Is A Limited Pay Life Insurance Policy Right For You? We Discuss What Limited Pay Life Insurance Is, Advantages, And Disadvantages

Updated: April 12, 2024 at 9:38 am

Have you heard about limited pay life insurance and wondered what it is about?

Have you heard about limited pay life insurance and wondered what it is about?

Yes, John. Another agent presented it to me, and it made no sense.

Well, sometimes the life insurance industry vernacular is wacky. In this article, we will discuss limited pay life insurance and if it is right for you.

We will discuss all the advantages and disadvantages and answer many questions in our FAQ section.

Here’s what we will discuss.

- What Is A Limited Pay Life Insurance Policy?

- Advantages And Disadvantages of Limited Pay Life Insurance

- What Are The Different Limited Pay Life Policy Periods Available?

- Is It Right For You?

- FAQs About Limited Pay Life Insurance

- Final Thoughts About A Limited Pay Life Insurance Policy

Let’s jump in and answer the question, “What is limited pay life insurance?”

What Is A Limited Pay Life Insurance Policy?

A limited pay life insurance policy is a whole life policy that allows the owner/payor of the policy to make premium payments within a fixed time period rather than continuously over the insured’s lifetime. The advantage is that you pre-pay your policy sooner to a fully “paid-up” status.

You pay your premiums over a set, fixed time period. Once you have completed the payments, you’ve paid the policy in full. You no longer are required to pay any more premiums. Your policy is 100% in force.

In other words, the carrier takes all those premiums that would have been paid over one’s lifetime. They then take the present value of that amount and fit it into a fixed time period (traditionally a set number of years). Once you complete the time period, your policy is fully “paid-up”, and you no longer pay again.

Limited pay life insurance is not available as a term life insurance policy (although term life insurance does have fixed time periods like 10 years and 30 years, for example). This type of option is only available on whole life policies.

Let’s see how this works. For example, let’s say Jim is a healthy 25 year old man and wants $100,000 whole life insurance.

Let’s see how this works. For example, let’s say Jim is a healthy 25 year old man and wants $100,000 whole life insurance.

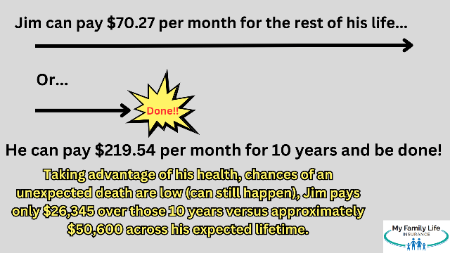

He could pay continuously for the rest of his life. That premium is $70.27 per month.

Or, he could pay over 10 years. Her payment is $219.47 per month. However, at age 35, he no longer pays for the rest of his life, and his life insurance coverage remains in force until his passing.

OK, John. Why would someone want to do that?

Now is a good time to discuss the advantages and disadvantages of limited pay life insurance.

Advantages And Disadvantages Of A Limited Pay Life Insurance Policy

Why would someone want to purchase a limited pay life policy? There are many reasons. Here are some advantages of limited pay life insurance.

- A shorter premium payment period for continuous, lifelong coverage. Once you’ve paid, you are done. Little chance exists for policy lapses

- Higher cash value accumulation (see the comparison). This continues through the life of the policy

- Higher income potential (because of the higher cash value). The owner can use this income for retirement income

- Potentially greater dividends. That means if you choose to receive the dividends as paid-up additions to purchase additional paid-up life insurance, you’ll potentially have higher cash value and death benefit. (See our article on participating vs. non-participating life insurance).

- You could save money on premiums. Look at our example. Jennifer pays only $30,682 over the 20 years, and then the policy is paid up. If she had a continuously paid policy and passes away at the end of the year at age 85, she would have paid $47,040 over those 56 years.

Of course, disadvantages exist. Here are some disadvantages of limited pay life insurance:

- Obviously, higher premiums. You pay lower premiums on a continuously paid policy. However, you may pay way more over the life of the policy.

- There is always an opportunity cost when paying extra into a policy. Let’s look at Jennifer again. She pays an extra $58 per month for her limited pay life insurance. If she invests that $58 over the next 20 years (age 30 to 49), she could have about $34,000 assuming an 8% average annual return rate.

- An unexpected death within the policy period means you’ve paid more in the policy than you had to (no human has that hindsight).

