How To Find The Best Burial Insurance For People With Bipolar Disorder | We Discuss Burial Insurance Options For You

Updated: April 12, 2024 at 9:39 am

If you have bipolar disorder, you probably think that you can’t obtain burial insurance.

That is simply not true. Sure, there might be life insurance carriers that decline you, but there are other carriers that won’t.

You just need to know where to look to find the best burial insurance for your situation.

We have helped many people in similar situations obtain burial insurance. It is actually easy to do!

In this article, we discuss how people with bipolar disorder obtain the best burial insurance for their situation.

Here is what we will discuss:

- Burial Insurance Underwriting And Differences From Traditional Life Insurance

- How To Find The Best Burial Insurance

- Burial Insurance Options Available

- Burial Insurance Cost

- Final Thoughts

Like most of our articles, we first discuss burial insurance underwriting. Why? The reason is that underwriting is the foundation of finding the best burial insurance for your situation.

Burial Insurance Underwriting For People With Bipolar Disorder

If you did not know, burial insurance is typically a whole life insurance policy with a relatively small face amount of up to $25,000 or $50,000.

That is all that it is. The industry calls it “burial insurance” because it is designed to help pay for your funeral and burial expenses.

Additionally, you can leave some money to loved ones, if you wish.

Before we get into the best burial insurance for people with bipolar disorder or manic depression, let’s talk about underwriting.

Underwriting for burial insurance is much different than that for traditional term life insurance, IUL, and even larger face amounts of whole life insurance.

These types of underwriting are going to want to know the severity of your bipolar disorder. They will want to know your medical history. They will certainly want to review your doctor’s records for the severity of the disorder, if there have been any suicide attempts, etc.

We talked about this in our life insurance for people with bipolar disorder guide.

Likely, you will have to undergo a paramedical exam as well. Also, carriers want to know if you have any other underlying health issues. (If you have bipolar disorder and need term life insurance, whole life, or an IUL, contact us, and we will discuss the steps and process with you.)

We have helped many people with bipolar disorder obtain term life insurance or permanent insurance with high death benefit (i.e. $100,000 and higher).

But, burial insurance underwriting for people with bipolar disorder is much different. We discuss this next.

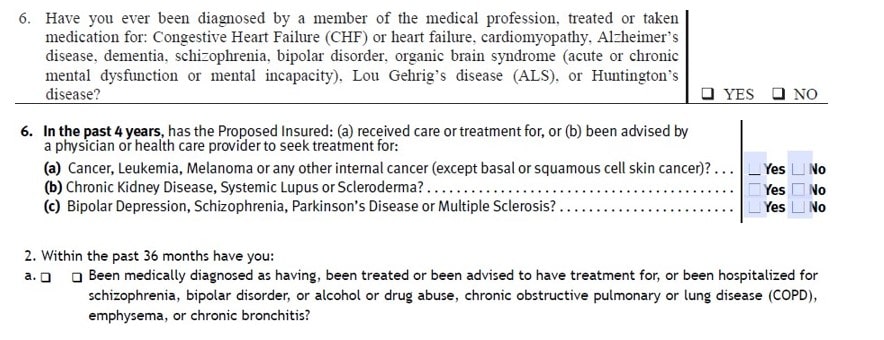

Burial Insurance Underwriting Health Questions Related To Bipolar Disorder

However, with burial insurance for bipolar disorder, underwriting is different. The carrier doesn’t care about all that other stuff.

They don’t want you to go through a medical exam or request your doctor’s records.

With burial insurance, all you do is answer a health questionnaire. The health questions require “yes or no” answers. They just want to know if you have bipolar disorder or not.

That’s right. No blood test, urine sample, etc., etc…Just a simple “yes” or “no”.

Additionally, if a carrier doesn’t ask about a specific health condition on the application, the carrier likely disregards it. This includes bipolar disorder.

Questions related to bipolar disorder are structured like this. These are some actual questions from 3 different burial insurance applications:

This brings us to a couple of points. As you can see, the burial insurance application is simply answering yes or no questions.

However, if you have another health condition, such as COPD, that condition might preclude you from your optimal burial insurance choice. Carriers look at ALL of your health conditions combined. Sure, burial insurance is still available, but the chance that a carrier will cover bipolar disorder AND COPD, at an optimal monthly premium, is low.

