Here Is Why Short-Term Disability Insurance Isn’t Worth The Money? | We Discuss The Reasons And Money-Saving Options

Updated: April 12, 2024 at 9:39 am

Let’s get straight to the point. Short-term disability insurance isn’t worth the money. It’s simply not.

Let’s get straight to the point. Short-term disability insurance isn’t worth the money. It’s simply not.

Except in 2 cases, and we will explain those situations further in the article.

However, outside of these cases, it just isn’t.

But, John, what if I get sick or hurt and can’t work?

OK, I’ll address that. But, short-term disability insurance still isn’t worth it.

Here’s an overview of what we will discuss:

- What Is Short-Term Disability Insurance?

- Why Short-Term Disability Insurance Isn’t Worth It

- Better Solutions For Short-Term Disability Insurance

- When Does It Make Sense

- Final Thoughts About Short-Term Disability Insurance

Let’s jump right into learning about short-term disability insurance.

What is Short-Term Disability Insurance?

Short-term disability insurance pays you an income in case you miss work for a short amount of time due to a disability. A disability could include a sickness, injuries (like a broken arm), or something more severe such as cancer or a heart condition.

In other words, it pays you for your lost income if you can’t work due to an illness or injury. Additionally, it pays you if you can’t do the job of your own occupation.

OK, so it is like sick pay, John, you ask?

Sort of, but, it’s not really like that. If you have sick pay, your company allows a certain number of days for a really short-term illness or injury like the flu or a cold.

Here are the characteristics of a short-term disability plan.

#1 The Benefit Period

The benefit period is usually 3 months to 6 months.

What’s the benefit period?

It’s the maximum time you can receive a benefit for 1 claim. (Note: some plans have longer benefit periods such as 18 months. There are some 24-month plans, but these are rare. The higher the benefit period, the higher the premium, all things being equal.)

What happens if you are still disabled at the end of the benefit period? Unless you have long-term disability insurance, then your benefits stop. You receive nothing more.

#2 The Waiting Period

There is a waiting period – one for sickness and one for an accident. The disability insurance waiting period or elimination period can be 0 days (day 1 coverage), 7 days, 14 days, 21 days, or some plans have 30 days.

The waiting period is based on the claim. You file the claim, and then you “wait” for your benefits to start. For example, you’ll see the combination as “0/7” which means a 0 day waiting period for accidents and a 7 day waiting period for sickness, respectively. The waiting period can be a number of combinations, “0/14”, “7/14”, etc. The available combinations are limited to the plan itself.

Let’s reiterate what the waiting period means because many people mess this up. Just as it sounds, you need to wait these number of days before you are eligible for benefits. Waiting periods eliminate small or frivolous claims. This is why plans with higher waiting periods have lower premiums, all things being equal.

So, if you have a plan with a 7 day waiting period for sickness, and are sick with the flu and return to work in 4 days, you aren’t eligible for a benefit. But, if you were out of work for 11, then you are eligible for 4 days’ worth of income. Make sense?

#3 The Benefit Amount

Typically, a short-term disability plan pays 60% to 66 2/3% of your weekly salary. So, if your weekly salary is $500 per week, expect to receive $300 to $334 per week depending on the plan.

You’ll receive this amount until the end of the benefit period or when you return to work.

What Are Premiums Like?

If you read any of our long-term disability insurance articles, you know we provide an estimate of premiums. Premiums on long-term disability insurance can run from $0.50 per day to $3.00 – it really depends on your age at application and your occupation. Your health matters, too. Nevertheless, long-term disability can be customized to your budget. As I have said, the cost of long-term disability insurance is a cup of coffee at your favorite coffee shop.

However, short-term disability insurance is a bit different. It is expensive. We have seen plans run $300 or more a month!. Why is it more expensive? People generally make higher claims on short-term disability rather than on long-term, although the chance of a long-term disability is still between 1 and 4 and 1 and 3 workers – still high.

