Thoughts About The Differences Between Group Vs. Individual Life Insurance

Let’s get started on what is group (i.e. employer-sponsored) life insurance and how does it work.

What Is Group Life Insurance?

Simply stated, group insurance is insurance benefits sponsored by an organization. Many organizations such as unions, fraternal organizations, and creditor/debtor groups can offer these benefits.

However, the largest and most popular group to offer these benefits are employers. If you are an employee of a company, you likely have these benefits. The employer sponsors the insurance, hence the name “employer-sponsored”.

After health insurance, group life insurance, hands down, has to be the most popular insurance benefit a company offers.

Why? There are several reasons. First, usually, it is easy to apply. You just sign up through your company’s open enrollment period. Typically, an employer’s open enrollment period is in the fall to coincide with the new year. Come January 1 (or the start date identified in the company’s plan document), you have life insurance.

(Note: If you are a new employee of the company, then you will have to work through a probationary period first before being covered by the plan.)

Second: group life insurance, specifically group term life insurance, is a nice benefit. We will discuss the advantages next.

Term life insurance is the most common life insurance type; however, companies can offer other types such as whole life and universal life.

Before we discuss the differences between group vs. individual life insurance, let’s discuss some of the benefits of group life insurance.

What Are The Benefits Of Group Life Insurance?

There are several benefits of group life insurance. Here are some of the advantages of group life insurance.

Easy application process – most of the time, you just need to fill out a simple form indicating how much life insurance you want among other general information like your date of birth and gender.

Easy underwriting process – the underwriting process for group life insurance is simple. Usually, group life insurance is offered on a guaranteed-issue basis. This means no underwriting – no health questions, no paramedical exam, no MIB check or prescription drug check, no phone interview, and so on.

is simple. Usually, group life insurance is offered on a guaranteed-issue basis. This means no underwriting – no health questions, no paramedical exam, no MIB check or prescription drug check, no phone interview, and so on.

If you are thinking that this benefits those with moderate to severe health conditions, you are correct. The guaranteed-issue underwriting for group life insurance has to be the #1 advantage of the insurance.

However, depending on your company size, the carrier may require a simplified health questionnaire. We at My Family Life Insurance do work with a carrier that offers guaranteed issue term life insurance (as well as guaranteed-issue disability insurance) starting at 2 employees.

Price – usually, the cost of group life insurance is very affordable as the employer typically pays for some of the premium. The cost-effectiveness makes a positive impact on your bank account, especially if you have a significant health condition. However, there is more to the cost aspect of group life insurance. We discuss this more in the next section.

Spousal / Children Coverage – if allowed, you can easily obtain coverage on your spouse and children, usually at guaranteed issue rates.

All of these seem great, right? Especially, the underwriting process where most group life insurance is issued on a guaranteed basis. That makes group life insurance an incredible opportunity, However, let’s compare group vs. individual life insurance. You will see some major differences.

5 Important Differences Between Group vs. Individual Life Insurance

Group life insurance certainly has benefits. However, there are major differences between group vs. individual life insurance. Many people don’t understand or realize there are differences. Let’s discuss some of the major differences next.

Limited Death Benefit

Most group life insurance plans offer limited death benefits. For example, a group life insurance plan may offer up to 3 X an employee’s salary.

Most group life insurance plans offer limited death benefits. For example, a group life insurance plan may offer up to 3 X an employee’s salary.

You might think,” Why, John? I need way more than that.”

Sure, you probably do!

The reason companies offer limited death benefits is that these plans must follow many nondiscrimination rules. In other words, they can’t discriminate.

Employer plans must follow a pre-determined formula. Otherwise, the company could face significant tax consequences. Here are some of the ways plans and carriers structure group employer life insurance:

- By employee salary – the most common, up to a certain limit, like 3 X salary up to $250,000.

- Job position – some plans offer varying death benefits based on the job position. For example, vice presidents only receive $500,000; directors receive $250,000; front-line managers receive $100,000; and skilled-workers $50,000.

- Length of service – not seen much, but it is an option. Your death benefit increases when you achieve a certain level of service. For example, people who have worked for the company for 10 years are allowed $150,000 of life insurance.

