Best Disability Insurance Options For Massage Therapists | Here’s What You Need To Know!

Updated: April 12, 2024 at 9:38 am

I think you’ll agree with me that massage therapists probably don’t think about disability insurance.

I think you’ll agree with me that massage therapists probably don’t think about disability insurance.

But, they should.

Why? Well, your work is hands on…literally. You truly make a difference in your client’s lives. Moreover, you particularly enjoy how you help your customers feel better, de-stress, or recover from chronic pain! You rely on your skilled knowledge as well as your physical ability to get the job done.

What if you could no longer do that job? Have you ever thought about what would happen if you became sick, ill, injured, and disabled? How would you pay the bills if you could not work?

A disability quickly affects your plans and the lifestyle you worked so hard for.

In this article, we discuss the following. Feel free to jump around as needed:

- Why Massage Therapists Need Disability Insurance?

- Types Of Disability Insurance For Massage Therapists

- Understand Disability Insurance Underwriting

- Makings Of A Strong Disability Insurance Policy For Massage Therapists

- Best Disability Insurance Options For Massage Therapists

- Estimated Costs Of Disability Insurance

- Is An Association Plan Right For You?

- Final Thoughts About Disability Insurance For Massage Therapists

Let’s jump in and discuss why you need disability insurance.

Why Massage Therapists Need Disability Insurance?

I get it.

You don’t think about disability insurance. Life is too busy.

You won’t get sick or hurt, either. That happens to someone else, right? (More on that in a minute.)

Your clients are very important, too. You need to focus on them, keep them happy, grow your business, and make money.

However, there is a group of people who are more important. Who can be more important than my customers, you think? They pay my income.

True. They do, but they don’t love you as your family loves you. By far, if you  have a family, your spouse and children rely on you more than you think. They love you more than anything.

have a family, your spouse and children rely on you more than you think. They love you more than anything.

In other words:

If you and your family will struggle to pay the bills (e.g. your mortgage, groceries, healthcare, electricity, etc.) if you get sick or hurt and can’t work, then you need disability insurance.

It doesn’t get much clearer than that. If you need more reasons, see our article on the 5 reasons you need disability insurance.

What Is Disability Insurance For Massage Therapists

What is disability insurance for massage therapists?

It is a type of insurance that pays you a monthly benefit amount if you can’t work as a massage therapist due to an illness or injury.

Simple. If you are sick or injured and can’t work, then you receive a benefit. This benefit helps pay your bills as you recover or go through treatments.

Sounds good, John, but I have health insurance. That will pay for everything.

I hear that from a lot of professionals. They think health insurance will pay for their income loss.

Health insurance pays for your medical expenses (and even then, it won’t pay for everything). So, how do you pay for your living expenses such as your mortgage, utilities, internet, groceries, those medical expenses that your health insurance DOESN’T pay for, etc?

Disability insurance helps pay for all that.

Sometimes you will hear disability insurance as disability income insurance. It all means the same thing as this insurance protects your income

What Is Your Plan B?

I speak to professionals about disability insurance every day. When I ask them:

If you got hurt yesterday, how would you pay your bills today?

I hear crickets.

As I like to ask, what is your “Plan B”?

Disability insurance is your Plan B. If you get sick or hurt (which happens very often) and can’t work without disability insurance, then you’ll have to answer some tough questions.

- Would you and your family be able to continue your standard of living without your income?

- What would you have to change?

- Would your spouse have to work or work more?

- Would you need to sell your home to make ends meet? Who could be flexible with the children?

- Would you have the money to hire someone to take care of the kids?

The tough questions can go on and on.

A disability can destroy your dreams. They don’t have to, though. With disability insurance, you have peace of mind knowing that you have a plan – and income – in place should the unexpected happen.

Yes, But A Disability Won’t Happen To Me

You think it won’t. However, the probability of having a long-term disability is anywhere between 1 in 3 and 1 in 4 workers.

Contrast this to unexpected death, say from a motor vehicle accident, which is 1 in 93. Even dying from cancer has better odds: 1 in 7.

