How The Definition of Disability Affects Your Benefits | If You Don’t Know This Definition, You Could Be in for a Surprise When You Make a Claim

Updated: April 12, 2024 at 9:38 am

As they say, “It’s all in a name.” In this case, the definition of disability in your policy determines whether or not you will receive benefits from your claim.

As they say, “It’s all in a name.” In this case, the definition of disability in your policy determines whether or not you will receive benefits from your claim.

What are you talking about, John? I’ll receive a benefit if I am sick or hurt.

Right?

Maybe. It depends on the definition.

The definition of disability is the “heart” of your policy. It is critical that you understand how the carrier defines your disability. The carrier pays (or does not pay) the disability benefit based on this definition, which is located in your contract.

Let’s see an example of how important it is to understand your policy’s definition of disability.

Example Of The Definition Of Disability

You were cleaning leaves out of your gutter when you shifted suddenly and slipped off your ladder. You broke your right leg in several places. Unfortunately, you require surgery to repair a torn patella tendon and muscle in your left knee.

Due to the severity of the break, you won’t be able to work properly for up to a year at your job as a food cashier at the supermarket. The break makes it difficult for you to stand for long periods of time on both legs. You will also need to go through extensive rehab and physical therapy.

Your doctor completes the necessary doctor’s report for the claim. Next, you apply for disability benefits through your employer’s plan.

Disability insurance is so important because its benefits keep food on the table and your lifestyle going while you can’t work.

Soon thereafter, you receive a notice from the insurance company that your claim has been denied! You become scared and nervous because you can’t work. How are you going to pay all of these bills and keep yourself going?

Then, you become angry when you read the definition of disability in your policy.

What Happened?

In the above example, you have a disability definition called “any occupation”.

This means the disability insurance company pays a benefit only if you cannot perform the duties of any occupation based on your education, experience/skill set, and work history. This is the strictest definition of disability. Social Security uses this definition (but it is even stricter, as you will see).

The carrier determined you could sit at the customer service desk at the supermarket and work.

What If You Had A Different Definition Of Disability?

If you had a different definition of disability, things could have been much different.

Here are 5 different types of definitions of disability. You should be aware of these definitions.

- True or Pure Own Occupation

- Modified Own Occupation

- Split Definition

- Transitional Occupation Definition

- Any Occupation Definition

- Social Security Disability Definition

We will begin with the most liberal definitions (i.e. those that have easier definitions to qualify for benefits) to the most stringent.

True Or Pure Own Occupation Definition of Disability

The most liberal definition of disability is the true, or pure, own occupation definition.

This definition allows you to receive a disability benefit based on your inability to perform your own occupation. You can work in another job and earn an income at the same time.

In other words, you could receive disability benefits based on your own occupation AND receive income from another job. You are considered disabled if you are unable to engage in the principal duties of your own occupation.

For example, let’s say you are a dental hygienist and hurt your right arm. Your doctor deems the injury a total disability. You receive disability benefits because you can’t perform the duties of a dental hygienist.

However, if you decide to do so, you can work in another occupation and receive earned income. For example, if you want to work as an office manager (a different occupation), you can earn money as an office manager and still receive your disability benefits.

In our example, you would receive benefits since you could not stand at your cashier’s stand. However, you could then work in customer service (and earn an income) if you wished to.

Modified Own Occupation Definition

If your policy contains the “modified own occupation” definition, you will still receive disability benefits based on your inability to perform the normal duties of your own occupation.

However, you can’t work in another job and receive an income.

As I tell people, it is an “either-or” situation. Either you receive disability benefits or you decide to work in another occupation. It is your pick.

In our example, because you could not work as a cashier, you would receive a disability benefit. It doesn’t matter that you could work as a customer service clerk. The policy pays a benefit based on your occupation.

What if you did want to work in another job? With the modified own occupation definition, you could not. You can’t receive disability benefits AND receive income from another job.

However, that’s not all that bad. You still receive a disability benefit based on your inability to perform the normal duties of your own occupation.

I ask professionals this all the time: “Honestly, if you are sick or hurt, do you think you still want to work?” I ask for an honest answer. Nearly all the time, that answer is “no.” They want to focus on getting better.

So, this definition of disability works well, too.

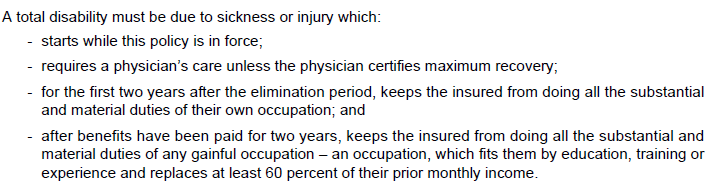

Split Definition Of Disability

Some carriers offer a “split definition,” which typically means an own occupation definition for the first couple of years of disability followed by an any occupation definition thereafter.

