How Disability Insurance Protects Business Loans | We Discuss And Educate You On This Important Insurance

Updated: April 12, 2024 at 9:39 am

If you are a business owner, you probably don’t think about using disability insurance to protect your business loans, right?

If you are a business owner, you probably don’t think about using disability insurance to protect your business loans, right?

You might already have some disability insurance already. So, why do you need another disability insurance policy?

Here’s a question you should ask yourself. If you have a business loan, how will you pay that loan back if you are sick or work and can’t work?

I’ll just use my benefit from my individual disability insurance, you say.

That’s what many business owners think they should do, but doing so puts you and your business in jeopardy.

In this article, I’ll tell you why, and how to go about securing disability insurance for your business loans the right way.

In this article, we will discuss the following. Feel free to jump around or navigate on your own.

- Why Do I Need Disability Insurance To Protect My Business Loans?

- Structure Of A Strong Business Loan Protection Insurance Policy

- Types Of Eligible Business Loans

- Potential Costs of Business Loan Protection Disability Insurance

- Other Options To Protect Your Business Loans (Not To Consider)

- Real Cases Of Disability Insurance Securing Business Loans

- Now You Know How To Protect Your Loans With Disability Insurance

Let’s start by discussing why you need disability insurance to protect your business loans.

Why Do I Need Disability Insurance To Protect My Business Loans?

We’ve discussed disability insurance ad nauseam. If you earn an income, you need disability insurance. It’s that simple. We aren’t going to rehash the reasons why. But, one major reason stands out.

You have a 1 in 4 chance of a long-term disability.

I am not one for statistics, but everyone in the disability insurance industry generally agrees with the 1 in 4 probability of disability. (Other industry statistics state 1 in 3).

To put that into context, the Social Security Administration estimates you have a  1 in 14 chance of an unexpected death.

1 in 14 chance of an unexpected death.

These statistics are all from government agencies like the Social Security Administration and the Department of Labor.

OK, John, you say. But, I already have disability insurance. I have an individual plan.

That’s good to hear. However, there’s a big problem if a disability happens. That individual plan you have is to help pay your mortgage, put food on the table, pay your utilities, and so on.

It’s not for your business loan, which might cost…thousands more per month?

Now, what will you do then?

Promissory Note Is The Promise To Pay…An A Major Mistake…

If you signed a loan, you probably had to sign a promissory note or a loan contract.

If you signed a loan, you probably had to sign a promissory note or a loan contract.

The contract states, essentially, your promise to pay. It lists the provisions of the contract.

That means during the good times, and even the bad times, too. Bad times can mean an unexpected death and certainly an unexpected disability.

Here’s a major mistake we see when business owners take a loan. They assign an existing life or disability insurance plan to the bank. Then, they are granted the loan.

On the surface, that sounds OK. However, remember, this money had other intentions. This means the money that was intended for your family to live off is now going to the bank to satisfy the loan.

In other words, you will have no, or limited, money to pay your mortgage, bills, food, etc. What will you do now?

This scenario could lead to a tough situation with your family. Avoid the tough conversations with your family. This is why you need a separate disability insurance policy to protect your business loans, which will ultimately protect you and your family.

Proper Structure Of Disability Insurance For Your Business Loans

A separate disability insurance policy that protects these loans is the logical choice.

Sometimes, this type of disability insurance policy is called business loan protection insurance. However, names aside, it is simply a separate disability insurance policy.

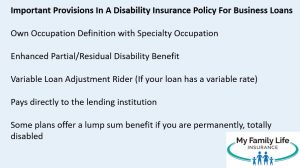

The structure of the disability insurance policy is not much different than your individual policy. For instance, you still want:

- Own occupation definition

- Residual disability benefits

On typical disability insurance policies, we would like to see a guaranteed purchase option among other things. However, business loan protection insurance isn’t your typical disability insurance policy. You don’t need the guaranteed purchase option or many of the other options.

Similar to an individual policy, a disability insurance policy for business loans has waiting periods from 30 days to 365 days. The right choice depends on your savings. While everyone’s situation is different, I do recommend a 30-day waiting period. Do you really want to wait for this money?

