7 Critical Mistakes That Mess Up Your Life Insurance Beneficiary Designation | Watch Out For These Situations

Updated: April 12, 2024 at 9:39 am

You probably didn’t know that you can make mistakes on your life insurance beneficiary designation, did you?

And if you do, and you pass away, your beneficiary mistake could have severe consequences.

Many people (and some agents) will tell you to not worry; just put anyone as your beneficiary.

But that is wrong. Doing so will potentially destroy the advantages of life insurance. Moreover, it could create chaos with your surviving loved ones.

You don’t want that to happen, do you?

The good news is that you are reading this article. If you’ve made one of these mistakes, you’ll have the opportunity to fix it.

Here’s what we will discuss:

- The Advantages Of Life Insurance

- Who Can Be A Life Insurance Beneficiary

- 7 Life Insurance Beneficiary Mistakes

- Final Thoughts Of Life Insurance Beneficiary Mistakes

Let’s discuss the advantages of life insurance first. By discussing the advantages, you’ll see how these mistakes affect your life insurance beneficiary designation.

The Advantages Of Life Insurance

There are many advantages of life insurance. We won’t discuss them all here. However, two important advantages stand out. Let’s discuss them in more detail.

The first advantage is the beneficiary receives the death benefit free from income tax. Let’s say you have a $500,000 life insurance policy. When you pass away, your beneficiary receives the $500,000 and does not report that as income on his or her tax return.

How awesome is that?

Another major advantage is that the death benefit money passes directly to your beneficiary, outside of the probate process. In other words, the death benefit doesn’t go through the court system. (However, it can if you mess up…we will discuss that later.)

Making mistakes on your life insurance beneficiary designation could affect these 2 important advantages.

You don’t want that to happen, right? If so, please read on.

Who Can Be A Life Insurance Beneficiary?

A life insurance beneficiary is simply a person or entity who receives money, in this case, a death benefit, from a life insurance contract, upon the death of the insured.

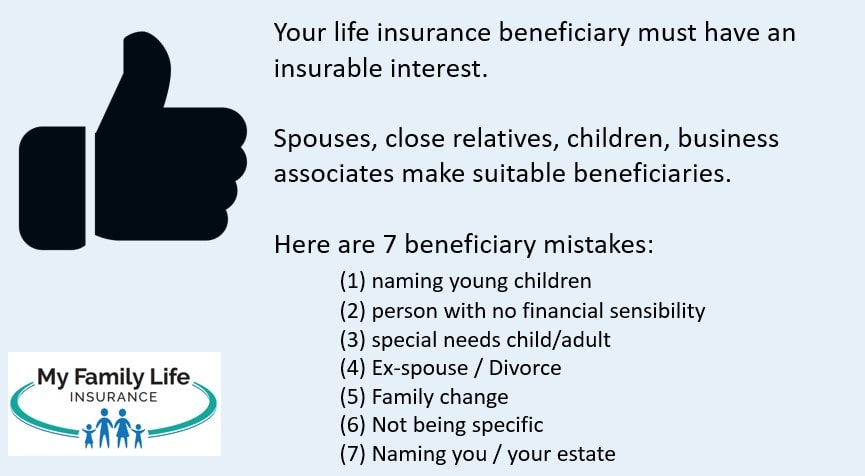

While you may think you can have anyone as a beneficiary, you can’t. A beneficiary must have an insurable interest.

What is insurable interest? It means that person or entity, as a beneficiary, would face financial hardship upon your death.

That means a beneficiary can’t be a stranger or some unknown person. Common beneficiaries with insurable interest include:

(1) yourself – but we don’t recommend as noted below

(2) your spouse

(3) your ex-spouse

(4) your children

(5) parents or grandparents

(6) other close relatives

(7) a fiancé (but usually not a boyfriend/girlfriend)

(9) Anyone with demonstrated hardship upon your death (i.e. a personal loan you made)

(10) a charity with demonstrated previously donation or connection

If you include a person without a clear insurable interest, you will have to prove that to the insurance carrier. For example, if you financially take care of your second or third cousin, while this is a relative, you may need to prove that insurable interest.