Similarities With Traditional Whole Life Insurance

OK, John. Are there any similarities between limited pay life insurance and a standard whole life insurance policy?

Yes, both are permanent life insurance designed to last your entire lifetime.

You can still take policy loans. Limited pay policies allow potentially higher policy loans.

Both have a guaranteed death benefit and level premiums. The life insurance premiums don’t change; they remain guaranteed.

They are both whole life policies.

What Are The Different Policy Periods Available?

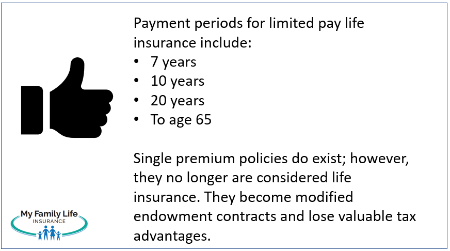

Life insurance companies offering limited pay policies allow a few different types of payment periods. These premium payment periods include:

- 7 Years

- 10 Years

- 20 Years

- To Age 65

Let’s give an example of a 10-year limited pay life policy. Again, this means the life insurance company takes the premiums a client would have potentially paid over his or her lifetime and coverts it into a fixed payment period. (In this case, 10 years.)

life insurance company takes the premiums a client would have potentially paid over his or her lifetime and coverts it into a fixed payment period. (In this case, 10 years.)

Let’s use Jim again. Jim is 25 and wants $100,000 of whole life. He is pretty healthy. He could:

- continuously pay over his lifetime, which costs $72.07 per month, or

- pay in 10 years, which costs $219.54 per month

The $219.54 per month seems like a lot. However, take into consideration that Jim is young and healthy. The chance of death, although it could happen, is low. He pre-pays the extra $147.47 per month. At the end of the 10 years, he no longer pays for the life insurance.

John, what about a single pay option? Is that available?

Single Premium Life Insurance

Yes. You are talking about single premium whole life insurance. You pay only once and you never pay again.

This is a limited pay option; however, a huge difference exists between the traditional limited pay periods (7 years, 10, 20, to age 65) and a single premium policy.

The difference is that the life insurance loses valuable tax advantages if paying a single premium.

In this case, the life insurance technically becomes a modified endowment contract (MEC). Without getting too detailed, MECs happen when a policy owner pays way too much premium into the policy than what is allowable by the Internal Revenue Code.

In this case, the life insurance technically becomes a modified endowment contract (MEC). Without getting too detailed, MECs happen when a policy owner pays way too much premium into the policy than what is allowable by the Internal Revenue Code.

Specifically, while the MEC policy’s cash value still grows tax-deferred, any policy loans become taxable. Moreover, any cash withdrawals before the age of 59.5 face an IRS penalty. Essentially, the life insurance mirrors the tax structure of a non-qualified annuity.

The policy’s death benefit remains income tax-free to the beneficiary, just like a traditional life insurance policy. So, that is good.

MECs are outside the scope of this article. Just know that if you pay a single premium, your life insurance turns into a modified endowment contract. You then lose valuable tax advantages of whole life insurance. However, if you never plan to access the cash value, then the MEC has the same valuable death benefit properties as life insurance.

Is Limited Pay Life Insurance Right For You?

Limited pay life insurance is a great option for and could be worth it for:

- people who have the budget to pre-pay their whole life insurance over a shorter, fixed time frame

- people who want faster cash value growth

- young children (limited pay life insurance is a great way to establish life insurance on children. You pay such a low rate for a paid up policy. For example, a $50,000, continuously paid whole life policy on a 1-year-old boy costs about $20 per month. A 20-year limited pay whole life insurance policy costs about $35 per month (rate subject to change at any time). In this example, by the time the child is 21, he will have a fully paid-up policy.

- those who want to participate in the “bank on yourself” or “be your own banker” concept.

- people who simply want to pay their policy in full during a fixed timeframe rather than their entire life

FAQs About Limited Pay Life Insurance

We answer frequently asked questions about limited pay life insurance.

Is A Limited Pay Life Insurance Policy Worth It?

A limited pay policy can be worth the extra premium payments. People who want to pay their whole life policy sooner over a fixed number of years could benefit from a limited pay policy. We discussed the advantages of a limited pay policy in the previous section.

What Are The Available Policy Periods For Limited Pay Life Insurance?

Typical payment periods include:

- 7 years

- 10 years

- 20 years

- pay to age 65

These options are subject to the life insurance carrier offering. For example, some carriers do not offer 7 pay or 10 pay limited life insurance.