But, John, I’m not going to get sick, hurt, or be in a wheelchair, you say. I hear that response a lot. If you can tell the future, then you would be a very rich person, right?

I am not intending to be condescending or facetious. However, I am showing the silliness of this common response

In all seriousness, when we think of disability, we think of someone bound in a wheelchair, right? Not true and far from it.

According to the Council For Disability Awareness, 90% of disabilities are from illnesses (like cancer) and musculoskeletal issues (like lower back pain) than from accidents. That means an illness or condition, such as cancer or a heart condition, has a higher probability of disabling you than a skiing accident.

Moreover, many massage therapists develop hand, wrist, arm, back, or shoulder problems over time. These chronic musculoskeletal issues are disabilities! Even carpal tunnel syndrome is a disability if it prevents you from doing your job as a massage therapist.

Ok, John, but I have workers compensation. I don’t need to worry about money. That’s great, I say. Did you know that 5% of disabling conditions are work-related? That means workers compensation does not cover the other 95% of disabling injuries. That makes sense since 90% of disabilities are from illnesses.

Again, what is your income plan if you can’t work?

The Types Of Disability Insurance For Massage Therapists

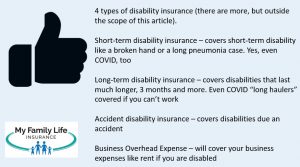

Now that I have your attention, there are 4 types of disability insurance available to massage therapists:

- short-term disability insurance

- long-term disability insurance

- business overhead disability insurance

- accident-only disability insurance

Many people ask us about the difference between short-term disability insurance  and long-term disability insurance. Here’s the difference.

and long-term disability insurance. Here’s the difference.

Short-term disability insurance, as it sounds, is designed for a disability of a short period. Let’s say you break your hand. Well, it’ll be hard to work as a massage therapist with a broken hand, right? So, that is a disability – you can’t do your job as a massage therapist. How long does a broken hand heal? Two to 3 weeks? Once you’ve met the waiting period, you’ll be eligible for benefits and receive some disability benefits.

Long-term becomes the life-saver for those disabilities that last longer than 3 months. Cancer… a catastrophic injury…ALS…Diabetes…back issues…you name it.

Most families can get by financially when one member has a short-term disability. Sure, it might be tough, but families can get by. However, it’s a long-term disability that can financially ruin families. A family can potentially face severe financial risks if a breadwinner does not have adequate long-term disability insurance.

Two Additional Disability Insurance Plans For Massage Therapists

Many massage therapists are small business owners or 1099 independent contractors. It’s a good idea for massage therapists to insure their business expenses as well.

Business overhead disability insurance insures your business expenses. So, if you are a self-employed massage therapist, then you can insure your rent, licenses, taxes, etc. This type of insurance is ideal and premiums are tax-deductible as well.

Finally, there is accident-only disability insurance. Think of this as a “last resort” disability insurance. It will only pay a benefit if you are disabled due to an accident. The better insurance companies offer coverage for both on and off-the-job injuries. Usually, carriers don’t ask health questions. Most accident-only disability insurance is affordable. The reason is that, as we indicated earlier, most disabilities are not caused by accidents.

In this article, we focus on long-term disability insurance. However, you can contact us for any questions about short-term disability, business overhead, or accident-only disability insurance.

Is Short-Term Disability Insurance For Massage Therapists Worth It?

We receive many inquiries from massage therapists wanting short-term disability insurance coverage.

Honestly, though, you don’t need it. That might shock you. However, those who say you do, you should question their intention. We feel that short-term disability insurance isn’t worth the money.

What, you ask? Why do you say that?

Here’s why.

Short-Term Disability Insurance Can Be A Waste Of Money

You will never hear this from most agents. But, I am not like most agents.

