4 Life Insurance Options Available For Multiple Sclerosis | Yes, People With Multiple Sclerosis Can Obtain Life Insurance | Here Is How

Updated: April 12, 2024 at 9:38 am

Do you have multiple sclerosis and have had a hard time obtaining life insurance?

Do you have multiple sclerosis and have had a hard time obtaining life insurance?

Yes, John, I have. I was just declined.

That happens, but the good news is that we can get you life insurance if you have multiple sclerosis, even if you have been declined before.

Even if I have been declined?

Yes. Moreover, we can usually help you obtain life insurance easily.

Even if you have been declined before.

The way I see it, people with multiple sclerosis have 4 life insurance options available to them.

In fact, barring any state availability limitations, you are approved for all of them.

We won’t go into details of multiple sclerosis, drugs, treatment, etc. If you are reading this article, chances are you already know these. We will cut to the chase. We will tell you what you need to do to obtain life insurance with multiple sclerosis and obtain the best policy for your situation.

- 5 Things To Understand When Applying For Life Insurance With Multiple Sclerosis

- Life Insurance Underwriting For People With Multiple Sclerosis

- Possible Life Insurance Outcomes For People With Multiple Sclerosis

- 4 Life Insurance Options Approved And Available For Multiple Sclerosis

- Favorable Carriers For People With Multiple Sclerosis

- Application Process For People With Multiple Sclerosis

- FAQs About Life Insurance And Multiple Sclerosis

- Final Thoughts About Life Insurance And Multiple Sclerosis

Let’s start with the 5 things you need to understand about the life insurance process.

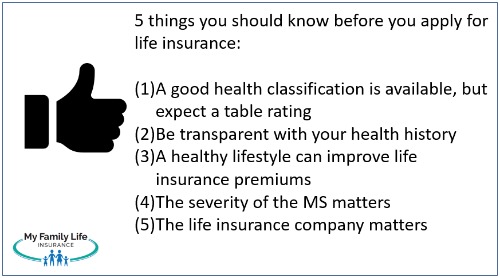

5 Things To Understand When Applying For Life Insurance With Multiple Sclerosis

(1) A Good Health Classification Is Possible

Generally speaking, life insurance underwriters classify risks based on health, medical history, driving records, and lifestyle history.

Underwriting is different for many types of insurance. For life insurance (disability and long-term care, too), health status is a main factor with underwriting. Preferred best is the best health classification category. In this category, you’ll pay the lowest rates available. Conversely, if someone has significant health conditions, the person could be “rated” (i.e. pay a higher premium) or declined altogether.

The good news is that someone with multiple sclerosis can obtain a good health rating. Typically, the best health rating that can be attained is the standard rating, which you can think of as average, normal health. I know other websites say this standard classification is available. However, that is tough as well.

Usually, a small table rating is a normal underwriting outcome for people with Multiple Sclerosis. Don’t distress, however. A small table rating is still a very good outcome as it generally identifies with normal health.

We will discuss this in more detail in our underwriting section later.

(2) Completely Explain Your Health History

We can’t stress it enough: we and the carrier need to completely understand your health history. Doing so saves everyone a lot of time and allows us to recommend the right policy for you.

health history. Doing so saves everyone a lot of time and allows us to recommend the right policy for you.

Be truthful about your condition on the application. Carriers will want to know your date of diagnosis, the date of your last attack, your type of MS, and your overall health otherwise. They will want to know the treatments you have had, their response to treatments, and if the condition has improved or remained steady over time.

Otherwise, you could be applying to the wrong insurance company! (see #5 below)

(3) A Healthy Lifestyle Can Positively Affect Your Premiums

Many prominent health publications state that maintaining a healthy lifestyle can mitigate the effects of multiple sclerosis. If you visit your doctor and neurologist routinely, take care of yourself, and maintain an active and healthy lifestyle, that will be a better health classification compared to someone who smokes and does not maintain a good lifestyle. While we can’t guarantee what health classification you will obtain, we can guarantee that diet, exercise, and following your regimen will lead to a lower premium than someone who does not.