Similar to an individual policy, a disability insurance policy for business loans has waiting periods from 30 days to 365 days. The right choice depends on your savings. While everyone’s situation is different, I do recommend a 30-day waiting period. Do you really want to wait for this money?

Additionally, the bank or lending institution receives the benefit payments directly. How great is that? You are not involved. The carrier remits payment right to your bank or lender.

Obviously, if you return back to work full-time, the plan stops paying, and you resume the loan payments.

Nevertheless, you have “plan B” if something were to happen. How great is that? You will have peace of mind knowing the bank receives the loan payments. You can then focus on what really matters: getting better and your family.

Types Of Business Loans Disability Insurance Protects

Disability insurance protects the following (not inclusive) business loans:

- SBA Loans

- Construction Loans

- Commercial Mortgage Loans

- Lease / Equipment Loans

- Working Capital

- Variable Rate, Term, Balloon Loans

However, some business loans aren’t eligible for disability insurance. These include:

- Interest-Only Loans

- Investment Loans

- Credit Cards

Contact us if you have questions or would like to know if your loan qualifies.

Potential Costs Of Business Loan Protection Insurance

Everyone wants to know about cost. The answer is that the cost depends on your situation.

I typically aim for my clients to pay $100 or less for their individual disability insurance. However, the cost of business loan protection insurance mainly depends on the amount of the loan and typical disability insurance underwriting factors such as:

- Age

- Occupation

- Health conditions, height / weight, tobacco and/or marijuana use

Additionally, your premiums depend on the size of your loan, term, and your monthly payments.

So, if you have a $500,000 loan, 10 year term, making $4,200 monthly payment, the cost of your disability insurance is based on the $4,200 monthly amount.

Ideally, you want to have the term of the loan match the term of the disability insurance. However, sometimes for budget reasons, that is not possible. As I always say, some protection is better than none.

We at My Family Life Insurance always aim to provide you with the most comprehensive coverage at the lowest possible cost.

Other Options Instead Of Business Loan Protection Insurance

There are always options. As I always say, any type of insurance contains advantages and disadvantages.

Some people tell us, “John, I already have disability insurance.” As we said, that is your individual disability insurance policy. The bank likely will require you to still pay the loan.

Then, people tell us they have a business overhead expense policy. Great. Although these policies cover business expenses, including loans, coverage is limited. The limitations include a dollar benefit cap and the term. For example, most business overhead policies have a 24-month benefit period. What if your disability lasts longer than 24 months? What will you do?

There’s no substitution in protecting your business loans with a properly structured disability insurance policy.

Real Cases Of Disability Insurance Securing Business Loans

We’ve worked with business owners for a while now. Here are 2 cases where we have helped business owners protect their business loans with disability insurance.

Contact us if you have any questions about how disability insurance protects business loans.

Auto Mechanic Expanding His Shop

An auto mechanic we work with constructed 2 new bays as well as upgraded equipment. The construction loan and lease payments were in excess of $10,000 per month. He was approved for a disability insurance policy covering these business loans.

Podiatrist Purchasing A New X-Ray Machine

A podiatrist purchased a new x-ray machine for her office. The loan amount was $2,000 per month for 5 years. Her individual disability insurance and business expense insurance could not necessarily cover this additional expense. We designed a disability insurance plan to cover this loan.

This is a 5-year term disability insurance policy. In 5 years, the policy terminates as the x-ray machine will be paid off.

Now You Know How To Protect Your Business Loans With Disability Insurance

I hope you found this article educational. I can’t stress how important business loan protection insurance is. Now you know how to protect your business loans with a properly designed disability insurance policy.

Would you like to discuss more? I am happy to talk to you about how we have helped other business owners protect their loans through disability insurance. Feel free to contact us or use the form below.

If you are worried about contacting us, don’t be. We aren’t trying to “sell” you. We really want to help you. At the very least, you’ll learn a little more. If you don’t want our help, no worries. We will part as friends. You see, that is the only way we know how to work with our clients. We always have your best interests first rather than our own.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".