Is A Single Premium Policy a Limited Pay Policy?

Technically, a single-premium life insurance policy is a limited pay policy. However, in this case, a single-premium whole life insurance policy becomes a MEC and loses valuable tax advantages.

Generally speaking, you will only want to purchase a single premium whole life insurance policy when you know you do not (or will not) need the cash value.

How Does The Premium Amount In Limited Pay Life Insurance Compare To Other Life Insurance Policies With Ongoing Premiums?

You’ll pay more premiums in a limited pay policy compared to a continuously paid policy. However, your payment timeframe is much shorter. Once you complete the payment period, you never pay again. The policy remains in force.

Are There Age Restrictions Or Requirements For Purchasing Limited Pay Life Insurance?

Generally, no. However, you will want to check with the life insurance companies to see. Newborn children are eligible for limited pay life policies via an application from their parents or grandparents.

What Types Of Death Benefits Are Offered With Limited Pay Life Insurance?

Usually, no death benefit restrictions exist except for any carrier-specific restrictions. Most carriers have a death benefit “maximum” limit based on one’s income.

For example, a 30-year-old woman may be eligible for a maximum death benefit amount of “30 X salary”, including any life insurance policies in force on her. If she makes $100,000, she conceivably could apply for a maximum of $3,000,000. If she already has $1,000,000 in place, then she could apply up to $2,000,000.

What Happens If I Miss A Premium Payment?

You’ll have a grace period, typically 30 days, to pay the life insurance. If you don’t pay after that, you run the risk of terminating your policy.

However, if you have an automatic premium loan option, the carrier will automatically take the premium from your cash value and pay your policy. If your cash value dwindles, the carrier terminates the policy.

Are There Any Riders Or Additional Coverage Options That Can Be Added To A Limited Pay Life Insurance Policy?

Yes, depending on the carrier, you can add:

- automatic premium loan provision

- term life insurance rider

- accelerated benefits (living benefits)

- accidental death and dismemberment

- critical illness

Some of these riders come with an extra cost. Contact us if you have any questions.

How Does The Underwriting Process Work And What Factors Impact The Premium Rate?

There’s no underwriting difference between a limited pay policy and a continuously paid whole life policy. When determining your premium rate, underwriters look at your:

- age and gender

- tobacco and marijuana use status

- height and weight

- prescription medication

- MIB

- driving record

- hazardous activities like skydiving

- health conditions

- lifestyle situations like felonies and DUIs

- family history of certain health conditions

- other information material to the underwriting decision

What Happens At The End Of The Premium Payment Period In A Limited Pay Life Insurance Policy?

At the end of the payment period, your policy is paid up in full and you don’t have to pay a premium again. Your policy is in force.

You can borrow from your policy and pay your loan back.

What Options Are Available If I Want To Surrender Or Cancel The Policy Before The Premium Payment Period Is Completed?

You have a few options if you want to surrender or cancel your life insurance policy. You can

- take the cash surrender value – this is the amount of cash value available less any loans,

- select a reduced paid-up option – this is where you take the current cash value and use it as a single premium to pay for a “reduced” death benefit whole life insurance policy,

- take an extended term life insurance option – this is where you want to keep the death benefit the same as your original policy. You use the cash value to pay for a term period. The length of the term period depends on your age, or

- activate an automatic premium loan provision

What Are Paid-Up Additions?

Paid-up additions are a dividend payment option. You use dividend payments from a participating whole life insurance policy to pay for fully paid-up life insurance. The benefit of using dividend payments (i.e. additions) to pay for additional life insurance is:

- an increase in cash value and

- an increase in the death benefit

Paid-up additions shouldn’t be confused with limited pay life insurance. The paid-up additions option is available on both continuous pay and limited pay whole life insurance policies.

Final Thoughts About Limited Pay Life Insurance

We hope you learned about limited pay life insurance, and if you feel it is right for you. Many advantages exist with limited pay life policies. However, you will want to analyze all your options available.

Do you have any questions about limited pay life insurance or your situation? Contact us or use the form below.

We are happy to discuss your options and answer any questions you have.

We won’t call you a million times a day like other brokers. Rest assured that we work for you and have your best interests first. We can help you determine if a limited pay policy works best for you or not.

If we can’t help, we’ll part as friends and will point you in the right direction as best we can. You can always reach back out to us if your needs change.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".