3 Life Insurance Options For People With Rheumatoid Arthritis [Approved! And, Here’s How]

Updated: April 12, 2024 at 9:38 am

If you have rheumatoid arthritis, you may wonder if you can purchase life insurance.

If you have rheumatoid arthritis, you may wonder if you can purchase life insurance.

The answer is more often than not, “yes”. You most certainly can obtain life insurance if you have rheumatoid arthritis. Additionally, as we will discuss, you’ll probably have affordable life insurance options available.

Sure, the severity of your rheumatoid arthritis plays a part in the underwriting, which affects your cost. But, you can still obtain life insurance.

The way I see it, 3 solid life insurance options exist if you have rheumatoid arthritis (also noted as “RA” in this article). The options really depend on your situation and the severity of the rheumatoid arthritis.

Here is what we will discuss:

- Can I Get Life Insurance If I Have Rheumatoid Arthritis?

- Life Insurance Underwriting Factors

- Life Insurance Decisions With RA

- 3 Life Insurance Options Approved For People With RA

- FAQs About Life Insurance And Rheumatoid Arthritis

- Final Thoughts About Life Insurance And RA

In this article, we discuss everything you need to know about purchasing life insurance when afflicted with rheumatoid arthritis. We will go into the underwriting in more detail and what underwriters look for. Additionally, we offer case study examples of people with rheumatoid arthritis.

Can I Get Life Insurance If I Have Rheumatoid Arthritis?

Yes, people with rheumatoid arthritis can get life insurance.

But…(you knew there would be a “but” here)

The availability and the amount you will spend on life insurance depend on the severity of your rheumatoid arthritis.

What does this mean? It has to do with underwriting.

Underwriting is the process of assessing risk. In terms of life insurance, underwriting departments assess your mortality risk.

In other words, they determine, based on your situation and other factors, your expected mortality and potential lifespan.

The:

(1) premium you will pay and

(2) life insurance coverage available…

…are directly influenced by this estimated mortality. If you have a better-than-expected lifespan, then you will pay less and have more life insurance options available.

Conversely, if your mortality is worse, then expect to pay higher premiums with fewer life insurance options available (if any).

See how this works?

Life insurance underwriters look at several factors when analyzing a life insurance application from someone with rheumatoid arthritis. Since underwriting is the foundation of life insurance approval, we discuss these factors next.

7 Underwriting Factors For People With Rheumatoid Arthritis

When it comes to all life insurance applications, life insurers look at:

When it comes to all life insurance applications, life insurers look at:

(1) your medical history – they analyze information in the MIB or will order your medical records

(2) prescription drug history – the type of medication matters

(3) driving records

(4) anything else material to the application like any criminal history, marijuana use, etc.

Although rheumatoid arthritis is not a fatal disease, it is an autoimmune disease. Autoimmune diseases have been shown to lower a person’s lifespan, and the same holds true for someone inflicted with RA. Life insurance underwriters know this and adjust their premiums and life insurance options accordingly.

However, as we said, the good news is that life insurance options do exist. The available options depend on what we just discussed above and the following factors specific to rheumatoid arthritis. These factors include:

(1) the date of diagnosis

(2) medication taken and treatment options

(3) any disability

(4) any deformity and symptoms

(5) frequency of flare-ups

(6) body parts affected

(7) any other medical conditions

Let’s talk about these factors in more detail.

Date Of Diagnosis

Generally speaking, the date of diagnosis matters. Underwriting departments like to see a recent diagnosis of rheumatoid arthritis. A longer diagnosis date indicates a longer treatment time. The longer the treatment time, the higher your mortality risk (generally). The higher the risk, the higher your premium.

This is a general answer, but hopefully, you understand that a recent diagnosis is more favorable than a longer one.

Medication Taken

The type and amount of medication play a part in underwriting for rheumatoid arthritis. Some types of medication are more favorable than others. If you don’t take any, that is even better.

Medication can have varying side effects.

Mild medications like aspirins, ibuprofen, and other non-steroidal anti-inflammatory drugs likely won’t affect your premium rates.

However, treatment with steroids, methotrexate, prednisone, other immunosuppressive drugs, and anti-rheumatic drugs will likely affect your rates. The reason is that these drugs have significant side effects that can affect other parts of your body.

