Ultimate Guide To Understanding Life Insurance With Living Benefits | We Discuss How These Plans Work And If They Are Right For You

Updated: April 12, 2024 at 9:38 am

Have you heard of life insurance with “living benefits”?

Have you heard of life insurance with “living benefits”?

Yes, John. I looked up living benefits of life insurance and got confused. Also, I spoke to another agent who really couldn’t describe them.

I understand. I read those same articles. They unfortunately lead readers astray. You end up not really knowing what living benefits are and how they work.

In this guide, we will tell you what living benefits are and how they work. You can then decide if a life insurance plan with living benefits is right for you.

Here is what we will discuss:

- What Is Life Insurance with Living Benefits?

- What Are The Common Living Benefits?

- Making A Claim For The Living Benefits

- What Life Insurance Policies Have Living Benefits?

- How Much Does Life Insurance With Living Benefits Cost?

- FAQs About Life Insurance With Living Benefits

- How We Can Help You Obtain Life Insurance With Living Benefits

Let’s jump in and discuss what is life insurance with living benefits.

What Is Life Insurance With Living Benefits?

Life insurance with living benefits is a typical life insurance policy, but it allows policyholders to access or advance the policy’s death benefit while alive (hence the term “living benefits”).

Why are living benefits possibly beneficial in your situation? Contrast a policy with living benefits vs. a traditional life insurance policy that only pays a benefit upon death. A policy with living benefits may prove valuable to you if you need the death benefit money now. A traditional life insurance policy pays a benefit only upon your death.

For example, both Ted and John have $2,000,000 term life insurance policies. However, Ted has a traditional term life insurance policy and John has one with living benefits. John can advance some of his $2,000,000 death benefit now (upon a specific event – more on that in a minute) whereas Ted can’t. His plan only pays a benefit upon his death.

As I just mentioned, policies with living benefits allow you to advance the death benefit at certain, specific qualifying events. What are these events? We discuss that next.

What Are The Common Living Benefits?

Now, you can’t advance the death benefit for any reason. A specific event, per the carrier’s contract, must happen. When a covered event happens, you can request an advancement of the death benefit. Three common living benefit scenarios exist, and they are:

- terminal illness

- critical illness

- chronic illness / chronic care

These 3 situations are compiled into an accelerated death benefit rider and are automatically included in the life insurance policy. So, you may see or read the living benefits as:

- terminal illness rider

- critical illness rider

- chronic illness rider

Think of the living benefits as a “swiss army knife”. You’ve just made your policy flexible with living benefits.

John, I’ve read other websites that list other living benefit riders. What is the difference?

Yes, I have read those, too. That is a source of confusion. These other websites list these riders as “living benefits”, but they are not. They are optional riders that may enhance your policy in some ways, but they do not advance the death benefit like the accelerated living benefit rider. They also require higher premiums. For example, the common, but wasteful (in my opinion), waiver of premium rider may add another $20 per month to your policy. It doesn’t accelerate your death benefit in any way. It just waives your premium if you get hurt or sick and can’t pay your premium. (However, in my opinion, better ways exist if you want this type of coverage, see my article about better options than the waiver of premium rider).

Let’s go into detail about the 3 living benefits.

Terminal Illness Rider

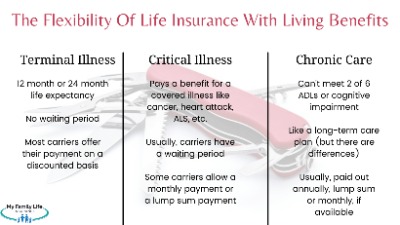

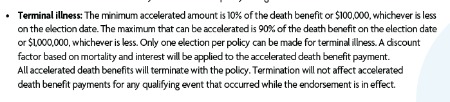

The terminal illness rider is a common rider on many life insurance policies. Essentially, if you are diagnosed with a terminal illness, such as one that has a life expectancy of 12 months or less, you can advance some percentage of the death benefit. The life expectancy timeframe / terminal diagnosis and the percentage depend and vary by the life insurance carrier.

The advantage of this rider is that you have money that you can spend now while living on anything you want. You can use it for your end-of-life care, personal needs, or anything else.

Many carriers allow 100% advancement of the death benefit upon a qualifying terminal illness, on a discounted basis, up to a certain death benefit limit. For example, a carrier may state that you can only advance up to the $1,000,000 death benefit, subject to the discount rate and mortality factors. Carriers discount the advancement because you are getting the benefit now versus in the future. That, by itself, does leave some death benefit remaining for your beneficiaries.

Critical Illness Rider

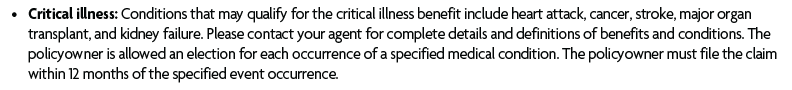

The critical illness rider allows for a lump sum advancement on the death benefit if you are diagnosed with a covered illness.

