Why The Disability Insurance Benefit Period Is Important To Understand | We Discuss In Detail This Often Overlooked Component Of Disability Insurance

Updated: April 12, 2024 at 9:39 am

Many professionals I speak with confuse themselves about the disability insurance benefit period.

Many professionals I speak with confuse themselves about the disability insurance benefit period.

They read incorrect information elsewhere about the benefit period. Or, they speak with another agent who tells them the wrong information.

The benefit period is more complex than you think. We discuss everything about the disability insurance period here.

You’ve come to the right place. I’ve been educating professionals like yourself about disability insurance for over 10 years.

Not all, but some agents and brokers think they can just “sell it” and move on.

So many moving parts exist with disability insurance, that this approach is the wrong approach. It is a disservice to you and your hard work.

Here’s what we will discuss:

- What Is The Benefit Period And Why Is It Important To Understand

- Comparison Cost

- Different Benefit Periods Exist!

- How Carriers Limit The Benefit Period

- Difference With Group / Employer Benefit Period

- FAQs About The Benefit Period

- Recap Why The Benefit Period Is Important To Understand

Let’s jump right in and discuss the disability insurance benefit period and why it is important to understand.

What Is The Disability Insurance Benefit Period And Why It Is Important To Understand

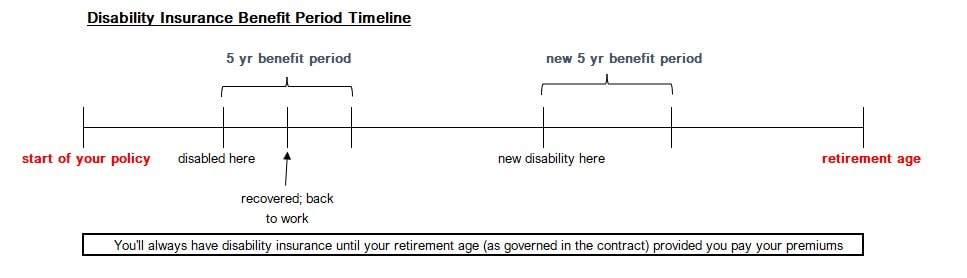

The disability insurance benefit period is the maximum length of time (i.e. period) that you will receive a disability benefit for 1 claim.

It is that simple.

No, John. Another broker told me it is the length of time the policy is in force.

I’m sorry, but what the broker told you was incorrect.

The benefit period is the maximum amount of time you can receive a disability benefit (i.e. money if you can’t work due to illness or injury).

Many people and agents think the benefit period is the length of the contract.

That is untrue.

The benefit period is the maximum length of time (i.e. period) that you will receive a disability benefit (i.e. money) for 1 claim.

Once you’ve been approved, you’ll have disability insurance until you are at full retirement age (that means around age 65 or 67). Note: some carriers allow coverage up to age 70 and those that do, increase your premiums each year from your full retirement age.

So, to recap, the disability insurance benefit period is the maximum amount of time that you will receive a “money” benefit for 1 claim.

Some examples will make this all clear.

Examples Of The Disability Insurance Benefit Period

For example, let’s say you have a 5-year benefit period. (Note: we will discuss all the benefit period options in a minute.)

You are then diagnosed with cancer. Fortunately, you have disability insurance. The carrier approves your claim.

Based on your policy and benefit period, you have up to a maximum of 5 years to receive your benefits.

In 12 months, you are back at work. Your disability benefits stop (because you are back at work).

10 years later, you slip on ice, seriously hurt your back, and tear the ACL in your right knee. Based on the own-occupation definition, the carrier approves your disability claim.

10 years later, you slip on ice, seriously hurt your back, and tear the ACL in your right knee. Based on the own-occupation definition, the carrier approves your disability claim.

After satisfying the elimination period, you receive your disability benefits. Your new claim starts a new 5-year benefit period. You have another 5 years to receive benefits for your hurt back and torn ACL.

Do you see how this works?

This is an easy and general example to understand.

Remember, you’ll have disability insurance until your retirement age (per the contract). So, you are always covered. As I tell other professionals, you can be the unluckiest person on earth and file many claims over your working lifetime. Each approved claim starts a new benefit period.

Why Is The Disability Insurance Benefit Period Important To Understand?

Now you might wonder why the disability insurance benefit period is important to understand.

There are many reasons why. Here are some of the top reasons.

- The first is to accurately know the plan you have and how it works.

- The second is to understand how long you can receive a disability benefit.

- The 3rd is you can save some serious money if you select a lower benefit period.

Yes, you can save money.

I know some brokers and agents place people in “to age 65” or “to age 67” benefit periods.