Does this mean you stop taking your drugs for the sake of life insurance? No! Always follow your doctor’s treatment plan.

Just know that the type of medication matters.

Are You Disabled?

Being disabled from RA also plays a part in underwriting. It indicates a severe rheumatoid arthritis situation.

If you:

(1) are disabled,

(2) are unable to work because of your rheumatoid arthritis,

(3) need motorized assistance, or

(4) can’t live independently,

…the carrier will increase your premiums or decline you altogether.

Additionally, being on SSDI because of your RA plays a major role in the life insurance options available.

(Don’t worry. We provide situational examples soon.)

RA Symptoms And Any Deformity?

While morning stiffness with rheumatoid arthritis isn’t usually an issue, deformities are. For example, the inability to use your hands or move your wrists will negatively impact your premium rates. Likewise, if you can’t walk or have deformities with your feet or toes.

If your rheumatoid arthritis restricts your mobility, that will likely have a great impact on rates.

Moreover, chronic joint pain plays a factor in available life insurance options and premium rates.

Frequency of Flare-Ups

Rheumatoid arthritis creates flare-ups from time to time. Flare-ups are an underwriting consideration because the more flare-ups you have, the higher the likelihood of joint damage. The higher the likelihood of joint damage, the greater the possibility of a deformity or disability.

Affected Body Parts

It is a known fact that rheumatoid arthritis affects other parts of your body. Carriers will want to know the extent of any joint damage you have. Additionally, they will want to know if you experience any bone erosion.

Moreover, rheumatoid arthritis potentially affects your heart, lungs, and other major organs. Additionally, it contributes to weight loss and even low blood counts, in some cases.

Life insurance underwriters will look at your situation from all angles.

Other Health Conditions

Other health conditions or hazardous lifestyle choices greatly impact your ability to obtain life insurance. Do you smoke or use marijuana? Are you overweight? Do you have other health conditions like diabetes?

Of course, there are some things outside of our control. However, maintaining a healthy balance as best you can with RA will lead to better underwriting results.

Now that you know what underwriters look for when assessing an application, let’s talk about the decisions underwriters make.

Life Insurance Decisions For People With Rheumatoid Arthritis

It is important to stress that the purpose of the underwriting process is to mitigate risk. All parties (the carrier, the agent, and you) want the best possible outcome for you.

Based on the information you provide about your rheumatoid arthritis and other information, the life insurance underwriting department makes an offer.

Additionally, they assign a health classification. Everything we discussed in the underwriting section forms this health classification. The amount you pay (i.e. the premium) for your life insurance is based on this health classification.

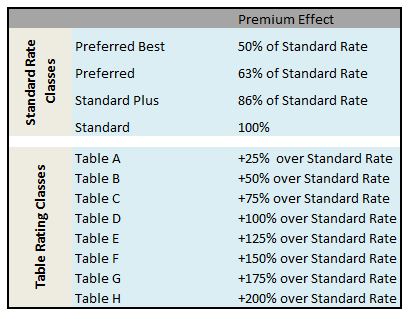

Life insurance carriers establish health classification ratings, also known as tables or table ratings. Look at the example below. This is a typical life insurance table. Depending on your situation, you will fit into one of these tables.

The tables start at preferred best (i.e. those for very healthy), which is the lowest premium you’ll pay. The tables go up to table J, which is the highest premium you’ll pay (all things being equal).

Standard rates are typical health, and lifestyle situations. The better your health and lifestyle, the better your classification and rate. Conversely, the worse, the worse your classification and premium rate.

Classifications below the standard rate are known as table ratings. If the underwriting department is unable to classify you on the table, they will decline your application.

Is Preferred Best Available?

Let’s get this out of the way: carriers won’t offer a person with rheumatoid arthritis a preferred best or preferred rating. The best health classification available is the standard rate. Standard rates are still very good! A Standard rating means the underwriting department says you have the average health and mortality of an average person.

arthritis a preferred best or preferred rating. The best health classification available is the standard rate. Standard rates are still very good! A Standard rating means the underwriting department says you have the average health and mortality of an average person.

