Your Best Critical Illness Insurance Options

Updated: April 12, 2024 at 9:39 am

If you read our article if critical illness insurance is worth the money, you know that answer really depends on you and your situation. Keep in mind that critical illness insurance is generally inexpensive when you consider the financial and emotional impact an illness takes on a family. In this article, we discuss the best critical illness insurance options for you and your family.

If you read our article if critical illness insurance is worth the money, you know that answer really depends on you and your situation. Keep in mind that critical illness insurance is generally inexpensive when you consider the financial and emotional impact an illness takes on a family. In this article, we discuss the best critical illness insurance options for you and your family.

First, we discuss critical illness insurance underwriting and then the types of critical illness insurance available. Then, we discuss the plans we feel are the best, offering the right type of coverage and premium. Honestly, there will be carriers you have never heard of. Is this a bad thing? No. It means we at My Family Life Insurance have a lot of options to place you and your family in the right critical illness insurance plan.

Remember, the “best” or “right” critical illness insurance plan is the one that fits your needs, situation, and budget. Moreover, it pays the benefit to help you and your family. It’s not based on a brand name or a carrier on TV.

Critical Illness Insurance Underwriting

Back in the day, you had to go through a full underwriting process for critical illness insurance. What is full underwriting? All that means is you would have to go through a medical exam, provide a blood/urine sample, have a height/weight check, and blood pressure check. While this might be common for very large coverage amounts, full underwriting for critical illness insurance is not very common nowadays.

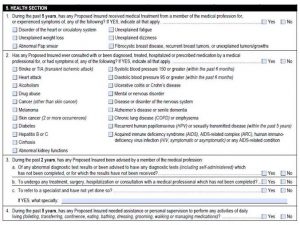

Simplified underwriting is the usual underwriting process for critical illness insurance. What does this mean? There’s no medical exam or any of the other stuff we described. While that sounds great, the carrier still underwrites you. They do this by asking you a health questionnaire. See the one below, for example. This is a real questionnaire from a carrier.

Note that if you answer “yes” to a question, that could lead to a decline.

The carrier then reviews your MIB and your prescription drug history. They do this to see your insurance application history and to confirm what you say on the application matches to the information contained on these databases. As we said in other articles, if you think you can pull the wool over the carrier’s eyes and lie on the application, think again. Carriers know when there is misinformation and when you are lying.

Ways To Obtain Critical Illness Insurance

There are a couple of ways you can obtain critical illness insurance.

The first way is through a life insurance policy via a rider. Some life insurance plans now offer it automatically. We aren’t big fans of having critical illness on term life because:

(1) when the term expires, so does your living benefit including your critical illness

(2) most people do not increase the death benefit to compensate for a possible reduction

We feel that critical illness coverage is useful on permanent life insurance policies for the simple reason that coverage continues with you, for your life. So, even if you are 75, and diagnosed with prostate cancer, you can withdraw a critical illness benefit – if you wish. Contrast with term life – which you probably would have let expire years ago.

Of course, if term life insurance is all that you can afford, then you do what is best for your family.

Life insurance policies allow you to withdraw a portion of the death benefit, up to a maximum, as specified by the carrier. For example, a carrier may limit the advancement of 50% of the death benefit not to exceed $250,000.

The second is a stand-alone critical illness insurance policy. Usually, these policies continue for your entire life. Some do terminate at age 75. Moreover, they may have benefits that are more extensive than what is attached to a life insurance policy. Most policies have benefits up to $50,000 and $100,000. Some have more. We like these policies for the reason that they continue, for life.

Best Critical Illness Insurance Options Attached To Life Insurance

As we mentioned, we are not opposed to critical illness coverage as part of a term life insurance policy. We feel that permanent life insurance policies suit critical illness coverage much better. You will have coverage and protection in case of diagnosis at older ages. More often than not, you will let the term expire along with the critical illness coverage. Why? Because term life insurance becomes prohibitively more expensive after the level term ends. Of course, you do what makes sense for your situation and family.

