Types of Burial Insurance

Updated: April 12, 2024 at 9:39 am

You may hear from your friends, family, neighbors, or even Alex Trebek that you need burial insurance. If you think you do, it is important that you know the types of burial insurance available. There are so many kinds and types. In this article, we discuss the various types of burial insurance, so you can make an informed decision. First, we will discuss what burial insurance is, and then discuss the types available.

You may hear from your friends, family, neighbors, or even Alex Trebek that you need burial insurance. If you think you do, it is important that you know the types of burial insurance available. There are so many kinds and types. In this article, we discuss the various types of burial insurance, so you can make an informed decision. First, we will discuss what burial insurance is, and then discuss the types available.

There can be many options, and those options depend on your health situation. There are also low-cost burial insurance options and ways to protect your burial insurance if you need to go into a nursing home. We will discuss those options as well.

What Is Burial Insurance?

It is simple. Burial insurance is a life insurance policy.

That is it, John, you ask? Why all the hubbub and confusion around it?

Well, back in the day, agents called it burial insurance. Why? They sold whole life insurance policies with small death benefits. The intention of the life insurance was to provide funds upon the death of the insured. The funds would be used for burial and funeral expenses. That is how the “burial insurance” name came about. But, simply though, it is a life insurance policy. Usually and typically, it is a whole life insurance policy with a small death benefit. The death benefit usually doesn’t exceed $25,000 or $30,000.

The advantage of burial insurance is the ease of the application process. I know what you are thinking. John, I don’t want to go through a medical exam. Carriers in the burial insurance market don’t require a medical exam. You simply answer a “yes/no” health questionnaire, have a phone interview with a member of the carrier’s underwriting team, and you will have burial insurance.

The hard part of the process, if there is one, is seeing which carrier you qualify with. You see, the burial insurance underwriting takes into consideration your health conditions. Generally speaking, all the carriers underwrite differently. For example, if you have multiple sclerosis, you may qualify with carrier X, but not with carrier Y. Carrier Y declines coverage for people with Multiple Sclerosis. Or, Carrier Y offers a different type of burial insurance.

How do you know which carrier you qualify with? Well, you need to work with an independent agency like My Family Life Insurance. We can tell you, based on your health conditions, the types of burial insurance you’ll qualify for. And, that brings us to our main topic.

The Types Of Burial Insurance

So, before getting into the types of burial insurance, know that there are different ways to save for your funeral. You can always go down to the local funeral home and set up a “pre-need” plan with them. You’ll pay as you go. If you die before your plan is fully paid, your surviving loved ones pay the balance. It’s not ideal, for many reasons.

You can also outright save, but that is not ideal for many reasons, but mainly because of tax implications. We will get into that shortly.

The flexibility of burial insurance makes it very advantageous. You aren’t tied to a funeral home. Moreover, depending on the type (more on that), if you die the next day, the benefit is paid in full. Your beneficiary receives the death benefit. Or, you can partly assign the benefit to a funeral home income tax-free. Yes, that is correct.

Let’s talk about the types of burial insurance. Warning: the industry has some goofy terms, but we will do our best to describe them in layman terms.

Immediate/Level Death Benefit Burial Insurance

The first type of burial insurance is called immediate, or level, death benefit. Immediate death benefit means your family will receive 100% of the death benefit if you died the next day after the policy has been issued. It’s pretty simple. You apply and go through the underwriting process. After reviewing your qualifications, the carrier grants you an immediate death benefit.

What are those qualifications? Well, in short, they are your health conditions. You need to truthfully say “no” to the carrier’s health questions on the application. See a real application below. If you can say no to the health questions on the application, you have a good chance of obtaining an immediate, or level, death benefit.

But, it’s not only about the health questions. A member of the carrier’s underwriting team also likely interviews you. During this time, the underwriter looks up your application history through the MIB and reviews your prescription drug history. If all matches up to what you said on the application and interview, the carrier grants you immediate death benefit.