- Flat Benefit – Everyone, regardless of salary, position, etc., receives the same death benefit amount. For example, let’s say XYZ corporation has 20 employees, ranging from the secretary to the CEO. They all get $100,000.

What is common in these plans? Typically, group life insurance has low death benefits. This is a reason why group life insurance is not enough coverage for yourself.

Your Company Owns The Policy

Maybe not a big disadvantage on the surface. However, let’s discuss this in more detail. When you have life insurance through your employer, you don’t actually own the policy.

What, John, you ask? I pay the premium.

Sure you do, and if you pass away, the carrier pays the death benefit.

However, you don’t own the policy. Your company does.

They own the policy from the insurer. In turn, you receive a certificate saying you are insured.

You may not think that is a big deal, but it can be.

As the owner, your company makes decisions about the group life insurance plan, like:

- Canceling or withdrawing the plan

- Allowing employees to take the insurance with them if they leave

Again, this might not seem like a big deal; however, it is.

What if you have a serious health condition, and your company lays you off? Most group life insurance plans are not portable. This is where having an individual life insurance plan makes sense.

Rates Go Up Every Year

The life insurance through my employer is cheap, you tell me!

Yes, it is designed to be that way. However, did you know those rates go up every year?

Really?

Yes. So we are clear, I am talking about group term life insurance, which is the most commonly offered group life insurance. (Group whole life insurance premiums stay the same.)

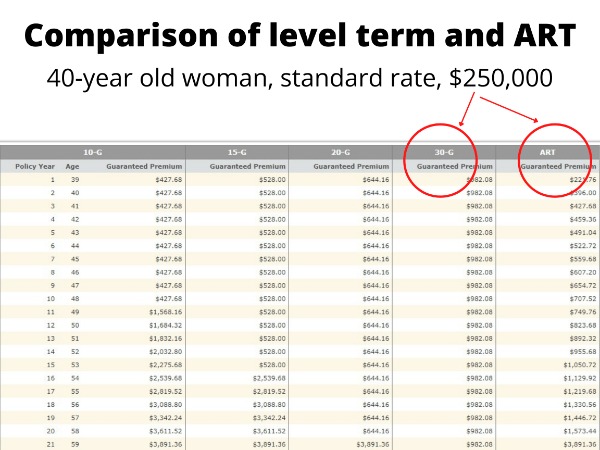

Group term life insurance is typically annually renewable term life insurance (ART). ART policies increase every year. They start out really cheap and then increase every year. See the excerpt below of an individual term life policy illustration.

At some point, paying a level premium saves money over the long run. In the excerpt, you would “break-even” at year 21. This means the cumulative premiums paid on the ART policy and the level policy are equal.

At some point, paying a level premium saves money over the long run. In the excerpt, you would “break-even” at year 21. This means the cumulative premiums paid on the ART policy and the level policy are equal.

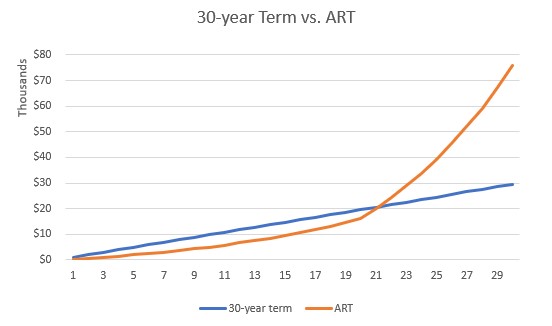

Here is another snapshot. You can see that if you paid the ART over 30 years, you would have paid about $75,000, which is $45,000 more than the 30-year level term policy.

Remember, the company pays these premiums to the insurance carrier. The company, in turn, charges you your share of the premium (through payroll deduction, likely). So, group term life insurance is still cheap, because your company pays for some of the premium, but your costs go up.

Remember, the company pays these premiums to the insurance carrier. The company, in turn, charges you your share of the premium (through payroll deduction, likely). So, group term life insurance is still cheap, because your company pays for some of the premium, but your costs go up.

However, the company’s cost is generally stable.

How is that, you ask?

As people leave or older workers retire, new employees come aboard. If these new employees are younger than the retired workers, then the company overall saves on premium money in total.

However, your costs still go up every year.

Usually, No Extra Benefits

Here’s another difference between group vs. individual life insurance.

Group term life insurance usually contains no extra benefits.