Permanent life insurance includes whole life, universal life, and even indexed universal life insurance (IULs). While I am not a fan of IULs, they can make sense as the cash value has the potential to grow much greater, over time, compared to other types of permanent insurance. You will then have a potentially larger death benefit to withdraw money from.

Here are our three favorable permanent life insurance policies which contain a critical illness rider or have critical illness automatically integrated with the life insurance plan.

(Note: We aren’t going to talk about the structure of the permanent policies in this article or the other living benefits available. We will only focus on the critical illness component, although most life insurance plans with living benefits offer chronic care and terminal illness coverage as well.)

Ameritas

When you think of life insurance with living benefits, you have to consider Ameritas’s FLX indexed universal life. Here are the particulars:

Issue Age: up to age 65 and guaranteed for life!

Underwriting: Simplified issue for death benefits up to $300,000. Fully underwritten for death amounts greater than $300,000.

Illnesses Covered: The number of critical illnesses covered makes this plan stand out. Covered illnesses include:

- Invasive, life-threatening cancer

- Stroke

- Major heart attack

- End-stage renal failure

- Major organ transplant

- ALS (Amyotrophic Lateral Sclerosis)

- Blindness due to diabetes

- Paralysis of two or more limbs

- Major burns

- Coma

- Aplastic anemia

- Benign brain tumor

- Aortic aneurysm

- Heart valve replacement

- Coronary artery bypass graft surgery

Benefit Amount: If you are diagnosed with a covered critical illness, you can advance 25% of the death benefit up to $250,000.

American National

American National has critical illness coverage on all of its products: term, whole life, IULs, and even guaranteed universal life (GUL).

Issue Age: Available up to age 65 and guaranteed renewable for life!

Underwriting: Depending on age, an applicant can have simplified underwriting up to $1,000,000 death benefit; however, people age 51 and over usually $500,000 simplified limit. Finally, people between the ages of 61 and 65 have simplified issue up to $250,000. Beyond age 65 is usually full underwriting at the carrier’s discretion.

Above these death amounts is generally full underwriting.

You can advance up to $2,000,000 (for up to age 65) of your life insurance benefits for covered critical illness! Wow! (Beyond age 65, the maximum is $1,000,000.)

Illnesses Covered:

- Heart Attack

- Stroke

- Invasive Cancer

- End Stage Renal Failure

- Major Organ Transplant

- ALS

- Blindness

- Paralysis

- Arterial Aneurysms

- Central Nervous System Tumors

- Severe Disease of Any Organ (resulting in significantly altered life expectancy)

- Major Burns (>40% BSA, 3rd Degree)

- Loss of Limbs

Benefit Amount: You can advance up to $2,000,000 (for up to age 65) of your life insurance upon diagnosis of a covered critical illness. Wow! (Beyond age 65, the maximum is $1,000,000.)

National Life

National Life’s critical illness coverage comes automatically on all of their products (term, WL, IUL).

Issue Ages: Any, per the underwriting guidelines and guaranteed for life!

Underwriting: Simplified underwriting from ages 18 to 60 for death benefits of $1,000,000 and less. For ages 61 to 65, the maximum death benefit for simplified underwriting is $250,000. Any amounts or ages outside of these ranges are at full underwriting at the underwriting department’s discretion.

Illnesses Covered: They cover critical illness and critical injury

Critical Illness includes:

- ALS (Lou Gehrig’s disease)

- Aorta Graft Surgery

- Aplastic Anemia

- Blindness

- Cancer

- Cystic Fibrosis

- End-Stage Renal Failure

- Heart Attack

- Heart Valve Replacement

- Major Organ Transplant

- Motor Neuron Disease

- Stroke

- Sudden Cardiac Arrest

Critical Injury includes:

- Coma

- Paralysis

- Severe Burns

- Traumatic Brain Injury

Benefit Amount: Generally speaking, you can advance up to $1,000,000 of death benefit for a critical illness diagnosis, but it depends on the following factors:

- Your state limitations

- The severity of the condition

- Discounted value of the death benefit

Best Stand-Alone Critical Illness Insurance Policies

More and more companies are offering stand-alone critical illness insurance policies. Here are several that we consider the best and a potential fit for you and your family. Note that the “best” depends really on your needs and situation.

