This Is How People With Down Syndrome Obtain Life Insurance | Your Guide To Obtaining Life Insurance On Your Loved Ones

Updated: April 12, 2024 at 9:38 am

You’ve been told that people with Down Syndrome can’t get life insurance. However, that is not true.

People with Down Syndrome can obtain life insurance. That is right.

If you have a relative, family member, or loved one with Down Syndrome and are thinking about obtaining life insurance on his or her life, you have come to the right place. We have helped many families with children, young adults, and older adults with Down Syndrome obtain life insurance.

Not all types of life insurance are available, though. Life insurance options are limited. Moreover, there is a process if you want to obtain life insurance for someone who has Down Syndrome. We explain all of this and a major pitfall many people, families, and even agents, overlook.

However, we have helped many people with Down Syndrome obtain life insurance.

In this guide, we describe how you can obtain life insurance for your loved one or relative with Down Syndrome. Specifically, we tell you:

- Why Is It Hard To Obtain Life Insurance

- Life Insurance Options For People With Down Syndrome

- Guaranteed Issue Life Insurance For Children Ages 0 to 17

- Guaranteed Issue Life Insurance For Adults Ages 18 And Older

- A Major Pitfall To Watch Out For!

- Frequently Asked Questions About Down Syndrome And Life Insurance

- Final Thoughts About Down Syndrom And Life Insurance

(If you want to watch an abridged version of this article in 3:34, click on the video below.)

Let’s start and answer the question, “Why is it so hard to get life insurance for someone with Down Syndrome?” It’s an honest and good question.

Why Is It Hard For Someone With Down Syndrome To Get Life Insurance?

Many people tell us that carriers declined their loved one life insurance because of Down Syndrome.

Why is it so hard to obtain, they ask? They tell us that their son or daughter is healthy every other way.

Here’s why it is hard. People with Down Syndrome, as you know, may have additional health concerns as well as a shorter life expectancy than the average person. According to the National Association For Down Syndrome, the average life expectancy of a person with Down Syndrome is 60 years old.

Life insurance companies know this.

Moreover, people with Down Syndrome could face additional health conditions and health issues including congenital heart problems among other things. They are a higher risk compared to other people.

Cognitive Ability – An Important Component

Additionally, people need to have the cognitive ability to enter into an insurance contract. This is actually a very important step in the application process. If you don’t have, or if carriers feel you don’t have, the cognitive ability to know what life insurance is, the purpose of it, know what a contract is, answer the medical questions, and sign your name, the carrier declines your application.

Unfortunately, many people with Down Syndrome do not have the cognitive ability to enter into an insurance contract. The lack of cognitive ability limits many types of life insurance.

Moreover, carriers consider a person’s “life’s functionality”. People with Down Syndrome usually can’t work full-time. Usually, they are on Social Security disability or supplemental security income (Medicaid).

Having the ability to employ and work is a component of the life insurance underwriting process. Other agents will say otherwise, but if a person demonstrates consistent, gainful employment, that helps.

Finally, so is the ability to live independently. Not necessarily by oneself, but having the ability to dress oneself, carry a conversation, manage a checkbook, and other everyday activities.

These are the reasons why people with Down Syndrome have a hard time obtaining life insurance through a traditional underwriting process. It is generally difficult to insure people with an intellectual disability such as Down Syndrome, Autism, etc.

Let’s be clear. This means that traditionally underwritten life insurance is hard to obtain for people with Down Syndrome. However, the good news is that life insurance options exist. Let’s talk about those options next.

Life Insurance Options For People With  Down Syndrome

Down Syndrome

There are several life insurance options available for people with Down Syndrome. However, don’t expect to obtain a large death benefit (even if other websites say otherwise).

Generally, a person with Down Syndrome can’t obtain a life insurance policy with a large death benefit. The reason is gainful employment (as we outlined in our life insurance for people with disabilities article).

However, he or she can obtain some amount of life insurance such as $25,000. This amount can be used for burial costs and final expenses. That should give you peace of mind.

The life insurance market for people with Down Syndrome changed considerably. However, we still have options. We discuss these options next.

#1 Group Employer Life Insurance For People With Down Syndrome

Group employer life insurance is an option; however, it usually is available if your loved one has a low to a mild form of Down Syndrome. He or she must have the cognitive ability to understand and sign financial documents.

If that is the case, and your loved one qualifies for group life insurance, this is a viable option. Typically, with group life insurance plans, the application asks no health questions.

In most cases, the person with Down Syndrome must work full-time. With most group employer carriers, that requirement is a minimum of 30 hours per week. As you are aware, many people with Down Syndrome do work, but likely not as much as 30 hours per week.

