How To Get The Best & Lowest Life Insurance Rates With A DUI| We Discuss What Options Are Available For Your Situation

Updated: April 12, 2024 at 9:38 am

If you’ve had a DUI or DWI, you probably think you can’t obtain life insurance.

Yeah, John. I made one mistake one night. I’m not an alcoholic. I’ve paid my dues, and carrier XYZ denied me.

I hear you. Some carriers simply decline an application if you have a DUI in your driving history.

However, I am here to tell you that you can obtain life insurance if you have a DUI or DWI, even if the event occurred in the last 12 months. And, at the best and lowest life insurance rates for your situation.

That is right.

If you have a DUI / DWI on your record, you’ve come to the right place. We have helped many individuals in similar situations obtain the life insurance they need, including those with DUIs.

Here is what we will discuss:

- Underwriting For DUI

- If your DUI Happened Over 5 Years Ago

- If Your DUI Happened Between 3 And 5 Years Ago

- DUI That Happened 1 And 3 Years Ago

- A DUI That Happened In The Last 12 Months

- What If You Have Had Repeated Offenses?

- What If I Am Currently On Probation Or Parole?

- FAQs About DUI

- Now You Know You Can Obtain Life Insurance

Let’s jump in and discuss life insurance underwriting for a DUI. We start most of our articles with underwriting because that is the basis for approval.

Life Insurance Underwriting With A DUI On Your Record

Underwriting is the process of analyzing an applicant’s background and determining if he or she qualifies for insurance.

Most people think that their health is the determining factor in a life insurance application. That isn’t necessarily the case.

With life insurance, underwriting reviews your:

- Health

- Financial

- Credit

- Driving History

- Any Public Records

- Lifestyle Situations

For example, you can be the healthiest woman on earth, but if you like to skydive, your skydiving history is the determining factor.

Same with a DUI. If you have a DUI on your record, the DUI will be the determining factor for life insurance approval.

Carriers will want to know the following if you’ve had a DUI:

- When did it occur?

- Was there property damage?

- Any jail time?

- Was this a felony or misdemeanor?

- Any repeated offenses?

- Any alcohol abuse?

- When were you discharged from the DUI offense?

- Any probation or parole?

- Any bodily injury or death?

Is A DUI A Felony Or A Misdemeanor?

Good question. The answer lies in what your state says. However, generally speaking, a DUI is usually a misdemeanor for the 1st offense, unless there is

- a repeated offense,

- property damage,

- serious bodily injury, or

- death

In these cases, generally, the DUI is a felony. If that is the case, then some types of life insurance could be unavailable, depending on your situation.

As we stated earlier, the life insurance options available depend on when the DUI occurred as well as your health, lifestyle situation, etc.

Note that most carriers will decline an application if you apply for life insurance within a year of a DUI. We discuss this further in the article.

Most carriers will decline an application if you apply for life insurance within a year of a DUI.

(The operative word is “most”. Unlike what other websites say, there are options. See further in the article.)

One of the determining factors of life insurance approval is when your DUI occurred and if any repeated offenses exist.

The longer time since the DUI, the better your chances at life insurance approval.

Because of your DUI history, carriers may require a paramedical exam with a blood and urine sample.

Let’s discuss your life insurance options next.

Life Insurance Options If Your DUI Occurred More Than 5 Years Ago

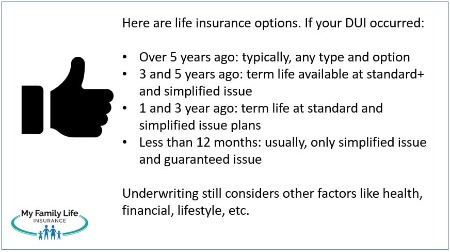

If your DUI occurred more than 5 years ago, then nearly all life insurance carriers will offer the best health classification.

You can have term life insurance, up to your financial ratio (for example, if you are 30, some carriers allow coverage up to 30 X your salary).

Feel free to check out the quotes below.

Of course, your health and overall situation matter. If you have a moderate health condition, that plays a part in the underwriting process, too.

You can also have whole life and universal life, including indexed universal life (IUL) and guaranteed universal life (GUL).

As discussed, the DUI should not have that great of an effect on underwriting, assuming that you have had no recurrences since.

Simplified issue whole life insurance is also available. We discuss that further in the article.

Life Insurance Options If Your DUI Occurred Between 3 And 5 Years Ago

Carriers limit your life insurance options if your DUI occurred between 3 and 5 years ago. The reason is risk. Some carriers still find that a DUI in that timeframe is a major risk. They will decline your application.