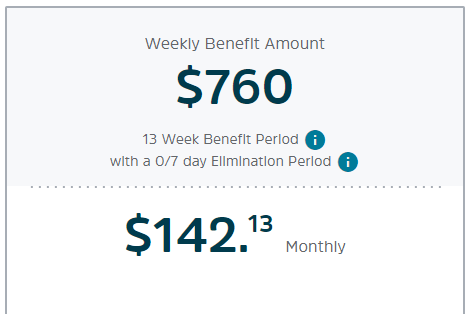

Short-term disability insurance can be a waste of money. I mean a lot. Just look at this real quote for a Massage Therapist. This quote is based on a $65,000 net income for a 40-year-old woman. Are you ready to spend $100 to $200 per month on short-term disability insurance?

(Note: this is a 0/7 day waiting period and a 3-month benefit period.)

There’s a reason short-term disability insurance costs so much. There are a lot more short-term claims. Spending a couple hundred a month on short-term disability insurance is common. I am talking about individual coverage. Policies through your employer, if you are an employee and offered, likely cost a lot less. Those can make more sense, but not individual coverage.

Second, short-term disability insurance covers disabilities for a short-term, maybe a couple of weeks to a couple of months. Then, you are done.

A Better Option For Short-Term Disability Insurance For Massage Therapists

However, there’s another favorable option that covers massage therapists. Do you know what that is?

If you said, emergency savings, you are right.

Saving a few months of expenses proves advantageous. Do you see why? You won’t spend needlessly on short-term disability insurance premiums. You already have the money for your short-term needs. It’s more important to have long-term disability insurance as those long-term disability situations place more financial pressure on families.

What about pregnancy? We described in our article that you could spend more on premiums than receive as a benefit. Yet, these other agents won’t discuss that or these alternatives. They’ll confirm you need it because you think you need it.

If you want some insurance for childbirth, pregnancy, or maternity leave, we discuss affordable options as well. We have helped many massage therapists obtain pregnancy or maternity leave insurance.

If you can obtain short-term disability insurance through your employer, then it could make financial sense. Otherwise, having an emergency fund for these short-term situations is the right solution.

Disability Insurance Underwriting For Massage Therapists

Hopefully, we have made a great case for disability insurance. Not only is your livelihood at stake, but also your family’s.

After you apply, your application goes right to the underwriting department. The underwriting department reviews your application and approves the premium and coverage.

After you apply, your application goes right to the underwriting department. The underwriting department reviews your application and approves the premium and coverage.

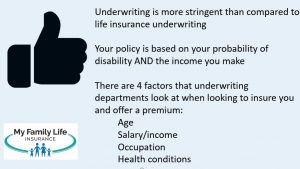

Disability insurance underwriting can be more involved than, say, life insurance underwriting. For disability insurance, there are 4 key areas for premiums and approval:

- Age

- Income/Salary

- Occupation

- Health Conditions

Your age and income are straightforward. The older you are, the more expensive the policy will be. The higher your income, the higher the benefit, and the higher the premium. Don’t worry about the actual premium. I’ll discuss that more when we talk about premiums below, and how we are different than other agencies.

In case you were not aware, your income is your W-2 gross salary if you are an employee. Your income is your net income if you are self-employed. So, if your W-2 salary is $60,000, that is the number used for underwriting.

Net income is off your Schedule C on your tax return (or whatever you use for your business filing). If you are self-employed, your net income is the number that the disability insurance companies insure. It is your gross sales less business expenses. Without getting into the weeds, your net income as a self-employed massage therapist is essentially the same as a W-2 employee’s gross salary. (Related: see our article on using the right income for disability insurance.)

Disability insurance companies like to look at the last 2 years or 3 years and average out. So, having the last 2 or 3 years of salary on hand is handy for the application process.

Your occupation is straightforward, but we will discuss this later.

First, let’s talk about health conditions next.

Health Conditions Matter With Disability Insurance Underwriting

Disability insurance underwriting is much different compared to life insurance underwriting. Remember, the insurance company is insuring your potential disability (not chance of death, as with life insurance). So, disability insurance underwriters look at your previous and current health conditions much differently.

Essentially, disability insurance companies won’t cover any previous or current health conditions. In other words, the insurance company excludes coverage.

Of course, there are exceptions.

For example, carriers may cover a low-maintenance health condition, such as hypertension or cholesterol, as long as there are no additional complications.