Again, it must be noted that in this case, your loved one must have the ability to sign and understand what he or she is signing. If you have guardianship or Power of Attorney on your loved one, then the group employer life insurance is likely unavailable.

Nevertheless, this might be an option if your loved one qualifies. However, if not, we still have options.

#2 Guaranteed Issue Life Insurance For People With Down Syndrome

Guaranteed issue life insurance is likely the option for your loved one with Down Syndrome. What is guaranteed issue life insurance coverage? Here it is in a nutshell:

- Typically, a whole life insurance plan with a small death benefit, usually not more than $25,000.

- no health questions. Just have a couple of administrative questions to answer.

- a waiting period on the death benefit. More on that in a minute.

These plans are good for people with moderate to severe medical conditions. As I mentioned earlier, these types of policies have, what I call, a “waiting period” on the death benefit.

Most policies have a two-year waiting period. What does this mean? If your loved one dies within the waiting period from illness or natural causes, you will receive your premiums back plus interest. So, it is a refund of your money.

After the waiting period, if the insured dies, the carrier pays the death benefit 100%.

Death by accident is covered 100% at any time, even during the waiting period.

Why do the carriers have a waiting period? They must mitigate their risk. They know people who apply for a guaranteed issue life insurance policy usually can’t qualify through traditional underwriting. So, they want to avoid a quick death benefit payout. Think about it. If life insurance companies were to pay a death benefit to anyone without proper underwriting, the carrier would go out of business quickly. That hurts everyone.

While some people don’t like the waiting period, it is a fair provision for all policyholders. Moreover, the carrier does refund your premiums back to your beneficiaries if you pass away during the waiting period.

Let’s discuss the specific plans by age next.

Guaranteed Issue Life Insurance For Children With Down Syndrome Ages 0 To 17

We just introduced guaranteed issue life insurance. It is typically a whole life insurance policy, which is a type of permanent life insurance. Permanent life insurance exists for the insured’s lifetime and pays the death benefit until he or she passes away.

I know what you are thinking…

John, I would like to purchase some life insurance for my (child or grandchild) with Down Syndrome, but all the companies decline.

We talked about this earlier. It is true. Most carriers do. Down Syndrome is a high-risk life insurance situation.

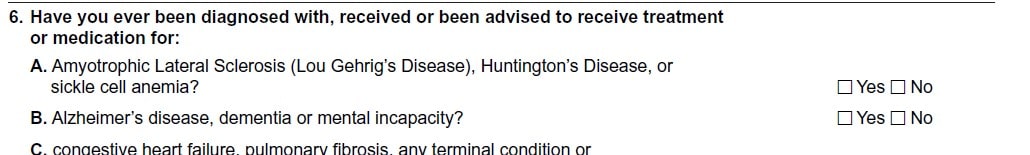

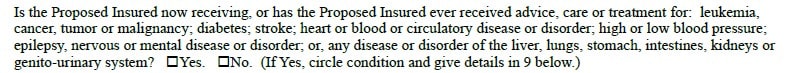

Just look at this question from a real-life insurance application here. Here’s the thing. Many applications don’t directly ask about Down Syndrome. The carrier asks about “mental incapacity”.

You have to say “yes” to this question, and then the carrier declines the application.

This is the unfortunate situation for many families who have children or grandchildren with Down Syndrome.

However, as we pointed out earlier, guaranteed life insurance exists. As mentioned earlier, a carrier we typically liked for children with Down Syndrome no longer offers a guaranteed issue product.

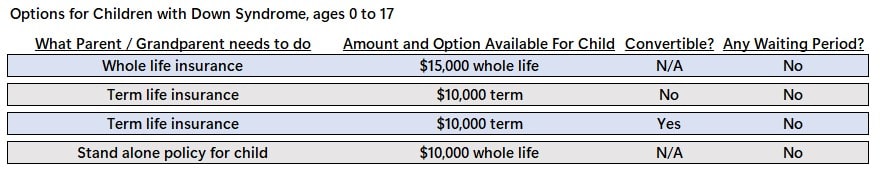

Life Insurance Options For Children With Down Syndrome

But, here at My Family Life Insurance, we have options for you. These options may require the parent or grandparent to obtain life insurance on themselves and then add a child rider which is underwritten at guaranteed issue. The benefit of this path is that there is no waiting period on the death benefit for the child.

Here are the options:

As you can see, term life insurance as well as whole life insurance are available. We also have a nice whole life plan that will insure children with Down Syndrome. You as the parent, or grandparent, would need to apply as the primary insured, and then we include your child (or grandchild) on a rider.