It is also crucial that your health records are up to date. Having recent health information is crucial to an accurate health classification. Our advice is to make sure your health records are up to date before applying for life insurance. Life insurance underwriters will order your medical records to confirm the stability of your MS.

(4) The Severity Of Your MS Condition Matters

Based on your health information, insurers will classify you as mild, moderate, or severe.

Based on your health information, insurers will classify you as mild, moderate, or severe.

A mild case of multiple sclerosis will have the best chance of a standard rating (assuming good health otherwise) or a small table rating. Mild cases have infrequent attacks and do not cause disability. You are also still gainfully employed and not on disability.

A moderate case situation may have more frequent attacks, but the person is not disabled and can still work, walk, and use their extremities.

Severe cases are those where the person is, unfortunately, disabled and needs a wheelchair or some other type of ambulatory device. Severe cases are usually rated or declined altogether.

However, as I mentioned earlier, no matter the severity of multiple sclerosis, we can help you obtain some level of life insurance.

We discuss more in our life insurance underwriting section.

(5) The Life Insurance Company Matters

Technology has made it much, much easier for people to apply for life insurance. Many life insurers allow a direct application platform that removes the agent or broker right from the life insurance application process. (We have our own direct life insurance application platform as well.)

However, if you have multiple sclerosis, you don’t want to apply for life insurance this way. You’ll get declined every time.

Why? Because computers are making this underwriting decision. In your case, you need a human insurance agent or broker and a human underwriter to analyze your application.

I know other websites suggest otherwise. However, trust me, the life insurance company will decline your application.

As we mentioned, though, we can still help you obtain life insurance. True story: we helped one woman with MS obtain life insurance with a particular carrier. The funny thing is, she applied directly with the carrier before reaching out to us. This carrier declined her initial application, yet through proper handling and underwriting, we helped her obtain life insurance the right way with the same carrier.

Additionally, life insurance underwriting guidelines are different among carriers. Some carriers will automatically decline those with MS while others will take the time to understand your situation and classify you accordingly. We at My Family Life Insurance only work with those carriers that have a history and expertise in underwriting individuals with multiple sclerosis. It is important that you contact us first so we can help you identify those favorable carriers.

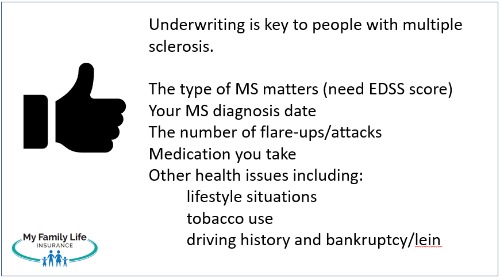

Life Insurance Underwriting For People With Multiple Sclerosis

In this section, we will focus on the types of multiple sclerosis, your prognosis, and medication. We will discuss how these factors affect underwriting. We then incorporate other factors in the underwriting process.

Underwriting is the process of the carrier reviewing your personal situation and making an offer of insurance coverage. It is the foundation of an approved application versus a declined application.

Here are the factors life insurance underwriting departments generally consider for people with multiple sclerosis:

- The type and severity of MS matters

- The date of your multiple sclerosis diagnosis

- How many attacks and date of your last attack

- What medications do you take

- Other health issues

Let’s discuss these factors in more detail.

The Type Matters

I’m sure you are aware of the types of multiple sclerosis. This is important: the MS type you have upon application affects the underwriting outcome.

Four types of multiple sclerosis exist. Additionally, life insurance availability depends on your specific situation. The information below is a general guide.

Relapsing-Remitting Multiple Sclerosis (RRMS) – this is the most common type of Multiple Sclerosis diagnosed. People with relapsing-remitting MS demonstrate periods of remission (no flare-ups or attacks) and then periods of relapses (temporary flare-ups). If you have RRMS, this is the best case, generally speaking, for life insurance coverage. People with RRMS usually have no or mild symptoms. They are not disabled and still gainfully employed.

