Are Life Insurance Benefits Included In Probate Upon Death? | They Could Be If You Are Not Careful

Updated: April 12, 2024 at 9:38 am

Many people ask me if life insurance is part of the probate process.

Many people ask me if life insurance is part of the probate process.

My answer is that it could be. If you aren’t careful, then life insurance proceeds could end up through the court system.

Is that a bad thing, John? A friend of mine passed and his life insurance went through probate.

First, I am sorry to hear about your friend. Additionally, yes; having a life insurance death benefit stuck in the probate process can be a bad thing.

You don’t want bad things to happen, right? Especially when it comes to a life insurance payout, right?

Do you want your wishes fulfilled, right?

Sometimes, if you aren’t careful, your life insurance policy ends up in probate.

However, in this article, we discuss life insurance and probate. Moreover, we discuss how to keep your life insurance out of probate.

Here is what we will discuss:

- What Is An Estate?

- What Is Probate?

- What Happens To Life Insurance When Someone Dies?

- Are Life Insurance Proceeds Part Of Probate?

- How To Avoid Life Insurance Going Through Probate? (Hint: It Takes 5 Minutes!)

- FAQs About Life Insurance And Probate

- Final Thoughts About Life Insurance And Probate

As A CFP® Professional, I have knowledge about estate planning. However, if you have specific questions, please contact a qualified attorney for legal advice.

Let’s jump in and first answer the question, “What is an estate?”

What Is An Estate?

You will hear the word “estate” a lot. What is an estate? It is simply the value of all the assets a person owns. A person’s death technically creates an estate.

OK, John, but how does this affect life insurance?

I don’t want to get too “in the weeds” right now, but your life insurance policy is part of your estate. That is how.

Now, in order to adequately answer your question, we need to discuss the probate process.

What Is Probate?

Most of us have an idea of what probate is. Many think it is a dark and long process of an old person determining who gets what upon someone’s death. (Ok, maybe that is my vision, lol).

Well, it’s not really like that. However, probate is simply the distribution of a person’s estate and assets, (the person is called the decedent) upon his or her death, per a set rule and regulations. The court system, specifically your state’s probate court, manages this legal process. It is governed by state law.

Probate happens through the execution of a legal document called a will.  The courts follow the requests in your will and the terms of your will. If no will exists, then the states follow specific rules and regulations on who gets what. (A process known as dying “intestate” – outside the scope of this article.)

The courts follow the requests in your will and the terms of your will. If no will exists, then the states follow specific rules and regulations on who gets what. (A process known as dying “intestate” – outside the scope of this article.)

The probate process can take a year or more. This can be a long process depending on the complexity of the decedent’s estate.

Moreover, going through probate costs money. The court system is not free. You will have to pay probate fees to the court, usually out of the decedent’s estate.

Additionally, it is a public process. Creditors and even family members can make a claim on your estate.

However, the state’s set of probate rules and regulations is a double-edged sword. While having rules and regulations provides a process, it can be a cold, unyielding, and heartless one. The courts simply follow a set of rules on who gets what. They are not following what they think the decedent would have wanted.

Simple Example Of A Disadvantage Of The Probate Process

For example, let’s say Julie passed away with an IRA of $500,000 with no named beneficiary. She died without a will, too, and really wanted her sister, Mary, to receive the money.

However, per the probate laws, Julie’s daughter, Rachel, receives the money. The bad news is that Julie really didn’t have much of a relationship with Rachel. Julie and her daughter unfortunately never got along. Although it would have been much better for Julie to name Mary as the beneficiary, she didn’t. Per the state’s probate law, Rachel receives the money.

Although this situation is an example, it is one that happens every day.

Let’s discuss how life insurance fits in with probate with a discussion of probate and non-probate assets

What Are Probate And Non-Probate Assets And How Does Life Insurance Fit In?

What Are Probate And Non-Probate Assets And How Does Life Insurance Fit In?

Now that you know what probate is, let’s discuss probate and non-probate assets. I promise this is easy and ties into the life insurance aspect.

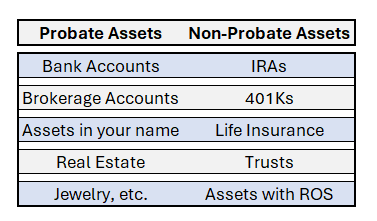

Let’s start with non-probate assets. Essentially, a non-probate asset is an asset that bypasses probate upon the decedent’s death.

This is what you want. The more that your assets go to those you want them to, and avoid probate, the better it is for all. It is even better for the courts as they can manage more complex cases.

What types of assets are non-probate assets? These are assets that all have a named beneficiary designation. These assets include:

- IRAs

- Retirement accounts like 401Ks

- Life insurance policies (yes!)

- Assets titled with rights of survivorship

- Trusts including living trusts and irrevocable trusts

So, these assets bypass or avoid the probate process and go right to your designated beneficiary. (However, in some cases, especially with life insurance, mistakes happen. Life insurance could end up in probate! More on that in a minute.)

