Life Insurance As A Retirement Plan | Yes, It Can Work, But Know The Details

Updated: April 12, 2024 at 9:40 am

Have you thought about using your life insurance policy as a retirement plan?

Have you thought about using your life insurance policy as a retirement plan?

Everywhere you read and hear, advisors say you need to use life insurance to save for retirement.

Other’s say, “No way!” Or, as I like to say, “swipe right”.

Who do you listen to?

As a CFP® Professional, I will give you the low-down scoop. This article can be lengthy, so feel free to click on the links below to jump around.

- What Makes Life Insurance As A Retirement Plan Attractive

- The Types Of Life Insurance Needed To Fund Retirement

- The Advantages Of Using An IUL For Retirement

- Buyer Beware: The Disadvantages

- Other Options To Save For Retirement

- Is Using Life Insurance For Retirement Good For Anyone?

- Now You Know If You Should Use Life Insurance For Retirement

Just FYI. While many advisors have an ulterior motive to post one way or another about this subject, I do not. Sure, I can help you with life insurance, but I no longer manage investment assets (it’s very easy to do this yourself). Most importantly, as a CFP® Professional, I am obligated to work in your best interests only and all times. This includes life insurance as well. Can your life insurance agent or advisor state this? Likely not.

Expect a balanced article describing both the advantages and disadvantages of using life insurance to save for retirement.

What Makes Life Insurance As A Retirement Plan Attractive?

Life insurance agents (and keep in mind we are one) like to espouse the cash value of permanent life insurance as though it is the best thing since sliced bread, sunny days, and a Keurig machine.

When we talk about using life insurance for retirement, it is permanent life insurance the type of life insurance.

Permanent life insurance includes whole life insurance, universal life, index universal life…any type of life insurance that generates cash value and designed to last your entire lifetime.

In all seriousness, there is a lot of flexibility with the cash value in a permanent life insurance policy. It is safe. Cash value is no different, in some regards, to a savings account at the bank. The big exception is it will earn much more than what you can at the bank. It is not, however, protected by the FDIC, but rather the backing of the life insurance carrier itself.

We are advocates of permanent life insurance, too – in the right situations! (We believe term life insurance is appropriate coverage in most cases).

Here’s why, however, many agents espouse the benefits of cash value. And, yes, there are benefits of cash value life insurance.

Benefits of Cash Value Life Insurance

Here are some of the benefits of cash value life insurance. The benefits will make more sense as you read on throughout this article:

The cash value grows tax-deferred. Keep in mind other comparable alternatives, like a CD or bank account, are taxable. Additionally, you will generally receive a higher interest rate compared to that on a CD or bank account for the same amount of principal investment risk, which is zero (0).

If this sounds like a tax-deferred vehicle like a 401K or IRA, you are right.

You can overfund the policy, within limits. However, this limit is usually pretty high.

Moreover, life insurance does not fall under ERISA rules. What are these? In layman’s terms, these are the rules that employers must follow to ensure employee benefits, including retirement plans, meet certain Federal standards. They are designed to protect you and the employer. These rules govern retirement plan contribution maximums and withdrawals as well.

There are no ERISA retirement plan rules to cash value life insurance. This means a policy owner can contribute a higher level of premiums into a life insurance policy, up to this maximum limit (called a 7-pay test which is outside scope of this article) and withdraw the cash value at any time, with no Federal tax penalty. Note: the carrier may implement its own penalties for withdrawing the cash value too early through a surrender charge.

If structured right, you can borrow the cash value are receive the cash value income-tax free. This can be a significant tax-free benefit for the right person or situation.

You can’t lose money either, except for policy expenses and surrender charges, if any.

Cash Value Life Insurance Similar To Roth IRA

Looking at it on the surface, the cash value in a life insurance policy, when structured correctly, has similar characteristics to that of a favorable Roth IRA.

Honestly, that is true. They both:

- accept after-tax premiums

- value grows tax deferred

- and value can be withdrawn income tax-free

There are some differences, however. Your Roth IRA premiums are capped by your adjusted gross income. However, your life insurance premiums, generally are not. There is a MEC/7-Pay rule you must follow. This is outside the scope of our article. Usually, the MEC premium limit is much higher than the Roth IRA premium limits.