Secondary Progressive Multiple Sclerosis (SPMS) – this is the next stage following RRMS. You feel the effects of MS and no periods of remission. Symptoms of MS tend to slowly worsen over time. If you have secondary progressive MS upon application, life insurance coverage approval will be a bit harder, but available.

Primary Progressive Multiple Sclerosis (PPMS) – Not many people are diagnosed with this type at the onset, about 10% according to the National MS Society. You have no remission or relapsing features. Moreover, your condition worsens from the onset. If you have primary progressive MS upon application, life insurance coverage approval will be a bit harder, but available.

Progressive-Relapsing MS (PRMS) – This is a progressive diagnosis of MS. This type is characterized by steadily worsening from onset with no indication of remission. If you have PRMS, life insurance approval may be difficult.

You Need Your EDSS Score

Having your EDSS Score from your neurologist is helpful for the underwriter. Your EDSS score indicates your MS dysfunction and possible level of disability. The lower the score, the better.

Additionally, the severity of your MS matters at the time of application. For example, let’s say you are diagnosed with RRMS, but have severe muscle weakness and need walking assistance. That is likely an unfavorable underwriting outcome even though you have RRMS.

Let’s talk about your diagnosis date next.

Your Diagnosis Date

Let’s say you were diagnosed with MS last week, and now you want life insurance. As I always say, and I am sure you hear elsewhere, the best time for anything is now.

insurance. As I always say, and I am sure you hear elsewhere, the best time for anything is now.

Unfortunately, that is not how life insurance underwriting departments see you with Multiple Sclerosis.

Generally speaking, they will decline you if you apply within a year of diagnosis.

Underwriting departments want to see how you react to your treatment and your prognosis.

So, usually after a year of your diagnosis, you can start researching carriers and companies for life insurance. However, we do have life insurance plans available if you want a “bridge” until this time. See the 4 life insurance options for people with Multiple Sclerosis below.

Contact us or use the form below as we can directly contact all of the carriers which favorably insure people with multiple sclerosis. We can find out, based on your situation, a tentative premium from the carriers.

The Number Of Flare Ups / Attacks

A flare-up or attack is the occurrence or re-occurrence of a symptom of MS such as vision problems, walking, use of hands, etc. After a few days, the flare-up goes away. Some flare-ups last for longer periods.

Knowing the number of flare-ups you had, the last one, and the severity (i.e. were you out of work and for how long) are important pieces of information. Those people who have not experienced a flare-up, or one in a long time, have the best chance for a lower premium (all other things being equal).

Medication Taken

There are various medications available for people with multiple sclerosis. Some are injectable and others are oral.

Underwriters expect medication prescribed to you. The fewer medications prescribed, generally the better.

However, there’s more to the medication story. Carriers will also look at other medication you take for ancillary conditions derived from MS. These conditions include bladder problems, depression, bowel dysfunction, or fatigue.

Other Health Issues

This brings us to a final point about life insurance underwriting for people with Multiple Sclerosis. The best rates available depend on the whole “you”. Underwriters look at your whole situation, not just the severity of your multiple sclerosis. So, they will consider your:

- height and weight / BMI

- tobacco use

- drug use

- other medical conditions (as mentioned previously)

- lifestyle

- driving history

- financial background and credit history

Underwriting departments look at the whole “you”. Let’s say you have RRMS and taking no medication. That is great! However, you smoke and have an above-average BMI. Well, that’s unfavorable, and you’ll pay a higher premium accordingly.

People with MS who have:

- demonstrated a positive prognosis for managing their condition,

- followed their treatment plan with their neurologist,

- low or no ancillary conditions derived from the MS, and

- follow a healthy regime of diet and exercise

will pay much lower premiums than someone who does not.

