Disability Insurance Underwriting Guide: Important Factors You Need To Know To Get Approved Today!

Updated: June 20, 2024 at 10:02 am

In my opinion, there is no disputing how important disability insurance is. Just go to www.gofundme.com to see the pain many people and families experience when a breadwinner is hurt or sick and can’t earn the income they need to continue their lifestyle.

Of course, the solution to many of these situations would be a comprehensive, affordable disability insurance policy. Their lives could have been so much better.

However, if you need disability insurance, you first need to understand how disability insurance underwriting works. Understanding how underwriting works is key to obtaining a disability insurance policy.

We receive phone calls from many people who are interested in disability insurance. However, they are unaware of how their background and health affect their chances of obtaining a policy. They think they can apply, and the disability insurance company approves them the next day.

Disability insurance underwriting doesn’t work like that. It involves various, complex factors.

This guide discusses the important aspects of disability insurance underwriting so you know what to expect during the application process. We will inform, clarify, and set expectations so you can get approved today.

This is a long, comprehensive guide. So, feel free to jump around sections. Here’s what we will discuss:

- What Is Disability Insurance Underwriting?

- Disability Insurance Underwriting Key Factors

- Disability Insurance Underwriting Fails and Pitfalls

- Can Disability Insurance Companies Remove Exclusions?

- Why You Need to Accept a Modified Disability Insurance Policy

- Other Options If You Are Not Approved

- Now You Know How Underwriting Works So You Can Be Approved Today

Let’s get right into it and discuss disability insurance underwriting.

What Is Disability Insurance Underwriting?

Underwriting is simply the process of reviewing and analyzing a specific risk before insuring or undertaking that risk. Any type of insurance goes through underwriting – a mortgage application, auto loans, investment accounts, and, of course, insurance. The underwriter – the person skilled in analyzing the risk – reviews your situation. Specific to disability insurance underwriting, the disability insurance underwriter reviews your:

- medical history

- occupation

- income

- medication

- driving records, felony history, and bankruptcy history

- “fun” activities

- and really, anything else he or she deems material to a decision

The risk, of course, that underwriters measure and analyze is the risk of a disability happening to you. If your situation falls into their underwriting guidelines, they approve you. If not, they will decline your application.

We will discuss these factors next. First, though, let me address something that needs to be said.

The best time to purchase disability insurance is right now. You are the youngest and (probably) the healthiest you will ever be.

Additionally, once you are insured, disability insurance carriers can’t go back to their underwriting and change your plan. (Unless you have a conditionally renewable policy, which is outside the scope of the article). For example, let’s say you have a disability insurance policy. Five years later, you are diagnosed with bipolar disorder. If your bipolar disorder leads to a disability claim, the company pays your benefit. Why? Because you applied and were approved before your diagnosis.

The time to purchase disability insurance is right now.

Now, let’s discuss disability insurance underwriting in more detail.

Disability Insurance Underwriting Key Factors

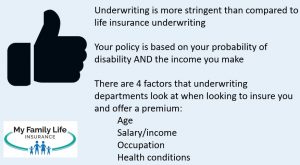

In our opinion, disability insurance underwriting is more stringent than other types of personal insurance, including life insurance and health insurance. Why? The underwriter and the carrier are insuring two things:

(1) your income

(2) your likelihood of disability

Additionally, the factors we introduced previously drive the underwriter’s decision.

Now, I know what you are thinking. “John, there is no way I am going to be disabled.”

As I have said previously, if you know your future, you should not be reading this article. You should play the lottery and win money.

But, you are reading this article…

Do you see what I mean?

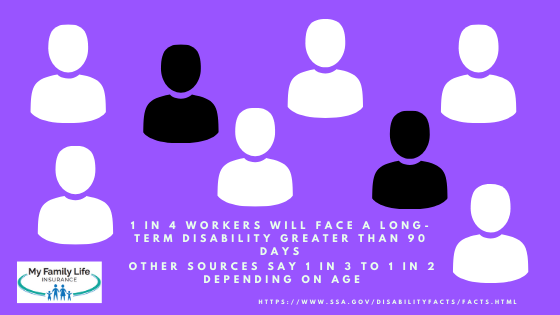

The fact is, 1 out of 4 workers, in general, will face a disability lasting greater than 90 days. That’s 3 months. Do you have enough money to survive that? Moreover, if a disability lasted 13 months, do you have enough money to survive that timeframe? Or 2 years? 5 years? Or more?