There are additional benefits: because these dollars are non-countable and income-tax free, they have no effect on social security taxation or Medicare premiums. That can be a benefit for the right person.

I want to be clear. Using cash value life insurance sounds great. And, it can be. The problem is that the concept has been oversold in our opinion by agents (not all, but most) not giving clients the full picture. How do I know this? I hear about it from people who become my clients! Like a person walking in the desert, thirsty, you start to see mirages of water.

When hearing about the virtues of life insurance as a retirement plan, you start to see things that aren’t really there. It can be a mirage. The closer you move towards these seemingly benefits, the more you realize some of the drawbacks.

We will discuss those later on, but let’s talk about the types of life insurance.

Types Of Life Insurance Needed To Fund Retirement

There are several types of life insurance that could work to fund your retirement. As long as the policy has cash value, the insurance could work as a funding mechanism.

However, there is really only one type that will work, and that type is called Indexed Universal Life (IUL).

Why an IUL? It is really the only type of insurance that is flexible with potential, above-average cash value growth.

Why is this? An IUL’s cash value performance tracks the performance of a market index, such as the S&P 500.

So, you think if the S&P 500 increases 20% in a year, will the IUL receive 20%?

Not, that is not the case. Let’s talk about the structure of an IUL in more detail. It’ll make more sense.

How Indexed Universal Life Works

There are several moving parts of an Indexed Universal Life (IUL). We describe them here. If you get lost of have questions, don’t hesitate to contact us or use the form below.

At the core of it, an IUL is still life insurance, an a universal life policy at that. Nothing is guaranteed – the death benefit is not, the premium, the cash value, the policy expenses. Nothing. In this regard, an IUL is similar to an investment. Nothing is guaranteed with investments, either.

Now, let’s talk about the cash value. This is where the magic happens.

Advisors suggest using an Indexed Universal Life policy because of the potential of the cash value growth. an IUL tracks the performance of a stock market index, like the S&P 500. It does not invest in the market.

You can’t lose money in an IUL if it tracks a stock index. The only way you can is from policy fees or surrender charges.

This means if the stock market crashes, as we witness today with the repercussions of the Coronavirus, you don’t lose money. Your cash value remains intact. Let’s say your cash value is $50,000 and the market crashes 25%, your cash value remains the same. In this case, $50,000.

How great is that!

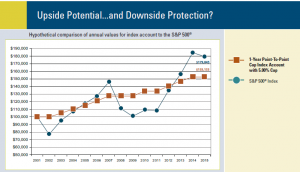

You’ll see these carrier-generated graphs in every IUL brochure.

This one isn’t actually as favorable as the others I have seen. Geez, these others suggest you should put everything you have into the IUL. Beware…many agents want it that way.

However, what the IUL is doing here is very valuable, and I will explain that next.

Mechanics Of An Indexed Universal Life Policy

An IUL is no different than any other permanent insurance except there are really no guarantees and it tracks a market indicator for hopefully higher cash value returns.

Carriers tout that you can’t lose money (with the exceptions I mentioned), and that is true. You see that in the graph above. In 2001 – 2003, the tech bust occurred and the market dropped. Yet, your cash value remained the same with no loss.

OK, John, you say. How do they do that?

The carrier purchases call options on the market index. I am not going to get into detail on what that is. But, if the market goes up, the carrier makes money on those call options. They credit your IUL with a portion of the call option gains.

What that means is that you don’t fully 100% participate in the market performance. You can’t. All risk – that is the risk of losing your money – is gone. The carrier removed that uneasy scenario from an IUL. However, because you have zero risk (essentially) of losing money, you can’t fully participate in the market. The carrier needs to make money, and it credits you a portion of the gains.

So, these gains are known as caps, spreads, or participation rates. All confusing. The most common term is the “cap”. The carrier caps your gain. Let’s say the carrier caps the growth at 8%. What does this mean? Let’s use an example.

If the market increases 45% in a year, the carrier only gives you 8%. If it goes up 5%, then you get 5%. What happens if the market drops 15%? Then, the carrier credits you 0%.

So, on the surface, it sounds great. Honestly, it is. However, the market, thankfully, is up more than it is down, even recessions. Do you want your money limited?

The Advantages Of Using An IUL For Retirement

We are going to talk about the drawbacks in a moment, but let’s summarize the benefits on an IUL for retirement.

