What Is Graded Death Benefit Whole Life Insurance? | We Discuss What This Type Of Life Insurance Is, And If You Need It!

Updated: April 12, 2024 at 9:38 am

Are you looking for life insurance, but were you offered graded death benefit whole life insurance instead?

Yes, the broker said that because of my health conditions, I am only eligible for a graded death benefit policy.

Sometimes, that can happen.

However, sometimes, better options exist that have better benefits or lower premium payments.

This article explains graded death benefit insurance and discusses when and, more importantly, if you need it.

You could save yourself hundreds over the lifetime of the policy.

(Note: sometimes, when you think you only qualify for graded death benefit policies, you are eligible for something better. We discuss more in the article.)

Here is what we will discuss.

- What is Graded Death Benefit Whole Life Insurance?

- When Do You Need Graded Death Benefit Whole Life Insurance?

- Advantages and Disadvantages of Graded Whole Life Insurance

- The Cost of Graded Whole Life Insurance

- Other Life Insurance Options (Important!)

- What About The Contestibilty Clause?

- FAQs About Graded Death Benefit Whole Life Insurance

- Final Thoughts About Graded Whole Life Insurance

Let’s jump in and answer the question, “What is graded whole life insurance”?

What Is Graded Death Benefit Whole Life Insurance?

A graded death benefit life insurance policy is one where the policy has a reduced death benefit in the first 1 to 3 years of the policy’s start date. This timeframe is sometimes known as the “waiting period” or the “graded period”. If you pass away during this timeframe, the life insurance company pays your beneficiaries either:

- the premiums you paid during this timeframe or

- a percentage of the death benefit

After this graded benefit period / waiting period, your beneficiaries receive 100% of the death benefit.

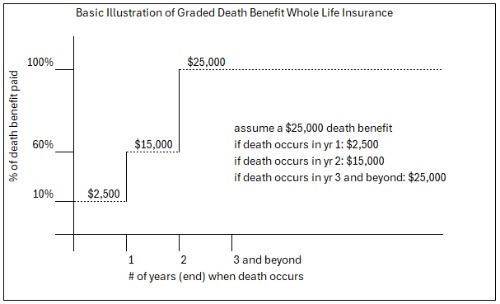

For example, let’s say Joe has a graded death benefit whole life insurance policy with a graded benefit period of 2 years. Let’s say the carrier pays 10% of the death benefit if he passes away in the first year and 50% of the death benefit in the second year. In the 3rd year and beyond, his beneficiaries receive 100% of the death benefit. He has a $25,000 policy.

For example, let’s say Joe has a graded death benefit whole life insurance policy with a graded benefit period of 2 years. Let’s say the carrier pays 10% of the death benefit if he passes away in the first year and 50% of the death benefit in the second year. In the 3rd year and beyond, his beneficiaries receive 100% of the death benefit. He has a $25,000 policy.

If he passes away in the 1st year, the carrier pays his beneficiaries $2,500 (10% X $25,000).

If he passes away in the 2nd year, the carrier pays his beneficiaries $12,500 (50% X $25,000).

In the 3rd year and beyond, his beneficiaries receive the full death benefit of $25,000.

See how that works? The death benefit is like a set of stairs.

Return of Premium

Some life insurance companies integrate a return of premium instead of a percentage of the death benefit. For example, a carrier may pay:

- 110% of the premiums paid if death occurs in the first year,

- 60% of the death benefit if death occurs in the second year, and

- 100% of the death benefit if death occurs in the 3rd year and beyond

For example, Joe paid a cumulative $500 in premiums in that first year. He suddenly passes away, and the carrier pays his beneficiaries $550 (110% X $500).

Typically, these policies are whole life insurance policies, which are a type of permanent life insurance designed to last a person’s lifetime.

However, as I will illustrate, a few carriers offer graded benefit term life insurance.

Adjustment For Accidental Death And Natural Causes

Many life insurance companies offering graded death benefit policies adjust the death benefit based on the cause of death. They typically split out death caused by an accident versus death of natural causes or illnesses.

For example, let’s use Joe again. However, this time, the carrier pays a graded benefit if he passes away from natural causes or illnesses and pays 100% of the death benefit if he passes away from an accident.

Here is what the death benefit payout looks like if Joe passes away in the first year:

- if death by an illness or natural cause: $2,500 payout

- if death by an accidental death: $25,000 payout

See the difference?

Let’s discuss why you would need a graded benefit policy next.

When Do You Need Graded Death Benefit Whole Life Insurance?

Graded death benefit policies are helpful when you don’t qualify for an immediate death benefit policy. Usually, this happens when the insured applicant has serious:

- medical conditions (but is expected to live for many more years) or

- lifestyle situations

For example, we have helped many people on parole or probation with a particular graded death benefit whole life policy. As you are aware, being on parole or probation is a serious situation. Many companies decline life insurance applications from people who are currently on parole / probation. Not this one. They provide a death benefit of over $100,000.