Here’s a real example of an office manager. I am sure you will agree with me that an office manager is a low, disability-risk job, right?

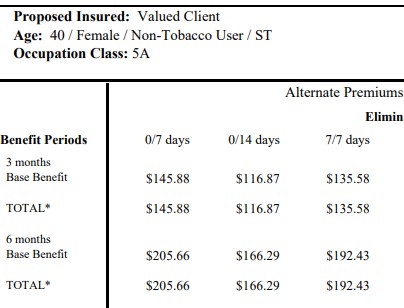

This quote here is for a 40-year-old, female non-tobacco user office manager making $75,000 annually. She could pay from $116 to $206 per month.

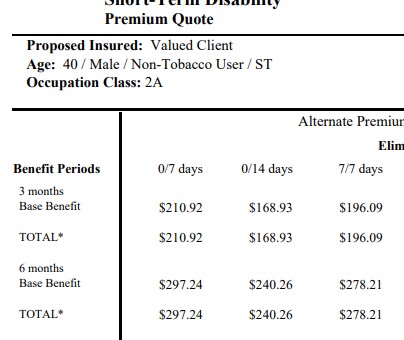

Likewise for a male auto mechanic (also age 40). You can see what his premiums could be.

Likewise for a male auto mechanic (also age 40). You can see what his premiums could be.

These will both provide a weekly benefit of about $1,000 per week.

These will both provide a weekly benefit of about $1,000 per week.

Is it worth paying from $170 to $300 per month for a $1,000 per week benefit for 3 months or 6 months?

That question brings us to our next section.

Is Short-Term Disability Insurance Worth The Money?

In our opinion, it is not. As we showed, it can be expensive for such a short amount of benefit.

Let’s put it this way with an example and use our auto mechanic as the subject. He spends $200 per month on short-term disability insurance. Let’s say he has a plan for 12 months. One day, he slips on ice and breaks his arm. He is out of work for one month. There is a 7 day wait for an accident. So, he receives $3,000 (instead of $4,000 because of the 7 day waiting period). Is it worth it to pay $2,400 for a $3,000 payout? Probably not.

Additionally, the benefit period itself is not worth it. Short-term disability insurance usually has a benefit period of 3 or 6 months. Anything longer than those is really long-term disability insurance. Refer to the real quotes above. A longer benefit period will cost way more than what I showed.

So, let’s say you are the office manager and select the 3-month short-term disability option. That means you will receive up to $12,000 for up to one claim. That is it.

In other words, the office manager will spend $2,400 every year for a $12,000 benefit.

Does that make sense?

You could pay these premiums for 10 years, spending $24,000, and then only receive a maximum $12,000 benefit.

Obviously, that doesn’t make much sense. Do you think it is worth your hard-earned money on a short-term disability insurance policy that may pay out less than you put in? Short-term disability insurance costs way too much for the benefit.

Ok, John, you say. You make a great point. Then what options do I have?

We discuss those next.

Better Solutions to Short-Term Disability Insurance

In our opinion, there are better options compared to short-term disability insurance. We discuss three affordable solutions to having short-term disability insurance. Here they are:

(1) Sickness/Accident Plan

We work with one plan that acts like disability insurance, but it is not. It has day 1 coverage (i.e. no waiting period) on both sickness and accidents. Premiums can range from $20 to $50 per month depending on the plan, or more if you use tobacco. Underwriting is simplified – no paramedical exam or anything like that.

How is this possible? They limit the options to only 6 combinations of plans, with the highest payout being $1,500 monthly. This can be an affordable option if you want some short-term coverage.

(2) Have An Emergency Fund

I am a CFP® Professional and honestly, this is truly the way to go for any short-term disability coverage. You generally want to keep 3 to 6 months of your income saved in an account that is shielded from stock market volatility. If you have the flu, you dip into your fund to pay for any expenses. If you break your arm, you dip in. You replenish as needed when you return back to work.