Many of these policies have a required waiting period before a submitted claim. The waiting period usually ranges between 30 and 90 days depending on the carrier.

We also list an estimated premium for a 50 year old non-smoking male and female, non-smoking at $50,000 coverage. The actual premium depends on a whole slew of factors including, but not limited to, your age, state, tobacco status, and health conditions. Note, as well, spouses and children are typically allowed, although children are usually allowed a lower benefit. Rates are subject to change.

Again, simplified issue underwriting typically means an application, MIB check, prescription drug history check, and a possible interview. Fully underwritten underwriting includes all of this, generally, in addition to a paramedical exam that includes a height / weight check, blood pressure, check, and anything else required by the carrier.

Assurity

Assurity has one of the more favorable critical illness insurance policies available. We discuss the plan specifics below.

Issue Ages: Ages 18 to 70 can apply. When you are accepted, the plan is guaranteed for life! Yes! Again, this means, as long as you pay the premiums, the policy remains in force. Even at age 88, for example.

Underwriting: They have simplified issue up to $75,000 and fully underwritten up to $500,000. Spouses and children are allowed, although they may be eligible for a lower benefit. They utilize a height and weight table.

Benefit Amounts: $5,000 to $500,000

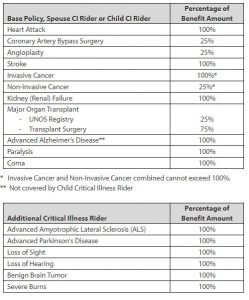

Covered Illnesses: Assurity covers the following critical illnesses.

Additional Riders Available: They have the following riders available (for an additional cost, not available in every state). Assurity has some interesting riders worth considering that not many carriers have.

- Return of Premium

- Accidental death benefit

- Critical accident benefit

- Additional critical illness coverage (see above)

- Loss of independent living (if you can’t meet 2 out of 6 ADLs)

- Increasing benefit

- Waiver of premium if disabled

- Reoccurrence benefit – 12 months between diagnosis (100% covered)

Example Monthly Premiums:

Male $102.22/month Female $81.72/month

Mutual of Omaha

Mutual of Omaha has a few different options for their critical illness policy. You can have it as stand alone or as a rider on one of their term policies. However, remember this valuable insurance pretty much ends at the end of the term life insurance.

Issue Ages: Issue ages are 18 to 89 for the heart/stroke and cancer plans. The critical illness plan’s issue ages are much lower, from 18 to age 64. Good news that if you choose their stand-alone plan, it is guaranteed renewable for life.

Underwriting: They utilize two underwriting approaches. From benefit amounts of $50,000 and less, they have express underwriting which is simply answering their “yes/no” questionnaire. There is no MIB check or prescription drug check. For amounts $50,001 to $100,000, there is the simplified approach which has the same “yes/no” questionnaire, but MIB, prescription drug check, and possible phone interview (at Mutual of Omaha’s discretion). They utilize a height/weight table.

Benefit Amounts: $5,000 to $100,000

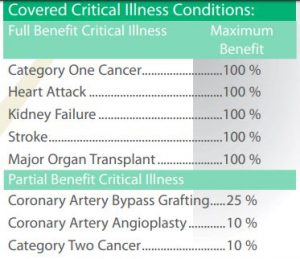

Covered Illnesses: Like the other carriers, Mutual of Omaha’s plan includes cancer, heart/stroke coverage. Additionally, you can choose either cancer coverage only, heart/stroke only, or a combination of cancer, heart/stroke. Moreover, you can add the following health conditions which make up their critical illness policy:

- Alzheimer’s disease

- organ transplant

- blindness

- paralysis

- deafness

- kidney failure

The plan covers 100% of the benefit for the above critical illnesses. Mutual of Omaha’s plan covers 25% of the benefit for the following:

- Coronary Artery Bypass Surgery

- Coronary Angioplasty

Additional Riders Available: Unfortunately, Mutual of Omaha has only two riders on its stand-alone critical illness insurance. They are:

- ICU admittance

- Return of premium

At the time of this writing, they do not have a reoccurrence benefit.