Having said all this, if you want a life insurance policy with a large death benefit, you will have to go through a full underwriting process where the underwriter reviews your health history, neurology records, and requires a paramedical exam (i.e. like a mini medical exam). We do have simplified underwriting options described in our life insurance options section.

We suggest that you fill out and print this multiple sclerosis questionnaire. It will have everything we need to start the process of accurately identifying the level of your multiple sclerosis. Then, contact us for our assistance. If you have read our other articles, you know we place great importance on you and your family.

Now that you know the underwriting process, let’s talk about the possible coverage outcomes for someone with multiple sclerosis.

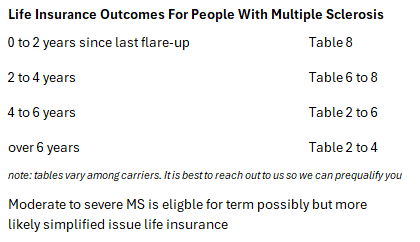

Possible Life Insurance Outcomes For Someone With Multiple Sclerosis

The below is a general guide and based on our interaction with underwriters and cases with people with multiple sclerosis.

Remember, most likely you will have a table rating, which is not all that bad provided you are healthy every other way.

Remember, most likely you will have a table rating, which is not all that bad provided you are healthy every other way.

Why would I need a table rating, John?

Well, because of the multiple sclerosis itself. Underwriters know it is a progressive disease that generally worsens over time. Additionally, people with MS generally have a lower life expectancy compared to someone who does not have MS.

There are health classifications called Preferred Best and Preferred. You pay the lowest premiums here. However, these are classifications are unavailable for someone with Multiple Sclerosis due to the progressive nature of the disease.

Other websites suggest standard rates (i.e. average health) are available, but that isn’t the case. With documented lower life expectancy for someone with MS, underwriters will add a table rating.

Don’t despair if you are on medication. If you have a good height/weight. Don’t use tobacco, etc, infrequent attacks, and have a minor health complication from the MS, then likely you’ll be in the table 2 to table 4 range. This is still a good premium range. A majority of our clients with RRMS fall into this range.

If you have PPMS or PRMS, your chances of a lower table rating are much more slim. You’ll likely fall into the table 6 to a possible decline depending on your condition.

If you are disabled and can’t work due to the MS, or you need a walker or need other assisted device, the carrier will likely decline your application.

If you are declined, don’t despair. We have additional life insurance options available which we discuss further in the article

4 Life Insurance Options Available For People With Multiple Sclerosis

The way I see it, people with multiple sclerosis have 4 life insurance options available to them. We have been able to help many people get approved with all of these options, so I know we can get you life insurance.

However, limitations exist, notably:

- state availability – not all options are available in all states

- you

What do I mean by “you”? Well, you have a progressive, high-risk condition. Carriers know this. You have to change your perspective when applying for life insurance.

You aren’t going to get the lowest rates. Moreover, you very likely won’t get standard rates, either, no matter what other websites say.

You’ll have a table rating, but if you are in good health otherwise, the rating should be low (like a table 2).

I have had many people with MS tell me to “pound sand” so to speak after we receive an estimate from the underwriters.

These people are missing the point about life insurance in the first place. It isn’t to pay the lowest cost, but rather to get life insurance to help your loved ones out upon your death. Unfortunately, they are not making their loved ones as important as they should be.

The life insurance won’t be “perfect”. You have to go into this process knowing you’ll have to pay a little bit more than someone who does not have MS. However, it will serve its #1 purpose: to pay a lump sum death benefit to your loved ones if you unexpectedly pass away (term life) or whenever you pass away (whole life). Moreover, we can always modify the plan to meet a budget. We have always done that.

Let’s jump in and discuss the life insurance options available to you.

Fully Underwritten Term Life Insurance Or Permanent Insurance For Multiple Sclerosis

If you are in a good situation healthwise with your multiple sclerosis, then fully underwritten term life insurance or permanent life insurance (like whole life or universal life) is available.

