3 Advantages Of Business Overhead Expense Insurance | Here’s Why Business Owners Should Consider This Unique Insurance

Updated: April 12, 2024 at 9:39 am

If you are a small business owner, say a hairstylist, and suddenly disabled, have you ever thought about how you would pay your studio rent? Thankfully, this is where business overhead expense insurance helps.

If you are a small business owner, say a hairstylist, and suddenly disabled, have you ever thought about how you would pay your studio rent? Thankfully, this is where business overhead expense insurance helps.

Oh, John, you say. I already have this insurance.

No. You probably don’t. You probably have business interruption insurance. That is through your commercial liability insurance. That is completely different.

What I am talking about is a policy that pays your business expenses if you can’t work due to an illness or injury. How will you pay your business rent, payroll, county taxes, etc. if you can’t work?

Thankfully, this is how a business overhead expense policy helps.

In this article, we will discuss:

- What Is A Business Overhead Expense Policy?

- What Does The Policy Cover And How Does It Work?

- 3 Advantages Of a Business Overhead Expense Policy

- Availability And Options Of Business Overhead Expense Policies

- Underwriting Of Business Overhead Expense Policies

- Estimated Premiums Of Business Overhead Expense Policies

- Do You Need A Business Overhead Expense Policy?

- Final Thoughts About Business Overhead Expense Policies

Before we discuss the advantages, let’s discuss what a business overhead expense insurance policy is.

What Is Business Overhead Expense Insurance

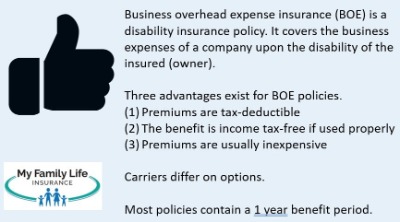

Business overhead expense insurance (BOE) is a type of disability insurance that covers your business expenses.

Here’s the benefit of this type of policy. Let’s use an example.

Let’s say you are seriously hurt in an accident. You are disabled for 10 months. You have an office downtown and a salaried assistant who helps you grow your business.

You have an office downtown and a salaried assistant who helps you grow your business.

Thankfully, you have individual disability insurance which pays your everyday living expenses like your mortgage, groceries, internet, utilities, etc. But, how are you going to pay your assistant and your rent?

You try to pay the rent you owe. It’s tough as your landlord isn’t very forgiving. It’s your problem, they say. They are expecting you to pay and on time.

You try to work out an arrangement with your assistant. Her salary relies on your ability to work. So, because you are disabled, she can’t receive her salary. Like your family, her family relies on her salary.

Worst case, you default on your rent. That’s bad from a credit perspective. Adding insult to injury (no pun intended), your assistant leaves to take another job.

These situations can happen. I am not making up some low-probability scenario. Many businesses go bankrupt because of a disability.

However, it doesn’t have to. This is where business overhead expense insurance helps. A lot!

Here’s What Happens If You Had Business Overhead Expense Insurance

In our example, let’s switch that you have an appropriate business overhead expense policy.

After meeting the required waiting period, you receive your business overhead benefit. You use this benefit to pay your landlord and your assistant. The policy has a maximum benefit period of 2 years, which is more than enough to cover the length of your disability. You continue to pay your landlord and assistant throughout your disability.

Upon your return, there’s no real interruption in your business, except for your “getting back into the swing of things”.

Do you see how a business overhead expense policy helps? We will discuss this in more detail. However, you probably want to know what these policies cover. Let’s discuss that next.

What Does Business Overhead Expense Insurance Pay For And How Does It Work?

Business overhead expense insurance is a type of disability insurance policy that covers your business expenses upon your disability. While it does not cover every business expense, it will cover and pay for the following:

- Rent

- Payroll / salaries

- Lease payments

- Business mortgage and interest

- Maintenance and repairs

- Professional fees such as licensing, membership fees, association fees

- Payroll taxes and other taxes you might have to pay on your business property

- Commercial and liability insurances for your business

- And more

These plans pay for normal and customary expenses related to your business.

Remember, as the business owner, you have to be disabled for this policy to pay a benefit.

How Does It Work?

A business overhead expense insurance policy is structured similarly to that of an individual disability insurance policy.

However, instead of net income, you are insuring your business expenses. Your monthly benefit is your monthly business expenses.

There is a waiting period or elimination period before the carrier pays your benefit.