Carriers also cover previous injuries as long as there are no pins, rods, or other structures supporting the injured body part.

However, carriers exclude anxiety and depression, even if under a low-maintenance regimen, from coverage.

Same with going to a chiropractor for “maintenance” on your back. A chiropractor is a Doctor. If you go to one, underwriters see that as an existing problem. So, they exclude coverage on your back and spine. (Note: we have been able to secure disability coverage, including back and spine coverage, for professionals who do visit a chiropractor. It’s a case-by-case basis and important to contact us so we can discuss your situation.)

If you have more serious health conditions, the carrier could place a rating on your policy. A rating is an extra premium the carrier charges for an increased disability risk. Moreover, the carrier may limit options such as limited waiting periods or reduced benefit periods.

Having an exclusion or a rating is not a reason to ignore a disability insurance policy. There are nearly endless ways for a disability to occur.

Your Occupation Matters, Too!

Many massage therapists ask us how their occupation matters with disability insurance underwriting. Well, some occupations are riskier than others. Carriers adjust for this.

All the disability insurance carriers classify occupations based on disability risk.

In general, the carriers classify from 1 or A to a 5 or 6. An occupation with a class 6 has the lowest disability risk due to occupation and a class 1 occupation has the highest.

All things being equal, you’ll pay a higher premium if you are a class 1.

Disability insurance companies usually classify massage therapists as a class 1 or a 2. In some cases, a higher classification may be available.

So, what does this have to do with massage therapists?

Well, you do have the potential for a higher on-the-job disability compared to, say, an office manager. Carriers underwrite this by assigning your occupation the classification number.

We have helped many self-employed massage therapists attain a class 5, thereby saving significant premium money.

While there is general alignment among the disability insurance carriers, some carriers elevate your classification higher. All things being equal, carriers with a higher occupation classification save you money with lower monthly premiums. While not guaranteed due to specific provisions, we have helped many self-employed massage therapists attain a class 5, thereby saving significant premium money.

Additionally, many companies have a work requirement. They generally require your working 30 hours or more per week for a disability insurance policy. These hours include any administrative duties to run your business.

If you are a part-time massage therapist, do not worry. We have helped many part-time massage therapists obtain disability insurance. Contact us for more details.

The Makings of A Strong Disability Insurance Policy For Massage Therapists

Let me tell you something that other agents won’t: disability insurance isn’t complicated. Moreover, you don’t (likely) need all the “bells and whistles”.

This is what I mean. Disability insurance can be tailored to your needs. However, we feel there are some “non-negotiable” provisions that you need in your policy. After that, your preference determines other options and riders.

The first “non-negotiable” is the own-occupation definition of disability.

Luckily, many carriers make this definition of disability available for massage therapists.

The own-occupation definition means that the carriers pay a disability benefit if you can’t perform your own occupation as a massage therapist. It pays even if your disability doesn’t prevent you from working in another job, say as a security guard.

The second feature is partial disability benefits. You’ll want this. All this means is that the carriers pay you a partial benefit if you can work, but just not full-time. Many carriers offer this, but they have a stringent definition (see to the right). We work with carriers that offer an easier definition for massage therapists.

Finally, guaranteed insurability options (future purchase options) are a key feature of a policy. This option gives you the ability to purchase additional coverage (i.e. more disability insurance) in the future, but with no underwriting required. You just need to show financial insurability.

For example, 3 years ago, you made $30,000 and bought disability insurance. Today, you are making $60,000. That is a $30,000 increase! You can insure that amount through the guaranteed insurability option. Without that option, you would have to apply for an additional policy and prove health insurability again. Who wants to do that?

In our opinion, these three features are key to disability insurance for massage therapists. After that, you can choose features and options at your preference. We discuss those next.

In our opinion, these three features are key to disability insurance for massage therapists. After that, you can choose features and options at your preference. We discuss those next.

Disability Insurance Basics For Massage Therapists

There are several definitions and provisions you’ll need to understand about disability insurance to make an informed decision.

