7 Guaranteed Issue Life Insurance Options Up To $100k | Easy To Apply

Updated: April 12, 2024 at 9:39 am

Do you want guaranteed issue life insurance, with no health questions, up to 100k in death benefit?

Yes!

Great. There is a way to obtain $100,000 of guaranteed life issue insurance, which means no or limited underwriting.

Great! How do I apply?

We will tell you how.

We will tell you what is available for people under the age of 40 as well as over.

Additionally, we discuss that you may qualify for better coverage by working with us.

Moreover, we give you concrete information that, yes, you generally, can obtain up to $100,000 and even over $100,000 in most states.

In this article, we discuss how you can obtain $100,000, guaranteed issue life insurance.

Let me be transparent. Guaranteed issue life insurance is not perfect, but you can still obtain up to $100,000 of life insurance if you need that coverage amount (depending on your age and state availability).

Here is what we will discuss:

- What Is Guaranteed Issue Life Insurance

- Parameters For Guaranteed Issue Life Insurance $100,000

- Who Could Use 100k Of Guaranteed Issue Life Insurance

- 7 Guaranteed Issue Life Insurance Options, Up to $100k

- Guaranteed Issue Life Insurance $100,000 Age 0 to 39

- Guaranteed Issue Life Insurance $100,0000 Age 40 to 89

- Life Insurance Options For Incapacitated Individuals

- (Almost) Guaranteed Life Insurance Options

- How We Can Help You Obtain $100,000 Guaranteed Issue Life Insurance

Let’s first briefly describe what guaranteed issue life insurance is.

What Is Guaranteed Issue Life Insurance?

Guaranteed issue life insurance is life insurance automatically issued to you. You just fill out an application and then you have life insurance. It is guaranteed issuance. The carrier automatically approves your application. Some life insurance companies call it guaranteed acceptance life insurance because the company automatically accepts your application. No underwriting exists. Also, no medical exam or prescription drug lookup is required.

These policies help pay for your funeral costs and final expenses. Usually, these types of policies are whole life insurance policies. Whole life insurance is designed to last your entire life and give you lifetime financial protection. In other words, as long as you pay the premiums, the plan pays a death benefit to your beneficiaries whenever you pass away.

The application for guaranteed issue life insurance is designed for ease. However, guaranteed issue life insurance availability depends on your age and the state where you live. It isn’t available everywhere or for every age.

Guaranteed issue life insurance makes sense for people with serious health issues, lifestyle situations, and medical conditions. These people can’t get other types of life insurance (like underwritten term life insurance or whole life insurance). It’s not an ideal type of life insurance for someone in good health.

Sounds great, John. So, I just apply, and I have life insurance?

Yes, but you need to understand the parameters of guaranteed issue life insurance, especially if you want up to 100k.

Let’s peel back the layers so you understand the advantages and disadvantages of guaranteed issue life insurance.

Parameters For Guaranteed Issue Life Insurance Up To 100k

However, while it sounds great, parameters exist for guaranteed issue life insurance up to $100,000.

First, just about all the policies contain a waiting period. The waiting period usually is 2 years (although we have a couple of plans available with a 1-year waiting period).

Generally speaking, this means if you were to pass away by illness or natural causes during the waiting period, your beneficiaries receive the premiums you paid + interest. (Note: carriers may have specific terms and provisions with their waiting period.)

After the waiting period, the policy pays the full death benefit 100%.

Generally speaking, at any point, if you were to pass by an accident (i.e. accidental death), then the policy pays 100%. (Again, carriers may have their own, specific limitations.)

So, the waiting period is simply on illnesses and natural causes.

I think you will agree with me that that makes sense, right? Remember, the carrier does not underwrite, so it does not know the health status or medical history of the applicants. The waiting period protects the life insurance company and avoids a quick payout. If a quick payout occurs, carriers are forced to raise premiums or cancel life insurance programs altogether. Trust me that if that happens, canceling a life insurance program hurts everyone.