Also, there is a benefit period. However, unlike an individual policy, a BOE policy usually has a maximum benefit period of 1 or 2 years.

The own-occupation definition is available as well as partial disability benefits.

There are optional riders as well. However, rider availability is based on the carrier, your occupation, age, etc.

Just like an individual plan, the carrier pays you the benefit directly. You, in turn, use it for your business expenses.

However, there are some minor differences, so now is a good time to discuss the advantages of business overhead expense insurance for business owners.

3 Advantages Of Business Overhead Expense Insurance

There are 3 advantages of business overhead expense insurance. If you are a small business owner, you are in an enviable position. A BOE policy can almost insure your gross revenues. Remember, on an individual disability insurance plan for the self-employed, carriers will insure your net income. (See our article on using the right income for disability insurance for more information.)

There are 3 advantages of business overhead expense insurance. If you are a small business owner, you are in an enviable position. A BOE policy can almost insure your gross revenues. Remember, on an individual disability insurance plan for the self-employed, carriers will insure your net income. (See our article on using the right income for disability insurance for more information.)

The business overhead expense policy, however, insures your business income (most expenses, but not all).

Your net income and your expenses total your gross revenues. If business owners have an individual disability plan and a BOE policy, they can insure their revenues (almost).

How great is that?

But, there’s more to the benefits of business overhead expense insurance.

Let’s discuss the first advantage of a business overhead expense policy.

#1 Premiums Are Tax-Deductible

Yes, the premiums on business overhead expense insurance are tax-deductible on your business taxes.

How great is that?

(Note: you’ll want to pay your individual disability insurance with after-tax money. Trust me, if you don’t and then make a claim, you’ll potentially have to pay tax on your benefit. If you have any specific questions about your taxes and tax impact, you should contact your CPA or tax adviser.)

However, if you make a claim, you’ll have to report that benefit as income.

What, you ask? So, I’ll have to pay tax on the benefit?

Well, no.

That brings us to #2.

#2 The Benefit Is Not Taxable (If Done Right)

You won’t pay a tax on the benefit provided you use the money to pay for business expenses.

Here’s a quick example. Let’s say you are disabled for 12 months. You receive $1,000 each month from your BOE policy. You would (likely) record the benefit as “other” revenue. So, you’d receive $12,000.

You then, in turn, use this to pay $1,000 of business expenses. So, your total expenses would be $12,000.

What is $12,000-$12,000?

Right, it is $0.

This is an easy example, but you can see the benefit is not taxable provided you use it on business expenses.

You mean I don’t need to use it on business expenses?

No. The carrier won’t tell how to use the money.

But, if you want the benefit non-taxable, you’ll use it on your business expenses.

OK, John, well, how much does this all cost?

Let’s discuss that next.

#3 Premiums Are Usually Cheap

Depending on your business situation, and if you are making a business profit, the cost of business overhead expense insurance is generally expensive.

Let’s illustrate this point with the example of a hairstylist.

Her studio rent is $550 per month. She has commercial liability insurance of $20 per month. She has other expenses like utilities and internet of $30 per month. So, $600 per month is the total of her business expenses.

Let’s say she is 30 years-old and healthy. A $600 per month business overhead expense policy costs around $13 per month.

What? That’s all?

Yes. Additionally, it is tax-deductible.

Well, John, my expenses are much higher.

No worries. Usually, a business overhead expense policy is still cheaper compared to an individual policy.

What about me? I’m an accountant with business expenses of $3,000 per month. I’m a 40 year-old female, healthy.

No problem. A business overhead expense policy costs around $66 per month.

That’s about $2 per day.

And…tax-deductible.

Availability & Options Of Business Overhead Expense Insurance

I’m ready to sign up!

Sounds great. But, only a handful of carriers offer business overhead expense insurance.

However, we work with nearly all of them. So, I am sure we can find a policy that fits your needs.

Speaking of needs, let’s discuss some of the options available on BOE policies.

Options Available On Business Overhead Expense Policies

The structure of business overhead expense insurance is like an individual disability insurance policy. A BOE policy usually contains:

- Modified own-occupation definition

- Partial disability benefits

- Presumptive disability benefits

- Minimum 30-day waiting / elimination period

- Guaranteed purchase options – allows you to purchase more coverage if your expenses increase

However, every carrier offering a BOE policy has something different.

