5 Reasons Why Association Disability Insurance Plans Can Be A Waste Of Money | Usually; We Give You The Inside Information So You Can Make An Informed Decision

Updated: April 12, 2024 at 9:39 am

If you are a professional and a member of an association, you’ve probably received information in the mail about your association’s disability insurance.

If you are a professional and a member of an association, you’ve probably received information in the mail about your association’s disability insurance.

You don’t have any yet, and you are aware of how important disability insurance is.

So, you think, why not?

You download the application, fill it out, submit it, and pay the first month’s premium.

You are happy, until you make a claim. Then, you don’t receive the benefit you expect.

In this article, we discuss why association disability insurance plans are potentially a waste of money.

How do we do that? Well, we do go over the advantages. We would be remiss if we did not do that.

And, yes; there are advantages.

However, there are some major issues, too. We discuss the disadvantages. Specifically, 5 reasons (and a bonus) why your association’s disability insurance plan probably isn’t very good.

Here’s what we will discuss.

- The Structure Of Associations Disability Plans

- Advantages of Association Disability Plans

- 5 Major Reasons Why The Association Plan Is A Waste Of Money

- Are There Any That Are Good?

- What Should You Do?

- Final Thoughts About Association Disability Plans

Let’s jump into the structure of association disability insurance plans.

Structure Of Association Disability Insurance Plans

There are hundreds of associations here in the United States. To be clear, in this article, I am discussing professional associations. Occupation groups form these professional associations. The largest professional associations in the US include the National Association of Realtors, the American Bar Association, and the American Institute of Certified Public Accountants.

However, there are hundreds, if not thousands, of professional associations here in the US. I am sure your occupation offers an association.

The purpose of a professional association is to advance, advocate, support, and further its occupational profession in society.

They do this in a number of ways. They also obtain and retain members by offering beneficial programs. One common program is insurance. Many professional associations offer several insurance options, including disability insurance.

The structure of an association disability plan is a bit different than an individual plan. Let’s introduce the 3 main players in association disability insurance.

The Main Players In Association Disability Insurance

There are 3 main players in an association’s disability insurance program.

The first is the association itself. The association, you can say, oversees the program and promotes it to its members. The association can make changes to the third-party administrator or the underwriter. These are the 2 additional players in your association’s disability plan.

The third-party administrator manages the billing and customer service of the  program. They also facilitate (note: not approve) claims payments. When you call the 800 number for the association’s disability plan, you are calling the administrator, not the association itself, and certainly not the underwriter. Cerner is an example of a third-party administrator.

program. They also facilitate (note: not approve) claims payments. When you call the 800 number for the association’s disability plan, you are calling the administrator, not the association itself, and certainly not the underwriter. Cerner is an example of a third-party administrator.

Finally, we have the underwriter. The underwriter approves or declines applications for disability insurance. They also approve or deny the claims requests. Common association disability insurance underwriters include The Hartford, New York Life, and MetLife.

When you pay your bill, you are paying it to the third-party administrator. If you need to make a claim, you call the same third-party administrator. They will then mail you the claim information from the underwriter.

Your association oversees all of this and determines the viability of the program. They can make changes to the plan as well. (For example, implement a new third-party administrator, new underwriter, or terminate the program altogether.)

Advantages Of Association Disability Insurance Plans

Yes, there are advantages of association disability insurance plans. If you have spoken to me or read my other articles, you know I say there are advantages and disadvantages to every type of insurance. No insurance is “perfect”.

The same is true here.

However, association disability insurance plans do have advantages, and we discuss them next.

The Premiums Are Usually Cheaper

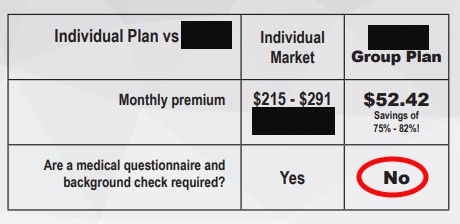

Most associations promote how inexpensive their premiums are compared to an individual, private plan.