Moreover, this statistic isn’t coming from me. It’s from the Social Security Administration.

As we have stated elsewhere in articles, this probability is worse than an unexpected death and even passing away from cancer.

If you understand how the underwriting works for disability insurance, you will be better educated and informed come time for the application.

Let’s discuss in detail these key disability insurance underwriting factors now.

Your Medical History

Your health history matters like any personal insurance (long-term care, life, supplemental health, etc.).

Unlike life insurance underwriting, seemingly innocuous injuries or illnesses could affect the disability underwriter’s decision.

Unlike life insurance underwriting, seemingly innocuous injuries or illnesses could affect the disability underwriter’s decision.

For example, that shoulder injury that laid you up for a couple of months won’t affect your life insurance approval decision. However, the disability insurance underwriter might exclude that shoulder and injury from coverage. Why? Because the injury prevented you from working before. Moreover, a greater possibility exists for that injury to happen again.

Disability insurance underwriters access your medical history in 4 ways (other than what is on the application). (Note: when you sign your application, you give the disability insurance company the right to access your medical and lifestyle history.)

- the MIB

- Milliman Intelliscript

- a telephone call

- your medical records

Both the MIB and Milliman Intelliscript contain medical claims data and diagnosis / treatment codes. Underwriters use this information to match up against what you say in the application.

So, if you were thinking of not disclosing a medical condition, think again. Underwriters have ways of finding out. It’s best to be honest on the application. Underwriters (and your insurance agent) don’t like surprises.

Additionally, some underwriters require a telephone call with you. The purpose of the call is to gain clarity about your occupation or something in your health history. We discuss more about the telephone call later.

Finally, if your information warrants it, underwriters will order your medical records. They will want to know the severity of any health problems you have.

Your Occupation

Your occupation matters in disability insurance underwriting.

Nearly all carriers provide occupation classes from 1 to 5 (or 6) with 5/6 being the best. In other words, the higher the number, the lower the disability risk of your occupation. Moreover, the lower the disability risk…you got it, the lower the premium, all things being equal.

For example, most companies assign a class 1 for the construction worker occupation and a class 5 for accountants. That means if you are a construction worker, you pay a higher premium than an accountant (all things being equal).

Regardless of your occupation, you should still enroll in a policy, even if you have to pay a higher premium. Why? A disability strikes anytime.

While occupational disabilities happen – and they happen all the time – they are not the #1 disability claim. As mentioned earlier, illnesses and musculoskeletal issues cause a majority of disabilities.

Some carriers upgrade your occupation to a higher class depending on your occupation and situation. For example, we work with a company that elevates the massage therapist occupation to class 5 if the therapist meets certain requirements. Nearly all other disability insurance companies classify the massage therapist as a class 2.

Finally, your average weekly hours worked matter. Disability insurance companies generally will insure an applicant who works 30 or more hours per week, which they consider “full-time.” Not many companies insure applicants who work fewer than 30 hours per week.

In other words, if you work part-time, then many companies won’t accept an application.

However, we still have options. We do work with a few companies that offer disability insurance for part-time professionals. We have helped many part-time professionals obtain disability insurance. Contact us if you have any questions.

Your Income / Salary

Of course, your income matters. The higher you make, the higher your premium. It’s that simple.

Is this a bad thing? No! Remember, we insure your income in case you can’t work due to a disability.

Is this a bad thing? No! Remember, we insure your income in case you can’t work due to a disability.

You can always reduce your monthly benefit if you don’t want to pay a high premium. For example, if your income allows you to have a $6,000 per month benefit, but you only want $3,000, then you can do that. The disadvantage is that, although you are paying a lower premium, you are potentially underinsured if you are disabled.

