How Part-Time Workers Get Approved For Disability Insurance Every Time | Disability Insurance Options For People Who Do Not Work More Than 30 Hours Per Week

Updated: April 12, 2024 at 9:39 am

We’ve talked about the importance of disability insurance ad nauseum. Self-employed professionals, workers, and employees should have some level of disability insurance to protect themselves. However, many carriers decline disability insurance for part-time workers (self-employed professionals and employees).

We’ve talked about the importance of disability insurance ad nauseum. Self-employed professionals, workers, and employees should have some level of disability insurance to protect themselves. However, many carriers decline disability insurance for part-time workers (self-employed professionals and employees).

If this is you, as a part-time worker, and have been declined for disability insurance, you’ve come to the right place.

We have helped many part-time workers and employees obtain disability insurance.

In this article, we discuss how. Here’s what we will discuss:

- Why Carriers Decline Part-Time Workers

- What Can Part-Time Workers Can Do?

- What About Many Part-Time Jobs?

- Don’t Forget About Underwriting

- Other Options Available

- Final Thoughts About Disability Insurance

Let’s jump in and discuss why carriers decline disability insurance for part-time workers.

Why Most Disability Insurance Carriers Decline Part-Time Workers

One of the first things we ask people who contact us about disability insurance is, “How many hours per week do you work?”

You may not think about this, but gainful employment is a major requirement with nearly all disability insurance carriers.

In other words, if you only work 10 or 15 hours per week at Starbucks, nearly all (but not all) carriers will decline your application.

You could be the healthiest applicant on earth. That doesn’t matter. You don’t work enough.

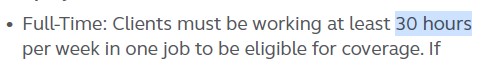

Many carriers have minimum-hour requirements. Typically, the hour requirements are 30 hours or more in your primary occupation. See these three excerpts from carrier underwriting guides:

![]()

Why do carriers do this? There are many reasons.

Reasons Why Disability Insurance Carriers Decline Part-Time Workers And Employees

Have you ever heard of the saying, “there’s no juice in that squeeze?”

All disability insurance carriers need to make money. If they did not, they could not survive in business.

Even the fraternal benefit carriers, which are not in business to make a bottom-line profit, need to make money.

So, one reason why is that people who work less than 30 hours per week are just not profitable to the carrier.

That is a valid reason why. Carriers offer a lot of benefits potentially (if a claim is filed) for a covered insured. Part-time workers and employees, for some carriers, just are not profitable for that benefit.

Another reason is risk. This is a major reason.

Generally speaking, people who work part-time are in unstable situations. I do not mean that in a bad way. People who work part-time may be college students, in flux between jobs, re-entering the workforce after some time out of it. Thousands of situations exist.

These situations are unstable from a risk point-of-view. If you are disabled, carriers will pay your contracted benefit. However, they do not want to pay a potentially significant benefit for an above-normal risk.

What can part-time workers do? Well, that is what we discuss next.

What Part-Time Workers Can Do With Disability Insurance?

If you are a part-time worker or employee, you’ve come to the right place. We’ve helped many part-time workers and employees obtain disability insurance.

How?

Well, first, this is the benefit of being an independent broker. We work with many carriers and pivot to your needs. (In this case, disability insurance for part-time workers and employees).

Thankfully, we work with several carriers that WILL offer disability insurance coverage to part-time workers.

We’ve worked with so many part-time workers and employees that we know the go-to carriers.

Also, these carriers limit your benefits in one way or another. For example, some may limit coverage to certain occupations. Others may limit the benefit period.

As we discussed earlier, this is how carriers manage this risk and make a profit.

Because of marketing reasons, we are not allowed to mention these carriers. However, here are overviews of the available options.

I am certain that most of these carriers fit your situation.

Carrier #1

- Up to $5,000 monthly benefit

- Up to 5-year benefit period

- Any waiting period / elimination period available

- Any covered occupation available

- Work between 20 and 29 hours per week consistently

- 2 years of stable employment required

- Limited rider options

The carrier will consider the combined income and hours for 2 or more unrelated occupations, up to 40 hours per week. The insured’s occupation class is based on the most hazardous occupation.

For example, Jim works as a coffee barista (a class 2) for 20 hours per week and as a self-employed piano teacher (class 3) for 15 hours per week.

The carrier can consider the combined income Jim makes from both occupations. However, his occupation class is a 2 as that is the lowest (i.e. riskiest/most hazardous) occupation class.

Carrier #2

- Will consider people who work 10 to 24 hours per week (anything greater is considered full-time)

- Class 2 through 5 occupations only

- Up to 5-year benefit period

- Any waiting period available

You must be a practicing Christian to apply for this disability insurance.