I don’t need extra benefits anyway, John, you say.

You don’t, I ask?

Let me ask you something. The chance of a man or a woman being diagnosed with cancer is 2 in 5 or 40%.

Knowing this, what would you do if you were diagnosed with cancer?

I don’t know, you say.

Could you work, I ask?

Likely not.

What would you do for money? All your treatments?

I don’t know.

That’s where life insurance with living benefits can help. You can advance part of the death benefit early for your needs and care. Covered situations usually include a terminal illness, nursing home care, and critical illness like cancer. These benefits are common on individual term life insurance nowadays.

However, these benefits don’t exist on group term life insurance.

Group term life insurance is straight term life insurance. You pass away, your family receives the death benefit.

But, if you need skilled nursing care because of an accident or had a heart attack, you can’t advance the death benefit for your needs and care.

Living benefits make life insurance a much more flexible planning tool.

You Can’t Take The Life Insurance With You

We touched on this earlier, but the subject deserves repeating.

Your group life insurance, generally speaking, doesn’t stay with you.

If you leave your company, your group term life insurance stays with the company.

Remember, they are the owner. Not you.

Your company can also terminate the group plan anytime. Remember, they are the owner.

I probably receive a few phone calls a month from people leaving their jobs or let go. They tell me they can’t take their group life insurance with them.

Moreover, some of them have disabilities or other health conditions. As we suggested, getting individual life insurance with a disability typically is a bit harder.

This underscores an important point: you should get individual life insurance as soon as you possibly can. If you are ever let go from your job or leave your job, your loved ones will have life insurance protection through your individual policy.

Do You Need Both? Group vs. Individual Life Insurance

You should now know the difference between group vs. individual life insurance, specifically term life insurance.

Is group life insurance worth the money, you ask?

Always.

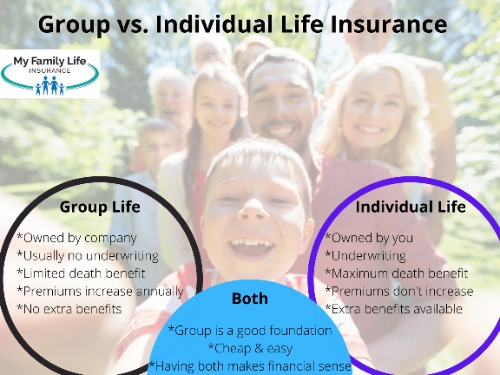

Here is an infographic on group vs. individual life insurance.

Group life insurance is easy. Usually, it is cheaper than an individual life insurance policy because your employer contributes to part of the premium.

Moreover, it is usually guaranteed issue. Sure, the death benefit is limited, but you can’t beat a guaranteed issue (i.e. no underwriting) policy.

However, the death benefit is usually too low for most families. This low death benefit makes an individual policy important.

Additionally, most group life insurance plans exclude other options like living benefits or integrated with disability insurance.

These omissions and limitations underscore the importance of having an individual life insurance plan.

So, should you skip out on group life insurance?

No. Instead, you just need to complement your group life insurance policy with an individual one. (Related: obtain term life insurance fast, with an instant decision)

The ease and price of group life insurance are hard to ignore. But, as we have outlined, it does have limitations.

An individual life insurance policy, especially one with living benefits, makes financial sense.

Now You Know The Difference Between Group vs. Individual Life Insurance

We hope you learned something from this article and now understand the difference between group vs. individual life insurance.

Group life insurance is sponsored through your employer. Behind health care insurance, group employer life insurance has to be the second most popular insurance benefit.

As discussed, however, there are major differences between group vs. individual life insurance. Specifically, group life insurance:

- offers a limited death benefit

- is owned by your employer, not you

- Rates increase every year (if term, generally speaking)

- offers no extra benefits, usually

- is not portable (i.e. you can’t take it with you if you leave your company)

These attributes don’t make group life insurance “bad”. On the other hand, they promote the need for some level of individual life insurance.

Do you need assistance or have any questions? We are happy to help. Contact us or use the form below. We only work in your best interests only. I know other agencies say that, but we mean it. There’s no risk with contacting us. If we can’t help you, we will point you in the right direction as best we can and part as friends. Seriously! You can always reach back out to us if your situation changes.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".