Remember, too, that you need to select the right income for disability insurance underwriting. If you are an employee, your income is your gross salary. Conversely, your income is your net income if you are a self-employed business owner. (Moreover, anything else, such as your salary draw, etc.) Your net income is your gross business sales minus your business expenses. It is your net income located on your business tax schedule. (Schedule C, Schedule E, etc.)

Underwriters may want a copy of your tax returns, W-2, or other financial information to substantiate your monthly benefit. This is called financial underwriting. The underwriters do not want to insure more salary / income than required. Remember that disability insurance companies provide monthly disability benefits in the 60% to 65% range for employees and around 70% for business owners and self-employed individuals. The actual benefit amount they will insure depends on your actual salary or income you make as well as the income limits of the disability insurance company.

Note: unearned income could affect your disability insurance application. Usually, disability insurance companies limit disability insurance coverage.

Your Prescription Drug History

When you submit your applicaiton, one of the first things the carrier does is look up your prescription drug history.

This is private information; however, the carriers have access to it through Milliman Intelliscript.

Temporary prescription drugs probably won’t matter in the application.

For example, if you took an antibiotic 2 years ago, the carrier may want to know what that was for. However, it should not matter unless it is a serious drug.

example, if you took an antibiotic 2 years ago, the carrier may want to know what that was for. However, it should not matter unless it is a serious drug.

Your prescription drug usage is not a secret. Disability insurance carriers rely on electronic data. Do you think you can avoid disclosing medication? No. When you sign the application, you agree to let the carrier review your prescription drug history.

How does your prescription drug history play into disability insurance underwriting? Let’s say you have high blood pressure. However, you forgot to mention your high blood pressure on the disability insurance application. The underwriter sees your prescription drug history. She sees you are currently taking lisinopril. Next, she contacts you to find out more because you answered “no” on the application.

For your information, you don’t want the underwriter to do any more work than he or she has to. Again, it is best to be honest on the application.

Driving Records, Felony History, Bankruptcy History

Your driving records, felony history, and bankruptcy history are also risk factors in the disability insurance underwriting process.

John. Why do these matter? They are not related to my health or occupation.

Well, they are. I think you would agree with me that a person with many speeding tickets or reckless driving citations heightens the chance of an accident, right? Moreover, an accident can lead to a disability. Companies will compensate for this increased risk through a possible rating or even a declined application.

A felony history matters as well. Generally speaking, a felony history indicates unstable situations. If you have a felony or misdemeanor, is that an automatic decline? No. However, underwriters will look at:

- when the felony occurred

- nature of the felony

- if you are currently on parole or probation

- your situation since then

Generally speaking, for severe felonies, no underwriter will approve an application for an individual disability insurance policy. You will have to obtain a policy through a guaranteed issue process (like for small business owners (Link) or a group employer).

Your bankruptcy history also matters, and if any entity subjects you to a lien.

Your “Fun” Activities

All work and no play burns you out, right? We all need extracurricular activities. They recharge us. However, some activities are deemed too risky by insurance carriers. They include, but are not limited to:

- skydiving

- hang-gliding

- motor-vehicle racing

- scuba diving (beyond 100 ft usually)

- rock climbing

- mountaineering

- anything else like this

Depending on the frequency and degree of participation, the carrier will exclude your activity from the policy or decline your application altogether. In other words, if you like to rock climb, any disabling injury from rock climbing is not covered.

your activity from the policy or decline your application altogether. In other words, if you like to rock climb, any disabling injury from rock climbing is not covered.

However, don’t worry here. We have insured MANY professionals who engage in hazardous extracurricular activities. We tell them upfront about the exclusion (see what I wrote earlier).

Sounds good, John, you say. But, what if I join after the policy is issued?

Good question. You are likely covered 100%. However, the carrier will probably investigate before paying a benefit. It wants to see if you participated before the application and lied. Trust me; carriers have ways of finding out. If this is the case, the carrier will deny any disability benefit claim.

However, if not, then no worries.

To summarize: the disability insurance company will likely exclude any current hazardous activities from coverage at the time of application. Any NEW activities performed AFTER the policy is in place are likely covered.