7 Major Life Insurance Beneficiary Designation Mistakes

Does naming a beneficiary seem easy? In many cases, it is. However, there are endless mistakes people make with their life insurance beneficiary designation. Here are seven of them.

#1 A Child

We commonly make our children the beneficiary of our life insurance policies. Why not? An insurable interest exists. The problem is many carriers won’t issue the death benefit to a minor child. Do you really think a 10-year-old or a 15-year-old knows how to manage money? Having children listed as life insurance beneficiaries are common mistakes. We see them often.

If you don’t, then the courts will assign someone to manage the money. It could be someone you don’t know, whom you don’t trust, or who can’t manage money themselves. You don’t want that to happen, do you?

A better solution is to include your spouse as primary. If this is not possible, then set up a trust for the child beneficiary. Additionally, you can name a reliable adult in the trust to manage the money, such as a brother or sister.

Honestly, a trust, in our opinion, is probably the best choice. A trust is a separate entity, created under law. Upon your death, the trust receives the death benefit proceeds and will disburse the money to your child per the terms of the trust – terms that you specify. We advise you to contact a knowledgeable estate planning attorney regarding specific questions.

#2 A Person Who Has No Financial Sensibility

Upon our death, we want to provide our loved ones with financial security. It is a normal feeling.

Sometimes, our loved ones simply have no financial sense. They spend more than they save. They have trouble saving money or they work paycheck-to-paycheck. Yes, there is one in every family. And, yes, I know you agree with me.

Is it sensible and responsible to name these people as a beneficiary? Think about how they would act if they received a $500,000 or $1,000,000 income tax-free death benefit proceeds? This money is to replace the current and future income lost due to your death, not to go on a Tiffany’s shopping spree.

If your spouse or close family member would spend the money like water, the best choice, as we identified above, is to create a trust. You can specify the terms of the trust. There are provisions known as spendthrift. These provisions impose limits on money issued to him or her.

#3 A Special Needs Child Or Adult

Children or adults with special needs are eligible for Medicaid government benefits assuming they meet income and asset limits. These limits depend on the state of residence. Generally, however, the income limit is $2,000 and no more than $3,000 in assets in the person’s name. If they have anything higher, they will be disqualified.

You and your relatives might think they are doing this person a favor and naming them as a beneficiary. Any proceeds from life insurance will likely disqualify them for needed government benefits. Worse, some states may disallow them from reapplying for a certain number of years.

Additionally, a special needs adult likely doesn’t know how to manage money. So, the courts will have to designate someone unless there is a legal guardian or POA established.

Additionally, a special needs adult likely doesn’t know how to manage money. So, the courts will have to designate someone unless there is a legal guardian or POA established.

For example, you take care of your sister who has down syndrome. You name her the beneficiary of your life insurance policy. She receives Medicaid. You unexpectedly pass away. The death benefit proceeds are paid to her. The courts have to assign a person to manage the money. Moreover, she has to report the death benefit to Medicaid who will then disqualify her benefits.

A specially designed trust, called a supplemental needs or special needs trust, is a solution to this issue. Like in the examples before, the trust receives any money for the benefit of the special needs person. Consult an experienced attorney specializing in this area of the law for more information.

#4 Not Changing An Ex-Spouse

Divorce is a major life change when it comes to beneficiary designations and life insurance. If you do not update your beneficiaries upon divorce, the proceeds on your death benefit may inadvertently go to your ex-spouse.

For example, you divorce your husband and remarry. You never changed your life insurance. Upon your death, your proceeds benefit your ex-wife, not your current wife. However, even more problems arise as we discuss below.