So, carriers want to avoid this situation. That is why they have a waiting period. It makes sense.

Mainly Whole Life Policies (But Term Life Available)

Second, most of these policies are usually whole life insurance policies (i.e. permanent coverage). Whole life is designed to last your lifetime, offers cash value, and has fixed premiums. However, a few carriers offer guaranteed issue term life insurance (more on that later). Most whole life carriers allow policy loans.

Additionally, most carriers limit the death benefit to $25,000.

So, yes, that means you have to enroll in 3 to 4 different carriers to obtain the $100,000 of guaranteed issue life insurance.

It’s not perfect, but it is available.

Availability Depends On Where You Live

Additionally, carrier availability depends on the state where you live. In other words, not all carriers are available in all states. For example, New York residents only have a few $25,000 plans available, not $100,000.

Your Age Matters, Too

Moreover, your age matters.

That’s right, John. I am 34 and have some serious health problems. My agent said I had to be 50 to get guaranteed issue life insurance.

Not true unless you live in a state that offers very few options. We work with many guaranteed issue life insurance plans for people under the age of 40. That is the benefit of working with a reputable, independent broker like My Family Life Insurance. We have life insurance options for just about every situation.

One more thing: guaranteed issue life insurance is available for incapacitated individuals like someone with Down Syndrome, Alzheimer’s, or autism. However, you probably can only purchase up to $25,000. Moreover, you’ll need a valid POA or guardianship form. Contact us to discuss more or scroll down to learn more.

You’ll Have To Stack Policies To Obtain $100,000 in Guaranteed Issue Life Insurance

Because no carrier offers 100k in guaranteed issue life insurance on a stand-alone basis, you will have to stack policies. You’ll see what I mean later in the article.

Not true, John. Another website says I can get up to $100,000 no problem!

I am not sure about that. I know what you are talking about, though. That program occurred a few years ago through a data-sharing association. We were contracted with them as well. I can tell you all about it. The only underwriting requirement was gainful employment. No waiting period existed.

The first carrier was Transamerica which offered a universal life insurance plan and a 10-year term policy. Their program was based on their group life insurance program. There was no waiting period, and they quickly exited the association.

Another carrier called Boston Mutual resumed the program, but they quickly exited the association as well. They offered a whole life policy. I can only guess that both carriers faced quick death benefit payouts because no waiting period existed. The people who applied were all sick and had serious medical conditions. Some may have even had a terminal illness. (Note: the people we enrolled are still current policyholders in the program, paying their premiums.)

Additionally, anyone says they can “work”, right? (Note: we required a current pay stub to ensure people were telling the truth.)

That is why a waiting period with guaranteed issue life plans is so important. It protects the carrier, current policyholders, and future policyholders.

So, maybe it is still being offered, but unlikely.

If you want the $100,000 (or more), you’ll have to stack policies (i.e. buy more than one). We give examples later in the article.

Who Could Use 100k Guaranteed Issue Life Insurance?

Really, anyone. However, as we discussed in our guaranteed issue life insurance guide, there possibly are other options for you instead of guaranteed issue life insurance. These options include:

-

-

- traditionally underwritten life insurance

- simplified issue life insurance

-

In both cases, the premium cost will be less than that on a guaranteed issue life insurance policy, all things being equal. Additionally, you would qualify for an immediate benefit. In other words, no waiting period.

That is right. Guaranteed issue life plans contain higher premiums because they are…that is right, guaranteed issue with no underwriting.

Contact us to find out if you qualify for something better. We always try for an immediate benefit (i.e. no waiting period). In many cases, we succeed.

However, unfortunately, there are situations where you don’t qualify for an immediate benefit. This is where a guaranteed issue plan is helpful.

Wait, John, I remember in a previous article you wrote that you should stay away from a guaranteed issue policy.