Just check out this excerpt from an association.

It’s true; association plans are usually cheaper. However, there is a reason for that. We will get into that more later.

Some associations say that they compile all the members as a “group”, which lowers the risk, and they can pass on those savings to members.

That may have some validity. However, the main reason is your association’s plan is likely much different than an individual plan.

All I can say, it’s important to compare apples-to-apples between plans or “look under the hood”.

That’s the purpose of the article. Consequently, you will see just why association disability insurance costs less than an individual plan. (Note: as an aside, you can see I circled the “no” in the snapshot. Contrary to what the association states here, you do have to answer health questions and go through a background check.)

Underwriting Is Usually Simple

If you’ve read my article on disability insurance underwriting, you know that the underwriting process is more stringent than life insurance underwriting.

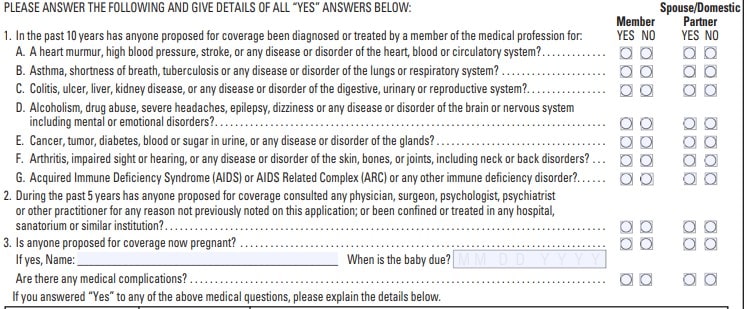

However, association disability insurance applications keep things simple.

For sure, you have to answer health questions. However, there aren’t that many compared to an individual plan. See the excerpt here.

Additionally, the program doesn’t usually require a paramedical exam, blood sample, or urine sample. So, that is good news.

Additionally, the program doesn’t usually require a paramedical exam, blood sample, or urine sample. So, that is good news.

Individual disability insurance plans, however, typically require a paramedical exam, with blood and urine. Recently, though, many carriers have moved away from paramedical exams and all that.

Moreover, as you can see on the snapshot, you can include your spouse on the same application.

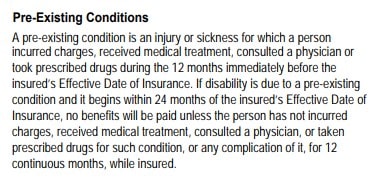

Coverage For Pre-Existing Conditions (Usually)

This is a unique advantage. Nearly all association disability insurance plans will cover a pre-existing condition. See this excerpt:

If you’ve read our article on disability insurance underwriting, you know private, individual plans will exclude pre-existing conditions. (However, carriers can remove some exclusions. Contact us to discuss your options.)

If you’ve read our article on disability insurance underwriting, you know private, individual plans will exclude pre-existing conditions. (However, carriers can remove some exclusions. Contact us to discuss your options.)

While covering pre-existing conditions is a nice advantage, it probably doesn’t make much of an impact when you look at the overall picture.

And, that brings us to the disadvantages.

5 Reasons Why Association Disability Insurance Plans Can Be Waste Of Money

At this point, you may think I am completely against association disability insurance plans. I am not. I want to stress here that I take a balanced approach to insurance. As a CFP® Professional, I hold to fiduciary duty. I put your interests before my own (and that’s how it should be).

However, I’ve seen so many association plans that lack the foundational structure that protects your income. The main reason is that the association needs to keep the plan “plain” to support all the members and keep costs low. Keeping costs low attracts members, of course!

So, this is the basis of the article: To make you aware of the drawbacks. You can then make an informed decision and see what is right for you.

In my professional opinion, these drawbacks keep your association’s disability insurance premiums low.

So, let’s discuss the disadvantages of the association disability insurance plans.

Limited Own-Occupation Coverage

An important disability definition that most occupations need is the own-occupation definition. There are a few modifications of this definition, which is out of the scope of this article. However, the essence of these definitions is that you will receive a benefit if you can’t do your own occupation even if you can do another job.