The good news is that none of these plans have a waiting period. The reason why is that you as the parent or grandparent are being underwritten.

One whole plan is available on a stand-alone basis at standard rates, but the carrier only offers the plan every couple of years.

Parents of children with Down Syndrome should consider life insurance on their child as soon as possible, at a young age, for reasons we discuss next.

Guaranteed Issue Life Insurance For Adults With Down Syndrome Ages 18 And Older

Adults with Down Syndrome who are between the ages of 18 and older have different life insurance options. In fact, it can be more difficult to obtain life insurance on an adult with Down Syndrome.

Why?

Because, at this point, they are deemed adults (by the state) simply based on their age.

You see, the states don’t see your child’s Down Syndrome. They see a person who, by age, is a legal adult. As such, they expect your son or daughter to apply and sign the application.

However, they really can’t. Remember what we discussed earlier? Your child needs to have the cognitive ability to understand life insurance, answer the health questions independently, and sign the application.

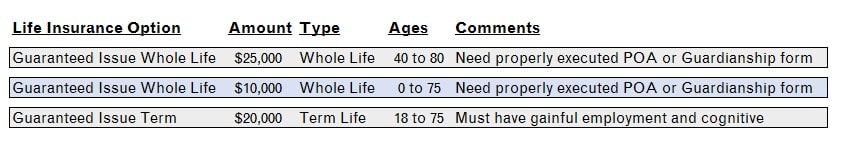

Nevertheless, life insurance options still exist as long as you have a properly executed POA or guardianship form.

That is right.

Obtaining life insurance for an adult with Down Syndrome requires an extra step – generally speaking – a properly executed POA or guardianship form. (Read below in our FAQs for more information about this.)

Here are options for adults with Down Syndrome.

So, you do have options. Contact us if you’d like to learn more.

So, you do have options. Contact us if you’d like to learn more.

What If My Loved One Has A Mild Case Of Down Syndrome?

Every once in a while, we receive a phone call from a parent or a loved one who says their child or relative has a low to mild form of Down Syndrome.

The loved one wants to know if traditional underwritten life insurance is possible. The person with Down Syndrome works, doesn’t receive SSI or SSDI, and lives independently among other positive characteristics.

Traditionally underwritten life insurance for people with low to mild cases of Down Syndrome is possible. Yet, it is still very tricky, too.

Your relative needs to have the cognitive ability to know what a life insurance contract is and what he or she is signing.

Moreover, he or she would need to independently answer the health questions.

Additionally, your loved one would need to qualify in other ways for underwritten life insurance. For example, he or she would need to have a good height/weight (BMI) and be generally free from other ailments.

Finally, your loved one may need to complete a phone interview with an underwriter.

Having said this, yes, it is possible for your loved one with Down Syndrome to obtain underwritten life insurance. We are happy to say that we have helped some families this way.

We do work with a term life insurance plan that is available for people with Down Syndrome, provided they are gainfully employed and can truthfully answer 6 health and lifestyle questions (contact us if this can work).

However, these situations are rare. If you want life insurance on your child, expect to enroll him or her into a guaranteed issue life insurance policy.

Watch Out For This Major Pitfall! Ownership Of The Life Insurance Policy

Before you decide to sign up for a policy, make yourself aware of a major pitfall. I can almost guarantee you won’t hear about it elsewhere.

The pitfall is having your loved one with Down Syndrome as the owner of the life insurance policy.

Why is that, John, you ask?

If a person with Down Syndrome has any assets in his or her name, then likely he or she loses valuable public assistance, government benefits, and other types of resources.

Assets include any type of property including checking accounts, investment accounts (including 529 plans), and even cash value whole life insurance.

The guaranteed issue whole life insurance we described contains cash value. Term life insurance generally does not contain cash value.

State law determines how much assets and income a person can have to qualify for public and government assistance (including Medicaid). Typically, this amount is $2,000. It’s not much. Anything above this amount, and the person potentially loses valuable aid and government benefits.

You don’t want that to happen, right? What can you do?

Thankfully, there are a few ways around this. We will give a general overview next. However, if you have specific questions, I highly recommend you speak to an estate planning attorney who specializes in special needs situations.

The Fix – Change Ownership

There are a couple of ways your loved one can still qualify for valuable aid and have a life insurance policy.

The two ways include:

- you can be the owner of the policy (as a legal guardian or POA), or

- you can have a trust (like a special needs trust) as the owner of the policy.

If you are the owner, you will need legal guardianship and/or power of attorney. This allows you to sign and execute the insurance application on your loved one’s behalf.