Usually, immediate/level death benefit affords the lowest premium available. So, our job is to find you a carrier that allows you to obtain a level death benefit based on your health conditions and prescription drug medication.

Carriers don’t care about minor health questions like high cholesterol. Honestly, no carrier cares about high cholesterol. But, they do care about moderate to severe health conditions and the recency of diagnosis and treatment of said health conditions.

What if you can’t answer “no” to all of the questions? Well, then, you probably eligible for a graded death benefit. We discuss that next.

Graded Death Benefit

Graded death benefit means you said “yes” to one, or more, of the health questions on the application. Additionally, it could mean an unfavorable drug prescribed to you. In these cases, the carrier offers a graded death benefit.

A graded death benefit means your family will receive a reduced death benefit or a percentage of the death benefit if you were to die in the first year of the policy’s effective date. That percentage could be 10% in the first year. If you die in the second year, the carrier offers a higher percentage of the death benefit, such as 50%. For example, let’s say you have a death benefit of $25,000. Using our percentages, you will have $2,500 in the first year and $12,500 the second year. Usually, in the 3rd year and beyond, the carrier pays 100% of the death benefit.

As you can tell, graded death benefits are reserved for people with moderate to severe health conditions. Example of these health conditions include:

- Kidney disease

- Hepatitis

- Diabetes (type 1) diagnosed as a child

- Diabetic complications

- Heart Attack

- Angioplasty/stent

- Stroke/TIA

- Cancer

- COPD/Emphysema

Recency matters, too. If you had a heart attack 10 years ago, and now everything is fine, you’ll probably obtain level death benefit. The situation changes if the heart attack occurred last year. Then, likely, the carrier approves you for a graded death benefit.

Again, it all boils down to the health questions on the application and the medication you take.

Guaranteed Issue Burial Insurance

If you have a severe health condition, then you aren’t eligible for an immediate or graded death benefit. Not to worry, though. There are carriers that offer guaranteed issue burial insurance or known as guaranteed issue whole life insurance. There are no health questions on the application. The carrier doesn’t care if you had cancer last year. There may be a couple of administrative and replacement questions. That’s about it. You fill out the application, send in your premium, and then you have life insurance.

Sounds good, John. What’s the catch?

The “catch” if there is one, is the carrier has a “waiting period” on the death benefit. The waiting period usually is 2 years, but other carriers have a 3-year waiting period. If you die within the 2 years (or 3), your beneficiary receives the premiums you paid + interest. After the waiting period, the carrier pays the death benefit 100%. Why do they offer a “waiting period”? Well, think about from the carrier’s perspective. They have no idea the risk profile of its applicants. Applicants who apply for guaranteed issue life insurance may have serious health conditions that significantly diminishes their life expectancy. An applicant could die tomorrow. And, if the applicant had a level death benefit, the carrier would have to pay. Honestly, that creates a solvency situation for the carrier. That isn’t good.

The carrier can’t adequately invest the premiums, ensuring the death benefit money is there when your family requires it. So, they have the waiting period. If you die within the 2 year period, the carrier pays back your premiums plus some interest. It is really a return-of-premium plan and no risk of losing your money.

Health Conditions For Guaranteed Issue Burial Insurance

What conditions qualify for guaranteed life whole life insurance? Well, there are several. These conditions don’t necessarily mean you will die tomorrow or within the next two years, but they do imply a diminished life expectancy.

Health conditions for guaranteed issue whole life insurance include:

- Down Syndrome

- AIDS/HIV

- Huntington’s Disease

- Severe drug use or alcoholism

- Kidney failure/dialysis

- Alzheimer’s/Dementia

- ALS

- Current or very recent cancer (treated ended less than 1 year)

If you or a loved one has any of these conditions, contact us. We work with an extremely affordable guaranteed issue whole life insurance plan. We can see if it is available in your state.