Yes, in our 5 burial insurances not to buy article, we did state that. The reason is most people, as I said, can qualify for an immediate benefit. (Or, even a graded death benefit, which offers a percentage of the death back to you during the waiting period instead of returning your premiums paid.)

However, maybe you don’t want or need underwritten life insurance. If not, guaranteed issue life insurance is good for:

(1) people who want a quick and easy application process. They don’t mind paying extra.

(2) people who have moderate to severe health conditions, or a lifestyle situation, and can’t qualify for an underwritten life insurance policy

Health Conditions That Generally Qualify For Guaranteed Issue Life Insurance

So, guaranteed issue life insurance is good for people who have:

- AIDS/HIV

- Huntington’s Disease

- Recent heart attack (last 12 or 24 months)

- Cirrhosis

- Help / assistance with activities of daily living

- Residing in a nursing home or assisted living facility

- Current cancer treatments

- Opioid Suboxone / Substance Abuse / Alcohol Abuse

- Recent inpatient hospital stays

- ALS

- Muscular Dystrophy

- Cerebral Palsy (severe)

- Cystic Fibrosis

- Pulmonary Fibrosis

- Mental impairments like Down Syndrome, Alzheimer’s, Autism

If you have any of these conditions or situations, you are probably eligible for the guaranteed issue life insurance up to 100k.

John, I am severely overweight with diabetes and my agent could only get me a guaranteed issue plan.

That is too bad. You should contact us as we have many carriers that use no height/weight chart. We could likely get you an immediate benefit plan.

Health Conditions That Generally Qualify For Immediate Or Graded Benefit Life Insurance

Having said that, here are conditions that appear a guaranteed issue policy is the only option. However, we have helped people with the following health conditions or lifestyle situations get an immediate benefit or simply better coverage:

-

- Wheelchair confinement

- Obese / high BMI

- Recent heart conditions such as cardiomyopathy, stents, etc.

- Cirrhosis

- Kidney Dialysis

- Complications From Diabetes

- Stroke / TIA

- Convicted felonies / current probation

- Drug / Alcohol abuse or use

- DWIs

- Bipolar disorder / Schizophrenia

- COPD

- Insulin use

- Parkinson’s

- And more

Your best option is to contact us so we can determine what you qualify for.

Let’s the 7 guaranteed issue life insurance options that can provide up to, and even over, 100k.