Remember that fully underwritten life insurance means a paramedical exam with blood and urine samples. Additionally, the life underwriter will access your medical records.

Know that, however, you will have a table rating. Again, I know other websites suggest otherwise, but I have not personally seen it on my best insurance clients with multiple sclerosis.

If you would like to search for preliminary quotes, feel free to do so on our term life quoter below. Note that the rates you see will be higher. However, these estimated rates do give you some understanding on costs.

Simplified Issue / Underwriting Life Insurance

Simplified issue / simplified underwriting life insurance is another option for people with multiple sclerosis.

It means that the life insurance carrier has taken out elements from the traditional underwriting process, notably:

- the paramedical exam (with lab work – blood and urine samples)

- doctor / medical records

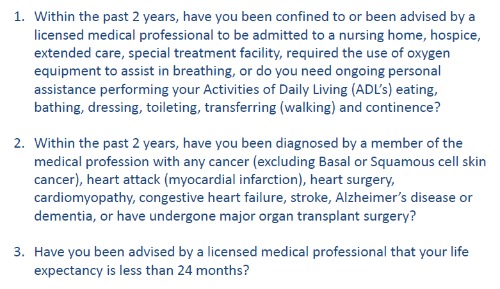

Typically, with simplified underwriting, you answer a health questionnaire. Look at a typical one here. The underwriter then looks up your:

- medical information through the MIB, and

- prescription drug history

If all checks out, then the carrier approves your application.

It is a quick process, which is why the life insurance is called simplified issue. However, because of the simplicity, carriers limit the death benefit to like $25,000 or $50,000.

Traditionally, simplified issue is whole life insurance. You may know this as “burial insurance”. Burial insurance is whole life insurance with a small death benefit.

We have options from age 0 to age 85, including some simplified issue term options.

Simplified issue life insurance is good for people with moderate to severe multiple sclerosis. Maybe the person:

- doesn’t work because of the MS

- is on SSDI

- uses assistance to move about

- needs personal assistance with activities of daily living

We have helped many people who are disabled from the MS obtain simplified issue life insurance. We only work with carriers that accept the multiple sclerosis diagnosis and treatment.

If you would like to see what simplified issue options are available, feel free to use our quoter here:

Guarantee Issue Life Insurance For People With Multiple Sclerosis

For people with severe multiple sclerosis, a guaranteed issue life insurance policy is likely the only option.

Guaranteed issue means the carrier automatically issues the policy. Some carriers call it “guaranteed acceptance” because the carrier guarantees accepting the application.

You just apply and you have the life insurance.

Because no underwriting exists, carriers place a waiting period on the death benefit. Usually, this waiting period is 2 years, although we work with a few carriers that offer a 1-year waiting period.

Generally speaking, if you pass away during the waiting period, the carriers refund the premiums you paid. It is like a forced savings plan. If you live through the waiting period, then the full death benefit is available. If not, your family receives back the premium you paid. It is really a “win-win” scenario. You don’t lose anything.

A guaranteed issue policy is really the only life insurance option if you’ve been declined before or you have severe multiple sclerosis.

Feel free to check guaranteed issue rates below. Note: we work with guaranteed issue plans starting at age 0, subject to state availability. We also work with many guaranteed issue term plans as well.

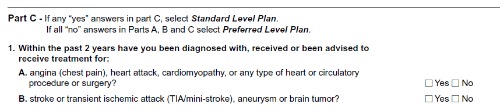

Almost Guaranteed Issue Life Insurance

Depending on your situation, you may be eligible for “almost” guaranteed issue life insurance. What is an “almost” guaranteed issue policy? Really, it is a guaranteed issue policy with only like 2 or 3 health questions that need answering. Here is an example:

Almost guaranteed issue life is good for people who have serious health conditions, but have a life expectancy of many years.

