Can I Obtain Life Insurance If I Have HIV?

Updated: April 12, 2024 at 9:40 am

Can I obtain life insurance if I have HIV? The short answer – yes.

Can I obtain life insurance if I have HIV? The short answer – yes.

The life insurance industry is changing for the better. Some insurers are not only adjusting policy premiums through monitored healthy ways (like fit bit), but also opening or expanding insurance coverage opportunities to impaired health conditions such as type 1 diabetes. These coverage options are greater today thanks impart to technology, advances in health care, and people generally living longer with these conditions. Young Americans living with HIV have a great chance of living into their 70s.

In this article, we discuss the options for life insurance if you have HIV. We also discuss a very viable alternative that is very affordable.

Life Insurance Options For People With HIV?

People living with HIV now are also receiving coverage consideration from insurance carriers, specifically life insurance carriers. According to the CDC, there are currently 1.2 million Americans living with HIV, with 50,000 new cases each year. Fifteen years ago, these people would never have been able to secure life insurance. With recent medical and technological advancements, several insurers have relaxed their coverage standards for people who have HIV.

At the time of this writing, there are only a select few carriers offering life insurance to those people living with HIV. Carriers will still issue life insurance coverage at a table rating, however.

Chances are, however, that the cost and coverage will be much better than applying for a guaranteed issue policy (please read on below).

It is our opinion at My Family Life Insurance that as medicine advances in this area, more carriers will start to offer and expand coverage.

The Details Of Life Insurance Underwriting For Someone With HIV

There are several carriers offering life insurance to people with HIV. These carriers include:

- Prudential

- John Hancock

- AXA

- American National

- Symetra

- Guardian

These carriers all offer different types of life insurance and death benefit maximums. For example, Prudential only offers term life insurance to individuals with HIV. On the contrary, Guardian (at the time of this writing) only offers permanent life insurance.

The carriers will all have different underwriting guidelines; however, they all have a general guidelines of underwriting. These include:

You are age 30 to 60 years at time of application submission and in generally good health.

You must reside in the United States.

The virus was not acquired via blood transfusion or intravenous drug use.

It has been more than 1 year since HIV diagnosis and, if being treated, greater than six months since current Anti-Retroviral Therapy (ART) was initiated.

Medical regimen has been stable for at least 6 months before application with a minimum of 2 recorded, acceptable CD4 counts and viral load results post medication change.

Viral load is undetectable (< 200 copies/ml) and stable.

CD4 count and viral load have been recorded within 6 months from time of application.

You must be consistently compliant with your treating physician’s recommendations for follow-up care and routine testing for CD4 counts and viral loads.

Also, you are free of Hepatitis B / Free of Hepatitis C.

You are free of Tuberculosis (TB) or Non-TB mycobacterial infection.

Alternative Life Insurance Options For People With HIV

There are several alternatives if individual life insurance is not possible or viable for you right now. These alternatives include, but are not limited to:

- Enrolling in your company’s life insurance program, if any. Most life insurance policies issued through your employer underwrite on a group basis. Essentially, that means the coverage is guaranteed and the rates are better – probably in the standard rating range. Typically, the plan limits your death benefit to 1X to 3X of salary.

- Applying for group life insurance yourself. If you are a business owner, you could apply for group term life insurance. The level of death benefit coverage depends on your company size. However, you will need at least 2 employees to obtain some level of guaranteed-issue coverage.

- Obtaining guaranteed issue insurance. While guaranteed issue policies have death benefit limitations, they are an option. It is best to consult us so we can direct you to the right policy. We discussed how burial insurance for people with HIV could be a viable option.

- Applying for accident insurance. These policies will pay a benefit upon a covered accident, like a torn rotator cuff while playing baseball. They do provide a death benefit upon accidental death.

Premium Cost Of Life Insurance

Honestly, the premium cost of life insurance for someone with HIV can be pricey. Prudential is more liberal to qualify, but is more costly. AXA and Symetra are very good with lower premiums, generally speaking, but still high.

Rather than paste on here what your premiums could be, why don’t you contact us or use the form below. We can have a better discussion with you about premiums and give you a preliminary quote on the spot.

However, we do work with one carrier that will be much cheaper. The carrier is an A-rated carrier and have one question on its application. The question has nothing to do with having HIV. Let’s talk about this option next.

A Viable Life Insurance For Someone With HIV

All of the aforementioned life insurance options are great. However, they involve:

- discussing your private information

- a paramedical exam

- typically longer underwriting process

- a high premium, usually

Thankfully, we work with a carrier that avoids all this and has one question on its application (well, technically 3 of them, but the other 2 involve coverage for your loved ones and if this is a policy replacement.)

We call it (almost) guaranteed issue life insurance up to $100,000. We have helped many individuals with this life insurance.

You just have to answer one question. If you answer “yes”, you have life insurance with an immediate death benefit:

Are you actively employed and can perform the normal activities of someone of like age?

That is it. Additionally, the carrier offers two types of life insurance:

- term life

- universal life

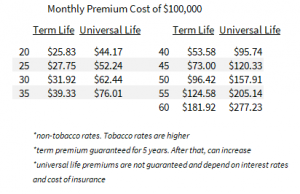

Premiums are generally affordable as you can see below. It is important to note that the premiums on the term life insurance are fixed for 5 years. After that, the premiums could increase. As with any universal life insurance policy, premiums are not guaranteed. However, you may be able to utilize this life insurance’s cash value as a pseudo-emergency savings fund.

How We Can Help

We hope this article provided education of life insurance coverage options for people with HIV. At My Family Life, we work doggedly to match the right insurance for you and your situation, even if it takes months to go through the process of doing so. Ensuring you and your family have the right coverage is our first and only priority. Feel free to call, text, or email us. Or, use the form below. We would be happy to help you.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".