There is an elimination period, or waiting period, which is like a deductible. It is the period of time that elapses before disability benefits begin. For example, if you select a 90-day elimination period and are disabled, you’ll be eligible for disability benefits on the 91st day. However, typically with carriers, you won’t get paid until 30 days later or day 120 or so. This means you need to have adequate savings to carry you and your family until benefits begin.

For long-term disability insurance, you can go as low as 30 days for a waiting period.

Disability insurance companies allow a benefit period of 5 years. It’s important to note that the benefit period is based on each claim. As long as you pay premiums, you will have disability insurance to age 67 (unless you have a conditionally renewable plan, and those do exist).

You might be wondering why we are telling you this. The reason is all of this leads to premiums. The lower the waiting period, the higher the premium you’ll pay. The longer the benefit period, the higher the premium you’ll pay. And, vice-versa. All things being equal, of course.

You will have to make decisions based on benefits versus cost. Everyone wants the “Ashton Martin” plan. However, nearly everyone can’t afford that. Additionally, the old adage runs true here: some coverage is better than none.

Some coverage is better than none!

Optional Disability Insurance Riders For Massage Therapists

You can add optional disability insurance riders (link) at an additional cost to your policy that best fits your needs and budget. Some popular rider options for massage therapists include:

Retroactive Injury Benefit Rider: Pays benefits from the date of disability due to injury (i.e. not sickness) if disability occurs within 30 days of the injury and continues through the elimination period.

Activities of Daily Living Rider: This rider pays an additional benefit if you can’t perform two or more of the activities of daily living or cognitive impairment.

Residual Disability Rider: This rider will pay a benefit if you return to work in your occupation, and you experience an income loss of 20% or more compared to your pre-disability income. Usually, the amount of disability income you receive is a percentage of your total monthly disability benefit. For example, let’s say you return to work and experience a 40% income loss. If your monthly disability benefit is $4,000, you will receive $1,600 ($4,000 X 40%).

Social Insurance Rider: Coordinates your benefit with the Social Security Administration. This rider lowers your premium; however, you potentially have to coordinate your benefits with SSDI (social security disability insurance). In other words, the social security benefits reduce the benefit you receive from the disability insurance company. Do you want to work with the government? I generally do not recommend this rider. Contact us to learn more.

Cost-of-Living Adjustment: increases your monthly benefit by the contracted inflation rate if you have been a year on claim.

Depending on the carrier, there are additional options such as a critical illness rider, non-cancellable provision, accident rider, and more.

The Best Disability Insurance For Massage Therapists

You are probably wondering who we like to work with. I mean, we did say “the best” in our title.

Well, because of advertising guidelines and remain compliant, we can’t disclose carriers in our articles any longer.

However, keep the following in mind:

- the “best” for you may not be for someone else. Everyone’s situation is different

- we have helped many massage therapists obtain disability insurance, so we know which carriers are favorable for your occupation and who are not

- depending on your state you reside in and other factors, you can have a class 5 occupation which is unheard of for massage therapists

- we routinely get our massage therapy client’s premiums below $100 per month (more on that below)

We work with many disability insurance companies and only those that offer:

- the own occupation definition

- enhanced partial disability benefits

- guaranteed insurability options

- occupation class to a class 5, where applicable (YES!)

- and other riders to meet your needs

We have the expertise to guide you to the right disability insurance decision. Moreover, we have even helped massage therapists, who were declined for disability insurance before, get the coverage they need.

If we can’t help you, or if there is a better option for you, we will tell you that. You see, helping you is our first priority. Your interests come first to us, not our own needs and interests.

How Much Do Massage Therapists Pay For Disability Insurance?

Everyone wants to know about costs. John, just cut to the chase. How much will all this cost?

Well, it depends.

Remember, disability premiums are based on the following:

- age

- occupation

- health conditions

- salary/income

You can’t change your age, and you can’t change your occupation. You can’t  change your health conditions…to a point.

change your health conditions…to a point.

Sometimes, carriers will reverse exclusions, depending on the situation. Your income is your income, and you want to insure as much as you can.