The Type Of Burial Insurance Depends On The Underwriting

As you can tell by now, the type of burial insurance available depends on the carrier and its underwriting. Additionally, availability depends on you. Here’s the kicker, though. Not all burial insurance carriers exclude or underwrite the same condition. For example, there are a few carriers that flat-out decline people who have sickle cell anemia. Then, there are carriers that don’t care if you have it. You won’t find any verbiage or question related to sickle cell anemia on their application.

Question for you. If you have sickle cell anemia, which carrier will you apply with? That’s right. The one that doesn’t ask the question.

This is why it is important to work with an independent agency like My Family Life Insurance.

It is also important to work specifically with us because we think well beyond your “now”. We also think about your and your family’s future. No other agency talks about the problems with these types of burial insurance. That’s right. Problems. So, let’s talk about these problems next. You’ll be glad we did because I guarantee many agencies don’t. We will then describe a couple more burial insurance options to avoid these problems.

A Problem With Burial Insurance And Life Insurance

Here’s a major benefit of using life insurance to pay for your burial and funeral expenses. The death benefit is income tax-free. That is right. Income tax-free! That is a huge advantage for life insurance.

Here is a problem when people say they will just save their money in a CD or a savings account for their funeral. Ultimately, at their death, the government taxes that money one way or another, through the probate process.

Yep…you got it…so the $20,000 CD you have earmarked for your funeral will ultimately be taxed to your beneficiaries through the probate and estate planning process. Same with that annuity or investment account.

So, what is the best solution?

Life insurance, you say!

Yes, you are right….to a point, though.

What do you mean, you ask?

Well, what you may not know is that whole life insurance, including burial insurance, builds cash value. Not to get in the weeds, but this is the structure of whole life insurance.

So, ultimately, the cash value is an asset. Why? Because you can conceivably terminate the life insurance at any point and take the cash. That is your money.

OK, so what is the problem then? You just said the death benefit is income tax-free. That is good. I don’t see a problem…

The problem happens if you need nursing home care. You see, nursing homes require you to pay. Your health insurance doesn’t. Medicare doesn’t. Nursing homes and assisted living facilities receive money from long-term care insurance and other types of insurance.

Medicaid Takes Your Burial Insurance Away

What if you don’t have this type of custodial care insurance? Well, then Medicaid pays. Medicaid is the payor of last resort for long-term care. And, before Medicaid pays your share, it will tell you to use your assets first to pay for your custodial care. Once your assets deplete, and you are destitute by their standards, Medicaid pays.

Do you know what that means?

I think so. Medicaid will require me to use the cash value in my burial that cash in your life insurance policy to pay for the nursing home care before it will pay one dime to the nursing home.

That is correct and the hard truth.

So, you mean I paid the burial insurance for nothing?

Well, not for nothing, but definitely not for its intended use…to pay for your burial and not burden your family!

So, you are telling me, how burial insurance is currently constructed, I could lose my burial insurance policy to Medicaid and the nursing home?

Unless you have long-term care insurance or other means to pay, then yes you will.

That stinks, John. Why didn’t my agent tell me this? How to avoid this?

Well, you are lucky. Not to worry because we have a couple of options that we describe next.

Another Type Of Burial Insurance – Guaranteed Universal Life

Remember we said that all burial insurance is a life insurance policy? Most of the time, it is whole life insurance because a whole life insurance policy will last your “whole life”. However, there is one type of life insurance that exists your whole life and won’t generate cash value. It is called guaranteed universal life insurance or GUL for short.

What’s a GUL? It is universal life insurance. Universal life insurance has been around forever. There are serious advantages and disadvantages of universal life policies. I really don’t want to get in the weeds, but one disadvantage is the cash value in the universal life policy might not be enough to keep the policy solvent. In other words, a traditional universal life policy ends up terminating itself. Again, this is really deep for this article, and if you want to know more, contact us.

