2 Solid CD Alternatives That Grow Your Money | These Options Offer The Same Principal Protection But Higher Returns

Updated: April 12, 2024 at 9:39 am

I get it: you want to grow your money safely, but Certificates of Deposit (CDs) offer a paltry return. You want safe CD alternatives that still grow your money.

I get it: you want to grow your money safely, but Certificates of Deposit (CDs) offer a paltry return. You want safe CD alternatives that still grow your money.

You’ve come to the right place. There are 2 CD alternatives that provide the same principal protection as CDs, but they currently offer a better return.

In this article, we will discuss the following:

- What Is A Certificate of Deposit And What Are The Benefits Of A CD?

- 2 Certificate of Deposit Alternatives

- 2 Benefits The Alternatives Have That Certificates Of Deposit Don’t

- Comparison Between Certificates Of Deposit And Alternatives

- Avoid These Options

- Now You Know The 2 Alternatives

Let’s jump in and discuss what a CD is.

What Is A Certificate Of Deposit And What Are The Benefits?

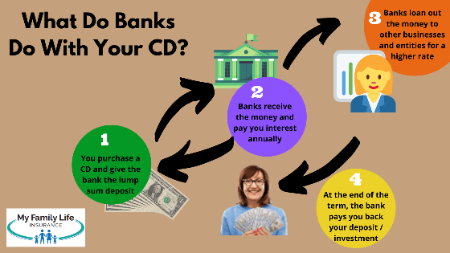

Certificates of Deposit are, what I call, time savings accounts offered through banks and other financial institutions.

Essentially, by purchasing a CD, you loan the bank money. In return, at the end of the time period, you receive your initial deposit back (i.e., your principal) and some interest.

the time period, you receive your initial deposit back (i.e., your principal) and some interest.

The interest rate offered by the banks corresponds to a couple of factors. Generally speaking, banks will offer a higher interest rate if you:

- Purchase a longer time period, and/or

- Invest a large amount

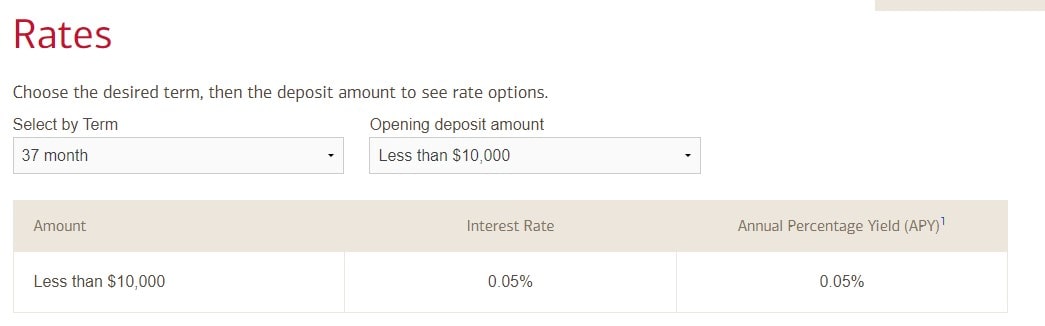

Check out this snapshot from a local bank in my area.

Pretty low rate for a 3-year term (essentially), right?

Pretty low rate for a 3-year term (essentially), right?

John, they sound like my savings account.

They are savings accounts, but a major difference is that there is a time period with CDs. For example, you can buy a 1 year CD. When that 1 year completes, you can receive your money back (with interest from the bank) or roll it into another CD.

Because of this time period, banks and other institutions typically offer a higher interest rate compared to other savings instruments.

But, as you can see above, rates aren’t that exciting.

You can purchase 6-month, 1 year, 2 year, and even 5-year CDs.

OK, John. But, why would I need one if rates are low?

That leads us to the next section.

What Are The Benefits Of A CD?

Good question. You’ll want a CD if you:

- Want to earn a higher interest rate compared to that of other savings vehicles

- Need your principal protected

- Need the CD time period to meet a savings goal (like purchasing a car in 3 years)

The FDIC protects certificates of deposit up to $250,000. This means if the bank that sold you the CD goes bankrupt, you’ll still receive your money back.

What Are The Disadvantages Of CDs?

No investment is perfect, CDs included.

Some main disadvantages of CDs include, but are not limited to:

- A low interest rate

- Money tied up

- Tax disadvantages (next)

While CDs offer a higher interest rate relative to their savings account counterparts, their rates are still low. Just see my snapshot above.

Risk versus reward derives the low rates.

If you are going to take on a greater risk (in this case, a higher chance of losing your principal investment), you’ll want the chance to earn a higher return, right?

