How to Secure Life Insurance when Applying for SBA Loans [Easy Process & Approval]

Updated: August 6, 2024 at 9:18 am

Loans have been a common lending solution for many small business owners. One common loan program is the small business loan program administered by the US Small Business Administration (SBA). In many cases, SBA lenders require borrowers to secure life insurance to cover the SBA loans.

Loans have been a common lending solution for many small business owners. One common loan program is the small business loan program administered by the US Small Business Administration (SBA). In many cases, SBA lenders require borrowers to secure life insurance to cover the SBA loans.

In this guide, we discuss the SBA loan requirements and when/how life insurance fits into the process. We will also discuss estimated costs and special situations where you may have a lifestyle or health condition preventing you from obtaining life insurance.

We have helped many small business owners obtain life insurance for their SBA loans. Moreover, we have even helped many small business owners with moderate to serious health conditions or lifestyle situations obtain life insurance when they thought they could not. If you fit into that category, you came to the right place. We can help in those situations.

Here is what we will discuss in this guide:

- SBA Loan Requirements and How Does It Work?

- Is Life Insurance a Requirement for SBA Loans?

- What Kind of Life Insurance Policy Do You Need For SBA Loans

- Special Situations: Pre-existing Conditions or Lifestyle Situations

- Estimated Life Insurance Premiums for SBA Loans

- Do’s and Don’ts of SBA Loans and Life Insurance

- Disability Insurance for SBA Loans – An Overlooked Safety Net

- Frequently Asked Questions About Life Insurance and SBA Loans

- Final Thoughts

Let’s jump in and discuss the SBA loan requirements and life insurance.

SBA Loan Requirements And How Does The Process Work?

The SBA offers many types of small business loans, including:

- 7(a) loans

- 504 loans

- micro loans

- disaster relief loans

Differences exist among these loans, which is outside the scope of this article. However, these loans help the borrower purchase fixed assets like equipment, commercial real estate, and working capital.

Banks and credit unions apply with the SBA to become an SBA lender. Most financial institutions, likely even your bank or credit union, qualify as an SBA lender.

Why do small businesses prefer an SBA loan to other types of commercial loans? Well, many benefits exist with SBA loans, including:

- lower interest rates and lower cap rates

- generally, an easier approval process

- lower or fewer collateral requirements (more on this later)

- longer loan repayment terms

- the SBA guarantees 85% of the loan itself (SBA lenders like this as it mitigates their risk and allows them to take on small businesses they likely may not have with other types of business loans).

Below are the requirements for an SBA loan:

- you qualify as a small business

- you are a for-profit business

- your business operates in the United States

- your business operates in an eligible industry (the SBA disqualifies gambling businesses, for example, for SBA loans)

- demonstrate the need for the loan

- sound purpose for the loan

The SBA Loan Application for Small Business Owners

Lenders underwrite your application. Underwriters analyze your ability to pay back the loan. So, they are going to look at:

- your personal credit

- business creditworthiness

- business cash flow

- type of business

- viability of the business

- your business plan for the loan

- collateral

You apply for an SBA loan through an SBA lender. They will consider all the above. If you have a solid reason for the loan and support paying it back, the lender will approve your application and offer the loan.

Is Life Insurance A Requirement for SBA Loans?

Do you notice what word I have bolded above?

The word “collateral”, John.

Yes. Collateral is simply an asset that secures the loan. An asset could be your savings, retirement accounts, home, business, personal property, real estate, etc.

Yes. Collateral is simply an asset that secures the loan. An asset could be your savings, retirement accounts, home, business, personal property, real estate, etc.

For example, let’s say you have an SBA loan of $150,000. You secure your home equity for the loan. Three years later, you pass away with an outstanding loan balance of $75,000. The lender is now made full through your home equity.

Nearly all SBA lenders require collateral. This is where life insurance comes into play with SBA loans.

