Get Ahead of the Curve: 2024 Short-Term Disability Insurance Costs Explained

Updated: April 12, 2024 at 9:38 am

In this article, we are going to discuss short-term disability insurance costs for 2023.

2023.

Disability insurance is an extremely important insurance that most families need. It is the only insurance that will pay a benefit to you if you are sick or hurt and can’t do your job. No other type of insurance does that.

Inflation is still high, money is still tight, and economists predict doom and gloom with a recession. I receive many phone calls from professionals about the costs of short-term disability insurance.

We will discuss all that and other options for short-term disability insurance.

In this article, we are going to discuss:

- Brief introduction on short-term disability insurance

- Costs of Short-Term Disability

- Attributes That Affect Costs

- Based On Everything, Is Short-Term Disability Insurance Worth It?

- Other Ways To Protect Your Family

- Now You Know The Short-Term Disability Insurance Cost (& Other Options)

Let’s jump in and discuss a brief overview of short-term disability insurance.

What Is Short-Term Disability Insurance?

Let’s say you break your hand. You are a plumber. You need your hand to work, right? The doctor says you can’t work, or you can work partially. This is a disability and likely subject to a disability insurance claim. You can’t work!

Let’s say you break your hand. You are a plumber. You need your hand to work, right? The doctor says you can’t work, or you can work partially. This is a disability and likely subject to a disability insurance claim. You can’t work!

There are a few different types of disability insurance, but two of the most common ones are short-term disability insurance and long-term disability insurance.

The largest difference between the two is that short-term disability insurance focuses on those times you can’t work for a short period of time. Maybe you have the flu or you broke your wrist, threw out your back, etc. These situations are potentially short in duration. You are back at work in a couple of weeks or a couple of months.

Long-term disability, however, focuses on those long-term situations: cancer, a severe injury, a stroke, etc. These situations last beyond 3 months. Maybe even 2 years or longer!

A short-term disability insurance plan pays a percentage of your income in case you are disabled and can’t work. The chance of a disability is real. Many industry sources state that the chance of disability is 1 in 4 working adults (link). Moreover, this probability is greater than unexpected death.

While the need for disability insurance is always present, one must consider costs, especially with short-term disability insurance.

Let’s discuss costs next.

Short-Term Disability Insurance Costs

Short-term disability insurance costs anywhere from 1% to 4% of your gross salary, a little more or a little less depending on your specific situation.

That means if you earn $50,000 gross, expect to pay around $500 to $2,000 annually.

Let’s say you are a 30-year-old woman making $50,000 per year. You work as a hairstylist and are otherwise healthy with no health problems.

You want the best short-term disability insurance coverage of 0/7 waiting periods. A “0/7” waiting period means immediate coverage for a disabling accident and a 7-day waiting period for an illness. You also want a year of coverage (i.e. 12 months).

You would receive about $580 per week for $210 per month.

If you wanted a 3-month benefit period, the cost is around $82 per month.

If you wanted a 14-day waiting period instead of “0/7” on that 3-month benefit period, then her cost is around $54 per month.

You can see how short-term disability insurance costs change. The higher the benefit period, the higher the premium. Conversely, the lower the benefit period, the higher the premium. All things being equal, of course.

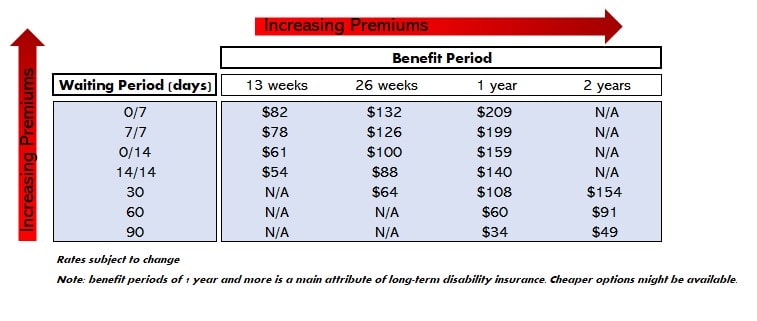

Here is a chart, if you want to “see” the numbers. These are estimated monthly premiums, subject to change.

As you can see, you’ll pay more for a lower waiting period and longer benefit period, all things being equal.