I know other websites say that standard rates are available for people with RA. That is true. However, most, if not all, people with rheumatoid arthritis have a table rating. The level of rating depends, as we stated earlier, on the severity of the disease as well as other factors we described.

Let’s discuss these health classifications with someone with RA through several case study examples.

Example Of A Standard Rating

Todd is a 34-year-old man. He was diagnosed with rheumatoid arthritis 3 years ago. He had one flare up. Other than rheumatoid arthritis, he is in great shape. He doesn’t smoke and limits his alcohol intake. He currently takes ibuprofen if he feels stiff and regularly sees his doctor.

A carrier could rate him at a standard rating.

Example Of A Table Rating

Martha is 50 years old. Diagnosed with rheumatoid arthritis ten years ago, she feels good, but the condition has taken a toll on her body. She takes Enbrel, which is an immunosuppressant. Although she has had success with Enbrel, she does have flare-ups. X-rays indicate no bone density problems or erosion issues. That is great news. However, she has more trouble with her feet and hands. She does work full time and is currently not disabled.

Carriers likely classify her as a table B through D. Note, depending on bone density and other tests, life insurance carriers may rate people with rheumatoid arthritis at a table F or higher.

Example Of A Decline

Rebecca is 55 years old and living with rheumatoid arthritis. The condition confined her to a wheelchair. She is disabled and does not work. She also needs assistance with activities of daily living.

Carriers will likely decline Rebecca. She is presently disabled.

I hope this gives you a good idea of how life insurance carriers classify people with rheumatoid arthritis. It is important to stress that these examples are just that. Examples. Your situation is different.

I am sure you have many questions about life insurance and rheumatoid arthritis. Let’s discuss some of those questions next.

3 Life Insurance Options Approved For Rheumatoid Arthritis

We have helped many people with rheumatoid arthritis obtain life insurance. The way I see it, 3 life insurance options exist for people with RA. Here are the 3 options.

Term Life Insurance And Permanent Life Insurance (Whole Life)

If you have mild rheumatoid arthritis, then term life insurance and permanent life insurance (like whole life and universal life) are available.

As we stated before, expect a standard rating to a table rating. If you take anti-rheumatic drugs like methotrexate and hydroxychloroquine.

Additionally, if you take immunosuppressant drugs or infusion drugs like Remicade, expect a table rating.

As we said, contrary to what you read elsewhere, standard ratings are rare for people with RA (although possible). Even in mild cases, life insurance underwriters will assign a low table rating of like table 2 or 3.

Remember that term life insurance lasts for a specific term, like 20 years or 30 years. Conversely, permanent life insurance like whole life or universal life is designed to last your lifetime and pays the death benefit no matter when you pass away.

If you want over $100,000 of life insurance, then expect a fully-underwritten life insurance process. Underwriters, essentially, look at everything including a paramedical exam (like a mini-physical) with a blood draw and urine sample.

Feel free to quote on your own below for term life insurance. Note that these are estimates only and the final rate depends on your situation.

Simplified Issue Life Insurance

Simplified issue life insurance is another option.

What is simplified issue? It means “simplified” underwriting. Essentially, carriers remove the medical exam (the paramedical exam) from the life insurance process.

Life insurance underwriters look at:

- your medical history (through the MIB) and medical information

- prescription drug history

- criminal records and other public records (depending on the carrier)

- answers on an application (like a health questionnaire)

Simplified issue is a simple application process. Carriers omit the medical exam and many of them will omit doctor records submission, financial history, etc.

and many of them will omit doctor records submission, financial history, etc.

Because of the “simplification”, carriers limit the death benefit. Carriers offering simplified issue whole life insurance, for example, typically limits the death benefit to $25,000 to $50,000. Simplified issue term carriers generally limit the death benefit to $150,000 to $250,000.

Yes, John, but they won’t accept people with rheumatoid arthritis.

Not true, these types of plans are generally good for people with moderate RA. With these simplified issue plans, you have to read what is on the application. Many of these simplified issue plans don’t ask about rheumatoid arthritis. If they do, they will accept mild to moderate cases.

Simplified issue whole life insurance is sometimes called burial insurance. Feel free to look up rates on your own. Rates are estimates only.