Carrier #3

- Work 20 to 29 hours per week

- Available for occupation class 3 and higher

- Up to $5,000 monthly benefit

- Earn at least $40,000 annually

The carrier limits some disability insurance riders.

Carrier #4

This carrier will consider full-time benefits and plan for the following occupations, provided the worker/employee works a minimum of 24 hours per week:

- Nurses (must be in a hospital setting)

- Pharmacists (must be in a hospital setting)

- Nurse Practitioners

- Phlebotomists

- Dental Hygienists

- Veterinarians

This list includes the above occupations in all available states except for California.

What About Many Part-Time Jobs?

It’s common nowadays for people to have many part-time jobs and earn income from various sources.

As we indicated earlier, we have a carrier that will insure multiple occupations provided you are at least working 20 hours.

Actually, many carriers do this.

Carriers assign the most hazardous job as the occupation class. We gave an example earlier.

Also, if you have multiple part-time jobs, but in the same occupation, that is OK, too.

Moreover, if those part-time jobs add up beyond 30 hours, then you are eligible for full-time plan options.

For example, let’s say Jill is a dental hygienist. She works 20 hours per week for one dentist, 10 for another, and then 5 on Saturdays only for another dentist. She essentially has 3 part-time jobs. However, because they are all in the same occupation of dental hygiene, we add up all the hours and income from each employer. Thus, she works 35 hours per week as a dental hygienist and is eligible for full-time disability insurance plans.

Part-Time Workers Still Need To Go Through Disability Insurance Underwriting

Even though you are a part-time worker or employee, you still have to go through underwriting.

John, I just got life insurance. I went through underwriting and know what it’s about.

Disability insurance underwriting is much different than life insurance underwriting.

Disability insurance carriers are insuring your income and your risk of disability. The chances of being disabled are much, much greater than dying of cancer, for example. (Unfortunately, many people pass away from cancer.)

Disability insurance carriers are insuring your income and your risk of disability. The chances of being disabled are much, much greater than dying of cancer, for example. (Unfortunately, many people pass away from cancer.)

So, disability insurance carriers dive much deeper into the underwriting process. They will look at:

- Age

- Gender

- Salary / income

- Occupation

- Health conditions, including BMI, injuries, hospitalizations

- Outside activities

The first 3 are self-explanatory. You do need to make sure you are using the right income for disability insurance. Additionally, passive income like rent, royalties, etc. is typically excluded unless there is some earned effort generating that income.

All disability insurance carriers underwrite your occupation based on risk. Carriers assign a number identifying the level of risk. An occupation assigned a class 1 is considered the riskiest and a class 5 the least risky.

For example, a carrier classifies a construction laborer as a 1 versus a class 5 for an accountant.

Of course, health conditions play a major role. Any current, chronic conditions are typically excluded from coverage. For example, if you take Wellbutrin for depression, carriers will exclude from coverage any disability relating to any emotional or nervous disorder.

Outside activities matter, too. If you like to use marijuana, engage in hazardous activities, etc. these activities will play a role in the underwriting process.

Other Options Available

There are other options available if you still don’t qualify based on hours or earned income.

Critical illness insurance (link) is an option. I call it the “little brother” to disability insurance.

Critical illness insurance covers a covered illness only. It does not cover accidents.

Additionally, it typically pays out in a lump sum dollar amount, although a couple of carriers pay via monthly amount like disability insurance.

Nearly every carrier covers the following common illnesses:

- Cancer

- Stroke

- Heart attack

These illnesses are the most common illnesses facing Americans.

However, some carriers go beyond these 3 illnesses and cover additional ones.

For example, some carriers will also cover:

- ALS

- MS

- Blindness/Deafness

- Severe (3rd degree) burns

- Kidney Failure

While I generally don’t recommend a “return of premium” option for disability insurance (see my take on disability insurance riders you need), I do recommend the return of premium option for critical illness insurance. The reason why is that the return of premium option tends to be inexpensive.

You can always purchase both disability insurance and critical illness insurance.

Final Thoughts About Disability Insurance For Part-Time Workers And Employees

Part-time workers and employees can obtain disability insurance.

We’ve outlined several carriers that will insure part-workers and employees.

Sure, carriers may limit benefits one way or another. However, you will have coverage if you are sick, ill, or hurt and can’t hurt.

You will then have the money to pay for bills and other things while you get better.

How can we help? Tell us your situation. Use the contact us or use the form below.

We only work in your best interests. That means we place you in the plan that benefits you and your family. Not us.

Additionally, there is no risk of contacting us. If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".