If you have a divorce settlement or divorce decree, and it requires you or your ex-spouse to continue the life insurance (as the insured), the beneficiary designation can change from a spousal designation (with insurable interest) to an ex-spouse or related family member designation (possibly no insurable interest). Why is this important? It depends on your state’s divorce and estate laws. Ex-spouses may not have the insurable interest that inherently comes with marriage.

True story: We received a call from a woman who divorced her husband years prior. For one reason or another, the life insurance policy was never updated. He was the owner and insured. She was the primary beneficiary. Without getting into the details, he became uninsurable.

The insurance plan in place was the best option for any life insurance. The ex-wife never changed her from spousal designation to related family member. As such, upon his death, a legal battle ensued with the carrier as the carrier sought to determine if the ex-spouse or the man’s estate receive the proceeds. Don’t make the same mistake. If you have a divorce decree or settlement paperwork, make sure the beneficiary designations are changed accordingly.

#5 Not Adjusting With Every Family Change

Family dynamics change often. Yearly, even. With every death and birth, you want to check your beneficiary designations. Why? Here is an honest mistake. Parents buy a life insurance policy on the life of their newborn son. The parents are the beneficiary. The son is now 40, married, with kids. He owns the policy outright now. He is the owner and insured. His parents are still the beneficiary. The son dies unexpectedly, and the parents…not his wife or kids…receive the death benefit money. Let’s hope the in-laws get along!

Another easy miss is when someone remarries. An insurance policy may list the ex-spouse as a beneficiary. As mentioned before, this is a problematic situation.

#6 Not Being Specific

Sure, it is easy that you want to leave your death benefit proceeds to your “children”. What if you remarry with a stepchild? According to your life insurance beneficiary designation, your stepchild will also receive money. Is that your intention? Maybe. An easier solution is to simply specify who, by name, with birthdates and social security numbers if possible.

#7 Naming Yourself Or Estate As Beneficiary

As mentioned earlier, a major advantage of life insurance is that the money passes free from probate. However, if you name yourself as beneficiary, you just destroyed this awesome estate planning tool. Instead of passing outside of the probate process, the life insurance money remains a part of the probate process. Moreover, the courts could take a year or longer to release the money.

Finally, probate costs consume the life insurance death benefit money. Ultimately, your beneficiaries will have much less than if you simply named them a beneficiary on your life insurance policy in the first place.

Final Thoughts About The 7 Critical Life Insurance Beneficiary Designation Mistakes

Take the time to review your life insurance beneficiary designations because mistakes happen.

Do you feel confused? Take advantage of our free beneficiary designation audit service.

Would knowing how your money will end up and who will receive the life insurance money beneficial to you? We can work with you to determine if your beneficiary designations are aligned with your goals, intentions, and values.

This is a complimentary service. Feel free to contact us if you have any questions or use the form below to get in touch with you. We will contact you promptly and as always, we keep your best interests first and foremost.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

4 thoughts on “7 Critical Mistakes That Mess Up Your Life Insurance Beneficiary Designation | Watch Out For These Situations”

Comments are closed.

Back pain can be such a life transforming ailment. So what are you to carry

out? Alternative therapies for neck and back pain, likewise called free treatments, are getting legions

of enthusiasts as they are rapidly becoming a brand-new technique

of operating to get rid of pain and complications located throughout the body system.

There are numerous followers who count on the numerous

alternatives of alternative therapies that apparently experience that aching back.

That is great to know, Christine. And, if your back pain keeps you from working, a disability insurance policy will cover you if you can’t work. Maybe you should check it out? I would be happy to answer any questions you have.

John

Back discomfort may be actually such a lifestyle altering condition. Different therapies for back pain, likewise known as free therapies, are actually getting

hordes of supporters as they are quickly coming to be a

new procedure of working to acquire rid of discomfort and also complications discovered all over the

body system.

Thanks, Sherrill,

Yes, there are hordes of supporters. But it’s not new, Sherrill. It’s called disability insurance. Maybe you should check it out? We help many occupations protect their income, including web spammers 🙂

John