We get this statement a lot, “John, I’m the mom (or dad). I have been the guardian of (insert person’s name) since she was a baby.”

I am sorry to say, but that is not guardianship.

You see, as I stated before, when your loved one turns 18 or 21 (depending on the state), he or she becomes an adult.

Your state doesn’t see your loved one’s disability or Down Syndrome. The state sees a person who, as an adult and by state law, can now enter into contracts and sign his or her name. He or she should have the cognitive ability to enter into contracts.

The problem is that your loved one likely can’t (as we discussed earlier).

However, a properly constructed guardianship or power of attorney designation allows you to sign and enter into legal contracts on behalf of your loved one. Just make sure your designation allows you to do that.

If you establish a trust (like a special needs trust or an irrevocable trust) for your loved one, the trust can be the owner and (usually) beneficiary, for the benefit of your loved one upon his or her passing.

I recommend speaking to a qualified estate planning attorney if you have additional questions about this.

What Is The Problem If My Child With Down Syndrome Owns Life Insurance?

Purchasing life insurance on a child is very easy to do. Carriers don’t require a guardianship form, power of attorney, or trust. As long as you have an insurable interest (as such with a parent-child relationship), you can sign as the owner easily. It is very easy to do!

However, a big problem arises when your loved ones are adults. When they are adults, usually 18 or 21 (but check your state), they automatically become the owner of the life insurance.

You will want to make sure you have a proper guardianship, Power of Attorney, or trust in place before this happens. Otherwise, your loved one runs the risk of losing valuable resources, programs, government benefits, and aid as we described earlier. The reason is that they automatically become the owner of the life insurance policy. Unless, of course, you show you have legal ownership of the policy.

Again, I am not an estate planning lawyer, so I recommend contacting one in your state for more specific information.

FAQs About Life Insurance And People With Down Syndrome

We discuss and answer commonly asked questions about life insurance for loved ones with Down Syndrome.

Does My Love One Need To Take A Medical Exam?

No. Guaranteed issue life insurance policies do not require a medical exam or anything like that. Carriers aren’t going to ask for medical records, either. Additionally, since it is a guaranteed issue policy, carriers aren’t going to ask about medical history or health issues.

OK. So, What Is The Benefit Of Guaranteed Issue Whole Life Insurance?

There are numerous benefits of guaranteed issue whole life insurance for people with Down Syndrome. These benefits include:

- no health questions or medical exam

- premiums that won’t change

- ability for a legal guardian or POA to apply on his or her behalf

- last the insured’s lifetime and pays no matter when the insured passes away

You can then use the death benefit money to pay for:

- funeral costs

- final expenses

In this case, the whole life policy is like a burial insurance policy – designed to fund your loved one’s funeral and burial costs.

Remember, though, of the waiting period I mentioned earlier in the article. The waiting period is a standard provision in all guaranteed issue life insurance policies.

Another Insurance Agent Told Me I Have To Get Term Life Insurance For My Loved One With Down Syndrome. How Do I Do That?

The benefit of term life insurance is that it contains no cash value. So, theoretically, your loved one could own the policy and not affect any aid or government benefits. (Check with a qualified in your state beforehand, though.) Term life also offers lower premiums compared to whole life. However, term life insurance is simply going to be hard to qualify for.

I am aware of other websites suggesting term life insurance as an option. They mention that you should get term life insurance on your loved one as soon as you can, preferably when he or she is a child.

However, what they fail to discuss is that not many carriers offer term life insurance on children. However, we are one of the few brokers that do work with carriers that offer term life insurance on children.

Additionally, all the carriers we work with ask about Down Syndrome in one way or another. Check out these health questions from one of the carriers we work with (that offers term life on children):

Carriers consider Down Syndrome as a mental disorder. Even if you said “no” to this question, many carriers have a “catch-all” question that asks about anything, like this:

Carriers consider Down Syndrome as a mental disorder. Even if you said “no” to this question, many carriers have a “catch-all” question that asks about anything, like this:

![]() It would be very difficult to obtain a stand-alone term life insurance policy on a child with Down Syndrome. However, the other options we described in our “Guaranteed Issue Life Insurance For People With Down Syndrome Ages 0 To 17” section exist.

It would be very difficult to obtain a stand-alone term life insurance policy on a child with Down Syndrome. However, the other options we described in our “Guaranteed Issue Life Insurance For People With Down Syndrome Ages 0 To 17” section exist.

We do, however, offer a “semi” guaranteed issue term life insurance policy, to age 100 for working adults between the ages of 18 and 74. Your child would have to be working in gainful employment.

