3 Guaranteed Issue Term Life Insurance Options | Easy Application | Everyone Approved!

Updated: April 12, 2024 at 9:38 am

Did you know guaranteed issue term life insurance exists?

No, John. I’ve only heard about guaranteed issue whole life insurance.

Right. This is guaranteed issue term life.

Same thing. No health questions (however, one does have some general questions to answer).

No MIB lookup or underwriting. Carriers don’t ask any health questions.

You fill out the online application. Then, pay via credit card or with a debit card.

You then have life insurance.

There are some differences. Notably, this is term life insurance.

We work with 3 guaranteed issue term life insurance plans.

John, tell me more.

We’ll go through all the details.

Here’s what we will discuss:

- How Does Guaranteed Issue Term Life Insurance Work?

- 3 Guaranteed Issue Term Life Insurance Plans

- How Much Does It Cost?

- Where Is It Available?

- Who Is This Good For?

- How Do I Apply?

- What If I Need More Coverage?

- FAQs About Guaranteed Issue Term

- How We Can Help

Let’s jump in and discuss how the guaranteed issue term life insurance works.

How Does The Guaranteed Issue Term Life Insurance Work?

I know what you are thinking.

John, how am I able to obtain guaranteed issue term life insurance? I only heard of guaranteed issue whole life insurance.

Here’s how you can obtain term life insurance with no health questions or underwriting.

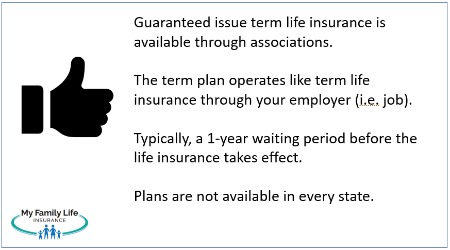

These guaranteed issue term life insurance options are through associations. In order to obtain the term life insurance, you have to join the association.

Note that the guaranteed issue term life insurance depends on where you live. Not all associations are available in all states.

Note that the guaranteed issue term life insurance depends on where you live. Not all associations are available in all states.

We will get into the associations in the next section. However, you will need to agree to the terms of the association membership if you want the life insurance. In other words, you’ll have to pay a membership fee as well as the premium for the life insurance itself.

That’s not so bad because nearly all of the associations offer value-added benefits along with the life insurance plan.

Additionally, like guaranteed issue whole life, some term plans have waiting periods. In other words, the life insurance doesn’t take effect until the waiting period elapses. For example, if a plan has a 2-year waiting period, the life insurance isn’t in effect until the 2-year period finishes.

In the meantime, you have access to other benefits offered by the association. Some plans will pay a benefit if you pass away from an accident during the waiting period as well.

Like Term Life Insurance Through Your Job

Finally, the term life insurance operates on a group/employer foundation. It is like the term life insurance one can get through an employer (i.e. your job). Like group employer term life insurance, the association or the life insurance carrier can terminate the plan anytime (please understand: no premium refunds if this happens).

Generally speaking, everyone is accepted. One association we work with does not require a social security number.

Let’s discuss the 3 guaranteed issue term life insurance options.

3 Guaranteed Issue Term Life Insurance Options

Here are the 3 associations and their corresponding guaranteed issue term life insurance options.

Elevate To Wellness Association

One association we work with is the Elevate to Wellness Association.

As you can read on their website, their mission is to promote health and wellness options for employees at small-to-mid-sized companies.

You are probably aware that small business owners and employees get “priced out” of competitive insurance and financial products.

The Elevate to Wellness Association offers various financial and insurance products to employees at discounted rates (similar to big corporations). These products include:

- life insurance

- dental and vision insurance

- critical illness insurance

- accident insurance

- hospital indemnity plans

- medical plans

- pet insurance

- prescription discount drug plans

- lifestyle options such as identity theft protection, computer services, wellness, etc.

They offer many robust insurance plans.

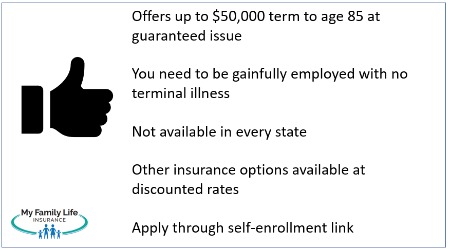

In terms of the life insurance option, you can purchase up to $50,000 at guaranteed issue. It is term to age 85. However, in order to obtain the life insurance (or any of these plans), you must be gainfully employed. If you are not working because of illness or injury, then you can’t join.