The main reason they do this is that they don’t know how the benefit periods work. They think, like the examples I show above, that the benefit period is the coverage period. As discussed, you’ll have disability insurance for your working life (as long as you pay the premiums).

Another reason is to protect their clients against a severe, long-term disability.

However, the probability of experiencing a severe, long-term disability is very low.

When I describe a long-term disability, I am talking about a disability that prevents you from working for the rest of your life.

That could be a:

- Severe accident

- Mental illness

- ALS, MS, or some other neurological disorder

- Drug / alcohol addiction

Thankfully, these disabling situations do not happen much. In fact, they are very rare.

John, I just saw on the news someone got paralyzed in an accident.

Yes, I see that every day. Every day, someone has a disability.

However, most times, the disability is not extremely long-term.

Disability statistics show that the average disability lasts 36 months. The claims departments I speak with say 18 months.

If you are faced with a disability, will it last 12 months, 18 months, 5 years, or more? Or less?

Typical Disability Insurance Benefit Periods

Many benefit periods exist.

For short-term disability insurance, typical benefit periods include:

- 3 months

- 6 months

- 9 months

- 2 years

For long-term disability insurance, benefit periods include:

- 6 months

- 2 years

- 5 years

- 10 years

- To age 65

- To age 67

This is out of the scope of the article, but if you wanted a plan with a 2-year benefit period, you would probably want a long-term disability insurance plan instead of a short-term plan. The reason is that, generally, carriers price the long-term disability insurance plan better.

Cost Comparison Of Disability Insurance Benefit Periods

Ultimately, the benefit period you select is up to you. As I always tell my clients, you can’t tell the future. So, you do the best you can right now with your needs and budget.

Many carriers limit the benefit period based on certain occupations or health conditions. More on that in a minute.

Do you want to see a cost comparison of the benefit periods? Of course, you do! I don’t know any other agency that will do this.

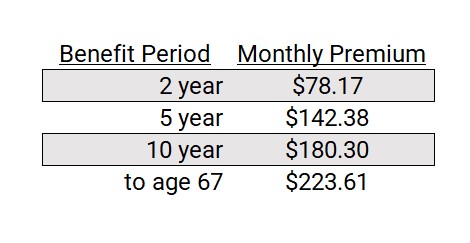

Let’s say you are a non-tobacco user dental hygienist, female age 40. You have a monthly benefit of $3,500, with the true, own occupation definition. You have a 90-day waiting period.

Here’s a monthly premium comparison. Rates are, of course, subject to change, underwriting, and rider preferences.

Here’s a monthly premium comparison. Rates are, of course, subject to change, underwriting, and rider preferences.

Remember, these are example premiums, and yours will be different based on your occupation, gender, health, and benefit.

However, these premiums aren’t that bad. But, as I mentioned earlier, you need to do what is best for you.

Do you need “to age 67” coverage? Maybe. Maybe not.

Remember, I said that, on average, a disability lasts around 18 to 24 months. Additionally, from a few claims departments that I have spoken to, nearly all their claims are satisfied in 5 years.

If the dental hygienist above selected the 5-year benefit period, she’d save $81 per month versus the “to age 67” coverage.

If she invested that $81 monthly until her retirement age, she could save around $85,000!

The remaining claims are those that are catastrophic disabilities.

But, John. What if I wanted to protect against a catastrophic disability only?

Good question. You probably didn’t know you can have different benefit periods in your policy for certain events.

Now is a good time to discuss those.

Different Benefit Periods In The Same Disability Insurance Policy

Let’s recap so far.

We talked about how the benefit period is the maximum timeframe in which you can receive your disability benefit.

As long as you pay your premiums, you will have your policy until your retirement age (around age 67) per the policy contract.

Every time you make a claim, that starts a new waiting period and benefit period (generally speaking, unless the disability is a recurrent disability. See our FAQs about that.)

You could be the unluckiest person on earth and make many claims over your working lifetime. Each claim, as I mentioned, starts a new waiting period and a new benefit period.

However, it is possible to have many benefit periods in the same policy.

How is that possible, John?

It depends on your plan and what riders you select.

Don’t worry; we will follow all this up with an example to make this all clear.

However, typically, carriers allow you to select 3 different benefit periods:

- Your benefit period is based on your “base” benefit. (The $3,500 in our dental hygienist example above is a base benefit).

- A benefit period based on a social security offset (a rider)

- A benefit period based on a catastrophic disability (a rider)

Let’s go over all 3 and then follow up with an example.

What Is the Base Benefit Period In A Disability Insurance Policy?

This is simple to understand and what we have generally discussed so far in this article.