Another Website Said I Could Get Up To $200,000 On My Loved One With Down Syndrome. Why Can’t You Guys Offer That?

Because it is highly unlikely and we are honest, transparent brokers. I am aware of websites professing about large death benefit coverage on people with Down Syndrome. It is not impossible, but it is highly unlikely. These websites are giving you a dishonest, false impression.

The only way a person with Down Syndrome could obtain a large death benefit is if he or she works in gainful employment. He or she also needs to have the cognitive ability to enter into an insurance contract, etc.

Let’s say that the person does. The carrier will likely want IQ testing results, a medical exam (likely), etc.

As I said, it is not impossible, but very unlikely.

I’ve Been My Son’s Guardian Since He Was A Baby. I’m His Mom. Why Do I Need A Guardianship?

(I want to preface that I am not a lawyer, but will give a general overview. Please reach out to a qualified attorney for specific questions.)

When your son turned 18, he became an adult in the state’s eyes. That means the state says he can make decisions and choices on his own.

Unfortunately, he probably can’t. You likely still make decisions for him.

The guardianship form or POA allows you to legally make decisions for your adult son and sign his name on his behalf.

If you are interested in life insurance, then the guardianship form or POA gives you the authority to purchase life insurance on his behalf (assuming it gives you the right to do that.)

Contact us if you have any questions.

What Other Options Exist For My Child?

Other options exist for your loved ones with Down Syndrome. We touch on them here. Please contact us if you have specific questions.

(1) Life insurance on yourself – many parents overlook this option. Sure, you might already have life insurance on yourself, but is it enough? You can enroll in another life insurance plan. Upon your death, the death benefit money could funnel into a special needs trust for your child. The trust can pay a benefit for your child’s care during his or her lifetime and ultimately at his or her death.

(2) Funeral Trust – a funeral trust can work. It is an irrevocable trust. You can fund the trust with money you have or establish a payment plan. The good news is that funeral trusts require no underwriting. Additionally, the trust does not affect any Medicaid benefits or government benefits.

(3) ABLE Account – Another overlooked option. ABLE accounts operate similarly to 529 college plans. They are investment accounts. The big difference is that the monetary value in these ABLE accounts does not affect your child’s aid or government benefits. You can also use the value in the account to pay for your child’s funeral expenses.

Now You Know People With Down Syndrome Can Obtain Life Insurance

If someone says you can’t purchase life insurance for someone with down syndrome, you now know they are wrong. People with Down Syndrome can obtain life insurance. There are many options.

Don’t know what to do next? Need our help? We would be more than happy to help you secure life insurance coverage for your loved one. Simply contact us or use the form below. You can also schedule a no-pressure call with us through our calendar. We can discuss your situation and see how we can help.

As with everything we do, we only work in your best interest only. That means if there is a better solution available that we can’t provide, we will point you in the right direction as best we can. Do you think most agents and agencies do that? Likely not. There is no risk to contacting and speaking with us.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

10 thoughts on “This Is How People With Down Syndrome Obtain Life Insurance | Your Guide To Obtaining Life Insurance On Your Loved Ones”

Comments are closed.

I would like to know what companies would cover my child so I can contact them and find out more information

Thanks

Hi Ike,

Feel free to reach out to us at (800) 645-9841, and we can help. We have helped many families who have children with Down Syndrome.

John

I am guardian of my uncle who is in a nursing home.. He is 66/yes old and has down syndrome.. I need around 8000$ for his burial.. I can’t afford the money for his funeral expenses when he passes. Do you think I can get a policy on him.. I live in the state of Ohio.. Thank you.

Hi Mary,

We can help. I will email you a quote and more information today.

My 38 year old son has mild to moderate down syndrome. He has always lived at home. I am wanting to know if I can take out a burial policy on him.

Hi Cheryl,

We can probably help as we have helped out many families. Life insurance availability depends on the state you live in among other factors. I will email you more information shortly.

John

I just got guardianship of my sister who is 55 with down syndrome she is very healthy she has had 2 hip replacement and a heart murmur fixed years ago but I don’t no what to do ? I would like to know if I could take out a life insurance policy on her if it is something that I need to do since I would not have the money to pay for anything if something would happen to her?

Hi Susan,

Sorry for the late reply to your comment. The answer is, likely, but I will email you more information.

John

Need info on getting my brother coverage for his down syndrome. He’s 39yr old and which company can take him.

Hi Kao,

Thanks for reaching out to us. It is best to give us a call so we can chat. There is more to it than knowing the carrier, as we described in our article.

Our number is (800) 645-9841.

John