Moreover, if you want a waiting period of 30 days or longer, that is really an attribute of long-term disability insurance. Other, less expensive options which may fit your needs better may be available.

Sounds good, John, but how are these rates determined?

Let’s discuss the underwriting attributes that determine short-term disability insurance costs.

Underwriting Attributes That Impact Short-Term Disability Insurance Costs

Underwriting determines the costs of short-term disability insurance.

We wrote about disability insurance underwriting; however, the article is geared toward long-term disability insurance.

The underwriting for short-term disability insurance is really no different.

Let’s discuss the underwriting factors that determine short-term disability insurance costs.

Occupation

Your occupation determines the costs of short-term disability insurance.

A construction laborer will pay a higher premium compared to an accountant, all things being equal.

Why?

The construction laborer has a higher disability risk from the job. It is that simple.

Health And Age

Obviously, your health and age play a factor. The older you are, the higher premium you’ll pay. Why? You now have a higher disability risk than if you applied 10 years earlier. It is that simple.

Your health matters, too. If you have any chronic issues or current health conditions under treatment, then carriers likely exclude these conditions from coverage. Additionally, moderate to severe conditions may warrant a higher premium.

Your Income

Your income plays a role as well. The higher your salary or net income (if self-employed), the higher your maximum available monthly benefit. The higher the monthly benefit, the higher your premium (all things being equal, of course).

Any Lifestyle Situations

Lifestyle situations play a role as well. Bankruptcies, marijuana use, reckless driving situations, etc. all play a factor in the costs.

Plan Structure

As we showed earlier, a lower waiting period and higher benefit period lead to a higher premium.

Additionally, disability insurance riders increase your premium.

As we discussed in our disability insurance riders article, some riders are worth the extra expense and some maybe you can pass on.

Based On The Costs, Is Short-Term Disability Insurance Worth It?

The cost of short-term disability insurance is anywhere from 1% to 4% of your salary. Other underwriting factors may increase or decrease the premium you pay.

Based on everything we discussed, is short-term disability worth your hard-earned money?

We discuss this question in more detail in a separate article; however, I believe it is not.

Here’s why.

If you are truly interested in a short-term disability insurance plan, your most economical option is a 3-month benefit period. Selecting a higher benefit period really becomes a long-term disability insurance option. There are many carrier options for long-term disability insurance.

If you are truly interested in a short-term disability insurance plan, your most economical option is a 3-month benefit period. Selecting a higher benefit period really becomes a long-term disability insurance option. There are many carrier options for long-term disability insurance.

Let’s go back to our hair stylist table. If she wants the best 3-month benefit period plan and selects the “0/7” waiting period option. If she is disabled, she could receive up to $7,540 in total for those 3 months ($580 per week X 13 weeks).

This $7,540 is a “savable” amount. Do you see that? She can save that amount as an emergency fund. Sure, maybe doing so takes her 5 years, but she can. It is achievable.

Conversely, the prospects of a long-term disability are much more financially damaging. A 2-year benefit period for her could provide over $60,000 in benefits. Now, at a 90-day waiting period (3 months), she would spend $49 per month. That is inexpensive for such a large, potential benefit.

She already has those 3 months saved. Then, if she is still disabled after 3 months, her long-term plan pays a benefit.

Do you see the point I am making? It just doesn’t make sense to purchase short-term disability insurance, unless…

Short-Term Disability Insurance Through Your Employer

…you get it through your employer. If that is the case, then short-term disability insurance might be worth the money.

Why?

Typically, companies will pay for some or all of the premium. That is nice!

Additionally, group underwriting is different than individual underwriting. Without getting too detailed, you spend a lot less on a plan through your employer (if offered) compared to an individual plan.

Group disability insurance plans can be “plain vanilla”. What I mean is that the carriers have to structure the plan in a way to meet the needs of all participants, not just you.

So, carriers limit the riders/options available on group disability insurance plans and, in some cases, plan structure, too (e.g. everyone receives 60% of gross salary up to a maximum monthly amount of $3,000).

However, in addition to a lower cost, group disability insurance plans usually:

- Has no underwriting, so people with moderate to severe health conditions are approved

- Cover pre-existing conditions (yes, that is right!)

- Cover childbirth and maternity leave

Wait, John. Are you saying individual short-term disability insurance plans do not cover childbirth / pregnancy?