Carriers are increasingly using this definition. It allows people to get situated with their disabilities and encourages them to improve and return to work.

Additionally, most carriers offer rehabilitation benefits and other incentives to get the disabled person back to work.

In our example, our cashier may have up to 2 years on the modified own occupation definition followed by the any occupation definition thereafter. We discuss the any occupation definition shortly.

Transitional Own Occupation Definition of Disability

You may see a transitional own occupation definition of disability in some disability insurance contracts.

This is a somewhat new definition and has flexibility because it allows you to work. This pays a disability benefit based on your own occupation and if you are employed in another occupation, provided your income does not match or exceed your income from your prior occupation.

In other words, you can’t “double dip” like the true own occupation definition.

Let’s use our cashier example. Let’s say you made $2,500 per month as a cashier, but $1,500 as a customer service rep. Under the transitional definition, the disability insurance company pays an additional $1,000 to you.

You do not receive any benefit if you earn more than your former occupation (in this example as a cashier).

Additionally, carriers offering this definition generally have a limited benefit period of 2 or 3 years during which you can catch up on your prior earnings.

This is an easy example. The $1,000 could be limited based on percentage limits in your plan, but you get the idea.

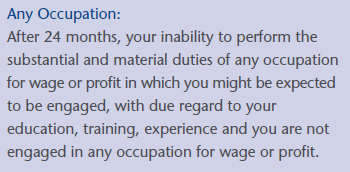

Any Occupation Definition

This is a stringent definition. This means if you can do “any” job based on your skill set, education, and experience, the life insurance company denies your claim. In our example, this is what happened to our cashier.

This is a stringent definition. This means if you can do “any” job based on your skill set, education, and experience, the life insurance company denies your claim. In our example, this is what happened to our cashier.

So, for example, you are a hairstylist and damage your ring finger. It might be hard to work as a hairstylist. However, the carrier may decline your claim under the “any” occupation definition because it feels you can work as an office worker.

I don’t see many straight any occupation disability definitions in contracts, but they do exist. So, be on the watch for these. Feel free to contact us if you feel your contact has the any occupation definition of disability.

Typically, the carrier pairs the any occupation definition after a 2-year modified or true own occupation definition. For example, our hairstylist has a modified own occupation definition for 2 years followed by the any occupation definition. In this case, she would receive a disability benefit for up to 2 years. The definition of disability transitions to the “any” occupation definition if she remains disabled after 2 years.

Social Security Definition of Disability

This definition is, hands down, the hardest definition to receive benefits. In order to receive disability benefits from social security (i.e., SSDI), you must:

- demonstrate the inability to work in any substantial gainful activity,

- by reason of any medically determinable physical or mental impairment(s),

- which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months

Eligibility for Social Security disability benefits is the easy part. Eligibility is based on working, typically having a 10-year work record. Once you achieve this, you have paid into your social security disability benefits.

However, qualifying is another. Social Security approves about 20% of first-time applications, and it can take years for someone to qualify. The reasons are many; however, the main reason is the substantial gainful activity.

Just look at this article about substantial gainful activity. It is depressing.

If you don’t have any disability insurance, you are subject to SSDI, which is hard to qualify for (and doesn’t pay much, either).

The moral of the story is to obtain your own personal disability insurance policy rather than relying on Social Security.

The Definition of Disability Depends on Your Occupation and Contract

Many people do not realize that disability insurance companies govern the definition of disability.

They mainly do this through your occupation. The riskier your occupation, the stricter the definition.

For example, a 35-year-old male accountant will have a better definition of disability (own occupation) in his contract versus a 35-year-old construction laborer (split definition or any occupation), all things being equal.

Nearly all the disability insurance companies use a split definition of disability. Here is one example.

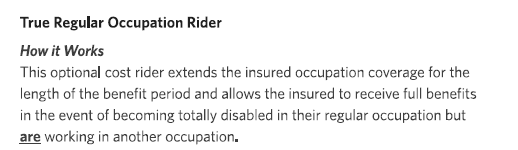

Usually, disability insurance companies use a modified own occupation for 2 years followed by an any occupation definition. However, any additional riders (like a true own occupation definition) depends on your occupation.

Key Takeaways About The Definition Of Disability

I hope you learned the different kinds of disabilit definitions. Generally speaking, the own occupation definition is the most flexible (and, therefore, more expensive) than the any occupation definition, all things being equal.

My recommendation: check your disability insurance contract now to see what you have.

Don’t have disability insurance? Contact us or use the form below.

As you can see, the definition of disability insurance is an important piece to any family’s financial plan. We will be happy to help you with your disability income insurance needs and determine which is the best course of action for your situation.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".