Example Monthly Premiums:

Both male and female $155.42/month

LifeSecure

LifeSecure offers an affordable critical illness insurance policy. However, as with many plans, there are attributes we like and there are attributes we don’t like.

Issue Ages: LifeSecure offers a critical illness plan from issue ages 18 through 70. If there is something we don’t like about the plan, it is the fact that it is NOT guaranteed renewable for life. The maximum age you can hold the policy is until age 75. That kind of stinks.

Underwriting: A good attribute, however, is their plans are simplified issue underwriting. You answer a yes/no application. LifeSecure does look up your application history through the MIB and conducts a prescription drug check.

Benefit Amounts: Start at $5,000 to $50,000.

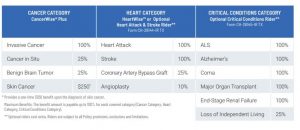

Covered Illnesses: But, there are some good attributes that we like. See the chart below for the benefit percentages. The plan does cover skin cancer as well as carcinoma in-situ, which other carriers do not.

Additional Riders Available: LifeSecure offers a few different riders. I am happy to see they offer a reoccurrence benefit, which is 50% of the original benefit, as long as the diagnosis or treatment is 12 months apart. Some of the other riders include a:

- Return of Premium

- Subsequent Diagnosis

- Health screening benefit

Example Monthly Premiums: LifeSecure offers some of the more affordable critical illness insurance.

Male $117.75/month Female $91.25/month

Aetna

Aetna has a cancer/heart attack/stroke plan only. It does not cover any other illnesses. With cancer, heart attack, and stroke being the leading causes of illnesses and deaths in the US, Aetna’s plan is worth it to include here.

Issue Ages: 18 to 89, which is one of the largest age ranges available. Coverage is guaranteed renewable for life!

Underwriting: Underwriting is simplified with a MIB and prescription drug check. What is unique is that they do not have a height and weight table. So, you can have a massive BMI and still apply. As long as you can truthfully answer the questions, supported by the MIB and prescription drug check, you will obtain their critical illness insurance.

Benefit Amounts: $5,000 to $75,000

Covered Illnesses: The plans cover the following at 100% coverage:

- cancer including carcinoma in situ

- heart attack

- stroke

The plan does not cover skin cancer, but does cover malignant melanoma. You can purchase the cancer and heart/stroke plans separately or all together. Unless you have coverage elsewhere, I recommend all together.

Additional Riders Available: They do offer a step-up reoccurrence benefit that pays a percentage of the benefit depending on when the re-diagnosis happens. A re-diagnosis after 9 years pays 100% of the benefit.

Example Monthly Premiums: Unisex rates available. For the cancer, heart/stroke plan, a person age 50 (non-smoking) wanting $50,000 in coverage will pay about $177.33/month.

United Commerical Travelers (UCT)

Here’s a carrier you probably have never heard of, but offers a very affordable critical illness insurance. United Commercial Travelers (UCT) is a fraternal organization based in Columbus, Ohio. In our opinion, better policies exist, but UCT’s critical illness insurance is worth a look.

Issue Ages: 18 to 64. The policy is not guaranteed renewable for life, so that stinks in our opinion. It expires at age 75.

Underwriting: Simplified issue up to $50,000. Amounts over $50,000 require full medical underwriting, so that stinks, too. They have a height and weight table as well.

Benefit Amounts: You can purchase from $5,000 to $100,000 of coverage.

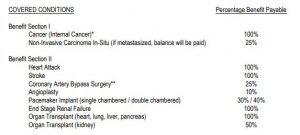

Covered Illnesses: They cover the following at the corresponding percentages:

Additional Riders Available: None. There are some things we don’t like about it, however. No reoccurrence benefit. Additionally, once a payment is paid 100% in full for any critical illness, the plan does not pay again. It is like one and done.