That’s right, John

However, CDs are essentially riskless assets. Your initial investment or deposit is safe from any stock market decline. The only risk is if the savings institution goes bankrupt or you need to pull your money before the contracted time period ends, whereupon the bank charges you a fee/penalty.

That brings us to the next disadvantage.

You have to keep your money in the CD for the time period. Otherwise, the bank charges you a penalty.

That’s a main difference between CDs and a traditional savings account. It is also why banks typically offer a higher rate on CDs than on savings accounts.

Sure, there are liquid CDs (or no-penalty CDs) which don’t have these types of charges (called surrender charges or withdrawal charges). However, their rates are lower compared to traditional CDs.

And, the rates on CDs are pretty low to begin with.

However, that still is a couple of percentages less than the CD alternatives.

Annual Taxation Of CDs

To add insult to injury, you are annually taxed on the interest you made with the CD.

What, John? I didn’t even use the money. It just sat at the bank!

That’s right. You can’t use the money, but you are still taxed. CD rates are paltry to begin with, but being taxed on the little interest you receive is insulting.

Each year you have your CD, you will receive form 1099-INT to include the income earned in your tax return.

OK, John, what are these alternatives to CDs you talk about?

Let’s discuss those next.

2 CD Alternatives That Still Grow Your Money

There are 2 CD alternatives that still grow your money.

OK, John. Another site listed like 20!

Yes, we will discuss this further, but be careful what you read elsewhere.

Those 20 options (or whatever the number) do not contain the same risk profile as Certificates of Deposit.

In other words, you can still lose money with those other options. Remember, with a CD, there is no risk to your initial investment or principal except for fees or withdrawing your money during the time period.

The CD alternatives I am about to share with you contain the same risk profile as a certificate of deposit. In other words, you can’t lose your money (except for certain situations which I will discuss). However, you will be able to earn way more interest compared to CDs.

Let’s get started.

#1 Accumulation Annuities

One solid option is “accumulation” annuities.

John, I heard annuities are bad!

Some are. However, the annuities I am going to tell you about are safe.

I am not talking about variable annuities that are loaded with fees. Those are the ones you are thinking about.

I am talking about simple and safe – what I call – “accumulation” annuities.

These annuities have no fees usually. If they do, they are low. They do have withdrawal charges. More on that in a minute.

I call them “accumulation” annuities because that is what they do. You can add money/investment and your money grows at a safe rate, nearly always much higher than CDs.

These accumulation annuities are not invested in the stock market.

They are offered by insurance companies. The insurance carriers are backed by their own assets along with reinsurance carriers. They also must belong to the state’s guaranty association.

John, but that means my money is not safe!

Not at all. Many of these insurance carriers have billions in surplus, or reserves, which means if they were to go bankrupt, they would have enough money to satisfy their contractual commitments.

Typical “accumulation” annuities include:

- Multi-year guaranteed annuities

- Fixed annuities

- Fixed index annuities

Multi-year guaranteed annuities (MYGAs) are the closest resemblance to CDs.

They offer a guaranteed rate for a set time period.

However, unlike CDs, MYGA (or any annuity) growth is not taxed until you withdraw the money. That means your money compounds quicker.

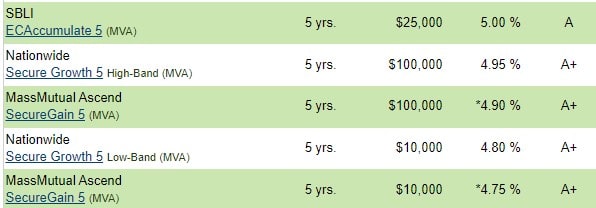

Moreover, rates are simply better. Here are 5-year MYGAs from A-rated carriers:

Other annuities that have safe principal attributes include fixed annuities and fixed-index annuities. However, their rate is not guaranteed like MYGAs. Conversely, though, you could earn a higher rate on these annuities.

#2 Permanent Life Insurance

Another option is permanent life insurance like whole life and universal life.

What? Whole life insurance is a scam!

Whole life can be a bad idea if it’s not used correctly. In this case, permanent insurance like whole life can be a great asset.

Moreover, the cash value is safe and protected like that of CDs.

You can’t lose money in a life insurance policy. The only way you can is through policy fees or surrender charges, which are more defined in universal life policies.

Additionally, the cash value grows tax-deferred whereas CD growth is taxed annually.

If you invest in whole life, the carrier guarantees a minimum interest rate like 3%. Whole life also offers dividends. You can have the dividends accumulate in the cash value with interest. Some carriers offer a 4% guaranteed return (as of this writing, subject to change) on the reinvested rate.