Life insurance isn’t necessarily a requirement for SBA loans. However, most borrowers don’t have hundreds of thousands of dollars lying around as collateral for the loan. Moreover, most borrowers don’t want to secure their savings, home, or other personal property as collateral. Right? Would you want to?

No, John. I don’t.

I don’t, either.

That is why life insurance is a common method of securing SBA loans. If you pass away during the loan payment period, the life insurance death benefit makes the lender whole. You’ve paid off the loan through the death benefit proceeds.

Following our example above, let’s say you took out a life insurance policy as collateral instead of pledging your home. Upon your passing, the lender receives the life insurance payout.

John, but in the example, the outstanding loan balance is $75,000. What happens to the other $75,000? The bank doesn’t receive the entire $150,000, does it?

Good question. I answer that next.

Collateral Assignment of Life Insurance for SBA Loans

In our example, the bank receives $75,000, not $150,000. You create this split through a collateral assignment, a form that states that the life insurance company pays the lender only the amount that the lender is owed.

The remaining balance goes to your primary beneficiary.

You make the collateral assignment after you’ve been approved for life insurance. Here is how the collateral assignment of life insurance works:

- apply for life insurance and are approved.

- your beneficiary is someone with insurable interest – your spouse, children, etc., just a typical life insurance beneficiary

- you request a collateral assignment form from the life insurance company (in some cases, this can be done during the life insurance application process)

- complete the form (some carriers may require a notarized signature)

- return it to the life insurance company

The collateral assignment terminates after you’ve paid off the loan. The lender sends a release to your life insurance company, which removes the collateral assignment. At that point, your primary beneficiary now receives the full death benefit.

What Kind of Life Insurance Is Needed For SBA Loans?

So, now you understand that, unless you have a ton of assets to put up as collateral, you will need life insurance to secure your SBA loan.

The SBA doesn’t specify what kind of life insurance you need. As long as a life insurance policy secures your SBA loan, the SBA lender really isn’t going to care.

The 2 most common types of life insurance are term life insurance and whole life insurance.

In my opinion, the best life insurance option to cover SBA loans are term life insurance policies. These policies pay a benefit only if you pass away during the term period.

With term life insurance, the policy owner/insured (i.e., you) can match the term life insurance period to the loan term.

For example, let’s say you have an SBA loan of $250,000 with a 25-year term length. You can purchase a $250,000 term life insurance policy with a 25-year term period, matching the loan term with the life insurance term period.

Moreover, term life insurance is simply going to be your cheapest option. You’ll have the lowest rates with term life. The reason why is that the life insurance company pays the death benefit if you pass away during the term period. If you are in good health, then the probability of an unexpected death during the term period is low. (However, it is not impossible, as anything can happen anytime, even to the best and most healthy of us.)

Is Whole Life Insurance a Good Option For SBA Loans?

Conversely, your most expensive life insurance option is whole life insurance. The reason is that the whole life insurance company pays the death benefit no matter when you pass away. That could be 10 years from now or age 95. As long as you pay the premiums, the whole life company guarantees paying the death benefit.

One advantage of whole life insurance is the cash value. Without going into the weeds, the cash value exists with whole life in order to keep the premiums level and guaranteed. The cash value is like a savings account (but, technically, it is not). For example, let’s say you have a $150,000 SBA loan. You purchase a $150,000 whole life insurance policy. You pay off the SBA loan. At the end of the SBA loan, your whole life insurance policy contains $50,000 of cash value. At that point, you can:

- keep the policy

- borrow some or all of the cash value amount

- terminate the life insurance and receive the $50,000

- convert the whole life insurance policy into a term policy (if the policy has nonforfeiture options – outside the scope of this article)

Life Insurance Underwriting Process

I won’t go into too much detail here, but here is a general overview of the life insurance underwriting process. If you have specific questions, contact us.