Again, the moral of the story: be honest on your application.

Anything Else?

Could mean a lot of things.

One lately, in particular, is the recreational use of marijuana. While many states have approved the use of recreational marijuana, it is not approved at the federal level. Knowing this, and the risk behind it, carriers usually consider marijuana use as tobacco (i.e. smoker status) and apply a rating, depending on the use.

They will even decline your application for excessive use.

Moreover, while in some cases, your application can go through non-medical underwriting, the carrier may require a urine sample to test your level of THC.

Additionally, carriers will look up your credit and any bankruptcy history. If you have a history of bankruptcies or severe credit issues, carriers will decline the application.

Tests The Carriers May Want to Confirm Your Health

While underwriters can get a good idea of your health through your MIB and Milliman Intelliscript reports, they also may require testing or medical exams.

A common medical exam that carriers may require is the paramedical exam. A paramedical exam is like a mini-medical examination or physical. It provides additional information that goes beyond the MIB and Milliman Intelliscript.

An examiner will come to your residence or work, if you prefer. (Note: some exam companies have locations where you can make an office visit appointment.) The examiner will conduct the following:

- measure your height and weight

- take your pulse

- take a blood pressure reading

- ask you the health and medical questions again

- obtain a blood sample

- obtain a urine sample

Underwriters may do this because:

- the monthly disability coverage applied for exceeds non-medical underwriting requirements

- they see something in your background information that needs clarity

It is nothing to worry about if the underwriter requires a paramedical exam. As long as you disclosed any pre-existing conditions, then there should be no surprises to your insurance agent or the underwriter. (Remember, underwriters don’t like surprises!)

The Phone Call

Many underwriters nowadays require a telephone interview with an applicant rather than ordering medical records or a paramedical exam.

In my experience, underwriters will ask for a phone interview if:

- you have medication in your prescription drug history which has a dual purpose

- the underwriter needs clarity on a current or prior medical / health condition

- something doesn’t jive with what you said on the application versus what is indicated on the MIB, prescription drug history, or other reports

- clarity on your occupational job duties

The telephone interview is nothing to stress out about. Usually, a 3rd party service trained in telephone underwriting conducts these interviews. The phone call can take 10 minutes or less.

The telephone interview is an important part of the underwriting process. However, if you are honest and transparent on the application, you can probably avoid the need for a telephone call.

How Pre-Existing Conditions Affect Disability Insurance Underwriting

Let’s discuss pre-existing conditions and the role they play in the disability insurance underwriting decision.

Generally speaking, if you have been diagnosed or treated for any health condition, the carrier excludes said health condition from coverage.

So, for example, if you are taking Wellbutrin for depression, the carriers will exclude mental or nervous disorders from coverage.

What, John?! That is wrong!

I understand. But, from the carrier’s perspective, it is not.

Think for a moment. If you were a disability insurance carrier, would you cover pre-existing conditions on someone?

Probably not, unless you want to charge a lot of money and you would have to.

No one would pay those premiums, and you’d be out of business.

Additionally, if you have a chronic condition that is managed well with your physician team, do you think that condition will cause a disability?

Yes!

The right answer is you don’t know. A million ways a disability happens. It’s not just from your pre-existing condition. Yet, we tend to only focus on the pre-existing condition.

However, let’s think about pre-existing conditions in more detail. Let’s say you have chronic back problems. Your doctor manages your back problems well, and you work just fine.

I bet the chances of a cancer diagnosis, injury, or another type of illness have an equal, or even better chance, of a disability rather than your managed illness or back problems.

See what I am saying?

Again, anything can happen anytime and a million ways exist for a disability to happen.

If you want to protect your family and loved ones, which is the main purpose of disability insurance, you will simply have to get around the pre-existing condition situation.

You can read more in our pre-existing conditions guide and contact us if you have questions.

Disability Insurance Underwriting Fails And Pitfalls

We have helped many white, blue, and gray-collar professionals obtain disability insurance.

We have seen almost every underwriting scenario and situation.