Moreover, other situations could lead to an application decline. For example, needing assistance with daily living tasks is one situation.

Not to worry, though, because we have other affordable options. We discuss those later.

Here’s the kicker, though. Many carriers don’t even ask about bipolar disorder on their application. So, who is the one we would recommend to you? That’s right. The one that doesn’t ask the question!

More On Burial Insurance Underwriting

Carriers will run your background through a few different databases to make sure what you say on the application matches to your records. One database is the MIB. The MIB shows your claim history and your insurance application history. It will show when you applied for insurance in the last few years. The MIB alerts the carrier to any red flags if what you said on your application does not match to any previously released information, through your application and claim history.

They will also look at your prescription drug history. Carriers can see all of that. (Even the ones I take.) If an answer to an application question does not match a prescription drug you take, that will be a red flag. For example, if you take an inhaler for emphysema, but say no to the question, “in the last 2 years, have you been diagnosed or treated for emphysema?”, the carrier questions your truthfulness. Same for medication used for bipolar disorder.

Some carriers have an additional step with a phone interview with an underwriter. The purpose is to confirm all this information.

Remember that lying on a life insurance application constitutes fraud. Obviously, fraud is a bad thing. There is no need to lie. We will find you the best policy for your situation, which we discuss next.

Just to recap, in terms of a burial insurance policy. If the carrier doesn’t ask your condition (in this case bipolar disorder) on the application, then likely the carrier won’t consider it.

How To Find The Best Burial Insurance For People With Bipolar Disorder

What is the best burial insurance for people with bipolar disorder? The “best” burial insurance comprises of 2 parts:

burial insurance comprises of 2 parts:

- Having an immediate death benefit

- Paying the lowest premium for your situation

That is it.

As we said earlier, obtaining the best burial insurance depends on your situation. If your burial insurance is stable with no hospitalization or manic episodes, there is no reason why you can’t obtain lower-cost burial insurance (list) from fraternal carriers or guaranteed universal life (link).

Basically, to find the best burial insurance, you need to do the following:

Contact us – we work with so many carriers, even more than the typical burial insurance broker, we can find you some type of burial insurance even with bipolar disorder.

Tell us your situation – be honest and transparent with us about your bipolar disorder as well as any other health conditions. We will ask you to answer a pre-qualification application with us over the phone.

Carrier selection – we search our carriers and see which one is the best one for your situation.

Apply – you apply via an electronic application with us over the phone. Carriers look up your information to confirm your situation

Approval – in many cases with clients with bipolar disorder, you are approved. Depending on what burial insurance you apply for, approval could be instant or take up to a few days.

As we said earlier, we work with many life insurance carriers, even more so compared to the typical broker, so I am sure we can find you some amount of burial insurance.

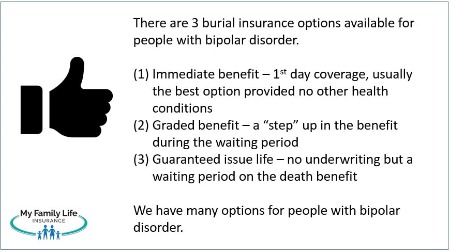

Burial Insurance Options For People With Bipolar Disorder

Burial Insurance Options For People With Bipolar Disorder

There are a few types of burial insurance for people with bipolar disorder. We will help you make sense of them next.

Not to worry. We can and will find you an affordable burial insurance plan regardless of your situation.

Immediate Or Level Benefit

The first one is called immediate, or level, benefit. This means the death benefit has “day 1” or immediate coverage.

Immediate benefit coverage is what you want. If you have the policy in place and die the next day, the carrier pays the death benefit.

The immediate benefit is also, generally, the least expensive burial insurance option.

Here’s an example of how immediate benefit coverage works. Let’s say Jim applies for $20,000 burial insurance. The carrier approves him with immediate benefit coverage. Six months later, Jim, unfortunately, dies suddenly. Jim’s beneficiary will receive the $20,000 to help pay for Jim’s funeral costs.

As we said, a policy with level benefit (i.e. immediate death benefit) usually contains a lower premium.