- Upside cash value growth with downside protection (i.e. no loss of money)

- Life insurance protection

- Potential for higher cash value growth compared to other types of life insurance

- Ability to overfund

- Tax deferred growth

- Potentially tax-free income for retirement

The downside protection is probably the largest benefit. After that, the ability to take the cash value as tax free income during your retirement is a close second. We did not discuss this, and won’t go into great details. However, you can do this by borrowing the cash value from the carrier. It becomes a loan. You’ll have to repay the carrier for the loan upon your death. This is done by having some remaining death benefit in your policy in which the carrier becomes whole.

An IUL can be useful, but not without disadvantages. Let’s talk about those next.

The Drawbacks Of Using An IUL / Life Insurance As A Retirement Plan

There are many drawbacks. Nothing is perfect. That’s the problem I have with agents espousing this like the best thing since sliced bread. It comes with heavy baggage. If you aren’t aware of that, it’ll drag you down.

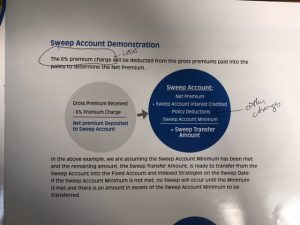

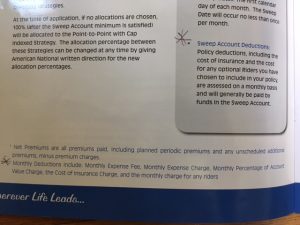

High Fees

There can be high fees and costs with Indexed Universal Life policies. Fee drag can be up to 4% of contribution or more. For instance, most IULs charge a monthly fee. Think we are joking? See the image taken from a popular IUL policy brochure. (Yes, that is our “wow” in the first picture on the right.)

Talk about a drag! Wait! There’s more!

Then, there is the cost of insurance, administrative fees, and more. Yes, mutual funds have costs, too – called an expense ratio, but we don’t know many that costs as much as an IUL policy.  Sure, agents will say an investment strategy or an investment advisor has fees – and they are right – but we don’t know many that costs that much. Possibly, a complex strategy for the affluent family warrants that kind of fee structure. However, for the typical family, no.

Sure, agents will say an investment strategy or an investment advisor has fees – and they are right – but we don’t know many that costs that much. Possibly, a complex strategy for the affluent family warrants that kind of fee structure. However, for the typical family, no.

We are not saying an IUL policy is “bad.” In fact, I just described how beneficial they can be! Like anything else, however, it works in the right situation.

Every policy illustration contains a sheet that describes the policy charges and expenses. You’ll want your agent to review that page. It can be telling.

Time Of Cash Value

It can take years to see the cash value build up, probably 5 or 10 years.

Why?

Simply because many IULs have front-loaded policy expenses. Like a typical investing strategy, an IUL requires a long-term mindset.

However, you may be discouraged to see that it can take a long time to generate adequate cash.

Carriers Can Change Rates

Carriers can change caps, rates, spreads, etc. Oh yes, they can. Remember, the carrier is in business to make money. Let’s say the markets drop or interest rates are low. What will the carrier do? They’ll lower their caps, participation rates, and/or spreads on their IULs.

Insurance carriers like high interest rates. It allows them to make more money and have flexibility with servicing their liabilities. When the markets drop and/or rates decline, the carrier still has to make money. They do this by limiting what they pay to you.

IULs Can “Implode”

I really don’t think this will happen, as the cash value growth tied to market index performance is great. However, conceivably, an IUL can implode. What this means is that the policy charges and expenses become so great that the cash value and your current premium can’t support its existence. You have to pay more premium into the plan just to keep it solvent.

This scenario happened to traditional universal life policies throughout the 1980s and 1990s as interest rates dropped. However, I don’t think IULs will share the same bad luck. The stock market would have to underperform for many years in a row. Nevertheless, it is something to be aware of, since an IUL is indeed a universal life policy.

Other Options To Save For Retirement

There are other ways to save for retirement instead of life insurance. Why not just invest in the stock market? I heard on a webinar once an advisor calling the market a “house of cards”. That is an unprofessional description of the market. Of course, his perspective was to invest 100% of your money in an IUL. Of course, anyone with ulterior motive will say something like that.

