21 Reasons Why Your Life Insurance Won’t Pay Out | Although These Situations Don’t Happen Often, They Can Happen

Updated: April 12, 2024 at 9:38 am

Do you know many reasons exist why a life insurance company won’t pay out a death benefit?

Do you know many reasons exist why a life insurance company won’t pay out a death benefit?

You want to know what these reasons are, right?

I have compiled 21 reasons why a life insurance company won’t pay out the death benefit.

This is a good list of activities to AVOID.

However, these things won’t happen to nearly everyone. In other words, life insurance companies pay a death benefit in nearly all situations.

However, they can void a death claim if you are not careful. I will explain more.

Here is what we will discuss.

- Does Life Insurance Pay a Death Benefit?

- 21 Reasons Life Insurance Companies Won’t Pay Out a Death Benefit

- What You Can Do

- Final Thoughts About the Reasons Why Life Insurance Won’t Pay Out a Death Benefit

Let’s jump in and discuss life insurance and the death benefit in general.

Does Life Insurance Pay a Death Benefit?

Yes, life insurance pays out a death benefit. In 2022, the life insurance companies here in the United States paid out almost $90 billion (yes, that is $90,000,000,000) in insurance claims.

Yes, life insurance pays out a death benefit. In 2022, the life insurance companies here in the United States paid out almost $90 billion (yes, that is $90,000,000,000) in insurance claims.

Moreover, they paid about $348,000,000,000 in accelerated benefits (i.e., living benefits, cash surrenders, etc.

So, when I hear someone say they think companies won’t pay death benefit, this comment is false. Sure, situations exist where a life insurance company won’t pay. However, as you will see, these situations are few and far between.

Let’s discuss the reasons why a life insurance company won’t pay out a death benefit.

21 Reasons Why a Life Insurance Company Won’t Pay Out a Death Benefit

Before we discuss the reasons why a life insurance company won’t pay out a death benefit, let me first say that these situations are mostly self-inflicted. In other words, if the life insurance company doesn’t pay out, you (as the insured or owner of the policy) did something to break the contract.

That is just a fact. The actions hurt your beneficiaries, loved ones, and family members.

So, when someone tells me he isn’t going to buy life insurance because his brother’s cousin’s sister’s cousin’s best friend who works at the department store unexpectedly passed away, and the life insurance company didn’t pay, I know that is false. It was something that person did (generally speaking, of course). Most of these situations are common sense situations. For example, let’s say you rob a bank and get shot. You committed an illegal activity. No life insurance company pays out the death benefit in that situation.

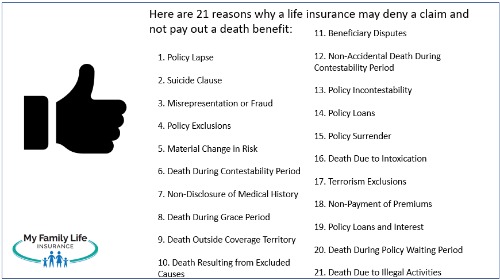

Every life insurance policy issued here in the United States typically has terms and conditions and fine print that dictate when a death benefit will or will not be paid out. Here are 21 of the most common reasons why a life insurance policy might not pay out a death benefit. These are in no particular order.

1. Policy Lapse

This is a very common situation and a major reason why a life insurance company won’t pay out the death benefit. If the policyholder or payor of the policy fails to make premium payments, the policy lapses. If the policyholder/insured doesn’t reinstate the policy during the reinstatement period, the company won’t pay out the death benefit.

The policy owner usually bears the onus. If you move, change banks, etc., you must contact the life insurance company to update your information. The life insurance company will always contact me, and I will always do my best to contact you. However, a policy lapse due to non-payment isn’t your insurance agent’s responsibility. It is yours.

2. Suicide Clause

Many policies have a suicide clause, typically within the first one to two years of coverage. If the insured commits suicide during this period, the company won’t pay out the death benefit.

3. Material Misrepresentation or Fraud

Although it is really hard to fool life insurance underwriters nowadays, life insurance companies will cancel your policy if they find out you lied or misrepresented facts on your life insurance application. The insurance carrier may deny the death benefit payout if the policyholder provides false information or withholds relevant information during the application process.

insurance companies will cancel your policy if they find out you lied or misrepresented facts on your life insurance application. The insurance carrier may deny the death benefit payout if the policyholder provides false information or withholds relevant information during the application process.