However, every carrier offering a BOE policy has something different.

Most carriers offer a maximum 1 year or 18-month benefit period. However, we work with a carrier that offers up to 24 months.

Additionally, a few carriers offer the “true” own occupation definition of disability.

A return of premium option is also available with a couple of carriers. If you never make a claim, you’ll receive your premiums back. You can also receive a “net benefit” if you make a claim, but your claim is less than the total premiums you’ve paid.

There are other options.

Some plans allow a “retroactive injury benefit”. It’s a little outside the scope of this article. However, this option pays an additional benefit if you are totally disabled due to injury.

Moreover, some carriers offer a discount if you apply for a business overhead expense policy and an individual policy at the same time.

Contact us if you would like to learn more or if you have any questions.

Underwriting Of Business Overhead Expense Insurance

We won’t spend a lot of time here because the underwriting for business overhead expense insurance is pretty much the same as that for an individual disability insurance policy.

Just like an individual plan, underwriters review your:

- Health

- Occupation

- Health conditions

- Lifestyle situations

However, instead of insuring your income, carriers insure your business expenses. So, they will want to review your business expenses. Be prepared to share the last 2 years of your individual and business tax forms.

In most cases, the carrier doesn’t require a paramedical exam, urine sample, and blood sample. Unless, of course, you have significant business expenses.

Estimated Premiums Of Business Overhead Expense Insurance

We touched on this earlier. Usually, a BOE policy is going to be cheap.

Moreover, the premiums, as we said, are tax-deductible.

Let’s look at a few situations. We will assume $3,000 in monthly business expenses, 30-day waiting period, and a 1-year benefit period. (Note: as we said in our underwriting section, the true cost is based on your age, health, occupation, and monthly business expenses.)

expenses, 30-day waiting period, and a 1-year benefit period. (Note: as we said in our underwriting section, the true cost is based on your age, health, occupation, and monthly business expenses.)

Male, plumber, 35 years-old: $54.20 per month

Female, physician, 35 years-old: $45.62 per month

Female, hairstylist owner, 45 years-old: $93.61 per month

Male, accountant, 45 years-old: $56.05 per month

Note: the hairstylist cost is more in this example because of age and occupation. Again, we arbitrarily picked $3,000 for comparison purposes.

What’s the commonality with all these? Well, they show that the premiums of business overhead expense insurance are:

- Inexpensive, and

- Tax-deductible

Essentially, the cost of business overhead expense insurance is a cup of coffee at your favorite coffee shop.

Do You Need A Business Overhead Expense Policy?

We have a few business owners who ask me if they need business overhead expense insurance.

They tell me that their business “runs on its own”. I know that’s possible, but they tell me if they are disabled, revenue would still come in.

On the one hand, I don’t disagree. On the other hand, however, it’s far-fetched.

On the one hand, I don’t disagree. On the other hand, however, it’s far-fetched.

Certainly, sure, if a business owner is “hands-off”, he or she may not need to worry about costs in the short term.

However, think about the long term. What if you were diagnosed with cancer (happens to 1 of 3 people on average) and out of work for a year? Will your business really survive?

I always say “yes, you do need a BOE policy” to these owners because of everything we’ve discussed so far. A business overhead expense policy is cheap, tax-deductible, and gives peace of mind.

If you don’t need to spend the benefit money right away, just keep it in your business checking account unless you need to use it.

Here’s another topic. If you are truly a “hands-off” owner, then who is a key employee that generates the revenue for your company. Is that person easily replaceable? Does he or she have a certain and unique skill set that makes a significant difference in your company? In other words, if this person or this group of people were to be disabled, your business would not survive.

If that’s the case, then you need key-person disability insurance on these employees.

Key person disability insurance is outside the scope of this article. Contact us if you have any questions.

Final Thoughts About Business Overhead Expense Insurance

We hoped you found this article informative. Business overhead expense insurance (BOE) is a unique type of disability insurance for business owners. As we discussed, three advantages include:

- premiums are tax-deductible

- benefits are income tax-free (if used properly)

- premiums are usually inexpensive

We went through several examples and also discussed why business owners need this type of policy.

Do you have any questions or need assistance? We are here to help and only work in your best interests. Feel free to contact us or use the form below.

There’s really no risk of contacting us. If we can’t help, we’ll point you in the right direction as best we can. We’ll part as friends, and you can reach out to us any time if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".