Underwriting is simply the process of reviewing your situation, corresponding to the probability of a specific event occurring. Regarding term life insurance, underwriters analyze your probability of an unexpected death occurring during the term period. With whole life, it is the projection of when you could pass away. Let’s say the average male passes away at age 85. However, you have bipolar disorder and rheumatoid arthritis – both of which generally lead to a lower life expectancy. The underwriter approves your application, but your premium is higher to compensate for the projected lower life expectancy.

After you apply for life insurance, the underwriter receives your application and reviews the following:

- your medical history – reviews databases such as the MIB, prescription drug report, and/or medical records. Underwriters may also require a paramedical exam, which is like a mini-medical exam.

- your prescription drug history

- driving history – underwriters look up your driving record

- criminal records and credit/financial history (contrary to popular belief, underwriters do not review credit scores)

- hazardous activities or hobbies like skydiving

- lifestyle situations like marijuana use

- any additional information the underwriter deems material to the decision

Underwriters analyze all of this information. They approve your application if you fit within their underwriting table guidelines. If not, they will decline your application.

John, I have some lifestyle situations that prevent me from getting life insurance and the SBA loan.

No problem. We have a solution for those situations. We discuss that next.

Special Situations: Pre-existing Conditions or Lifestyle Situations

John, I can’t get the SBA loan because my pre-existing situation prevents me from obtaining life insurance.

No problem. You have come to the right place.

No matter your situation, we have helped people with moderate to severe lifestyle or medication conditions obtain the life insurance they need for their SBA loans.

John, it can’t be. My agent told me that it wasn’t possible.

I hear this a lot. Unfortunately, your agent is incorrect. In fact, we can likely get you the life insurance for your SBA loans, even if you have a pre-existing condition or lifestyle situation.

We have helped people with the following health conditions or lifestyle situations obtain life insurance for their SBA loans:

- bipolar disorder

- suboxone use

- DUI/DWI

- Felonies

- Cancer in recent remission

- Substance abuse and alcohol abuse

- people who need the life insurance quickly with minimal underwriting (i.e. even healthy individuals)

- overweight/obesity

- and more

We work with a unique insurance company that will offer life insurance for these situations quickly, too. This isn’t a guaranteed issue life insurance policy. They will decline if you have many severe co-morbidities.

All we need from you is some basic information about your health and lifestyle situation that prevents you from obtaining traditional life insurance. We pass this along to the company, and they provide a quote. The application is a one-page application, and underwriting is quick.

This process makes it advantageous for those needing life insurance quickly to satisfy SBA requirements.

If you fit this situation, please get in touch with us. We can likely help.

Estimated Life Insurance Premiums for SBA Loans

Would you like to know your estimated life insurance rates? Feel free to enter your information in the quoter below. Or, you can contact us.

The quoter is self-explanatory. However, it is important to note that these are estimates only, and underwriting determines the final premium rate.

If you have a special situation, please call us rather than use the quoter. We can go over your information over the phone.

Do’s and Don’ts of Life Insurance for SBA Loans

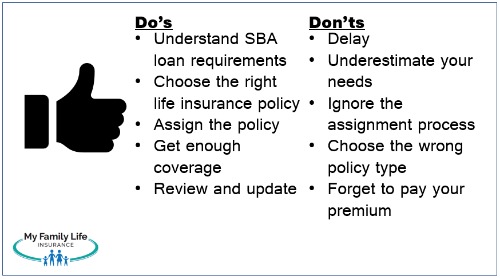

When it comes to life insurance for SBA loans, there are several important do’s and don’ts to remember. Here are some key points for each.

Do’s

- Understand SBA Requirements: The SBA typically requires life insurance for loans involving sole proprietorships, single member LLC, partnerships, or when the loan is reliant on an individual’s performance. Understanding these requirements ensures compliance and smooth loan processing.

- Choose the Right Life Insurance Policy: Select a policy that meets both the SBA requirements and your personal needs. This often means term life insurance, which is more affordable and sufficient for covering the loan term.

- Assign the Policy to the Lender: Ensure that the life insurance policy is assigned to the lender as collateral. This protects the lender’s interest and is a common SBA loan condition.