We’ve encountered many fails and pitfalls. You need to be aware of these. These probably won’t lead to an application decline. However, they will lead to adjusted benefits and/or exclusions.

If these scenarios apply to you, that’s no need to ignore disability insurance. Just be aware of these possible exclusions and limitations.

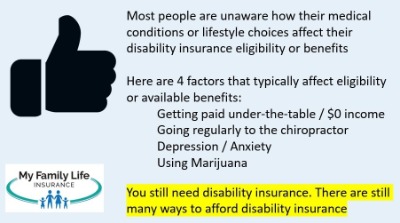

You Get Paid Under-The-Table

Carriers insure income. We addressed income earlier. If you get paid under the table, you are out of luck.

To obtain disability insurance, you must show earned income through a W-2 or positive net income through your tax returns.

If you make no money or get paid under the table, I’m sorry. You don’t report it, so the money isn’t insurable.

It’s no problem, John, you say. I just won’t provide the information.

Well, think again.

Let’s say you get paid under the table. You trick the carrier, and they issue a policy.

A year later, you get in an accident. You file a disability claim, and the carrier requests your income tax return or proof of salary.

Uh-oh…

If this happens, you may be out of luck.

Moreover, they may even cancel or rescind your policy.

If you are serious about disability insurance – and you should be – the remedy is simple: Record your income properly.

You Go To The Chiropractor

Seems benign, right? You routinely go to the chiropractor for a spine adjustment. It also feels good. There’s nothing wrong with your back, of course. You also go for wellness.

That’s not how carriers see it.

Every application has a question like this:

“In the past 5 years, have you ever consulted another healthcare provider, chiropractor, therapist, counselor, psychiatrist, or psychologist?”

Here is the carrier’s point of view: Chiropractors are doctors, right? Why would you go? For fun? Nah…

Carriers say there must be a problem with your back.

In other words, you have a back and spine issue. Most carriers simply apply a back and spine exclusion to your policy.

However, you don’t see it that way. You go to the chiropractor because it keeps your back strong. You feel it prevents a back disability from happening.

So, first, let’s just say, in general, that chiropractor visits lead to a back and spine exclusion.

However, a few carriers have taken a more lenient approach to chiropractic visits.

If you only go a few times a year, just for “maintenance” and no documented back issues, a few carriers won’t exclude coverage.

However, if you go a lot, let’s say more than 6 times per year, carriers will exclude your back and spine from coverage.

That is just how it works. Think about it. If you go about 12 times a year, that is 1 time per month. That is a lot. Anyone would think you have a back or spine issue, even if you like going and the adjustment feels good.

Contact us, let us know your occupation, and we can help.

You Have Documented Depression Or Anxiety

This is a tricky area. We receive many phone calls from folks who take first-line medication for depression and/or anxiety. The pandemic hasn’t helped, either, with a significant increase in depression and anxiety in young adults.

We are always upfront. What I tell them is that nearly all the carriers limit your benefit to a 90-day waiting period / elimination period and a maximum 5-year benefit period.

Additionally, they place an exclusion. Any disabilities arising from any emotional or nervous disorder aren’t covered. This includes substance and drug abuse.

Usually, the carriers don’t budge.

Why is that? That doesn’t seem fair…

Same here. I understand. I have spoken to nearly all of them about it. Rather than try to explain here their reasons (as it gets really detailed), contact us, and I am happy to discuss.

But, John. I am prescribed anxiety medication to help me sleep only.

Doesn’t matter. If you are taking anxiety medication to help you sleep, then you have anxiety. That’s the way carriers see it. If it’s hard for you to fall asleep, and you need medication to help you with that, then that is anxiety and an exclusion.

This is another example of stringent disability insurance underwriting. With life insurance, a first-line medication for controlled anxiety and/or depression is no big deal. However, remember, carriers are insuring your chance of disability.

As an aside, we have helped many people maneuver this situation and still have disability insurance. Please see our topic on removing exclusions below for more details.

You Smoke or Use Marijuana

As of this writing, getting life insurance with marijuana use is no big deal.