Three critical illnesses that are typically covered are:

- heart attack

- stroke

- cancer

In other words, if you are diagnosed with cancer, you can advance some portion of the death benefit. The amount varies by the life insurance company.

You can read that this particular carrier covers additional critical illnesses such as kidney failure. The better carriers that offer life insurance with living benefits offer different types of illnesses beyond the standard heart attack, stroke, and cancer.

You can read that this particular carrier covers additional critical illnesses such as kidney failure. The better carriers that offer life insurance with living benefits offer different types of illnesses beyond the standard heart attack, stroke, and cancer.

Moreover, you can read this particular carrier has a minimum 5% or $50,000 lump sum advancement. Additionally, you don’t specify how much you want. If you file a claim for advancement of the death benefit because of a critical illness, the carrier analyzes your medical condition. They determine your prognosis, and your payout is based on that.

You can use the money however you want. You can use them for medical bills, medical care, medical expenses, personal needs, etc.

Chronic Illness / Chronic Care Rider

The final living benefit is the chronic illness or chronic care rider. This rider pays a benefit if you, essentially, need long-term care services like nursing home care or assisted living care. This rider works similar to that of a traditional long-term care policy. However, it is important to note that the chronic illness rider is not, technically, considered long-term care insurance (or, technically, offers long-term care benefits).

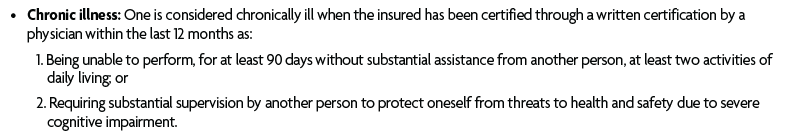

Essentially, this rider pays a monthly benefit if you can’t do 2 out of 6 activities of daily living or have severe cognitive impairment. See this example from a carrier:

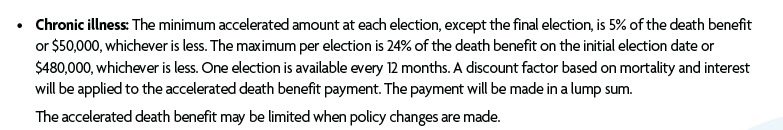

Moreover, this is how this particular life insurance company pays out the benefit:

Although it is very similar to long-term care, the chronic illness rider is not, technically, a long-term care rider. The chronic illness rider does not meet the qualified definition of long-term care insurance. Moreover, nuances and differences do exist between a stand-alone long-term care policy and a chronic care living benefits rider. It is important that you read and understand how each works and are different.

John, aren’t these all stand-alone insurance products as well?

They are. You can buy a stand-alone critical illness policy or a long-term care plan. However, a few things to keep in mind here:

- the cost of these stand-alone products may be more than the life insurance premium

- the payout or benefit distribution is different

For example, stand-alone critical illness policies usually pay out their benefit in a lump sum. For example, if you have a critical illness policy with a $75,000 benefit, that’s the maximum amount it will pay upon a covered illness.

Contact us if you’d like to learn about stand-alone insurance plans.

How Do You Make A Claim For The Living Benefits?

Making a claim for living benefits is a simple process. You:

- contact the carrier and get the claim paperwork

- pay an additional charge to exercise the living benefit

- submit any medical records (or allow the carrier to contact your doctor)

Look at this example:

What Life Insurance Policies Have Living Benefits?

Life insurance with living benefits is available on 3 common policies:

- term life insurance

- whole life insurance

- universal life insurance

Yes, that is right. Some carriers that offer living benefits offer them on their term life policies. However, be aware that living benefits end when your term life policy expires. For example, if you have a 30-year term policy, your living benefits end after 30 years (unless, of course, you decide to keep it going, whereupon your premiums increase exponentially every year.)

This brings us to, in my opinion, the best life insurance structure for living benefits.

The Best Life Insurance For Living Benefits

I’ve been in financial services since 2009 and am a CFP® Professional. I don’t like mentioning the best “this” or the best “that” because what is the “best” for one person may not be for another person.

The same holds here. However, I do believe permanent life insurance policies like whole life or universal life are a better fit for living benefits. The reason is that these types of life insurance are designed to last your entire life. Having living benefits on these plans creates a unique financial planning tool for when you are older. You will have additional protection in case you need custodial care services or if you are diagnosed with any covered critical illness.

With term life, you lose all the valuable living benefits when the policy expires. It will. Term life premiums exponentially increase after the level term period ends. They become cost-prohibitive.

John, my financial planner says all permanent life insurance policies are bad!

I know what financial planners say. If your financial planner says this without any real, legitimate reason, then he or she has not done due diligence. Permanent plans are a bad idea when they are used incorrectly. Having said that, they are a good idea when they are properly structured for you. Living benefits are one of those reasons.