7 Ways To Obtain Guaranteed Issue Life Insurance, Up To $100k

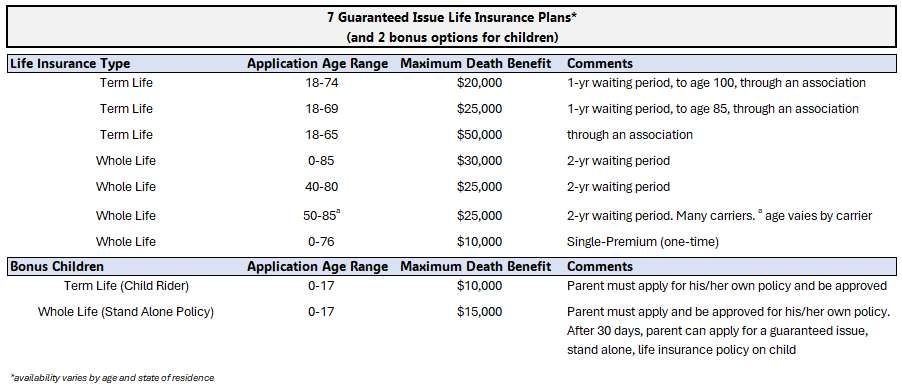

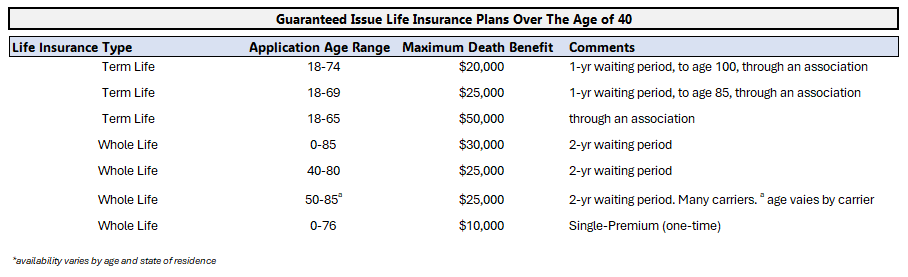

We work with 7 guaranteed issue life plans that will total more than $100,000 (if you want that amount).

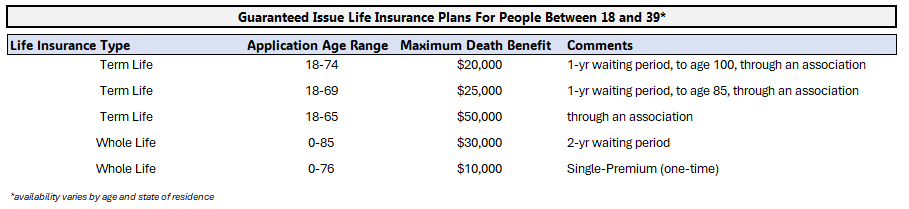

(Note: we actually work with more options as many carriers offer guaranteed issue life insurance in the 50 to 85 age range.)Here is a chart below of our offerings. Because of marketing rules, we can’t specify the carriers. Please contact us if you would like to learn more.

Next, let’s split out these options by age. I think you will then understand your options much better.

Guaranteed Issue Life Insurance Up To 100k For Ages 0 to 39, With Estimated Rates

We have access to several guaranteed issue life insurance carriers that will insure people under the age of 40.

Are you sure about that, John? I am aware of only carriers insuring beyond age 50.

Yes, we do have access.

Let’s discuss guaranteed issue life insurance options for someone 18 and under first.

Guaranteed Issue Life Insurance For People (i.e. Children) Under Age 18

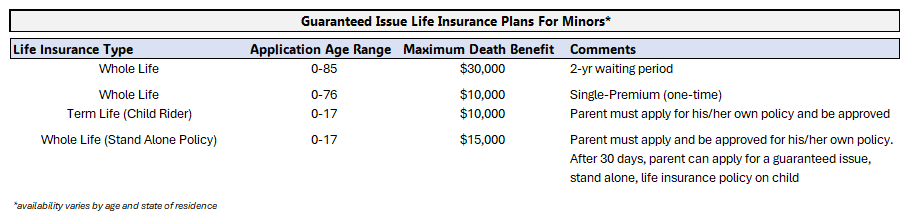

We will touch on guaranteed issue life insurance for minors, subject to state availability. We have a few options for children age 0 to 17:

So, not $100,000, but $65,000 is a decent amount to have on a minor child. Contact us if you would like to learn more.

So, not $100,000, but $65,000 is a decent amount to have on a minor child. Contact us if you would like to learn more.Guaranteed Issue Life Insurance Over 100k For Someone Between 18 and 39

So, we have many more guaranteed issue policies for people over the age 18 to 39. Here are some options. Again, state availability (i.e. where you live) limits these options:

So, in most states, a person can obtain up to $135,000 in guaranteed issue life insurance. Wow!!

So, in most states, a person can obtain up to $135,000 in guaranteed issue life insurance. Wow!!People age 18 and older have access to guaranteed issue term life insurance. Associations make these plans available. You have to join the association in order to obtain the life insurance. Contact us if you would like to learn more. We’ve helped many people obtain guaranteed issue term life insurance.

Here are example rates, assuming a man and woman are both age 30.

The rate isn’t that bad. Remember, these are whole life policies. Whole life policies are designed to last your lifetime. The premiums remain fixed. The policies grow cash value.

Why did I include a “payback” data point? Well, I hear many times that people tell me they will just invest when I tell them the premium.