If you are interested. It is best to contact us, especially if you are interested in a simplified term life insurance policy. We need to prequalify you with the simplified term life insurance.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is just how it sounds. You apply for life insurance and voilà, you are accepted and have life insurance.

Carriers don’t underwrite you. They don’t require a medical exam or look up your medical history.

Obviously, guaranteed issue life insurance is reserved for those severe cases where the applicant is disabled from the RA; can’t walk, work, etc.

Because these plans don’t underwrite, they limit the death benefit to $25,000, usually.

Guaranteed whole life and term life exist.

If you’ve been declined for traditional life insurance before because of your RA, then likely guaranteed issue life insurance is your only option.

You can search for estimated guaranteed issue whole life rates here.

Note: if you want guaranteed issue term life, feel free to search at rates here: https://protectionpluslife.com/m/jbarnes

Life insurance options are not available for all ages and states. Contact us if you have any questions.

If you feel you are in a guaranteed issue situation, check out the additional articles we wrote about guaranteed issue life insurance plans:

Guaranteed issue life insurance for people under the age of 40.

Guaranteed issue term life insurance.

$100,000 Guaranteed issue life insurance.

No waiting period guaranteed issue life insurance.

FAQs About Life Insurance And Rheumatoid Arthritis

Below, we answer some common questions about life insurance for people with rheumatoid arthritis.

What Types Of Life Insurance Are Available For People With Rheumatoid Arthritis?

If you have rheumatoid arthritis, the types of life insurance available depend on the severity of your condition. However, many people with rheumatoid arthritis are eligible for term life insurance and/or permanent life insurance. Permanent life insurance includes whole life, guaranteed universal life, indexed universal life, among others.

Additionally, as we indicated, many simplified issue life insurance plans exist. Many of these plans accept people with RA.

If you are declined, you still have options. If you have severe RA, guaranteed issue life insurance exists. Guaranteed issue life insurance contains no health questions. The carrier doesn’t ask any health questions. You simply fill out the application. Upon application review, the carrier issues the life insurance policy. We work with an affordable guaranteed issued life insurance plan if you would like to learn more.

Do I Need To Take An Exam?

Possibly. Some carriers will require a paramedical exam. Other carriers will not require one, up to a certain death benefit amount. As we stated earlier, these plans are called simplified issue life insurance plans. Additionally, some carriers that usually don’t require a paramedical exam could require one.

However, if you want the best rates available, you will likely need to go through a paramedical exam.

As Someone Living With Rheumatoid Arthritis, When Is The Best Time To Purchase Life Insurance?

The best time, no doubt, is now. You are likely the healthiest at this moment. Moreover, you will pay the lowest premium available to you right now. If you wait, you risk paying a higher premium and/or a decline if your condition worsens.

I Have Some Stiffness With My Rheumatoid Arthritis. That’s It. How Much Do You Think I Would Pay?

We aren’t underwriters. In our experience, however, expect a classification between standard and table D. As we mentioned, it’s unlikely a carrier classifies you at preferred best or preferred.

I’d like to repeat, although other websites say so, underwriters are unlikely to offer standard rates to someone with rheumatoid arthritis.

In order to provide an accurate quote, we would need to know more about your health and situation, in addition to your rheumatoid arthritis.

Can You Tell Me About The Life Insurance Application Process If I Have Rheumatoid Arthritis?

We aim to make the application process as easy as possible. Who wants to spend tons of hours applying for life insurance? No one does. Here’s a step-by-step process. However, your specific situation might be different.

First, we learn more about you and your situation. We conduct a life insurance needs analysis. We’ll ask you many of the questions we outlined above in our section titled “7 Underwriting Factors For People With Rheumatoid Arthritis”.

Next, with this information, we reach out to life insurance carriers that underwrite people with rheumatoid arthritis favorably. Not all life insurance carriers analyze people with rheumatoid arthritis the same. For example, some carriers automatically decline people with rheumatoid arthritis. Obviously, we stay away from those carriers.

The carriers provide a tentative health classification, based on the severity of your condition. We then report these offers back to you.

With our assistance, you select the option.

After that, we conduct the life insurance application. We complete the application over the phone with you. Nowadays, many carriers conduct the health questionnaires and assessments themselves. If that is the case, we will start the application with you and then notify the carrier to contact you to complete your application.