Example Monthly Premiums: $102.26/month for male and $81.72/month for female. Does not include any fraternal dues. As you can see, it is as competitive as Assurity’s rates, but Assuurity has more benefits.

PALIC

Philadelphia American Life Insurance Company (PALIC) has a couple of plans. One plan has coverage of up to $50,000. The other one up to an amazing $1,000,000. In the words of Harry Caray, “Holy Cow!” However, there are stipulations to the $1,000,000 policy.

Issue Ages: 18 to 64, terminates at age 75, so that stinks

Underwriting: In our opinion, PALIC has too many underwriting limitations. For the $50,000 plan, you can only purchase up to $20,000 on a stand-alone basis. Amounts $30,000 and higher can be included on PALIC’s health indemnity plans (HCS and HSP III). Phone interviews are required for amounts of $40,000 and higher. They reserve the right for phone interviews on coverages of $30,000 and less. The $1,000,000 coverage is only available on PALIC’s HSP Gold health indemnity plan.

Benefit Amounts: Up to $20,000 stand-alone. Up to $50,000 on their HCS or HSP III plan. Finally, up to $1,000,000 on the HSP Gold plan.

Covered Illnesses: Here are the coverage amounts for their stand-alone plan:

Their plan attached to their HSP Gold plan is much better. The good news is that any diagnosis has 100% full benefit, with the exception of disclosed limitations such as amputations.

Additional Riders Available: None available unless part of PALIC’s indemnity plans

Example Monthly Premiums: Here are the rates for their $50,000 plan: male is $86.60/month and female is $61.20/month. As for the $1,000,000 plan, remember it is attached to the HSP Gold. The additional cost for a male is $118.76/month and female is $129.26/month.

Manhattan Life

Manhattan Life shines in its uniqueness. While many other carriers offer the traditional lump sum plans, Manhattan focuses on recovery as well. Moreover, they cover critical illnesses that many plans don’t cover. They offer two stand-alone cancer plans, but we won’t focus on that for our article. They offer a critical illness plan called Critical Protection and Recovery (CPR). While other plans focus on a lump sum, Manhattan’s CPR focuses on the treatment and recovery of a person with a covered illness.

Issue Ages: 18 to 69 and guaranteed renewable for life!

Underwriting: Simplified issue underwriting with height and weight table

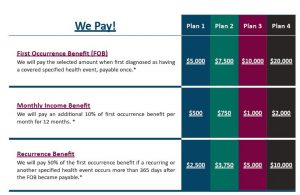

Benefit Amounts: See the chart below for the benefit amounts on their CPR plan. Manhattan Life offers 4 plans on their CPR plan It is pretty simple. See the chart below. If you are diagnosed with a covered critical illness, then you receive the following, based on the selected plan.

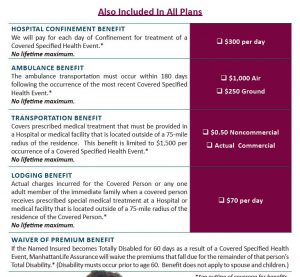

They also include the following benefits as well:

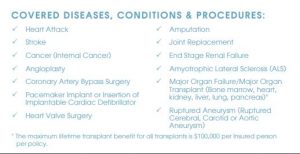

Covered Illnesses: They cover the following illnesses at 100%

- Heart Attack

- Major Third-Degree Burns

- Paralysis

- Stroke

- Major Human Organ Transplant

- End-Stage Renal Failure

- Coma

- Coronary Artery Bypass Surgery

- Cancer

Additional Riders Available: None. What you see above is what you get, which is very robust in our opinion.