There are factors outside one’s control. However, we at My Family Life Insurance aim to keep premiums at $100 or less per month for disability insurance. Nearly all the time, we accomplish that. You can easily customize a policy for $100 per month.

Stated another way, disability insurance can easily cost anywhere from $1.00 to $3.00 per day. Maybe more, as we mentioned. Do you think that is expensive? If you buy coffee every day or your lunch, you are spending your disability insurance premiums anyway. That’s right. The cost is equivalent to the cost of a cup of Starbucks coffee.

Another way to look at the cost:

Disability insurance costs 2 cents for every $1 you make. Think about that.

There is no excuse to protect your family and livelihood. As we mentioned, some coverage is better than none. Don’t let cost be the deterrent for a solid policy protecting your family. (Related: See disability insurance mistakes people make.)

What About Disability Insurance Plans Through Associations?

The American Massage Therapist Association (AMTA), and some of the other massage therapy associations, offer disability insurance to their members. The Hartford Financial Services Group underwrites the disability insurance for the AMTA. The association offers disability insurance plans for AMTA members.

Is a disability insurance plan through an association right for you? Association disability insurance programs tend to be “plain vanilla”, which means they are simple and basic and may not meet your specific, individual needs. Many of these plans are an extension of group employer disability plans. However, because of their simplicity, they tend to be lower in premium cost as well.

In our opinion, the disability insurance program through the AMTA is no different. Is it a bad plan? No. There are benefits and drawbacks. Here they are as we see them.

Benefits include:

- very low monthly cost

- easy application

- spousal coverage, even if he or she is a non-AMTA member

- pre-existing condition coverage after a 12-month waiting period

While these are positives, the plan contains many drawbacks which we discuss next.

Disadvantages of the AMTA Disability Insurance Plan

• limited monthly benefit – the most you can receive is $4,000 per month. This amount equates to $68,000 annually. If you earn more than this, you’ll have a potential income replacement gap. For example, let’s say you earn $100,000 as a massage therapist. That means your maximum income replacement is about $5,800 per month. If you have the AMTA disability insurance for $4,000 and go on a disability claim, how will you come up with the additional $1,800 per month?

• limited coverage for sicknesses – if you have a disabling sickness or illness, ATMA pays benefits for only 12 months. Remember, most disabilities are from sicknesses rather than injuries. Additionally, many disabilities last longer than a year. That is concerning to us.

• modified own occupation definition for 2 years – they contain a modified own-occupation definition for 24 months. After that, the definition transitions to the unfavorable “any” occupation.

• no residual disability benefit – a majority of disabilities start as a partial disability. Cancer, Multiple Sclerosis, arthritis…you name it, can start as a partial disability. Under the AMTA plan, the policy won’t pay. Why? It will only pay a partial benefit once you are totally disabled (i.e not working at all) and meet your elimination period. But, you are working and your doctor says you can work…see the problem?

A residual disability benefit pays without the total disability requirement. You generally need a certain loss of income, loss of work time, or a combination of both.

While advantages exist with the ATMA plan, there are drawbacks. We feel the drawbacks outweigh the benefits. However, you have to do what you feel is right for your situation.

Final Thoughts About Disability Insurance For Massage Therapists

We hope now you have a solid idea why massage therapists need disability insurance. Confused? Don’t feel that way. We’re here to help educate you and protect your income and future.

Don’t know where to start? Use this disability insurance needs analysis worksheet. Follow the instructions; it is rather easy to fill out (we at My Family Life Insurance try to make understanding insurance easy).

Next, feel free to reach out to us for our assistance or use the form below.

We only work for you, your family, and your best interests. We have helped many massage therapists secure the right disability insurance for their specific situation, giving them and their families peace of mind.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

2 thoughts on “Best Disability Insurance Options For Massage Therapists | Here’s What You Need To Know!”

Comments are closed.

A quote please

Hi Jae,

Thanks for reaching out to us. I can give you a quote. It would be easier for you to call me at (800) 645-9841 X 1.

As we wrote in our article, the average cost is around a cup of coffee per day, maybe a little more or less.

John