However, this is not the case with disability insurance.

I can write an entire blog about disability insurance and marijuana use.

Many disability insurance carriers will decline an application from someone who uses marijuana.

Sure, it might be legal in your state. But, it is not on a federal level.

This is an evolving scenario. I predict carriers will be more lenient with people who use marijuana. However, currently, there are a few carriers that will insure people who use marijuana. But, at tobacco use rates.

John. That’s OK, you say. I will just hide the information.

Think again. If you file a disability claim, and the carrier finds out you are a marijuana user, likely the claim is denied.

Listen, we have helped people who use marijuana obtain disability insurance. We can help you, too. Just contact us.

You Withhold Important Information

I am seeing this pitfall often nowadays.

If you work with me, I usually will send you a pre-qualifying questionnaire. I need to know your health and lifestyle history to properly educate you on the underwriting expectations.

Additionally, if you have health or lifestyle conditions, I can contact underwriters and find out what they think about your situation before you officially apply. That way, we know what to expect beforehand. It saves everyone a lot of time and effort, especially if underwriters would ultimately decline your application. Wouldn’t you want to know expectations beforehand if the underwriters would have declined your application anyway?

Which unfortunately happens. I have had clients withhold important medical information from me and the underwriters. In other words, they did not disclose significant medical history on the application. We go through the entire underwriting process, and they are declined. Remember that I said that underwriters don’t like surprises? If I had known about these situations, I could have pre-qualified the applicant, spoken to underwriters about insurability, and possibly could have gotten them some coverage.

Can Carriers Remove Exclusions In Disability Insurance Underwriting?

The short answer. Yes!

However, it is not that easy.

Moreover, the ability to remove exclusions depends on the situation. It’s possible, though.

Here’s a real story. A doctor prescribed a client of ours anxiety medication during her college years. Our client felt anxious about school, etc. So, the doctor prescribes medication.

She’s out of school now and contacted us about disability insurance.

Of course, we explained how carriers underwrite people diagnosed with anxiety. In her case, however, she and her doctor felt that it was a one-time situation. Our client hadn’t taken the medication for a while, either.

In her case, the carrier placed the 90-day/5-year benefit period with the exclusion. However, the disability insurance company agreed to review this exclusion in 2 years. If the client did not have the prescription filled during this timeframe, has no symptoms, and is under her doctor’s care, then the company would remove the exclusion.

So, yes. Exclusions can be removed. However, you will need to show the reason behind the exclusion, which is no longer an issue.

Some exclusions probably could never be removed. These are moderate to serious illnesses like bipolar disorder, rheumatoid arthritis, alcoholism, etc.

Why A Modified Policy Is Better Than No Policy

As stringent as disability insurance underwriting is, we have been able to help people with moderate to serious health conditions. We have helped people with bipolar depression, moderate anxiety, previous cancer diagnosis, and more.

When you work with us, and you have a unique situation, we contact the underwriters directly and discuss your situation. We don’t give them your name or anything like that, so your personal information is safe.

However, you may be thinking,“@$^# this! I’m not going to go through this!”

Well, you may be doing a disservice.

Remember, who is behind this disability insurance? Well, it is you. And then your family, and then your life.

If you are disabled, and can’t work, how will you pay your bills?

Well, will you tap into retirement savings – and destroy your future?

Will you sell your home – and destroy your future?

Will you rack up debt – and destroy your future?

Do you see what I am getting at? There is no good alternative except for taking a modified or rated policy that will still pay a percentage of your income. The peace of mind is invaluable.

Yes, there is John, you say. I will just invest!

So, FYI, I am a CFP® Professional, and I know how hard it is for people to save. Be honest with yourself, will you? I doubt it.

Just look at this example.

The Math – How Savings Doesn’t Work

Even if you dedicated yourself, the savings amount is insurmountable.

For example, let’s say you are eligible for a $5,000 monthly benefit, 5-year benefit period. You make $90,000 per year. You are age 45. The premium is $132 per month.

However, because of health conditions, the carrier rates you, and your premium is now $210 per month for the same $5,000 benefit. Is it a good deal? Absolutely! Let’s put some math behind it.