Your policy states your “base” monthly benefit. Your base monthly benefit is based on the income/salary you make.

In our dental hygienist example, $3,500 is the base benefit. The benefit period is 5 years. Upon an approved claim and after the waiting period, the hygienist in our example receives $3,500 monthly up to a maximum of 5 years.

Simple, right?

However, what would happen if she selected a rider called the social security offset?

Let’s discuss this next.

How The Social Security Offset Benefit Period In A Disability Insurance Policy Works

Some policies contain a social security offset. Many carriers call it other things, like social insurance offset. But, they all mean the same thing.

Usually, carriers offer this as a rider.

However, as we wrote in our disability insurance riders article, it is a rider you probably don’t want if you can help it.

Without getting into the weeds, selecting this rider creates another benefit, waiting period, and benefit period, separate from your base benefit.

You see, by selecting this rider, you allow the government – social security administration, worker’s compensation, railroad disability – to participate in your disability payments.

Premiums are comparatively lower because the carrier transfers some of your disability risk to the government.

Let’s use our dental hygienist as an example. Let’s say instead she selects a $2,000 base benefit and a $1,500 social security offset. It is still $3,500 in total. Upon eligibility, she receives $3,500 initially. However, 6 months later, the carrier, by contract, tells her she needs to apply for social security disability benefits. If she is approved, the carrier still pays the base benefit of $2,000, but not the $1,500. That is because what she receives from social security offsets her $1,500.

This is a very easy example for understanding. It can be more complex. Contact us to learn more.

However, as you can see, the social security offset can have its own waiting period and benefit period.

Let’s say our hygienist selects a 2-year benefit period on the social security offset and a 5-year on the base benefit period. If she is disabled, she’ll receive her $3,500 ($2,000 base and $1,500 social) for 2 years. After 2 years of disability, the social security disability benefit goes away, leaving her with only the $2,000 benefit.

The Catastrophic Disability Benefit Period

The 3rd benefit period is on the catastrophic disability rider. Other carriers call this the “ADL rider” or something similar.

Again, this is a rider. It allows an additional benefit – on top of your base benefit – if your disability:

- Prevents you from performing 2 out of 6 activities of daily living or

- Causes cognitive impairment like dementia or Alzheimer’s

Because this is an added disability benefit, it increases the cost of your policy. However, the additional cost of this rider usually is not expensive as disabilities are not catastrophic.

Here are some brief examples of how this works. Let’s say our dental hygienist has a $3,500 base benefit and a $2,000 monthly catastrophic benefit. If she is diagnosed with cancer, she will receive $3,500 (unless the cancer causes her to not perform 2 out of 6 activities of daily living).

Let’s say, instead, she gets into a severe car accident and breaks both her legs. The carrier pays $5,500 as she qualifies for the catastrophic benefit as well.

The catastrophic disability benefit rider allows its own waiting period and benefit period, depending on the carrier. For example, you could select a 5 year benefit period on the base benefit and a to age 67 coverage on the catastrophic benefit. We have many professionals do that to protect themselves from a catastrophic disability.

Let’s wrap all this together in an easy example.

Example Of How The Benefit Period Work In A Disability Insurance Policy

Let’s use our hygienist example again. This is going to be an easy example so you can see She selects a plan with the social security offset and the catastrophic disability rider. Her monthly benefits and benefit periods are as follows:

- $2,000 base monthly benefit with a 5-year benefit period

- $1,500 social security offset with a 10-year benefit period

- $2,500 catastrophic benefit period with to age 67 benefit period

She gets into a catastrophic accident.

She applies for social security disability and is approved for $1,500 from the Social Security Administration.

Let’s assume there’s no chance for her to resume her career as a dental hygienist. For the first 5 years, she receives $6,000 each month, which comprises of:

- The $2,000 base benefit

- $1,500 social security benefit from the SSA

- $2,500 catastrophic benefit

After 5 years, she no longer receives the base benefit. So, starting year 6 of disability, she receives $4,000, which comprises of the $1,500 social security benefit and the catastrophic benefit.

Assuming in another 5 years she is still not working, the social security benefit ends (it’s 10-yr benefit completes). She receives the catastrophic benefit of $2,500 until age 67 whereupon benefits stop.

This is how the benefit periods work, in general.

How Carriers Limit The Benefit Period On Your Disability Insurance Policy

John, I understand everything so far. I am going to apply for the to age 65 benefit period.

I hear what you are saying.

Seems like everyone wants to age 65 or to age 67 benefit period.

We went over that most disability insurance claims resolve in fewer than 5 years.

Additionally, the longer the benefit period, the higher the cost of your policy, all things being equal.