Do you think the company won’t find out? Think again. Here is an easy example. Let’s say you like to go mountain climbing. You are an avid rock climber / mountain climber and like to perform this activity any chance you get. Every life insurance application contains a question about performing dangerous activities. Mountain climbing is a risky activity. When the life insurance agent asks you this question, you think, “There is no way the life insurance company will find out.” So, you lie (which is insurance fraud) and say “no”.

Your friends and mountain climbing colleagues say you are an expert climber. One day, however, you get distracted and miss an eye loop. You fall to your death.

Your wife makes the claim. However, the life insurance company reviews the cause of death. Combined with the life insurance payout of $5,000,000, they investigate the claim.

They investigated and determined you had lied on the life insurance application. They deny the claim.

Many life insurance lawyers exist; however, they likely won’t be able to challenge a denial from a lie.

4. Policy Exclusions

Some policies have specific exclusions, such as death resulting from certain activities like high-risk sports or illegal activities. With others, it is the type of life insurance policy itself. For example, many graded benefit whole life insurance policies exclude a death benefit payout if the insured dies in the first two years of the policy.

Read your policy exclusions. If you have questions, ask your agent or broker (or talk to us).

5. Material Change in Risk

This scenario doesn’t happen often, but it could. Once the carrier approves your application, you are covered for any situation (governed by exclusions, contestability clauses, waiting periods, etc.).

However, let’s say you let your policy lapse and now have applied for reinstatement. If you now have high blood pressure, controlled with medication, that is usually OK. However, if you had a heart attack 3 months ago, the carrier denies your request and your policy won’t pay out.

6. Death During the Contestability Period

Insurers have a contestability period, usually the first two years of the policy, during which they can investigate and deny claims based on material misrepresentation or fraud.

We discussed this earlier. It is standard for the life insurance company to investigate any claim during the contestability period.

7. Non-Disclosure of Medical History

We discussed this before. If you fail to disclose relevant medical history or conceal pre-existing conditions, the insurance company may refuse to pay out the death benefit.

8. Death During the Grace Period

If you die during the grace period (the period after a missed premium payment when coverage is still in force), the insurer may withhold the death benefit until premiums are paid.

9. Death Outside Coverage Territory

Life insurance policies issued here in the United States cover death anywhere in the world, provided you are not participating in a war or some other type of situation. However, it is always good practice to read your policy’s exclusions and limitations as some policies may exclude death in certain parts of the world. If you die in one of these countries or territories specified in the policy, the carrier may not pay out the death benefit.

10. Death Resulting from Excluded Causes

If you die as a result of a cause explicitly excluded in the policy (e.g., war or certain types of accidents), the life insurance provider may not pay out the death benefit.

11. Beneficiary Disputes

This is one situation that insured and policy owners can miss. When you apply for life insurance, your beneficiary must have insurable interest. Insurable interest means your beneficiary will have a serious financial impact upon your death. Obviously, spouses, children, and close family have insurable interest. Additionally, business owners and key employees also have an insurable interest.

The company doesn’t pay the death benefit if your beneficiary doesn’t have insurable interest.

Beneficiary mistakes are one of the many reasons why life insurance companies won’t pay out.

Things get convoluted when the beneficiary changes or there is a change in the insured-beneficiary relationship (i.e., divorce).

For example, if you name yourself as the beneficiary of your own policy and pass away, your death benefit goes right to probate. You have just destroyed one of the main advantages of life insurance. Death benefit proceeds bypass probate and go right to the beneficiary (assuming proper beneficiary designation).

One situation that gets overlooked is divorce. Upon divorce, couples no longer possess insurable interest. Many states revoke a divorced spouse as a beneficiary UNLESS a divorce decree or divorce settlement exists.

You can read about one real, unfortunate incident that happened to me when I first entered financial services.

12. Non-Accidental Death During Contestability Period

If you pass away under suspicious or non-accidental circumstances during the contestability period, the insurer may investigate and potentially deny the claim.