Almost guaranteed issue life is good for people who have serious health conditions, but have a life expectancy of many years.

You can find almost guaranteed issue life insurance through associations as well.

Favorable Carriers For People With Multiple Sclerosis

You likely realize that not every carrier insures people with MS. Some carriers flat out decline.

However, many do underwrite people with Multiple Sclerosis. We have had success with the following life insurance carriers insure people with Multiple Sclerosis:

- AIG

- Banner

- Prudential

- Principal

- Protective

- American National

- Minnesota Life

Unfortunately, although other websites say this and that carriers are the “best” carrier, there is no “best” carrier.

The best carrier is the one that will insure and approve your application. However, the right and best carrier depends on your situation. The best thing to do is fill out the questionnaire and contact us. We can then proceed with an estimate from the life insurance companies.

Life Insurance Application Process For People With Mulitple Sclerosis

The life insurance application process is different with us compared to other agents and brokers.

The life insurance application process is different with us compared to other agents and brokers.

The main difference is that we prequalify you with carriers before you submit an actual application. That way, we know what to generally expect. If everything you provide to us is accurate, then we should expect approval. The final life insurance rate you’ll pay should be close to the estimated rate.

This saves everyone a lot of time. Far too often, I hear from people who went down the path of applying with the wrong carrier. Or, the broker didn’t do his or her diligent pre-qualification in the beginning.

In the few situations where our clients were not approved, it was from misinformation (i.e. saying your situation is mild when it was severe) or forgetting other health conditions (like diabetes and sleep apnea). While these co-morbidities do not necessarily mean a decline, it could mean that we applied with the wrong carrier to start with. If we had known these co-morbidities, we could have pivoted to another carrier.

So, I hope you see we take great duty and care for your situation. We know that life insurance is extremely important insurance. It allows surviving loved ones to grieve and not worry about money.

Here is what to expect when you work with us.

Contact Us – you can contact us right from this page or give us a call at (800) 645-9841. Alternatively, you can text us at (800) 645-9841 as well.

Tell Us Your Situation – You have to tell us your situation, transparent and complete. The best outcome is one where you truthfully tell us your situation so we know how to proceed. If your MS is severe, it doesn’t benefit anyone if you tell us it is mild and you move about just fine. Underwriters have access to your records and will determine the severity of your multiple sclerosis. It is best to be transparent and honest so we can recommend the right life insurance option. You also fill out the questionnaire.

Carrier Selection – we prequalify you through the favorable carriers that accept people with Multiple Sclerosis. If your situation deems a simplified issue option, we review the health questions and your medication.

Apply – depending on the life insurance option selected, you will apply through us or an application link that is sent by the carrier. We do everything over the phone or video conference, if required. You receive the application to sign via email/electronic signature.

Approved – if all checks out, and it should unless there was misinformation during the prequalification process, you should be approved. Nearly all of our clients with ultiple sclerosis are approved for the plan they applied for. Sure, maybe the rate is a little bit higher or lower, but the carrier approves their application.

Frequently Asked Questions About Life Insurance And Multiple Sclerosis

Let’s answer some frequently asked questions about life insurance and Multiple Sclerosis.

What Are the Eligibility Criteria for Life Insurance if I Have Multiple Sclerosis?

There are no eligibility requirements per se. As we mentioned in this guide, we can help you obtain life insurance if you have multiple sclerosis, even if you have been declined before.

We just need an honest, transparent assessment of your situation, so we can prequalify you. This will set the proper expectations on approval and the types of life insurance options available.

Can I Obtain Life Insurance Coverage with Multiple Sclerosis?

Yes. We have helped many people with Multiple Sclerosis. The life insurance options available depend on the severity of the MS and your overall situation.

How Does Multiple Sclerosis Affect My Life Insurance Premiums?