We require some type of current pay stub to show proof of your gainful employment. You must also work 20 or more hours per week.

Premiums are pretty cheap. We helped a 24-year-old woman obtain $50,000 for $10 per month, including the membership fee.

How to enroll? You have to contact us. The only plans the association offers through its website are their lifestyle plans which include $7,000 of term life insurance only. If you are interested, we can get you set up.

Emergency Management Alliance

The next association is the Emergency Management Alliance.

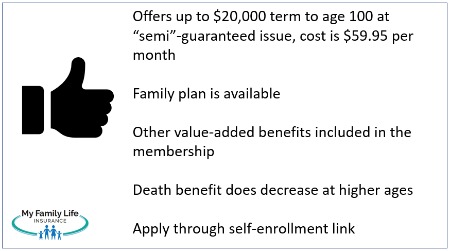

They offer up to $20,000 in term life insurance for a member for a flat $59.95 per month for 1 member.

They offer up to $20,000 in term life insurance for a member for a flat $59.95 per month for 1 member.

Even better, they offer family plans for $89.95 per month which includes $20,000 on the enrolling member, $10,000 on a spouse, and $5,000 each on children.

Eligible ages are 18 to 74.

It is term to age 100, so it lasts your lifetime.

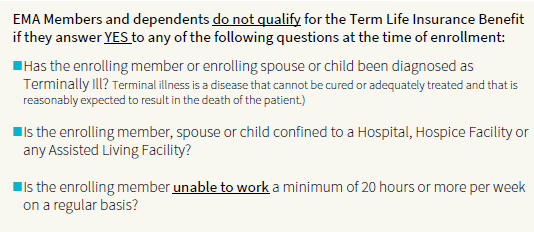

However, the association requires answers to 3 pre-qualifying questions. See the snippet. This is like “almost” guaranteed issue life insurance.

So, the applicants can’t be terminally ill or confined to a nursing home, etc. Moreover, the enrolling member must work in gainful employment.

But, John. I am 70 years old. I am retired, but I’m able-bodied and can work if I need to.

If you are retired, that is OK, as long as you are able-bodied and can work or have the ability to work if you want to. You can then enroll in the life insurance. The association doesn’t accept individuals who unfortunately are not able-bodied (physically and mentally) to work in gainful employment.

That brings us to this point, this term life plan is a great option for able-bodied seniors looking for life insurance.

As specified in the brochure, the death benefit does reduce at age 70 to $10,000. (More on why in a minute.)

However, compare these options. A $10,000 policy with the EMA costs $59.95 per month for a 71-year-old man. The same 71 year-old-man can buy a $10,000 guaranteed issue whole life insurance policy for about $108 per month.

There is a 1 year waiting period on the life insurance.

If you’d like to apply, you can do so here: calstarbenefits.com/index.cfm?id=713217

Contact us if you have any questions.

United Service Association For Health Care (USA+)

The final association is the United Service Association for Health Care (USA+).

They were established in 1983 and have provided a member term life insurance since 1987.

They offer 3 term life insurance options (all term to age 85):

- ages 18 to 64, $10,000 costs $42 per month

- ages 18 to 64, $25,000 costs $65 per month

- ages 65 to 69, $10,000 costs $69 per month

A 1-year waiting period exists on the life insurance. After 1 year, the life insurance is in force.

Unlike the other 2 associations, this is a true guaranteed issue term life insurance plan. No health questions or anything.

Moreover, they will take people who are under a qualified and properly constructed POA or guardianship (i.e. it has to give you the right or authority to purchase life insurance). You just have to submit the POA or guardianship along with the application.

A brochure is available here.

Additional, no-cost benefits include:

- vision discount program

- emergency helicopter (e.g. life flight)

- identity theft

In my opinion, the offerings through the USA+ Association are excellent. Rates are affordable. Moreover, most people could use a vision plan. Additionally, everyone could use an identity theft plan. Again, these are part of the membership.

If you’d like to apply, you can access the application. Then return it to us for our signature and processing.

How Much Does Guaranteed Issue Term Life Insurance Cost?

The premium rates for the term life insurance in the Elevate to Wellness Association depend on your age.

Conversely, the premium rates for the term life insurance plans through the EMA and USA+ are fixed no matter your age. The guaranteed issue term rates for the EMA and USA+ are $59.95 and $65 per month, respectively.

One thing: these associations all have a one-time, non-refundable administrative fee of $20 to $25.

Where Is The Guaranteed Issue Term Life Insurance Available?