There are many carriers that accept people with bipolar disorder. So, I am sure we can find you some amount of coverage with an immediate benefit.

Graded Benefit

The second one is called graded benefit. The name kind of describes how this type of burial insurance works.

A “graded” burial insurance policy has a waiting period on the death benefit.

Carriers have a couple of options how they administer the waiting period.

One option the carrier pays back all your premiums you paid if you pass away from an illness or natural cause during the waiting period. The waiting period usually is 2 or 3 years, depending on the carrier. If you are still living after the waiting period, the carrier pays the death benefit at 100% to your beneficiary.

Another option is the carrier pays a percentage of the death benefit to your beneficiary if you pass away (from illness or natural cause) during the waiting period. For example, a graded benefit might be 10% of the death benefit paid to your beneficiary if you pass away in the first year, 65% if you pass away in the 2nd year, and 100% of the death benefit paid if you pass away in year 3 or beyond.

Example

An example will make this coverage clear. Let’s use the same example, except the carrier approves Jim for graded benefit coverage. The graded death benefit is 2 years. Should Jim die of a natural cause or sickness within the 2-year timeframe, the carrier will reimburse his beneficiary the premiums plus 10% interest. If Jim dies in year 3 and after, the full death benefit paid to his beneficiary. (One caveat: beneficiaries receive the full death benefit anytime if death by accident.)

Unfortunately, Jim unexpectedly dies of sickness 6 months later. His beneficiary receives the premiums back plus 10%.

People with many health complications usually end up with graded benefit coverage. So, if you have bipolar disorder AND something else, like a stroke in the last 2 years, then a graded benefit might be your only option.

A graded benefit plan is not bad. However, we aim to find a level benefit coverage when possible. Level benefit coverage usually means the lowest premium cost for you.

Guaranteed Issue Burial Insurance For People With Bipolar Disorder

Guaranteed issue life insurance is another option for people with bipolar disorder.

If your situation doesn’t allow an immediate or graded benefit, a guaranteed issue is available.

This means just as it sounds: you automatically receive coverage. Just:

- fill out an application and answer a few non-health questions

- send in the application with the premium draft information

and, you now have life insurance. The carrier does not run your background through the MIB or prescription drug history.

Guaranteed-issue coverage contains a “waiting period” death benefit, usually 2 years. We work with a few different guaranteed-issue carriers. Sometimes, the cost of the guaranteed-issue life insurance coverage is less than that of a traditional graded benefit policy. If that’s the case, it makes sense to apply for the guaranteed-issue coverage.

We work with many guaranteed issue carriers, even a guaranteed issue term product which you can self-enroll here and for those under the age of 40.

Burial Insurance Cost For People With Bipolar Disorder

Now that you know the types of burial insurance available to you, which type do you think we will choose? That’s right. The one with the lowest cost and that best fits your situation.

That is ideally the best burial insurance for your situation.

If you want to search rates on your own, feel free to do so below. The quoter doesn’t capture all available plans, so please make sure to contact us so we can see what else is available.

People with bipolar disorder can obtain immediate death benefit coverage. As we said earlier, however, other health conditions affect approval. If you are overweight, have cancer, or have some other significant health condition in addition to bipolar disorder, the chances of an immediate death benefit coverage are much lower.

That is where we come in. We have helped people with bipolar disorder AND some other health condition obtain proper coverage, usually at level death benefit coverage.

Having said that, many carriers don’t even ask a question about bipolar disorder on their application. So, as we mentioned earlier, these are the carriers we will generally recommend.

That is right!

We work with many burial insurance carriers.

Final Thoughts About Burial Insurance For People With Bipolar Disorder

We hope you found this article informative. You can obtain burial insurance if you have bipolar disorder.

As we discussed, the best burial insurance is the one offering an immediate benefit at the lowest possible premium for you.

If your situation warrants, other types of burial insurance exist.

We have helped many people with bipolar disorder obtain burial insurance. I am confident we can help you out, too!

Are you ready to get started? Feel free to contact us or use the form below.

We work with many carriers in the burial insurance area and know we can find the right coverage for you.

There is no risk of contacting us. As with everything we do, we work with your best interests at all times. That means if there is a better option for you than what we can provide, we will help put you in touch with someone who can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".