As described earlier, a paramedical exam could be required. If that is the case, we will help schedule that for you.

Carriers require your doctor’s records if you have rheumatoid arthritis. This is nothing you need to do. The carrier will reach out to your doctor directly.

Once the carrier receives all the information, they will make a decision. We will then communicate that with you and answer any questions you have.

Are “No-Exam” Life Insurance Plans Available For People With Rheumatoid Arthritis?

Yes, “no-exam” life insurance options exist. These types of plans remove the medical exam from the underwriting process.

However, life insurers that offer no-exam life insurance usually limit the death benefit. For example, many no-exam term life insurance carriers limit the death benefit to $250,000.

Moreover, the no-exam life insurance costs more (generally).

Nevertheless, these plans are available. Contact us for more information.

Can People With Psoriatic Arthritis Obtain Life Insurance Options?

Yes, people with psoriatic arthritis can obtain life insurance. Fully-underwritten life insurance options like term life, whole life, and universal life are available. Additionally, people with psoriatic arthritis can obtain simplified issue life insurance.

Obviously, different types of arthritis exist, and the type of arthritis you have plays a major role in life insurance availability.

Psoriatic arthritis is another long-term condition that causes red, scaly skin patches and rashes. It also causes joint and swelling pain in different parts of the body, namely in the hands and feet.

Similar to the underwriting process for RA, life insurance underwriters will want to know the severity of the disease. Essentially, they will want to know everything we spoke about in the underwriting section of this article: diagnosis date, medication you are on, any disability, etc.

From our experience, life insurance underwriters will assign people with psoriatic arthritis a table rating.

Contact us for more information.

What If I Have A Mild Disability From Rheumatoid Arthritis?

You can obtain life insurance if you have a mild disability from rheumatoid arthritis. Obviously, life insurance options will be more limited since you have a documented disability from your RA.

Contact us so we can determine what your options are.

What If A Life Insurance Company Declines Me Because Of My Rheumatoid Arthritis?

You still have options. Some people blindly apply for life insurance, not knowing if the carrier is the right carrier for them. They are then declined, and it turns out the carrier was the wrong carrier. Some carriers simply do not insure people with RA.

Others underestimate the severity of their condition. They think they have a mild case when, in fact, their situation indicates severe RA. After the underwriter reviews their application and situation, they decline them.

In both cases, life insurance options are still available. If you have been declined, please contact us so we can let you know your options.

We walk “the talk”, too. For example, a person with RA reached out to us. She was declined by a favorable life insurance carrier for rheumatoid arthritis. After spending 10 minutes with her over the phone, I determined she applied and went about the application process the wrong way.

Together, we reapplied for the term life insurance policy with the same carrier. She was approved at table 2.

So, really. If you have been declined, contact us.

What Are The Best Life Insurance Companies For Someone With Rheumatoid Arthritis?

As we stated, some life insurance companies work better for people with rheumatoid arthritis than others. However, there is no “best” carrier. The best carrier is the one that will insure you at the best possible premium. However, in our experience, the following life insurance companies are generally favorable for someone with rheumatoid arthritis:

- Prudential

- Pacific Life

- AIG

Additionally, many simplified issue life insurance carriers work well for people with rheumatoid arthritis.

Now You Know People With Rheumatoid Arthritis Can Obtain Life Insurance

We hope this article about life insurance and rheumatoid arthritis was helpful. Can you obtain life insurance? Of course, you can.

As we wrote, the type of life insurance and cost really depends on your specific situation.

We know maneuvering through all of this stuff can be confusing.

That is why we are here. Contact us, or use the form below, if you would like our assistance.

We would be very happy to help you out. There is really no risk of contacting us. Why? At the very least, you’ll learn something new.

If we can’t help you out, we’ll part as friends! Seriously! You see, we at My Family Life Insurance only work in your best interest. You can bet the recommendation we offer to you is the one that fits your situation, not someone else’s and certainly not ours.

If we can’t help you, we tell you that. Additionally, we will point you in the right direction and help you out as best we can. You can always reach back out to us if your needs or situation changes. This is the only way we know how to work with our clients.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".