For example, let’s say you are a dental hygienist. You hurt your arm and can’t work. The carrier pays you a benefit because you can’t do your own occupation even though you could work in telemarketing or something else.

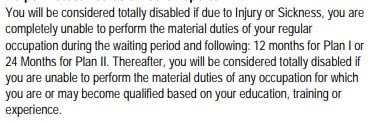

Many of the association disability insurance plans offer the own-occupation definition, but only for 2 years. See the excerpt.

This means if you are still disabled after 2 years, the association policy reverts to the any occupation definition. This means the carrier stops paying you a benefit if you can do any job suited by your skills, education, and experience.

That kind of stinks (well, it really stinks), especially if you have a specialized occupation like a dental hygienist, podiatrist, surgeon, auto mechanic, etc.

Most disabilities are around 18 months (direct from the claims departments I speak with; not the stats flying on the internet). So, it is probable your association plan will cover, but do you want to take that chance?

Individual disability insurance plans offer the favorable “true” own-occupation definition for your benefit period, giving you peace of mind.

Limited Partial Disability Benefits

I am floored how many association plans do not have this important benefit. Essentially, partial disability benefits allow you to receive a benefit if you can’t work full-time. In other words, you can work part-time, but not full-time.

Admit it; when you think of a disability, you think of someone who can’t do his or her job in their full capacity, right? Maybe someone in a wheelchair or someone bedridden. In other words, someone on full or total disability receiving their total benefit.

Fact is, many disabilities are partial disabilities, and many disabilities can start out as a partial disability. Multiple sclerosis, chronic injuries, and emotional disorders are all examples of health conditions that may start out as a partial disability. There are many more.

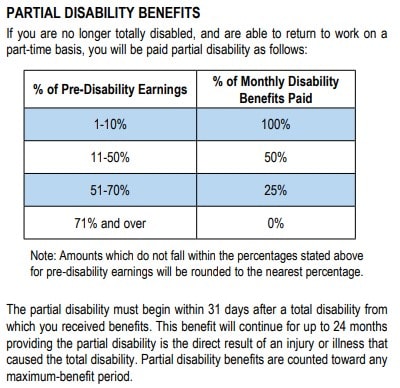

Look at the fine print of your association plan. Do they include a partial disability? If they do include a partial disability benefit, sometimes that benefit won’t pay until you’ve received a total benefit first. In other words, you have to return to work recovering from a total disability first.

See the excerpt here.

But, what if your doctor says you can work, but not full-time? Take Multiple Sclerosis. You could be on a partial disability for years before you receive a total disability benefit.

Do you see the issue?

Individual disability insurance plans don’t have this issue. If you are partially disabled and still working, individual plans pay a pro-rated share of your total benefit. That’ll help pay the bills as you will have a loss of income, going from full-time work to part-time work.

Additionally, individual plans allow you to receive your partial disability benefit for your entire benefit period. You can see here with the association plan, partial benefits are payable up to 24 months.

Coordination With Social Security (And Other Insurances)

Do you like to coordinate?

On get-togethers with friends, yes!

However, when it comes to disability insurance, the answer should be “no”.

Many individual disability insurance plans offer an option to coordinate your benefit with social security, workers compensation, and other state/government benefits.

This coordination lowers the risk on the disability insurance carrier. And…

…whatever lowers the carrier’s risk, usually lowers your premium.

That’s what happens here. If you receive an additional benefit from elsewhere, the carrier reduces its own payment to you.

Some carriers call this a “social offset”. Carriers use different terminology for this offset provision.

But, whatever they call it, it’s all the same. If you have a coordination provision with your association’s disability insurance, you’ll receive a lower benefit.

Sure, maybe you are OK with that. But, is it worth the hassle?