Probate Assets And Probate Estate

What assets get stuck in probate? The easy answer is anything that doesn’t, lol. However, these assets typically are probate assets and are part of the probate process:

- Stock brokerage accounts outside of an IRA (unless a Transfer on Death designation)

- Bank accounts including your checking and savings accounts (unless a Payable on Death designation)

- Your home (that is right), if no one is living there

- Jewelry, etc.

- Real Estate

- Assets title in your name and you as the beneficiary (remember this)

We introduced the “estate” earlier. Technically, upon your death, you can have a gross estate and a probate estate.

Your gross estate includes everything you own including life insurance (probate assets and non-probate assets). (However, estate credits exist to reduce the value of the gross estate, which ultimately yields your taxable estate.)

Your probate estate includes those assets that are stuck in probate. Your probate estate should be less than your gross estate.

Let’s discuss what happens to life insurance when the insured on the policy dies. Discussing this will then help you understand how life insurance can be part of probate.

What Happens To Life Insurance When Someone Dies?

When the insured of a life insurance policy dies, a family member notifies the life insurance company and files a death claim. The life insurance company mails their claim forms. They include a certified copy of the death certificate along with the life insurance claim and mail this all back to the carrier. The company then sends the death benefit money to…

…do you know?

The life insurance beneficiary.

As we stated before, having this beneficiary designation allows life insurance to avoid probate.

In nearly all cases…

What, John? What do you mean, ‘In nearly all cases..’

Well..people mess up. They have good intentions, but they mess up. I see and read about life insurance beneficiary mistakes all the time.

Having the right beneficiary designation is key to having your life insurance avoid probate.

But, John. You said above that life insurance is a non-probate asset and that it bypasses probate!

Yes, and it does if you do things the right way. Most people do. However, some people don’t.

Now is a good time to discuss life insurance and probate and how the two tie together.

Are Life Insurance Proceeds Included in Probate?

Most of the time, life insurance proceeds are not included in probate. When the insured dies, the life insurance company mails the policy’s death benefit to the primary beneficiary on file.

That is one of the great advantages of life insurance. Policy proceeds avoid probate. Moreover, the beneficiary pays no income tax on the death benefit. In other words, the death benefit proceeds are free from income taxation.

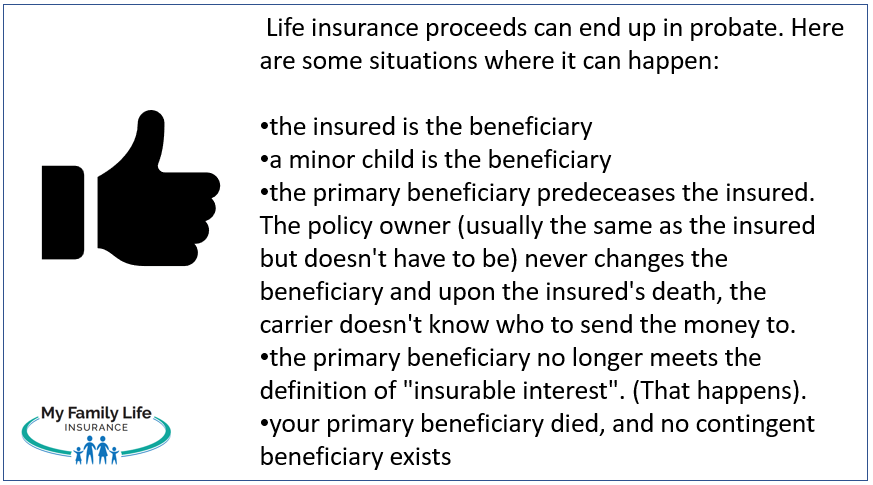

However, life insurance proceeds can get stuck in probate if:

- the insured is the beneficiary

- a minor child is the beneficiary

- the primary beneficiary predeceases the insured. The policy owner (usually the same as the insured, but doesn’t have to be) never changes the beneficiary and upon the insured’s death, the carrier doesn’t know who to send the money to.

- the primary beneficiary no longer meets the definition of “insurable interest”. (That happens).

- your primary beneficiary died and no contingent beneficiary exists

So, life insurance proceeds typically are not included in probate (thankfully!), but they can if your life insurance beneficiaries are all messed up. This is why I personally recommend you review your beneficiary designations every year. Far too often, life insurance death benefits end up in probate because the insured/policy owner did not review the beneficiary designation.

Example Of A Life Insurance And Probate Problem!

For example, let’s say John was 23 years old when he purchased a $1,000,000, 30-year term policy. He wasn’t married at the time, so he named his mother as the primary beneficiary with no contingent beneficiary named.

At age 33, he married Denise. Unfortunately, his mom passed away a few years later. At age 40, John passed away in a car accident. He didn’t have a will. He thought he was too young for that!

Denise knew he had a $1,000,000 policy so she filed the life insurance claim. However, the money is supposed to go to his mom, who is deceased.

Who gets the money now?

Well, Denise will (likely), but first, the policy will have to go through probate since the primary beneficiary (John’s mom) died.