You are going to pay a higher life insurance premium than someone who does not have MS, all things being equal. Life insurance costs are just going to be higher. I know other websites say that standard rates are available, but this is very unlikely. Underwriters know this is a progressive disease, which typically worsens over time. They will apply a table rating to compensate for that risk.

Are There Specific Life Insurance Policies Tailored for Individuals with Multiple Sclerosis?

As we described in our life insurance options section, people with Multiple Sclerosis can obtain all types of life insurance. However, if you have moderate to severe MS, then a simplified issue life insurance plan could be your best option.

Will My Multiple Sclerosis Diagnosis Affect the Coverage Amount I Can Receive from Life Insurance?

It could. If you have a severe diagnosis or you are on SSDI / disability because of your MS, then carriers will limit the death benefit coverage.

Do I Need to Disclose My Multiple Sclerosis Diagnosis When Applying for Life Insurance?

Yes. If you don’t disclose and answer “yes” to the multiple sclerosis question on the application (if the application asks), then that is a lie. That comes across as fraud because any reasonable person should know they have a disease like MS. The underwriter will likely decline your application.

Are There Any Exclusions Related to Multiple Sclerosis in Life Insurance Policies?

There are no exclusions except for the standard suicide clause, the 2-year contestability clause, and other standard limitations and exclusions like the “Acts of God / Acts of War” clause.

Can I Upgrade My Life Insurance Policy if My Multiple Sclerosis Condition Improves?

Yes, if your MS improves, we can consult carriers and see if they will offer a better life insurance rate.

How Does My Lifestyle and Health Habits Influence Life Insurance Options with Multiple Sclerosis?

Generally speaking, establishing a healthy, active lifestyle yields better life insurance outcomes than not. If you are otherwise healthy, except for the MS, many life insurance carriers will approve your application (with a table rating) for term life, whole life, and other types of life insurance.

Will I Need to Undergo Medical Examinations for Life Insurance with a History of Multiple Sclerosis?

If you are applying for fully underwritten life insurance, like $1,000,000 of term life, then underwriters may require a paramedical exam with blood and urine samples. However, many carriers are moving away from this. If your MS is stable, and you consistently visit your neurologist, then they may waive the paramedical exam.

Underwriters will definitely order your medical records to confirm stability, diagnosis, and prognosis.

Can I Apply For Disability Insurance and Long-term Care Insurance As Well?

We have helped many professionals and families obtain disability insurance and long-term care insurance. Unfortunately, many disability and long-term care companies will decline applications if you have MS. It is a serious pre-existing condition that could lead to a disability. In other words, there is a good chance that you will have to make a disability or long-term care insurance claim. So, carriers won’t approve the application.

The best thing to do is contact us so we can consult the disability and long-term care underwriters. However, options do exist. If you are a business owner with employees, we can get you guaranteed issue disability insurance and likely guaranteed issue long-term care as well. Your company is the owner of the policies as the policy would route through the company.

We also have an annuity with a long-term care rider that is essentially guaranteed issue.

Final Thoughts About Multiple Sclerosis and Life Insurance

Yes, you can obtain life insurance if you have multiple sclerosis. Doing so can be an easy process!

You just need to be mindful of the application and underwriting process. Working with an independent insurance agency that specializes in helping individuals obtain life insurance with Multiple Sclerosis can help with this important step. We at My Family Life Insurance have helped many individuals with Multiple Sclerosis obtain life insurance. We know what carriers look for on the application and can direct you to the right carrier.

Are you ready to get started? Do you have any questions? Feel free to contact us or use the form below. We will be more than happy to help you and your family

We only work in your best interests. Unlike other agencies, we are not beholden to one particular carrier. We work for you to obtain the right life insurance at the lowest possible price.

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest.

By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private.

However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".Learn More

One thought on “4 Life Insurance Options Available For Multiple Sclerosis | Yes, People With Multiple Sclerosis Can Obtain Life Insurance | Here Is How”

Comments are closed.

I have a relative with relapsing remitting MS. He needs life insurance. Can you help?