No Guaranteed Purchase Options

If you’ve spoken to me about disability insurance, you know I believe in 3 key provisions which makes a formidable disability insurance policy (at a minimum):

- Own-occupation definition

- True partial disability benefits (without a total disability requirement)

- Guaranteed purchase options

Guaranteed purchase options (or future purchase options) allow you to purchase more disability insurance as your income grows. The kicker is that there is no additional health underwriting required.

your income grows. The kicker is that there is no additional health underwriting required.

Really, you ask?

Yes. First, the carrier approves your initial policy. Then, you can buy more disability insurance per the provisions in your individual contract.

Even if I’ve been previously disabled?

Yes. Let’s say Joe had cancer 3 years ago. He received a disability benefit for 1 year. He is now back at work and not receiving disability benefits. His income has grown by $15,000 in those last 2 years. Per the provisions of his disability insurance policy, he can purchase more disability insurance. The carrier requires no additional underwriting except to support the salary growth (W-2, tax schedule, etc.).

He can currently have diabetes, rheumatoid arthritis, multiple sclerosis, emotional disorders, or enthusiastically partake in an extreme, hazardous sport like skydiving. He’ll then get the additional insurance, provided his income increased.

How great is that?

Unfortunately, most association disability insurance plans do not have this valuable option.

If you want to increase your benefit due to an increase in your salary or your net income, you will have to reapply.

That’s no big deal if you are healthy. But, what if you aren’t now? Then, the carrier can rate your new policy or decline it altogether.

Additional Benefits Unavailable

Association disability insurance plans usually do not offer additional benefits.

You see, they have to keep the plan “plain” in order to meet the needs of all.

However, with an individual disability insurance policy, you’ll have a wide range of options.

Popular options include:

- Catastrophic disability benefit coverage

- Enhanced partial disability benefits

- Mental/emotional disorder benefit period extension

- True or Pure own occupation definition

- Return of premium rider

- Non-cancelable contract

And, more.

If you have an association disability insurance plan, you likely won’t have any of these options.

A notable omission in most association disability insurance plans is the non-cancelable contract. This provision prevents the carrier from increasing your rates and/or changing the provisions of the plan.

This can be important for many occupations. In other words, the association disability insurance carrier can change the provisions of the contract.

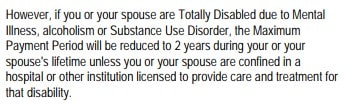

Additionally, you likely have a 2-year benefit limitation for mental/nervous disorders (anxiety, depression, etc.) on your association disability plan. Moreover, this limitation includes disabilities from drug or alcohol abuse.

Additionally, you likely have a 2-year benefit limitation for mental/nervous disorders (anxiety, depression, etc.) on your association disability plan. Moreover, this limitation includes disabilities from drug or alcohol abuse.

However, individual plans allow you to receive a benefit for these disabilities for your entire benefit period. (That is, 5 year, 10 year, or to age 65 – whatever benefit period you select).

Again, as we said earlier association disability insurance plans keep the plan “plain vanilla” to attract members and keep costs low.

Many of these options are valuable. Do you want to bypass them for potentially lower and limited benefits? Sure, your premiums are lower. Hopefully, however, we have shown you why the premiums are lower.

Bonus…One More! Your Premiums Increase

I can’t believe I forgot this one. Here’s one more, to make 6 reasons instead of 5.

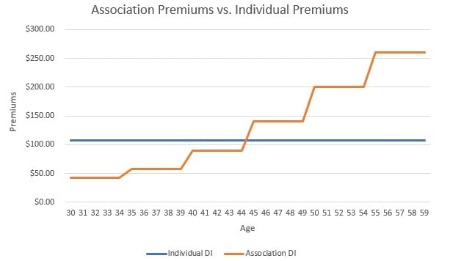

A notable difference between association disability insurance plans and individual ones is that associations increase your premium every 5 years.

Do you want your premiums increasing every 5 years coupled with everything we have discussed so far?

Moreover, these premiums can follow the shape of a staircase.

Sure, the association disability insurance premiums are cheap to start.

But…

Check out this graph I put together. It shows the premiums for an association disability insurance plan versus a comparable individual policy, both in age, occupation, and benefits (as best we can).