See the problem here?

How To Have Your Life Insurance Proceeds Avoid Probate?

So, how do you have your life insurance policy avoid probate? It is simple.

It takes about 5 to 10 minutes.

You check your named beneficiaries every year. You make sure they are current, make sense, and follow your wishes.

If not, you can submit a “change of beneficiary” form to your life insurance carrier.

In our example above, John should have reviewed his life insurance policy upon his marriage to Denise. He then could have submitted a change of beneficiary designation form to his carrier. Denise would then have received the money with no probate process involved.

Some situations exist where you will need to follow a legal process for a beneficiary change. This is common in divorce situations. If your ex-spouse is still the primary beneficiary, you will want to make sure the life insurance carrier and the divorce courts all have signed off on this. The reason is that, technically, ex-spouses do not have an “insurable interest” with the other spouse (rather obvious reason), unless minor children are present or one of the ex-spouses has a disabling condition.

These legal scenarios are outside the scope of this article and my jurisdiction. Please consult a qualified attorney for specific questions.

FAQs About Life Insurance And Probate

We address and answer questions about life insurance and probate.

Is Life Insurance Part Of An Estate After Death?

Yes. Life insurance proceeds are part of a decedent’s estate upon death.

Should I Place A Life Insurance Policy In A Trust To Avoid Probate?

A trust is a legal entity that avoids probate itself. While it may seem counterintuitive, you should place a life insurance policy in a trust in certain situations. One situation is if you have disabled children or family members who would need the life insurance proceeds for their needs and care. In this case, an irrevocable life insurance trust is advantageous for them.

We are not estate lawyers and do not offer legal advice. Please reach out to estate planning lawyers about the use of life insurance in a trust.

Do All Life Insurance Policies Go Through The Probate Process?

No. Not all life insurance policies go through probate. Only those policies that have no beneficiary designations or incorrect beneficiary designations will go through probate.

Is There Any Difference Between Whole Life Insurance And Term Life Insurance For Probate?

While there are differences between whole life insurance and term life, they will both go through probate if no adequate beneficiary designation exists. The cash value of the whole life can matter, but that is outside the scope of this article.

What Happens If There Is No Named Beneficiary On A Life Insurance Policy, And The Policy Goes Through Probate?

If no named beneficiary exists, then your life insurance policy goes through probate. The court will then decide who will get your death benefit money. Do you want that to happen? Probably not. Please check your beneficiary designations to make sure they accurately meet your wishes.

Can The Decedent’s Will Impact The Distribution Of Life Insurance Proceeds During Probate?

Good question. I will give general information here. Please seek a qualified attorney for specific, follow-up questions. Yes, the will could provide “safety net” language (as I call it) directing the courts on how to issue the death benefit proceeds. However, keep in mind probate can be an intrusive and public process. It is possible for creditors or even family members to contest the will and make a claim to those death benefit proceeds.

Is It Advisable To Consult With An Attorney When Dealing With Life Insurance And Probate Matters?

Yes. Probate is an intricate process that you will want to consult with an estate planning attorney.

How Can I Ensure That My Life Insurance Policy And Estate Are Set Up To Minimize Complications During Probate?

The easiest way to minimize complications is to review your policy beneficiary designations every year. Make sure you want the death benefit money to go where you want it to go.

Moreover, consult a qualified estate planning attorney if you have a complex situation or specific questions.

Is It Possible To Contest A Life Insurance Policy’s Beneficiary Designation During Probate?

Yes, a beneficiary dispute can happen. Probate allows creditors and family members to contest the will. This can be common in high-valued estates. The estate battle between Anna Nicole Smith and her ex-husband’s family dragged on for years.

How Do I Change Beneficiaries On My Policy?

If you want to change your beneficiary, you will need to fill out a change of beneficiary form through your life insurance provider. Every carrier has this form. Once you fill it out, sign the document, and submit the form, the carrier will then update your file with the new beneficiary. Assuming no changes in your wishes, your policy’s death benefit proceeds will go to your intended beneficiary.

It is a good idea and highly recommended to review your life insurance beneficiary designations every year.

Final Thoughts About Life Insurance And Probate

I hope you learned that life insurance can end up in probate. We discussed several situations where this can happen including, but not limited to:

- you are the insured and the beneficiary

- your minor child is the beneficiary

- the primary beneficiary predeceases the insured. The policy owner (usually the same as the insured, but doesn’t have to be) never changes the beneficiary and upon the insured’s death, the carrier doesn’t know who to send the money to.

- the primary beneficiary no longer meets the definition of “insurable interest”. (That happens).

- your primary beneficiary died and no contingent beneficiary exists

As long as your beneficiary designation is correct, your life insurance policy bypasses probate. That means the life insurance proceeds go right to your beneficiary.

Do you have any questions or concerns? Do you have a life insurance policy with a beneficiary you’d like to run by us? Contact us or use the form below. I am happy to discuss your situation and answer any questions. Moreover, we only work in your best interests.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".