The guaranteed issue term life insurance plans are not available in every state.

The best thing to do is contact us. We can search the 3 associations and see if plans are available.

If not, we typically have other options available for you.

However, one of the great aspects of these 3 associations is that their term life insurance plans are available to New York state residents. While outside the scope of this article, not many carriers exist in New York due to state regulations. These life insurance options are available in New York.

Who Is The Guaranteed Issue Term Life Insurance Good For?

Who is the guaranteed issue term life insurance good for?

Anyone, really, but here is a list of people who might benefit from this plan.

These include, but are not limited to:

- Undocumented immigrants and non-citizens

- US-born people who opt out of a social security number

- People on Medicaid

- People on SSDI or disability

- Those who are currently on parole or probation.

- People with HIV or AIDS.

- Those living with Huntington’s Disease

- People taking suboxone or another type of substance abuse prevention medication

- Those in current cancer treatments, but have a good prognosis for recovery

- People with cerebral palsy or muscular dystrophy

- Those confined to a wheelchair

- People on oxygen for COPD

- Families who have siblings, children, or relatives with autism or Down Syndrome (remember, one plan will accept proper POA or Guardianship)

- People who simply don’t want to go through underwriting

The list goes on.

People who are in tough situations due to health conditions or lifestyle situations should consider this guaranteed issue term life insurance.

How Do I Apply For The Guaranteed Issue Term Life Insurance?

Applying for the guaranteed issue term life insurance is easy.

You will want to contact us if you want to apply for the term life insurance through the Elevate to Wellness Association.

The other Associations accept a self-enrollment process or the PDF application.

What If I Need More Coverage?

John, the $50,000 is a good step, but I need more.

If you need more, contact us.

We’ve helped many people secure the life insurance they need.

We’ve even helped people who were declined before, sometimes with a traditional policy (i.e. an immediate benefit – no waiting period). Feel free to search at plans below:

If your situation dictates a guaranteed issue whole life insurance plan, we have many options.

We have a plan that is available for people under the age of 40. Also, we have many affordable options, including one from a Catholic Fraternal Benefits Society.

We need to know more about you so we can make an educated recommendation.

Frequently Asked Questions About The Guaranteed Issue Term Life Insurance

We answer commonly asked questions about the guaranteed issue term life insurance products through associations.

Is This Legit?

Yes. The term life products are legitimate products through associations. As long as you meet the requirements, they are guaranteed issue. (The term life plan through the EMA does have 3 questions to which a majority of people can say “no”. If not, we have the plan through USA+.)

Can The Association Cancel The Life Insurance Anytime?

Yes. Term life insurance plans through associations operate similarly to employer/group term life insurance. In those cases, carriers or the company can terminate the plan. The same with associations and the corresponding term life carrier.

However, no indication exists that either the association or the carrier will terminate the association’s term life insurance plans.

Do I Receive A Policy?

You actually don’t receive a policy. The association is the policyholder, and they will issue you a certificate upon joining. The certificate contains all the important details of your coverage, beneficiary, death benefit amount, etc.

Most certificates arrive in the mail within 15 business days of the effective date of your membership.

Why Is There A Waiting Period?

As we explain in our guaranteed issue life insurance guide, the reason carriers do this is to avoid quick payouts of the death benefit. There’s no underwriting, so carriers must mitigate their risk somehow (in order for the premiums to be reasonable and their plan solvent and competitive).

Who Are The Underlying Life Insurance Carriers?

The life insurance carriers who underwrite the association term plans are all A-rated carriers. You can read about them in their respective brochures or contact us.

Why Does The Death Benefit Decrease?

This is a common characteristic of group term life insurance. The death benefit stays consistent until sometime after normal working age, whereupon it decreases.

Carriers do this to keep costs low for everyone. Obviously, people have a higher probability of dying when they are older versus when they are younger. Carriers know this. They also know that this is term life insurance. Term life insurance rarely goes beyond age 80, although these 3 associations allow it (with a reduction in the death benefit).

How We Can Help You Obtain Guaranteed Issue Term Life Insurance

We at My Family Life Insurance are happy to help you with guaranteed issue term life insurance products.

Please let us know if you have any questions about it. You can contact us or use the form below.

If you need more insurance, let us know. We can help.

We always work in your best interest, and there’s no risk in contacting us. If we can’t help you, we’ll part as friends and point you in the right direction as best we can. You can always contact us later if your situation changes.

Additionally, remember, that we work with many carriers and can likely find you more coverage or better coverage.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".