Check out this graph I put together. It shows the premiums for an association disability insurance plan versus a comparable individual policy, both in age, occupation, and benefits (as best we can).

These premiums are taken right from the association’s brochure. As you can see, you pay the same premium on an individual plan.

Sure, you save money on the association plan…initially. Let’s deconstruct these premiums further.

Over the 30 years, you will have spent $38,600 on the individual plan.

Wow, John, that is so much, you exclaim!

Yes, however, you will have spent $47,400 on your association’s disability plan!

What!

Sure, premiums might be lower, but you will be spending more money in the long run. Moreover, you are potentially spending money on a plan that offers limited benefits.

Well…Are There Any Association Disability Insurance Plans That Are Good?

Well…no, at least not in my opinion. I know if I am disabled, I want to make sure I have the favorable and formidable contract provisions which allow me to receive a benefit.

But, there are a few association plans that I’ve seen that have a good foundation of coverage for its members.

One that I’ve seen is the ADA – American Dental Association. Their offering seems to be a solid plan.

However, it wasn’t that long ago that the ADA’s plan was, in my opinion, pretty lousy. Just search google, and I am sure you will see writings about it.

Notably, it included that awful partial disability limitation we discussed earlier. However, their new plan gives you the option to purchase a rider that allows you to receive partial benefits before a total disability.

They state their policy is noncancelable.

They also have other optional benefits.

Additionally, they contain a drawback which we did not discuss – limited monthly benefits. You can only insure up to $180,000 of income. If you earn higher than this amount and want full coverage, you’ll have to seek an additional plan.

I am sure they might have other drawbacks not discussed here. Another general drawback of association disability insurance plans is that the disability during the waiting period must be consecutive days. So, if you don’t work for 61 days and then work on the 62nd day, your waiting period starts all over again.

This brings us on what you should do.

What Should I Do?

This might sound strange, but you should contact your association’s disability insurance plan and get some information.

It’s important that you understand all the options you have.

However, it’s extremely important that you compare apples-to-apples as best you can.

In a majority of cases, you will likely find that an individual plan is a much better fit with much better protection.

Sure, an individual plan costs more…initially. So? You are likely getting much better protection compared to your association’s plan.

Moreover, I just showed where you are likely to overspend on your association’s disability insurance in the long run.

Additionally, your individual plan may not cost as much as you think. We routinely help our clients obtain affordable disability insurance. Most times, the cost is about a cup of coffee per day.

Additionally, your individual plan may not cost as much as you think. We routinely help our clients obtain affordable disability insurance. Most times, the cost is about a cup of coffee per day.

Most importantly, we are transparent. So, what else should you do? Contact us and let us know how we can help. I am happy to review your association’s disability insurance plan and describe the benefits and drawbacks. You see, as a CFP® Professional, I hold fiduciary duty. This means I have to place your interests before my own. And, I do.

If your association’s plan is strong and formidable, I’ll tell you that. If not, I’ll tell you that, too. We’ll compare your options, and then you can make a decision.

Now You Know The 5 Drawbacks Of Association Disability Insurance Plans

We hope you learned a lot in this article to make an informed decision. That is our goal.

Are association disability insurance plans right for you? Well, we outlined many drawbacks regarding these types of plans.

What to do next? The best thing to do is compare your associaiton’s disability insurance option to an individual one.

Likely, you will see the individual one provides more protection for you and your family.

We showed that a comparable individual plan will cost less in the long-run. Moreover, you will have many options on your individual plan. These options strengthen your policy benefits upon disability.

How can we help? We are happy to review your association’s disability insurance plan and offer our recommendation.

So, what to do next? Contact us or use the form below.

We only work in your best interest. As a CFP® Professional, I hold fiduciary duty. I am not going to force you one way or another. At the end of the day, you decide is best for you and your family.

If you decide the association plan is better for your situation, no worries. We will always part as friends, and you can reach back out to us if your needs change. This is the only way we know how to work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".