Although one plan currently on the market offers very limited benefits for childbirth/maternity leave, many individual plans do not.

So, if your intention for short-term disability insurance is a paid “maternity leave”, you may be disappointed.

Are you feeling positive about short-term disability insurance? Let’s quickly discuss some alternatives for short-term disability insurance.

Alternatives For Short-Term Disability Insurance

Let’s recap what we have discussed so far.

Short-term disability insurance costs anywhere from 1% to 4% of your gross salary, depending on your situation and other scenarios.

Disability insurance underwriting is an involved process.

Short-term disability insurance may not be worth the money. In our hair stylist example, if she wanted the “0/7” plan, she will spend almost $1,000 annually for a $7,500 maximum benefit (over 3 months). Contrast this to a long-term disability insurance policy which provided $60,000 for $600 annually.

Individual, short-term disability insurance usually do not cover maternity leave. Short-term disability insurance through your employer is likely a better option and worth the premium.

So, what are the alternatives for short-term disability insurance that may be a more cost-effective and better use of your hard-earned money? There are plenty. These options are not mutually exclusive and can be established together.

#1 Establish Emergency Savings

As we identified earlier, the most economical way to protect yourself against a short-term disability is to establish emergency savings. If another agent or broker tells you otherwise, you have to question their honesty. Many individual short-term disability insurance plans limit childbirth and maternity coverage.

#2 Enroll In Long-Term Disability Insurance

Long-term disability insurance provides a financial safety net if your disability last longer than 3 months. In our hairstylist example, a long-term plan with a 2-year benefit period provides up to $60,000 for $50 per month.

If you really want some type of “pseudo” short-term disability insurance, you can always apply for a lower waiting period like 30 days.

#3 Life Insurance With Living Benefits

You might be thinking, “Why are you suggesting life insurance when this article is about disability insurance?”

I am not talking about any type of life insurance, but rather those with living benefits.

Living benefits allow the insured to advance the death benefit sooner for the following situations, including, but not limited to:

following situations, including, but not limited to:

- A terminal illness

- A covered illness like cancer or heart attack

- Assisted living, rehab, or nursing home situations

Look at the 2nd and 3rd bullet points. Cancer and heart attacks are likely disabling situations. Same if you need any rehab or skilled nursing care for an injury or illness.

In other words, life insurance with living benefits does have disability insurance attributes.

Now, I would still recommend long-term care disability insurance, but life insurance with living benefits can supplement.

#4 Stand-Alone Critical Illness Plan

Another option is a stand-alone critical illness plan. Some carriers offering stand-alone critical illness plans offer additional illness coverage.

If these plans fit your situation, you will want plans that:

- Last your lifetime and

- Allow you to receive your money back if you never make a claim

Unlike the return of premium plans on life insurance and disability insurance, the return of premium fees with critical illness plans is usually low.

Now You Know The Short-Term Disability Insurance Costs (And Other Options)

In this article, we illustrated short-term disability insurance costs. If you are interested in purchasing a short-term disability insurance policy, expect to pay anywhere between 1% and 4% of your gross salary.

We also discussed if short-term disability insurance is worth your hard-earned money. I wouldn’t say you are throwing your money away, but there are possibly better ways to protect yourself in the short-term while obtaining peace of mind with income protection. We discussed:

- Emergency savings

- Long-term disability insurance

- Life insurance with living benefits

- Stand-alone critical illness plan

Do you need our assistance? Would you like us to talk through your situation and determine what could make sense?

Unlike other agencies, we really don’t have a monetary interest. Our only interest is helping you make the right decision. If that means another solution is viable and we can’t help you, no worries. We will point you in the right direction as best we can.

If that means you want to work with us, great! We always have your best interest, so you can have peace of mind knowing you won’t be “sold” or “pushed” into a product with us. We will gladly discuss your situation and help you any way we can. Feel free to contact us or use the form below to reach out.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

2 thoughts on “Get Ahead of the Curve: 2024 Short-Term Disability Insurance Costs Explained”

Comments are closed.

I had no idea that people who have jobs that are riskier pay more insurance than those who don’t. It makes sense now that I look at it but I had no idea beforehand. This is good to know for anyone who wants to work in a job that is potentially dangerous to their health.

Thanks, Franklin. If you would like more information, just let us know.