The operative word is “some”. While some carriers decline your application, there are others that will accept an application, provided you qualify in other ways like health, credit, etc.

There is a handful of carriers that will still accept an application; however, not at the preferred best classification available as discussed in the previous section.

The best classification available for term life will be standard rating or, in some cases, standard +. These are still good classifications. Think of “standard” rating as typical health of the average American – on a maintenance drug like lisinopril, maybe a little overweight, non-smoker, etc.

Of course, simplified issue life insurance is available. I alluded to this in the previous section.

Simplified issue is really simplified underwriting. Basically, you answer a few health questions. If all checks out, you have life insurance.

Many carriers offering simplified issue life insurance do not ask about DUIs or look up your records. They only look up the information in your MIB and your prescription drug history.

The process is very quick. Unless your DUI is related to any substance or drug abuse, then you should qualify for simplified-issue life insurance.

Those are the advantages; however, there are disadvantages.

For one, you’d have to qualify age-wise. Many simplified issue carriers offer a policy for individuals starting at age 40. Some are lower.

Two, many simplified carriers go up to $25,000 in death benefit, which is not much.

My Family Life Insurance Is Different

However, we at My Family Life Insurance are different. We work with many more carriers than the average broker. We usually find life insurance when others can’t.

Also, we work with carriers offering a higher death benefit amount on simplified issue plans.

For example, we work with a graded whole life insurance plan that offers coverage up to $150,000. It works great in these situations as there is no MIB lookup, no MVR lookup, and only a prescription drug check.

So, unless you have a moderate to a serious health condition and taking medication for it, your application likely will be approved.

Moreover, the rates are very comparable to other carriers offering whole life insurance.

Many people think whole life insurance is a bad idea, and it can indeed be so in the wrong situations. However, this whole life plan is a great option in these kinds of situations.

We also work with other simplified options, so I am sure we can find you some level of coverage.

Life Insurance Options If Your DUI Occurred Between 1 And 3 Years Ago

If your DUI happened between 1 and 3 years ago, you’ll have even fewer life insurance options.

If your DUI happened between 1 and 3 years ago, you’ll have even fewer life insurance options.

Do you see a trend here? The longer you wait to apply, the better the probable outcome.

But, John. I don’t want to wait. What if something happens to me?

Good question. You hit the nail on the head.

Other agents and brokers will tell you to wait. But, by doing so, you run the risk of developing a medical condition or even worse, passing away.

As I always tell my clients, you have to do the best you can right now.

Some coverage is better than none.

Having said that, there are a couple of carriers that will offer term life insurance within this time period.

The best classification available is a standard rating. As we indicated before, a standard classification is just fine.

Moreover, the simplified plans we discussed are also available.

Guaranteed Issue Plans Available

Guaranteed issue life insurance is also available. You can search for rates here. Just select “poor health” in the health class option.

We work with many guaranteed issue plans, including guaranteed issue term life insurance.

John, I heard guaranteed issue is a waste of money.

Well, yes and no.

If you qualify for something better, then yes, it is a waste of money.

However, as I said before, you can only do what is best right now. If a guaranteed issue plan is the best option right now, then that is an option.

All guaranteed issue plans traditionally have a waiting period on the death benefit. Usually, it is 2 years.

That is not as bad as it sounds. If you pass away from illnesses or natural causes in the first 2 years of the policy’s start date, then your family receives the premiums paid + interest or a percentage of the death benefit back. After the 2 years, the carrier pays the death benefit 100% in full.

If you pass away from an accident, the carrier pays the death benefit 100% anytime, even in the first 2 years.

So, the limitation is just on illness and natural causes.

We work with a couple of affordable guaranteed issue term life plans. One, you can enroll here yourself:

We work with another guaranteed issue term plan that requires some additional information from you as it has no waiting period. Contact us to learn more.

Life Insurance Options If Your DUI Occurred In The Last 12 Months

If your DUI occurred in the last 12 months, no term life insurance carrier offering an immediate death benefit will accept you.

That is just how it is.

However, as I mentioned, there are simplified issue plans available.

Yeah, John. But, I don’t want whole life insurance.

Some coverage is better than none, really.

Moreover, that simplified issue whole life insurance plan I mentioned above contains living benefits.

Life insurance plans with living benefits are worth the money. They basically allow you to advance the death benefit sooner while you are living.

Moreover, the plan offers competitive premiums.