Example Monthly Premiums: $122.10/month unisex rates

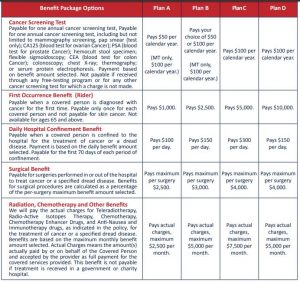

Wait…There’s More: Manhattan’s Critical Cancer And Dread Disease

They also offer a cancer and specified disease plan, called Cancer Care Plus. The pla is similar to that of Critical Protection and Recovery. You’ll receive a lump sum diagnosis benefit, but also a slew of additional benefits to help you along with your treatment. Honestly, the treatment benefits are too long to list, so contact us if you want to find out more. For example, one of those benefits is the use of immunology, in which, at the time of this writing, no other carriers are offering for coverage. It’s worth considering.

Issue Ages: 18 to 69 and guaranteed renewable for life!

Underwriting: simplified issued with an MIB and prescription drug history check along with a possible phone interview. There is also a height and weight table.

Benefit Amounts: Look at the chart below to see the 4 plans available.

Covered Illnesses: Although this plan is predominantly cancer coverage, it does cover the following critical illnesses, many of which a person can’t get anywhere else.

- Heart attack, heart disease, stroke (as a rider)

- Addison’s Disease

- Muscular Dystrophy

- Tay-Sachs Disease

- Amyotrophic Lateral Sclerosis

- Myasthenia Gravis

- Tetanus

- Diphtheria

- Niemann-Pick Disease

- Toxic Epidermal Necrolysis

- Encephalitis

- Osteomyelitis

- Toxic Shock Syndrome

- Epilepsy

- Poliomyelitis

- Tuberculosis

- Legionnaire’s Disease

- Reye’s Syndrome

- Tularemia

- Lupus Erythematosus (SLE)

- Rheumatic Fever

- Typhoid Fever

- Meningitis

- Rocky Mountain Spotted Fever

- Whipple’s Disease

- Multiple Sclerosis

- Sickle-Cell Anemia

- Whooping Cough

Many of these diseases are rare and inherited, so this plan may be worth a look on family coverage or if anyone in your family has a history of these illnesses and diseases.

Additional Riders Available: Heart Attack, Stroke, and Heart Disease as well as an Intensive Care Unit rider

Example Monthly Premiums: $72.36/month unisex rates

Surebridge

Surebridge does not have a direct critical illness plan per se. You have to purchase their cancer or heart/stroke plan (or both) and add the critical illness component to it. Surebridge’s plans have some interesting features that we feel warrant a discussion here.

Issue ages: 0 to 90 – that is the oldest age range we have seen. And, the plan is guaranteed renewable for life!

Underwriting: Like most of the other plans, Surebridge is simplified underwriting. However, there is NO MIB, prescription drug check, or interview. There is a height/weight table

Benefit Amounts: $5,000 to $100,000 for ages 0 to 63. Beyond age 64, up to $50,000.

Covered Illnesses & Benefit Amounts: As mentioned, you can purchase Heart/Stroke and Critical Illness with their Cancer plan. This chart below says it all:

Additional Riders Available: A cancer and heart/stroke reoccurrence benefit, as well as a wellness benefit, are available.

Example Monthly Premiums: $99.50/month for male and $63/month for female. Surebridge has some of the more affordable premiums.

Summary The Best Critical Illnesses Insurance Options

We provided a lot of information here. Are you looking for the “best” critical illness insurance? Well, the “best” never exists; every plan has advantages and disadvantages. The right one for you is the one that fits YOUR needs and budget. However, if we had to pick, in general, Assurity, Manhattan Life, and Surebridge all provide plans that have the combination of affordable premium and solid benefits. Here is the list of the best critical illness insurance options:

- American National

- National Life

- Ameritas

- Assurity

- Mutual of Omaha

- LifeSecure

- Aetna

- UCT

- PALIC

- Manhattan Life

- Surebridge

Conclusion

We hope you found this article about the best critical illness insurance options informative. There are many options. What is best for you? Contact us or use the form below. We are happy to help you any way we can. As always, we only work in your and your family’s best interests only.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".