I know it is harder than it sounds. You have to start somehow. Many people find the task of saving daunting. But start out trying to save for your deductibles: health, auto/home, etc. You will find this is an easier approach. If you need to, pay for a sickness/accident plan to start. Then, when you have an appropriate amount saved, cancel. Yes, I said cancel. You might be thinking how can an agent tell you to cancel? That’s blasphemy! Again, we don’t consider ourselves as insurance agents, but rather a team of professionals, always working in your best interests, and we happen to know insurance.

I know it is harder than it sounds. You have to start somehow. Many people find the task of saving daunting. But start out trying to save for your deductibles: health, auto/home, etc. You will find this is an easier approach. If you need to, pay for a sickness/accident plan to start. Then, when you have an appropriate amount saved, cancel. Yes, I said cancel. You might be thinking how can an agent tell you to cancel? That’s blasphemy! Again, we don’t consider ourselves as insurance agents, but rather a team of professionals, always working in your best interests, and we happen to know insurance.

(3) Increase The Waiting Period On Your Long-Term Disability Insurance

Both short-term and long-term disability insurance have waiting periods. We already discussed that before for short-term disability insurance. With long-term disability insurance, you can generally start with a waiting period of 30 days. This will increase your premium, but not as significant as having a stand-alone, short-term disability insurance plan.

You might think that doesn’t sound good. You are spending more money! First, you can’t think that way.

Long-term disability insurance is really the way to go here. You aren’t insuring protection against a cold or a minor injury, but rather one that can last longer than a year. Imagine if you didn’t earn a paycheck for 1 year or 2 years? That makes your financial situation tight, and which is what long-term disability insurance protects.

Remember I said the threat of a long-term disability is devastating. You suddenly can’t go to work because of the cancer diagnosis and…you don’t have any money coming in to pay your mortgage. It is scary.

Increasing the waiting period to 30 days gets you a benefit faster than if you had a 90-day waiting period – 60 days or 2 months sooner.

Think about that. You break your knee skiing, you will probably be able to receive benefits after a 30 day waiting period. Have a cancer diagnosis? You’ll receive a partial disability benefit if your doctor says you can still work. Of course, a 30-day waiting period shields you from making sickness claims for the flu or pneumonia. But, if you have an emergency fund established, you don’t need to worry about that.

When Is Short-Term Disability Insurance Worth The Money?

We said at the beginning of the article that there are 2 cases where short-term disability insurance is worth the money.

The first case is if your employer offers short-term disability insurance. In this case, the premiums for short-term disability insurance are likely very inexpensive as your employer subsidizes a portion of the premium or all of it.

case, the premiums for short-term disability insurance are likely very inexpensive as your employer subsidizes a portion of the premium or all of it.

Additionally, many group-employer short-term disability insurance plans cover child birth and maternity as a covered condition. This is a benefit for women and families. In this case, short-term disability insurance makes sense. Contrary to what you think, currently, individual short-term disability insurance plans DO NOT cover a normal child birth/maternity. They usually only cover complications of pregnancy/child birth.

The second case is if your state offers a disability insurance fund. Currently, there are 6 states offering a state disability insurance fund for employees and other qualified workers. You pay this through your payroll tax.

These state funds all operate a little bit differently, but they are intended to be short-term as many of the states have a 3-month benefit period. California’s plan offers a 52-week benefit period. Many of these states offer maternity as a disability.

Final Thoughts About Short-Term Disability Insurance Worth The Money

No, short-term disability is not worth the money. We showed how expensive it is compared to the benefit you will receive. In our opinion, it just doesn’t make sense.

We think there are better options including, but not limited to:

- An accident / sickness plan

- Emergency savings

- Increasing the waiting period on your long-term disability plan

Do you need assistance with understanding your options? Feel free to contact us or fill out the form below. Work with us who place your needs and interests first and foremost. We would be happy to speak with you about the alternatives to short-term disability insurance. There’s no risk to contacting us. If we can’t help you, we will point you in the right direction and part as friends. You can always contact us again if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".