- Get Sufficient Life Insurance Coverage: The policy coverage should be at least equal to the maximum loan amount. This provides adequate security for the loan and fulfills SBA conditions.

- Review and Update Regularly: Regularly review your policy to ensure it continues to meet the loan requirements and adjust coverage as necessary with changes in loan balance or business circumstances.

Don’ts

Here are some “don’ts” when it comes to obtaining life insurance for SBA loans.

- Don’t Delay Getting Insurance: Delaying the acquisition of required life insurance can stall the loan approval process, as SBA loans often require proof of insurance or collateral before disbursing funds.

- Don’t Underestimate Coverage Needs: Getting less coverage than required can result in non-compliance with loan terms, risking loan denial or default complications.

- Don’t Ignore Policy Assignment Details: Failing to assign the policy to the lender properly can invalidate the loan security and complicate claims if the insured passes away. Make sure you establish a collateral assignment.

- Don’t Choose Inappropriate Policy Types: Avoid choosing policies like whole life or universal life insurance if they are unnecessary in your specific situation or too expensive compared to term life insurance, which is typically sufficient for SBA loans.

- Don’t Overlook Renewal and Premium Payments: Neglecting to renew the policy or missing premium payments can lead to policy lapse, which compromises loan security and compliance. It’s always good to have a secondary address on file in case you miss a premium payment.

Disability Insurance For SBA Loans – An Overlooked Safety Net

Although the SBA requires collateral, usually provided in the form of life insurance for most of us, what if I told you that most term life insurance policies never pay out the death benefit?

That was one website says. It says 99% of term policies don’t pay out the death benefit, mostly because people let their policies lapse (i.e., they stop paying premiums).

That was one website says. It says 99% of term policies don’t pay out the death benefit, mostly because people let their policies lapse (i.e., they stop paying premiums).

Take away the lapse issue; I have been told that 3% to 5% of term policies pay out the death benefit. Why so low? Because most of us will survive the term period. We purchase term life insurance because of that substantial financial loss IF we unexpectedly passed away (the 3% to 5% probability).

You see, IF we pass away, our loved ones face serious financial devastation. That is why term life insurance makes sense. For a small premium (usually), you protect your family from serious financial devastation. Moreover, if you live (which you hope), then you will lose some premium money, which will be insignificant in the long run.

However, what if I told you that you face a far more serious situation than a premature death?

What would that be, John?

A disability.

Oh, John. I won’t end up in a wheelchair!

How do you know? If you knew your future, you would be very rich, right?

Most agents stop at life insurance—not us. We also specialize in helping professionals obtain disability insurance.

Did you know a 20-year-old has a 1 in 4 chance of getting a disability? That isn’t our statistic. It is from the Social Security Administration. One in 4 is 25%, and this probability generally increases as we get older (according to other sources). That makes sense, right?

A Disability Isn’t a Wheelchair Event

Moreover, a disability isn’t a wheelchair event. It is a situation where you can’t do your job due to an illness or injury. That can be cancer, back pain, damage nerves in your hand, etc. You can be perfectly fine working in another occupation. The disability prevents you from working in your occupation.

But, John, the SBA will just waive my payment if I am disabled! Disability insurance isn’t a requirement!

Are you sure about that?

Check out this article.

Your lender is in business to make money. As the article explains, they will garnish your collateral and any personal assets you have to fulfill the loan.

Be honest with yourself. How would you continue to pay your SBA loan if you got sick or hurt and could not work?

Do you want that to happen, knowing a disability happens frequently?

The best thing to do is establish a disability insurance policy that will pay your loan in case this happens. You can establish a monthly benefit for the monthly loan amount.

Moreover, disability insurance doesn’t cost a lot. For most professionals, it will cost about a daily cup of coffee.

Contact us. We can help.

FAQs About Life Insurance and SBA Loans

Here are common frequently asked questions about life insurance and SBA loans.