The payback period represents the timeframe when the premiums you pay will equal the benefit, in this case $75,000.

So, for the 30-year-old woman, if she saves $146 per month, she will have accumulated $75,000 in 43 years.

That’s a…long time…Anything can happen during that timeframe.

I think you will agree with me that a person:- probably won’t save that long,

- likely won’t save at all, and

- has a chance of passing away before he or she fully saves

So, all decisions point to purchasing life insurance.

Guaranteed Issue Life Insurance Up To $100,000 Ages 40 To 89

At or after age 40, your options to secure 100k of guaranteed issue life insurance are more plentiful.

Remember, however, that availability is subject to state approval. Many states do not have all carriers available. Contact us to find out who is available in your state.

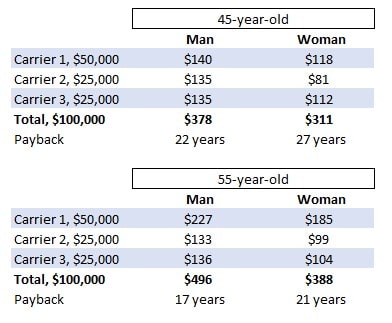

Remember, however, that availability is subject to state approval. Many states do not have all carriers available. Contact us to find out who is available in your state.Here are breakdowns for a man and a woman, age 45 and age 55.

These prices may seem a little outrageous; however, keep in mind a few things:

- These policies generate cash value.

- Do you really think you can save this amount each month?

- What if you pass away before the payback period ends? What will your loved ones do?

As before, the decision ends with purchasing life insurance.

If you’d like to search your own rates, feel free to search in our tool below. Note the disclosure. Also, not all carriers participate in the quoting tool. It is important to contact us in order to see what you are eligible for.

Guaranteed Issue Life Insurance For Incapacitated Individuals

If you have an incapacitated individual who is unable to answer questions and sign for himself or herself, you still have life insurance options.

Although generally rare, a couple of carriers do allow a power of attorney or guardian to apply and sign a guaranteed issue life insurance application.

You can purchase up to $25,000 with each carrier.

This is a nice option for people who have loved ones with:

- Down Syndrome

- Alzheimer’s

- Autism

- Dementia

- Other incapacitated situations

The guaranteed issue life insurance is an appropriate product for these situations. There are no health questions or underwriting. It makes the process very easy. Keep in mind, however, the waiting period. That still applies.

Again, you do have to have a power of attorney or guardianship authority. Moreover, from what the carriers tell me, you also must have the legal authority to sign contracts and financial documents. Sometimes, this is spelled out as such.

Other times, however, such authority is described as having the authority for the person’s estate or property.

However, sometimes, this authority is left out. If it is, then you do not have the authority to sign contracts and financial documents on behalf of the person. In other words, you can’t purchase the life insurance.

I am not a lawyer, and I advise you to consult a qualified attorney in your area if you have specific questions.

Nevertheless, we have helped many families obtain life insurance for their loved ones who are in incapacitated situations.Contact us if you have any questions. We are happy to help and have helped many families obtain life insurance on their loved ones.

(Almost) Guaranteed Issue Life Insurance Options Up To 100k

John, I do have a serious health condition, but I think I might qualify for something other than guaranteed issue life insurance.

There is no harm in applying for an underwritten policy. Many carriers nowadays have a simplified issue underwriting process. This type of process usually involves answering some health questions and signing the application. The carrier then looks up your information in databases including the MIB and prescription drug database.

There are no exams, blood samples, urinalysis, etc.

If you want to try for an underwritten plan, contact us. We can discuss and see what options you have.

Having said that, some “almost” guaranteed issue plans have a handful of health questions.

As we discussed earlier, we have helped many people obtain immediate death benefit life insurance coverage (when they thought they were only eligible for a guaranteed issue plan).

You’ll have lower, better rates compared to the higher monthly premiums with guaranteed issue plans.