For example, we have helped many people on parole or probation with a particular graded death benefit whole life policy. As you are aware, being on parole or probation is a serious situation. Many companies decline life insurance applications from people who are currently on parole / probation. Not this one. They provide a death benefit of over $100,000.

Additionally, it is comparatively low cost to other types of whole life insurance. All of our clients who are on parole or probation are in good health. So, they overlook the graded benefit period (2 years) and focus on the low-cost, long-term coverage of the life insurance.

Then, when they qualify for traditional term life insurance or something better, we can stack on another plan at that time.

See how that fits? The same is true if you have serious health conditions.

Now might be a good time to discuss the advantages and disadvantages of graded benefit policies.

Advantages and Disadvantages of Graded Death Benefit Whole Life Insurance Policies

When I tell people they are eligible for a graded death benefit policy, some of them scoff at that option.

However, advantages exist with graded death benefit whole life insurance. We discuss these as well as the disadvantages.

(Note: as we discuss later in the article, by working with an independent brokerage like My Family Life Insurance, we can determine if better life insurance options exist.)

Advantages of Graded Death Benefit Whole Life Insurance Policies

Many advantages of graded death benefit whole life insurance exist. These advantages include:

- Great for people with serious health issues (but expected to live many years) or serious lifestyle situations

- Limited and easy underwriting. Applicants only need to answer some health questions

- No medical exam. I honestly don’t know any graded benefit policies requiring a medical exam

- Typically a whole life insurance policy, so designed to last your entire life (and pay a death benefit when you pass away)

- A “bridge” until you qualify for something better (if possible)

- Overall, an easy application process

Disadvantages of Graded Death Benefit Whole Life Insurance Policies

Some disadvantages exist for graded benefit policies, including:

- Higher premiums. You’ll generally pay higher premiums compared to someone who is eligible for a level benefit (i.e. immediate death benefit)

- Lower face amount. Carriers generally limit the face amount of the policy to like $25,000. If you need more death benefit coverage, you will have to add additional policies from other carriers. (Note: we always add policies for our clients and can help.)

- A graded benefit for the first 2 or 3 years. Underwriters implement a graded period to compensate for the risk (of an early death). Once the graded period ends, the policy owner is eligible for the policy’s full benefit.

Now that you know the advantages and disadvantages of graded death benefit whole life insurance, let’s discuss the cost of graded death benefit whole life insurance.

The Cost Of Graded Whole Life Insurance

Enter your information in the quoter below to obtain an estimated premium cost.

Select “decent health” in the health status field. The quoter will populate the graded whole life insurance options. Note, however, that it will not show all options. Contact us to find out all of your options.

Additionally, you can see options for an immediate benefit along with corresponding premiums.

As I mentioned, we have helped many people who were initially offered graded whole life obtain something better. Contact us if you would like to know what your options are.

Other Life Insurance Options (Other Than Graded Whole Life Insurance)

Did you know other life insurance options exist besides graded benefit policies?

Many people unthinkingly apply with carriers, not doing their due diligence or homework.

In fact, many people who call us about graded benefit policies are surprised to find out they are eligible for an immediate benefit policy or something better (i.e. higher death benefit and/or lower premiums).

So, if someone says that you are only eligible for a graded benefit policy, pivot to another broker (hint, hint. us 🙂 ). You will want to do your homework and pivot to an independent broker like My Family Life Insurance. An independent agent or broker has many life insurance options available. He or she can determine what other options you have.

Here they are.

Term Life Insurance

Depending on your lifestyle situation or medical condition, you may be eligible for term life insurance. We have helped many people who thought they were eligible for a graded benefit policy obtain term life insurance. Contact us to learn more.

Immediate Benefit Whole Life Insurance

Life insurance companies that offer graded benefit whole life insurance likely also offer immediate benefit whole life insurance. In other words, many life insurance companies offer immediate benefit policies. However, they all underwrite differently. Some companies will insure, say, someone with COPD, while other companies won’t. Moreover, some companies will just offer a graded benefit policy for COPD.

That is why I say you need to work with an independent broker (like us, wink wink) or agency. We have access to many life insurance companies, even more so than the average independent agency. For example, we have many low-cost burial insurance policies that many agencies do not have access to.

The best thing to do here is contact us and let us know your situation. We can review the medical questions and underwriting with the many carriers we work with. If an immediate benefit life insurance plan is available, we will share that information with you, including the health questionnaire. If not, we can provide other options.

Guaranteed Issue Life Insurance

Another option is a guaranteed issue life insurance policy. This type of policy contains no underwriting. In other words, the carrier doesn’t ask health questions or look up your information in the MIB or prescription drug history.

You apply, pay the initial premium, and you have the life insurance.

Because the carrier doesn’t underwrite, it places a waiting period on the death benefit. Usually, that waiting period is two years.

Just like graded death benefit whole life insurance?

Yes.

But, John, isn’t guaranteed issue life insurance more expensive than graded whole life insurance?