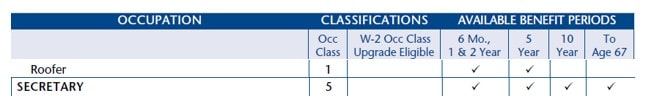

However, many carriers limit your benefit period depending on many factors.

One major factor is your occupation. If you are a blue-collar worker, many carriers limit your available benefit period to 5 years.

They then allow to age 65 or to age 67 benefit period for white-collar workers like accountants or lawyers.

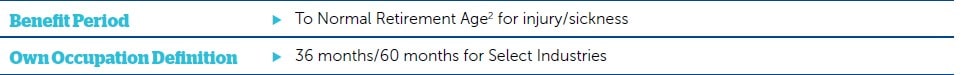

See this excerpt from an underwriting guide.

For example, a roofer may only have a 5-year benefit period, whereas a secretary has up to age 67.

For example, a roofer may only have a 5-year benefit period, whereas a secretary has up to age 67.

John, I am a roofer, and I have to age 65 coverage!

Are you sure about that? Many professionals get confused about this.

While, truthfully, the carrier may allow to age 65 or to age 67 benefit period, it is at the “any” occupation definition.

This means the carrier pays if you can’t do any job suited by your education and experience. If you can, then you no longer receive a disability benefit.

In other words, the disability has to be catastrophic in nature in order to receive a benefit.

Health Conditions Matter, Too

Another way disability insurance carriers limit a benefit period is due to a lifestyle situation or health condition.

For example, as we wrote in our disability insurance underwriting guide, carriers generally limit your benefit period to 5 years if you take medication for anxiety and/or depression.

They may also limit your benefit period depending on other health conditions and/or lifestyle or hobby situations.

Another agent had me go through the entire application process with a paramedical exam, only to find out I’m only eligible for a 5-year benefit period.

You don’t have to submit an application to a carrier to find out. Contact us and let us know your situation. We can speak to an underwriter beforehand and let you know what the underwriting outcome might be.

How Your Benefit Period Differs For Group Employer Coverage Vs. Individual Disability Insurance Coverage

Another misstep I see professionals make is the disability insurance provided through their employer.

Many employers offer short-term and long-term disability insurance as an employee benefit.

These professionals tell me they are “all set!”, but in reality, they are far from it.

The disability benefit from the group employer carrier is not only taxable (likely), but also limited or dollar capped, likely. For example, many group plans will say you “receive 60% of your salary up to $3,000”. If you make $150,000, that $3,000 monthly benefit won’t go far at all. Moreover, it is taxable.

Additionally, while the benefit period on group employer disability insurance is usually to age 65, you only receive that benefit if the disability meets the “any” occupation definition of disability.

What if you are a heart surgeon and lose the use of your right wrist? While your occupation is very specialized, there are other jobs you could likely do.

Same if you are an HVAC technician, sign language interpreter, etc. Specialized occupations need some level of own occupation definition.

We’ve discussed in prior articles why a supplemental disability insurance plan helps in these group employer situations. The supplemental disability plan will not only provide better and more benefits, but also offer the to age 65 coverage at the own-occupation definition (provided the carrier allows it).

Contact us if you have any questions. I am happy to answer them.

Frequently Asked Questions About The Disability Insurance Benefit Period

Who would have thought the disability insurance benefit period is so involved?

I know, John. I go on other websites and they may have a paragraph about it.

Yes. As I mentioned earlier, I see many professionals messing up the disability insurance benefit period. They mistakenly think or understand how it works. Upon a claim, they may be seriously disappointed.

That is why I’ve dedicated this guide to understanding how the disability insurance benefit period works, including answering some frequently asked questions below.

As always, if you have any questions, just contact us.

What Happens To My Benefit Period If I Change Jobs?

Your policy goes with you as you change jobs. For example, let’s say you applied for disability insurance with a 5-year benefit period as a nail technician. You went back to school and now work as an accountant. The 5-year benefit period still applies if you are disabled while working as an accountant.

What Benefit Periods Are Available To Me?

As mentioned earlier in the article, generally carriers make the following benefit periods available to professionals:

For short-term disability insurance:

- 3 months

- 6 months

- 9 months

- 2 years

For long-term disability insurance:

- 6 months

- 2 years

- 5 years

- 10 years

- To age 65

- To age 67

As discussed earlier, carriers limit your disability insurance benefit period based on your:

- Occupation

- Health conditions or lifestyle situations

What Happens If My Benefit Period Ends And I Am Still Disabled?

If you are still disabled after your benefit period ends, the carrier stops paying.

For example, you have a 5-year benefit period. If you are still disabled day 1 of year 6, you are no longer eligible for a disability payment from your plan.