Additionally, graded benefit plans exist. Graded benefit plans mean the carriers pay a percentage of the death benefit if you pass away in the first 2 years.

For example, a graded benefit plan might pay 30% of the death benefit in the first year and 70% in the second year. After the second year, it pays 100%.

There are many “almost” guaranteed issue plans that we discuss next:

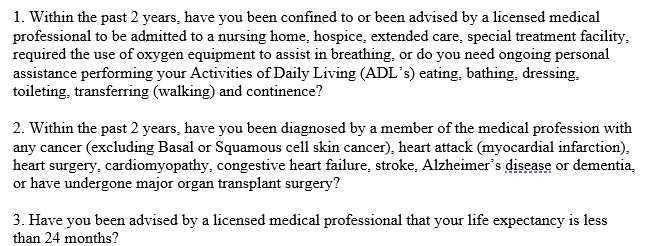

“Almost” Guaranteed Term Life Insurance To Age 100

Here is an option. You can purchase up to $30,000 of life insurance. You have to be between the ages of 40 and 80 to apply. The life insurance goes up to age 100.

There’s no smoking or tobacco distinction.

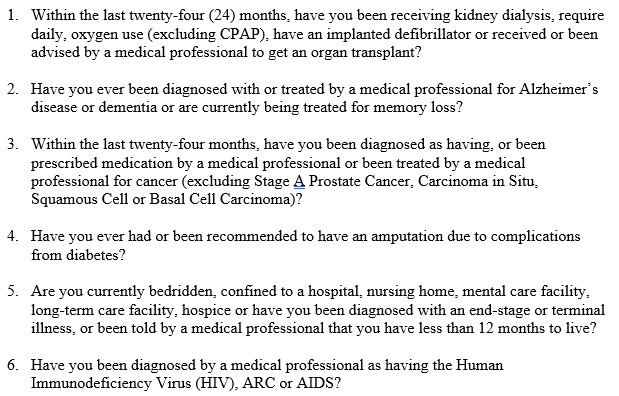

Here are the health questions. If you can answer these, you pretty much qualify for the life insurance.

Note on question #2. It asks if you have been diagnosed, not if you have been receiving treatment. So, you can qualify for the life insurance if you have or undergoing any treatment such as medication.

A Simplified Whole Life Option

Here is another option. On this one, you can purchase up to $25,000, ages 40 to 90 apply.

There are no height/weight charts, MIB look-ups, or prescription drug checks. If you can answer “no” to these, you have life insurance:

If you can say “no”, you generally have life insurance.

How We Can Help You Obtain 100k Of Guaranteed Issue Life Insurance

We hope you see that guaranteed issue life insurance up to 100k is available.

Are the options perfect? No. However, you can purchase up to $100,000 if you need it, subject to your age and state availability.

Additionally, we went over some “almost” guaranteed issue plans. As we stated, we routinely help people obtain life insurance with an immediate benefit.

This brings us to an important point. Contact us so we know your health situation.

Far too often, people enroll in a guaranteed issue life insurance plan because the application is easy.

It is!

However, they do themselves a disservice because they might have qualified for an immediate benefit or a lower premium rate.

So, just contact us or use the form below. We are happy to go over your options.

As we always say, there is no risk in contacting us. You see, unlike other agencies, we must work in your best interest. It’s the only way we know how. If we can’t help you, no problem. You’ll learn a little more, and we will part as friends.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

4 thoughts on “7 Guaranteed Issue Life Insurance Options Up To $100k | Easy To Apply”

Comments are closed.

I would like to learn more. Sounds like I may qualify. Can you contact me?

Hi,

I sent you a private email separately about this earlier in March, but if you have questions, then please contact us directly at (800) 645-9841.

John

Hello I’m looking for guaranteed life insurance for mom

Hi Diana,

Thanks for reaching out to us. We can likely help. I will email you additional information.

John