The market is not a “house of cards” but very temperamental. It has its good days and bad days. Like we are in now, if you are invested for the long-term, this is a GREAT time to invest. However, if you were close to retirement, you shouldn’t have most of your money in the market anyway.

The reason advisors and agents fall back to IULs is the guaranteed floor. You can’t lose money. However, you can’t grow it as much as well.

I took a look and performed a very simple analysis using no policy fees, investment fees, etc. I chose a real IUL and its cap rates. The investment always came out on top – over the long term. Now, as I write this, the market is down over 30% – like in 2008 and 2009 with the housing crash. I expect it to recover. Who knows, but if the market doesn’t recover, then your IUL is worthless, too, for the reason I outlined earlier.

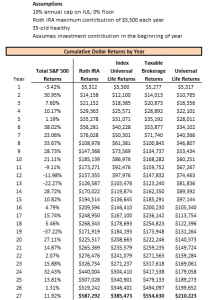

Illustration

For the illustration below, we assumed no costs (except for the universal life policy, which was taken from an insurance carrier). We assume the Roth and taxable accounts invest in the S&P 500. We looked at the last 27 years of S&P 500 returns and project those forward 27 years. Is it perfect? No. Does it provide a close approximation and educational perspective? Absolutely yes.

One misstep can unravel this entire process, causing taxation of the cash value. It is everything you wanted to NOT do.

Looking at the above illustration, if you invested in a Roth, you could come out ahead on an after-tax basis compared to the IUL and the universal life policy. The taxable brokerage account could have an equivalent after-tax amount of $473,000, after considering a gain $406,000 at 20% tax.

Looking at the above-estimated values, which would you choose? Yes, we don’t know what taxes will be like in the future. True, money invested in the stock market is subject to stock market risk. We did, however, look at the last 27 years of S&P 500 returns and apply those returns in our illustration. An investment in a Roth or taxable account still came out ahead. Again, the illustration is for your understanding only. We would have to apply specific fees to obtain a true value. Those fees can be rather high in an IUL or other life insurance policy.

What About A Fixed Index Annuity?

A fixed index annuity can work just as well as an IUL, and without the needed health and financial underwriting. There is a suitability report to answer, but that is it.

A fixed index annuity has similar features compared to an IUL. It has cap rates and floors.

Like the IUL, you can’t lose money in a fixed index annuity (except for surrender fees and other charges). They are conservative investments.

Which Leads Us To This

IULs and fixed index annuities are conservative investments. Over the long run, you may achieve a 5% return on these investments. Maybe not. In any case, they are not designed for high growth returns.

Instead of using a bond or bond alternative in your portfolio, have you considered using an IUL or fixed index annuity? These may be a good alternative.

Is Using Life Insurance As A Retirement Plan Good For Anyone?

Yes, you can certainly use life insurance as a retirement plan. However, it requires a balance. Do you need to invest all of your money in an IUL? If you are thinking this, we did our job: it Most people are better off investing in a Roth IRA (if they qualify) or through their employer-sponsored retirement plan. However, there is a section of people who could use life insurance as a retirement plan.

They include:

(1) those who have maxed out their retirement contributions. Keep in mind, even holding tax-advantaged stock could be a better option. Tax-advantaged stock includes those that offer qualified dividends and held over a year. See our illustration above.

(2) the affluent who can use these types of policies. They will face high taxes, and this could mitigate the tax impact.

(3) People who want to balance an IUL or fixed index annuity with their other retirement accounts.

If you feel life insurance as a retirement plan can work in your situation, we suggest using those policies that can generate above-average cash value balanced with costs and fees. We can help you determine those.

Now You Know If You Need Life Insurance For Retirement

Ultimately, we suggest using life insurance for its intention – to provide a death benefit upon death.

As we described, using life insurance as a retirement plan can have benefits. Be aware of the drawbacks. It can take a long time to see the benefits of this strategy. See our illustration above, meant to enhance your understanding of this strategy and options you have.

If you want to find out more, contact us or use the form below.

There are certain carriers which specialize in this strategy, and we work with them. First and foremost, though, we will determine if this strategy is right for you. If it is, we will walk you through all of the drawbacks. The last thing we want is for you to put your hard-working money into something that does not perform to your expectations. That is how we always have and always will work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".