For example, a 30-year-old man, non-smoker, a $150,000 whole life insurance death benefit costs $145 per month.

That is actually a really good rate since $150,000 with a low-cost, traditional whole-life carrier (we work with) costs $133 per month.

As mentioned before, you have the guaranteed issue term options as well.

We have plenty of options to get you some type of coverage.

Can You Get Life Insurance If You Have Repeated Offenses?

Yes, if you have had repeated DUI offenses, many carriers will still offer life insurance.

However, as we indicated earlier, then time is the issue.

For example, if your DUIs were over 10 years ago, then carriers won’t see that as an issue, generally.

However, if your first DUI was 7 years ago and then your last one was 3 years ago, well…that could be tougher.

As we indicated earlier, simplified issue life insurance is available.

Guaranteed issue life insurance is also available. As mentioned, we offered a couple of guaranteed issue term plans.

The best thing to do is contact us and we can talk to you about your options.

If you have many DUIs over a certain timeframe, some life insurance options may not be available. As mentioned earlier, the life insurance availability really depends on your situation.

What If I Am On Probation Or Parole?

Carriers traditionally do not offer term life insurance to people who are currently on parole or probation.

We wrote about this in our life insurance for people with criminal records and felonies guide.

However, as we have discussed throughout this article that some level of life insurance is available.

If you are on probation or parole because of your DUI, contact us to find out your options.

Frequently Asked Questions About Obtaining Life Insurance And DUI

Frequently Asked Questions About Obtaining Life Insurance And DUI

Below are some frequently asked questions about DUIs and life insurance. If you have any questions, just let us know.

How Do Carriers Find Out About My DUI?

Easy. Your DUI is on your motor vehicle records and public records.

When you apply for term life insurance, carriers ask for your MVR records. They also will look up your information through public databases.

So, there is no use lying on your application. Carriers find out. It is best to be upfront so we can reach out to the carriers and see what they can offer.

However, and I know I am sounding like a broken record, there are simplified issue and guaranteed issue plans available. These plans traditionally do not ask about or look up your DUI in the underwriting process.

We went over these options earlier in the article.

What If I Die From Drunk Driving?

If you are an innocent victim of drunk driving, even if you have a DUI on your record, the carriers will pay your death benefit.

However, nearly all carriers here in the US exclude a death benefit payout when the insured performs an illegal activity. So, if you were drunk and die from your drunk-driving accident, carriers will likely deny your beneficiary’s claim.

Can My Life Insurance Rates Increase After A DUI?

Be careful where you read elsewhere on the internet as there are many websites which suggest that your life insurance premiums increase after a DUI. This isn’t the case IF you already have life insurance.

If you have life insurance and then receive a DUI offense, your life insurance rate stays the same (or increases / decreases based on the terms of your contract, not because of a BUI. Universal life is a type of life insurance whose premiums can increase).

The issue becomes if you have a DUI and now want life insurance coverage. Yes, your rates will be higher than a comparable person without a DUI. However, as we wrote in this article, the time period from your DUI is a determining factor. If your DUI occurred over 5 years ago with no relapse, and you are in good health, then carriers make the best life insurance rates available.

Should I Purchase Accident Insurance?

I receive many questions about people wanting to purchase accident insurance. In other words, a policy that pays a death benefit if you pass away from an accident only.

I am not a big fan of accident “life” insurance. The reason is these plans only pay if you die from an accident, like a car accident.

As much as you read or hear on the news, most people do not die from an accident.

Moreover, I just described how people with a DUI history can obtain life insurance.

A life insurance policy protects your family from accidental death and illnesses/natural causes.

If you do feel the need to purchase accident “life” insurance, better types exist which help pay for accidental injuries.

These accident plans provide a cash benefit for any accidental injuries and also pay a death benefit if you die from your accident.

Now You Know You Can Obtain Life Insurance If You Have A DUI

If you have a DUI history, you can obtain life insurance.

As we discussed in our article, the time period from your DUI matters the most, followed by your health and other underwriting factors.

If your DUI occurred more than 5 years ago, many life insurance options are available including term life, whole life, and other types of life insurance.

Life insurance is still available for DUIs that occurred less than 5 years ago.

Remember, too, that we have simplified issue life insurance plans. Typically, these types of plans DO NOT review your motor vehicle records.

Are you ready to get started? Feel free to contact us or use the form below.

There is no risk of contacting us. We only work in your best interests. That means, we put you and your family first rather than our own needs. In other words, we place you in the plan that is right for YOU, not us.

And, if we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".