In that case, your only option is social security disability benefits from the SSA provided you worked the required number of years (minimum 10 years).

The SSA uses a more stringent definition of the “any” occupation definition. However, since you are still disabled, it is very likely you can’t do “any” job.

Remember, most claims are settled within 5 years. But, if you want to protect yourself against a very long-term disability, you can add the catastrophic disability benefit to age 65 or to age 67. Or, you can opt for to age 65 or 67 coverage if the carrier allows it for your occupation.

What Happens If My Disability Happens Again?

This is a good question.

As we indicated earlier, you can have several disability claims over your lifetime. Upon each approved claim, a new waiting period and benefit period start.

However, this implied the disability was a new one.

What happens if an old disability is preventing you from doing your job?

This situation happens a lot, which is why all the carriers have rules for recurrent disabilities. In other words, a previous disability that happens again.

Most carriers state that if the disability happens again within 6 months of returning to work, full-time, with no residual effects, then the disability claim is simply continued from the prior claim. Any remaining benefit period is applied to this new claim.

For example, let’s say our hygienist hurt her back and was out of work for 9 months. She returns back to work, full-time, with no issues. Then, 4 months later, she hurts her back again and submits a claim.

This is a recurrent disability since the claim is within the 6 month period. So, she has 4 years and 3 months remaining on her benefit period for her back.

The elimination period doesn’t start again since this is an extension of an old claim. She already satisfied the elimination period.

Does A Mental Illness Affect The Disability Insurance Waiting Period?

The short answer is yes.

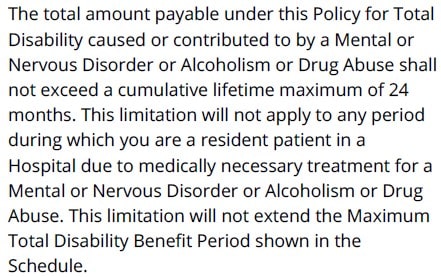

If you are diagnosed with a mental illness, like anxiety, depression, schizophrenia, etc. then your benefit period is 2 years. It’s not the benefit period you applied for.

That’s the case with nearly all the carriers. There are a couple that allows a mental illness claim to follow the benefit period you applied for. However, nearly all of them limit a mental illness claim to 2 years only. See the excerpt.

That’s the case with nearly all the carriers. There are a couple that allows a mental illness claim to follow the benefit period you applied for. However, nearly all of them limit a mental illness claim to 2 years only. See the excerpt.

This also applies to claims for drug abuse or substance abuse.

That’s right. You could have applied for to age 67 benefit period. If your claim is due to anxiety, for example, then your benefit period for your claim is 2 years, not to age 67.

As I mentioned, a couple of carriers already include any claim from a mental illness or drug/substance

You might be asking yourself why carriers limit the benefit period for a mental illness, nervous disorder, or drug/substance abuse. The reason is that these claims can be quite lengthy, so carriers limit their risk.

Some carriers do allow the purchase of a rider that extends the contracted benefit period to mental, nervous disorders, or substance abuse disabilities.

Who Should Have A To Age 67 Benefit Period?

Many professionals tell me they want a to age 67 benefit period. We then discuss what that really means, the costs, other options, etc. Essentially, everything you’ve read here, I discuss with the professionals.

I already showed the opportunity cost of going with a lower benefit period. I also discussed how most claims are settled within 5 years.

Do you need to age 67 benefit period coverage? Ultimately, the decision to have a to age 67 benefit period, if it is available, depends on you, how you feel about disability insurance, and the cost.

However, there are a group of professionals who probably need a to age 67 benefit period.

These professionals include, but are not limited to:

- High wage earners

- Doctors

- Business owners

- Those with very, very specialized occupations

Again, ultimately, the decision is yours. Disability insurance is “plan B”. It’s like that spare tire or AAA. You hope you never need the spare tire or need to call AAA. If you have to, you are happy you have coverage.

Final Thoughts About The Disability Insurance Benefit Period

We hoped you learned a lot about the disability insurance benefit period. I am aware not many websites go into detail as we do. The disability insurance benefit period is much more involved.

We discussed why the disability insurance benefit period is important to understand. Also, we discussed various benefit periods available. We also compared the premiums for many different benefit periods. Of course, your cost will be much different.

Group employer coverage typically has the to age to 65 benefit period. It is usually the “any” occupation after 2 years of disability. We discussed the need for an individual, supplemental plan which improves your disability insurance coverage.

Do you have any questions? We are here to help. Use the contact us or use the form below.

There’s no risk of contacting us. If we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your situation changes.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".