What Is Life Insurance For SBA Loans?

Life insurance for SBA loans is a policy that provides financial protection to the lender in the event of the borrower’s death. The policy ensures that the loan is paid off, preventing default.

Why Do SBA Lenders Require Life Insurance?

SBA lenders require life insurance to mitigate the risk of loan default in case the borrower dies. This ensures that the loan can be repaid even if the borrower is no longer alive.

Who Needs To Be Insured For An SBA Loan?

The person who needs to be insured is typically the primary owner or key person whose death would directly impact the business’s ability to repay the loan.

How Much Life Insurance Coverage Is Required For An SBA Loan?

The coverage amount generally needs to match the loan amount, ensuring the loan can be fully repaid in the event of the borrower’s death. The loan agreement spells out the required amount of life insurance.

Can Existing Life Insurance Policies Be Used For SBA Loans?

Yes, existing life insurance policies can be assigned to the lender if the coverage amount meets the loan requirements and the lender accepts the assignment. However, you will want to make sure you have enough death benefit to still support your loved ones in case of your death. Therefore, a separate policy makes sense even though you can use existing life insurance policies to satisfy existing SBA loan requirements.

What Happens If The Borrower Cannot Qualify For Traditional Life Insurance?

We are one of the few brokers that have helped people with moderate and severe lifestyle and health conditions obtain life insurance that satisfies SBA loan requirements. Contact us if you have any questions.

Is Life Insurance Required For All SBA Loan Types?

While not all SBA loans require life insurance, it is commonly required for larger loans or when the business’s success heavily relies on the borrower.

How Long Does The Life Insurance Policy Need To Be In Force?

The life insurance policy typically needs to be in force for the entire loan term to ensure coverage throughout the loan repayment period.

Can The Life Insurance Policy Be Cancelled Once I Repay The SBA Loan?

Yes, you can cancel the policy once you have fully repaid the SBA loan. Many of our clients do that.

Or, if you used your existing policy, you can change the beneficiary back to your original preference.

How Quickly Does The Life Insurance Policy Need To Be Obtained After SBA Loan Approval?

SBA Lenders usually require the life insurance policy to be in place before the loan funds are disbursed. If you need life insurance quickly, contact us. As we wrote earlier, we can usually help you obtain a policy within a few days.

Help! I Need Life Insurance Fast, Or I Won’t Get My SBA Loan. Can You Help?

Yes, we work with an insurance carrier that can create and bind a life insurance policy for you within a day or 2. They can get you a policy very fast. Moreover, they can insure hard-to-place situations such as:

- people with obesity

- felony history

- drug / substance abuse

- mental disorders such as bipolar disorder

- recent cancer remission

- and more

They aren’t “guaranteed issue”, but they can cover and offer a life insurance policy for SBA loans in many situations where traditional carriers can’t.

Contact us if you have a moderate to severe lifestyle or health situation and need life insurance for your SBA loan. We can analyze your situation and get you a quote.

Final Thoughts About Life Insurance For SBA Loans

Now you know the process of obtaining life insurance for SBA loans. In this article, we discussed:

- SBA loan requirements, including life insurance

- Type of life insurance for SBA loans

- The life insurance underwriting process

- Getting a life insurance policy if you have a moderate to severe health condition or lifestyle situation

- Estimated premiums

- Obtaining disability insurance to further protect your loan (and your family)

- Answered many questions about life insurance and SBA loans

Do you have any questions or want to get started? Contact us or use the form below.

We have helped many small business owners obtain the life insurance they need for their SBA loans. Moreover, we have helped professionals with moderate to severe health conditions or lifestyle situations obtain the life insurance they need to satisfy SBA lender requirements.

We only work in your best interests. That means we put you and your situation first, not us or the insurance carrier. If we can’t help you, we will point you in the right direction as best we can.

This is the only way we know how to work with our clients.

Moreover, if you decide not to work with us, that is fine. You can always reach back out to us if your needs or situation changes.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".