However, GULs don’t have this problem because of its design. While they do generate some cash, usually the amount is not enough and ends up dissolving as the policy continues. What is guaranteed is the death benefit, as long as you pay the premium. Sounds like whole life insurance, but without the cash value implications.

If there is a drawback of GUL, it is that the underwriting is more intense. I call it a long-form underwriting. There are more health questions and health history required. While you probably won’t need a paramedical exam, you should be healthy with a low health condition, if any, like high blood pressure on one medication.

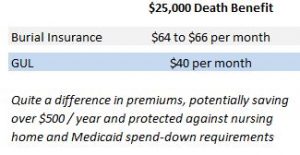

But the advantages outweigh this drawback. Not only is your policy protected from Medicaid, but also premiums are much less than a comparable burial insurance policy. See below.

Funeral Trust Is An Option

I know what you are thinking. John, I have moderate to severe health conditions. I will never qualify for a GUL. What do I do?

Then a traditional burial insurance policy should work, because it will likely be easier to qualify for coverage. But, assuming you are still living, you will want to ultimately transfer the cash value to a funeral trust. What’s a funeral trust? It is a trust that protects the cash value in your life insurance. No nursing home, creditor, or Medicaid takes it away. If you need nursing home care, the money is protected by the trust.

Keep in mind we are talking about cash value. Many agents don’t explain what cash value is. That is your money that accumulates over time as you paid premiums. Let’s say you have a $10,000 face value policy. There is $4,000 of cash in it. Do you think the carrier pays $10,000 upon your death? It does, however, $4,000 is a return of your money – the cash value – and the $6,000 comes from the carrier. As you live, your share becomes more and the carrier’s less.

Using the example above, if you need to go into a nursing home and apply for Medicaid, Medicaid will say, “Mrs. Jones, before we can pay, you need to use that $4,000 towards your nursing home costs.” It stinks. It makes your heart sink.

The funeral trust protects that cash value money. It can’t be touched. By no one. Honestly, of the types of burial insurance available, we feel that a funeral trust operates the way burial insurance policy should work.

How A Funeral Trust Works

The funeral trust works well in this situation. It protects that money and uses it for your burial expenses. Would the trust receive the face value? No, but the cash value is protected an all is not lost. We suggest to start thinking about transferring that money when the cash value (remember, this is yours) at 70% of the death benefit. For example, you have a $10,000 policy with $7,000 in cash value. The $7,000 is yours and the carrier owes your family $3,000 upon your death. Would you give up the $7,000 for the $3,000? No, you would not.

When you transfer the cash value and establish the trust, the trust becomes owner of the cash value. The cash value grows at a pre-determined interest rate. Upon death, the money in the trust is sent to a funeral home of your choice.

We wrote about the uses of funeral trust in our article about protecting your assets from nursing home costs and the Medicaid spend-down process. Review that article for more detail.

The trust also works in “crisis” situations where you have a family member in a nursing home and assets deplete quickly. We receive phone calls all the time whose family members are in this situation. They want to protect the burial insurance. Know that we have the experience and duty of care to help you and your family. Contact us for our help.

Premium Costs Of A Burial Insurance Policy

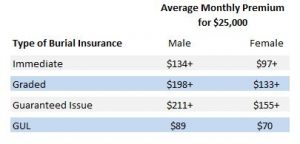

To give you an idea, we looked at the monthly premiums for the various types of burial insurance. In our chart below, we assume a 65 year-old man and 65 year-old woman, non-tobacco. Here is what you could expect to pay as of this writing. (Note: below is an average. We will find you the lowest cost burial insurance based on your situation.)

Conclusion

We hope you enjoyed this article about the types of burial insurance. Knowing your options and the types help you in the long run and your journey to purchasing burial insurance.

We have the knowledge, duty of care, and expertise to help you and your family select the right type of burial insurance, based on your health and personal situation. Are you ready to work with an agency that puts your and your family’s interest first? Contact us or use the form below. We would be happy to help you any way we can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".