13. Policy Incontestability

Many people erroneously think that once the contestability period ends, they are in the free and clear.

That isn’t quite the case. Life insurance companies can still deny a claim after the contestability period. After the contestability period expires, the policy becomes incontestable, meaning the insurer can deny the claim based on non-payment of premiums or if the claims department suspects fraud. Look at our previous example with our mountain climber. He had a $5,000,000 policy. The life insurance claims department said, “Hmmm…might be good to check and make sure mountain climbing was NOT a hobby or activity at the time of application.” It was and they denied the claim.

This brings us to a good point: if you engage in a risky activity (like skydiving) or develop serious medical conditions AFTER approval, the carrier pays the death benefit. After all, that is why you obtain life insurance.

Companies are only looking for fraud at the time of application.

14. Policy Loans

This situation happens more often with permanent life insurance, such as whole life insurance and universal life insurance.

If you – as the policyholder – take out a loan against the policy’s cash value and fail to repay it, the outstanding loan amount may be deducted from the death benefit. If the loan is too great, then the policy itself will terminate.

15. Policy Surrender

This one is obvious. There will be no death benefit payout if the policy is surrendered or terminated before the insured’s death. While this seems obvious, beneficiaries have contacted me about their loved one’s policy, only to find out he or she surrendered it years ago.

So, before you decide to surrender your policy for the cash value, make sure you understand all the consequences. Contact us for assistance.

16. Death Due to Intoxication

Although rare, some policies have exclusions for deaths resulting from alcohol or drug intoxication, especially if it’s deemed contributory to the cause of death.

Carriers usually cover death due to alcohol abuse or drug abuse unless the person passes away during the contestability period or suicide clause. Additionally, accidental death policies, which aren’t life insurance policies to begin with, usually exclude these situations from coverage.

Again, this situation underscores reading and understanding your policy.

17. Terrorism Exclusions

In most cases, deaths resulting from acts of terrorism may not be covered under the policy.

18. Non-Payment of Premiums

Life insurance companies won’t pay the death benefit if the policy lapses due to non-payment of premiums and the grace period expires. This is one of the major reasons why a life insurance company won’t pay out.

19. Policy Loans and Interest

This situation happens with permanent life insurance. If the policyholder takes out a loan against the policy and the accrued interest exceeds the policy’s cash value, the death benefit may be reduced by the outstanding loan balance and interest.

20. Death During Policy Waiting Period

Some policies have waiting periods, typically for graded death benefits, during which the full death benefit is not payable if death occurs within a specified period after the policy is issued or reinstated.

21. Death Due to Illegal Activities

Carriers won’t pay out a death benefit if you die while engaged in illegal activities. Again, let’s say you decide to rob a bank and get shot. The carrier will void the death benefit claim and refund the premiums you paid.

What You Can Do So The Life Insurance Company Pays Out The Death Benefit

There are various reasons why the life insurance company won’t pay out a death benefit. We listed 21 of them.

I hear from many people that they think life insurance is a scam. They say they know someone whose family never got paid. However, as we indicated above, most of those situations are self-inflicted.

Most of the time the insured-policy owner does something to void the contract. Or, dies within the waiting period (if graded benefit or guaranteed issue).

Here are some things you can do to make sure the company pays your death benefit upon your death:

- pay your premiums

- read your contract

- don’t do illegal things

- be honest on your life insurance application

- know your beneficiary designations

As I mentioned, nearly all life insurance companies pay the death benefit when it is needed the most.

Final Thoughts About the Reasons Why Life Insurance Won’t Pay Out a Death Benefit

I hope you learned the many reasons why a life insurance company won’t pay out a death benefit. These reasons do happen; however, they are usually in our control. In other words, if the company doesn’t pay the death benefit, the reasons typically falls on something the insured or policyowner did to void the contract.

Situations like non-payment of premiums, beneficiary changes, misrepresentations, waiting periods, policy exclusions, etc. all fall on the policy owner/insured.

Do you have any questions? Feel free to contact us or use the form below.

We only work in your best interests as that is the only way we know how to work with our clients. We are happy to review your situation, answer any questions you may have, and help you and your family.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".