An indexed universal life policy (IULs) can work here, too. I know. I wrote about the disadvantages of IULs, and there are some. However, every investment has disadvantages. As long as you know the disadvantages and set your expectations correctly, IULs are a solid alternative to CDs. We even work with one IUL that has similar guarantees as that of whole life insurance.

2 Benefits These CD Alternatives Have That Certificates Of Deposit Do Not

There are 2 benefits the CD alternatives have that CDs don’t.

These benefits include:

- Taxation

- Living benefits

As discussed earlier, the growth in an annuity and a life insurance policy grows  tax deferred. It is not taxed (as ordinary income) until the owner of these alternatives terminates the policy and elects to receive the value.

tax deferred. It is not taxed (as ordinary income) until the owner of these alternatives terminates the policy and elects to receive the value.

(Note: with life insurance, particularly with IULs, you can receive the cash value income tax-free.)

Another benefit, that is rarely discussed, is that both annuities and life insurance offer living benefits.

Living benefits allow the owner to use the benefit sooner for the following reasons:

- A covered critical illness like cancer

- Long-term care or chronic care like assisted living and nursing home care

- Terminal illness

For example, let’s say you invest in a $100,000 annuity with a 3 X long-term care rider. If you qualify for long-term care, the annuity pays a benefit of up to $300,000 for your care.

Can your CD do this?

No.

Certificates of Deposit do not have this benefit. You can’t advance the value any sooner. Well, you can, but you’ll pay a penalty. Moreover, you don’t have a leverage factor like what I describe above.

With life insurance or annuities, you won’t pay a penalty if you exercise living benefits.

Feel free to contact us if you have any questions.

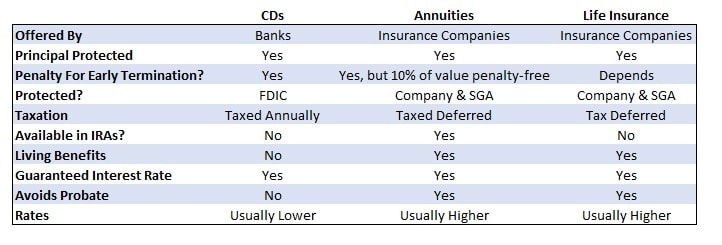

Comparison Of The CD Alternatives And CDs

It is best to compare and contrast CDs with annuities and life insurance.

Which works best for you?

That really depends on your needs and situation. However, annuities and life insurance will offer the same type of principal protection with a higher interest rate.

Avoid These Options

Search “CD alternatives” in a search engine, and you will read other websites with way more than 2 alternatives.

Yeah, John. One had like 10.

It’s important that you be careful what you read elsewhere.

Let me ask you something. Why do you want to purchase a CD?

I want my principal protected and earn a safe return.

As we stated earlier, annuities and life insurance have the same risk profile as CDs. In other words, these alternatives protect your principal / investment, just like a CD.

However, they offer higher interest rates. Moreover, the growth is tax deferred. In regards to life insurance, the cash value can be withdrawn income tax-free if structured properly. Some annuities and life insurance plans offer living benefits as well.

That is not the case with CDs.

So, these other websites list:

- Tech Stocks

- Bonds

- Mutual Funds

- Real Estate

- REITS

- Municipal Bonds

- Crypto

- Foreign currency (what?)

- Dividend paying stocks

What do these all have in common?

Well, John, from experience, I can lose my money.

That is right. These all have the ability to lose your principal/ initial investment.

However, because of the risk of losing money, they offer a potentially higher return compared to CDs, annuities, and life insurance.

And, they should. Because you are undertaking a greater risk to your investment.

But, with CDs, your principal is safe. So, the return is much lower.

Annuities and life insurance offer the same principal protection, but they offer a higher return.

These options shown on other sites are not true alternatives to CDs.

Yes, you should invest in these options, especially if you have a long timeframe.

However, they are not true CD alternatives.

Now You Know The 2 CD Alternatives That Still Grow Your Money

Are you looking for an investment that can offer a higher return, but still maintains the same principal protection as certificates of deposit?

The CD alternatives we discussed in this article are good choices.

These include:

- Annuities

- Life insurance

Do you have any questions or would like more information?

Feel free to contact us or use the form below.

As with anything we do, we always place your interest first. That means we are not beholden to a carrier or company, but to you, and making sure the products we recommend are the right ones for your needs and situation.

There is no risk of contacting us. If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us at any time.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".