Indexed Universal Life For Living Benefits

I do personally like indexed universal life with living benefits. If you have read my articles about indexed universal life, you know I believe they are oversold. I think way too many people purchase a policy without really knowing how these policies work. They are focused on using IULs as a retirement plan and are sold on the virtues of “zero is your hero”. I can go on and on. I have spelled out the disadvantages of IULs. However, a properly structured and funded IUL with living benefits could prove extremely valuable (from a protection standpoint). The reason is the use and structure of the death benefit with universal life. I do believe that IULs with living benefits are a great financial planning tool for kids.

If you have any questions about IULs with living benefits, please contact me.

How Much Does Life Insurance With Living Benefits Cost?

Life policies with living benefits will cost more compared to a traditional life insurance policy. Here is an example of a term option. Let’s say Todd is a healthy, 30-year-old man. He wants $1,000,000 of term life insurance.

Life policies with living benefits will cost more compared to a traditional life insurance policy. Here is an example of a term option. Let’s say Todd is a healthy, 30-year-old man. He wants $1,000,000 of term life insurance.

He can apply for a traditional term life policy. A policy with Banner Life will cost around $51 per month.

A policy with North American, which offers living benefits on their life insurance, costs about $60 per month.

So, for $9 more per month (in this example), Todd can get valuable living benefits on his life insurance policy. In this case, it is worth the extra premium.

This is just an example. Your cost of life insurance with living benefits depends on your:

- gender

- health

- age

- anything else that is material to the underwriting decision

Frequently Asked Questions About Life Insurance With Living Benefits

We discuss frequently asked questions about life insurance with living benefits.

Are Living Benefits Automatically Included in All Life Insurance Policies?

No. Not all life insurance companies have living benefits integrated with their life insurance. Contact us if you would like to know the carriers we work with.

What Expenses Do Living Benefits Typically Cover?

You can use the money for anything you want. There are no restrictions.

Is There a Waiting Period Before I Can Access Living Benefits?

Generally speaking, carriers don’t have a waiting period before you can utilize the living benefits. However, check with the carrier first. Some carriers may have a waiting period on the critical illness rider component.

Are Living Benefits Taxable?

Generally speaking, the advancement of the death benefit is not a taxable event. However, please consult with a tax advisor for more information about this.

Can I Customize the Living Benefits Coverage in My Life Policy?

No, you can’t customize the living benefits coverage. That is a drawback of coverage. If you do want to customize your policy, you should review stand-alone critical illness and long-term care plans. Contact us if you have any questions.

What Happens to the Death Benefit if I Use Living Benefits?

The death benefit reduces accordingly. An easy example: you have a $1,000,000 policy with living benefits. You make a critical illness claim. The carrier analyzes your situation. They send you a check for $200,000. Your death benefit is now $800,000. Note: if you have a permanent plan with cash value, your cash value decreases proportionally.

The carrier adjusts your premiums accordingly.

Are Living Benefits Available in Term Life Insurance or Only Permanent Policies?

Living benefits are available in term life insurance and permanent plans including whole life insurance and universal life insurance.

Can I Add Living Benefits to an Existing Life Insurance Policy?

No. You can’t add living benefits to an existing life insurance policy. You will have to apply for a stand-alone critical illness or long-term care insurance policy.

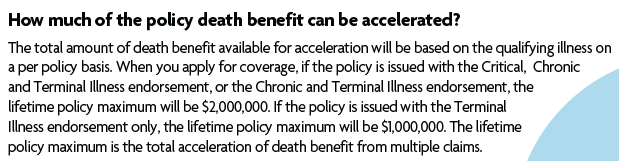

Are Living Benefits Subject to Policy Limits?

Yes. Carriers have dollar limits. See this example.

Are Living Benefits Automatically Included, or Do I Need to Opt-In?

Carriers that offer life policies with living benefits automatically include the living benefits in the policy. However, carriers can opt you out of living benefits if you don’t qualify for them. For example, let’s say you had cancer 8 years ago. You can get approved for the life insurance itself, but the carrier can void the critical illness rider in your policy.

Can Living Benefits Help Cover Medical Expenses Not Covered by Health Insurance?

Yes. You can use the money however you want. One use of the money is to pay for medical costs that are not covered by your health insurance.

How We Can Help With Life Insurance With Living Benefits

I hope you have a better understanding of life insurance with living benefits. These are nice policies that incorporate:

- critical illness

- terminal illness

- chronic care / chronic illness coverage (like long-term care)

You can advance the death benefit sooner for a covered event. These policies can prove valuable with their flexibiity.

Do you have any questions or want to explore life insurance with living benefits? Contact us or use the form below.

We have helped many individuals and families obtain the life insurance they need. We work in your best interests, which means we put you first, not our own needs. Also, we are also not beholden to one particular insurance carrier, allowing you to choose which is the right plan for you.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".