In that 5-year benefit period, you are insuring up to $300,000 of income ($5,000 per month X 12 months X 5 years). That’s a lot. Think about how your life changes having that safety net.

The obvious non-math answer is: if you were disabled tomorrow, do you have $300,000 dedicated (not your home or retirement) to support you? The answer I know is “no”. (This is why it makes sense to take a modified policy). But on with the analysis…

Results

Do you know how long it will take to insure your income by investing? At $132 per month and a conservative 5% annual return (why would you put risk if you need this money), it will take you 47 years to save $300,000 at $132 per month!!!

Do you think you will do better by saving $210 per month?

No.

It will take you only 38 years.

And, what will you do if you are disabled with no policy?

Just for your knowledge, let’s say you dedicated to saving $300,000 in 10 years as a disability fund. So age 55 through your retirement age, you have some protection in case of disability. At a 5% annual return, you will need to save almost $2,000 per month! That is $24,000 per year and probably 1/3 of your take-home pay. Yikes!

Let’s say you only have that $210 to save, well, you need an annual return (over 10 years) of 40% each year. That is just not going to happen unless you are extremely speculative with your money.

The math doesn’t work. Taking a modified policy is the right choice.

Back To Accepting A Modified Policy

This is the reason why you need to take a modified policy. You don’t know when you will be disabled. Additionally, it takes a very long time to save that money, if you even can.

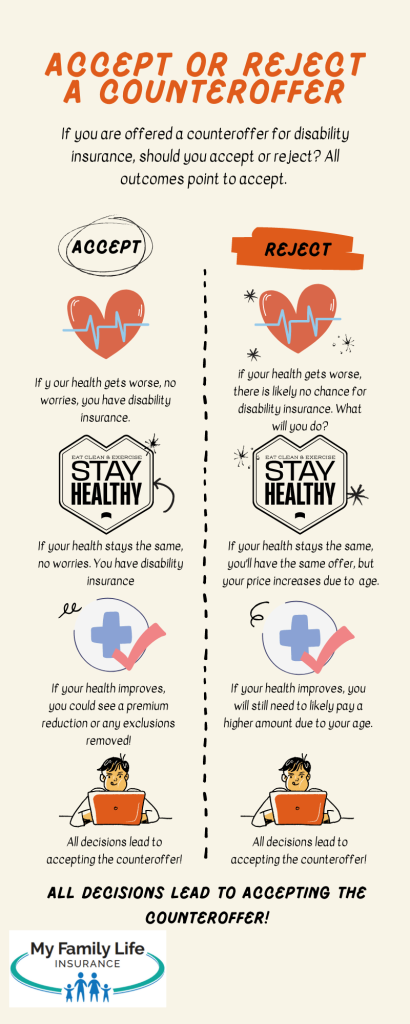

Here is a succinct illustration, which shows your options if you accept or do not accept a modified disability insurance policy. All points to accept.

What If I Am Declined For Disability Insurance?

What if you go through the underwriting process, and you are still declined for disability insurance? You still have options. (Note: we really don’t let our clients go through all that first. If you have moderate to serious medical conditions, we tell you and/or contact the underwriters for eligibility.)

However, if you are declined for disability insurance or seeking other options, let us know. We have helped people with alternative options for disability insurance. Although these options are not ideal, they will provide some benefits.

These options include critical illness insurance and hospital indemnity insurance. Additionally, we do offer guaranteed issue disability insurance based on your situation.

If you are a business owner, we do have guaranteed issue disability insurance options.

Now You Know How Disability Insurance Underwriting Works So You Can Get Approved Today!

We hope this article explained the disability insurance underwriting process better and how to get approved today!

Although the underwriting is more stringent, there is nothing to worry about or fear. We help you along the way.

Now that you are aware of disability underwriting, are you ready to take the next step? Contact us or use the form below if you would like our assistance in helping you find the right disability insurance policy. As we mentioned earlier, we have helped many individuals, even those with health conditions, obtain important disability insurance. As with everything we do, we always have your best interests.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".