Sometimes, if you can believe it, guaranteed issue life insurance costs less. That is why I bring up guaranteed issue life insurance as an option. We work with many guaranteed issue plans that are either:

- cheaper than graded death benefit whole life insurance,

- lower in waiting periods, or

- both

For example, we work with many guaranteed issue term life plans. Depending on your situation, we can get you $25,000 of term life for $50 per month with a one-year waiting period.

Most guaranteed issue life insurance plans are whole life insurance plans. We work with many that are lower in cost than those you find elsewhere.

So, sometimes, it is better to go with a guaranteed issue life insurance policy. It could be better when:

- the cost is lower,

- the waiting period is lower, or

- both

Check out our related articles about guaranteed issue life insurance for people 40 and under and guaranteed issue plans with no waiting period.

Does a Contestibility Clause Matter?

Every fully underwritten life insurance policy with an immediate death benefit has a contestability clause. What is a contestability clause? It says that the life insurance company can investigate and contest a death claim if death occurs within a specified period (known as the contestability period), which is usually two years from the policy’s start date.

This means that if you pass away within the first two years of the policy’s start date, the life insurance company has the right to investigate and contest the death claim. The clause prevents quick death benefit payouts due to fraud.

With a graded death benefit policy (and guaranteed issue policy), the contestability clause doesn’t exist.

Why?

A graded life insurance policy already has a probationary period (i.e., the waiting period) for the contestability period. There is no disputing what the carriers say. If you pass away from a natural cause or illness in the first 2 years, the carrier pays the premiums back or some percentage of the death benefit. They aren’t going to investigate as language exists how they pay in the first two years. Additionally, a probationary period is already in place.

Frequently Asked Questions About Graded Death Benefit Whole Life Insurance

We answer some frequently asked questions about graded death benefit whole life insurance.

What Are the Key Features of Graded Whole Life Insurance?

Features of graded death benefit whole life insurance include:

- easy application process

- level premiums (although usually higher than immediate death benefit plans)

- waiting period from 2 to 3 years, depending on the carrier

- good for people with severe health conditions or lifestyle situations

How Does Graded Whole Life Insurance Differ from Traditional Whole Life Policies?

Graded whole life insurance differs from traditional whole life in a few ways:

- Carriers may limit borrowing from the policy’s cash value. Some companies do not allow you to access the cash value component.

- Traditional whole life has an immediate benefit, whereas graded whole life does not

- Lower premiums with traditional whole life

Are Any Graded Whole Life Insurance Plans Available For New York Residents?

You may know that few carriers make their life insurance products available to New York residents. The reason is the stringent insurance laws the state requires for insurance companies. Having said this, we do have a few graded death benefit whole life insurance options available, including guaranteed issue term plans.

What Are the Pros and Cons of Choosing Graded Whole Life Insurance?

Many advantages of graded death benefit whole life insurance exist. These advantages include:

- great for people with serious health issues (but expected to live many years) or serious lifestyle situations

- limited and easy underwriting. Applicants only need to answer some health questions

- no medical exam. I honestly don’t know any graded benefit policies requiring a medical exam

- typically, a whole life insurance policy, designed to last your entire life (and pay a death benefit when you pass away)

- overall, an easy application process

Some disadvantages exist for graded benefit policies, including:

- higher premiums. You’ll generally pay higher premiums compared to someone who is eligible for a level benefit (i.e., immediate death benefit)

- lower face amount. Carriers generally limit the face amount of the policy to like $25,000. If you need more death benefit coverage, you must add policies from other carriers. (Note: We add policies for our clients all the time and can help.)

- a graded benefit for the first 2 or 3 years. Underwriters implement a graded period to compensate for the risk (of an early death). Once the graded period ends, the policy owner is eligible for the policy’s full benefit.

What Happens If I Die During the Grading Period?

If you die during the grading period, the payout to your beneficiaries depends on how you passed away.

If you die by an illness, natural cause, or natural death, the life insurance company pays your beneficiaries either the premiums you paid or a percentage of the death benefit.

The life insurance company pays 100% of the death benefit if you die by accident (i.e., accidental death).

After the grading period, the company pays 100% of the death benefit, no matter your type of death.

Is Graded Death Benefit Whole Life Insurance Suitable for Everyone, or Are There Specific Eligibility Criteria?

Yes, but graded death benefit whole life insurance is really designed for people with serious health conditions or severe lifestyle situations who do not qualify for a traditional life insurance policy. If you are healthy or don’t have a serious lifestyle situation (like a felony), better life insurance options exist. Contact us to find out more.

Final Thoughts About Graded Death Benefit Whole Life Insurance

I hope you learned more about graded death benefit whole life insurance. It can be a solid life insurance option if you have serious:

- health conditions, but expected to live

- lifestyle situations that prevent you from traditional life insurance policies

We discussed the advantages and disadvantages of graded whole life insurance, other life insurance options, costs, and underwriting.

Do you have any questions or would like to get started? Contact us or use the form below.

As with anything we do, we only work in your best interests to find the right policy for you. We aren’t beholden to any one life insurance company, only the right one that fits your situation budget.

Moreover, if we can’t help you, we will point you in the right direction as best we can. You can always reach back out to us if your situation changes.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".