How High-Risk Applicants Get Approved For Life Insurance | 3 Life Insurance Options Available To You

Updated: April 12, 2024 at 9:39 am

Here’s the situation: you’ve applied for life insurance, and the carrier says you are a high-risk or impaired risk. So, they decline your application.

Here’s the situation: you’ve applied for life insurance, and the carrier says you are a high-risk or impaired risk. So, they decline your application.

If you are a high-risk applicant and need life insurance, you’ve come to the right place.

We’ve helped many high-risk individuals obtain life insurance, even if they have been declined before.

As always in these situations, approval is on a case-by-case basis and there is a process you need to follow.

Many people who have high-risk conditions or lifestyles obtain life insurance through us. Here is what we will discuss:

- What Is High Risk?

- Process To Obtaining Life Insurance

- 3 Life Insurance Options Available

- What Are The Favorable Carriers?

- What If You’ve Been Declined Before?

- Final Thoughts About Impaired Risk Life Insurance

Let’s jump in and discuss what is considered high risk.

What Is High Risk Or Impaired Risk?

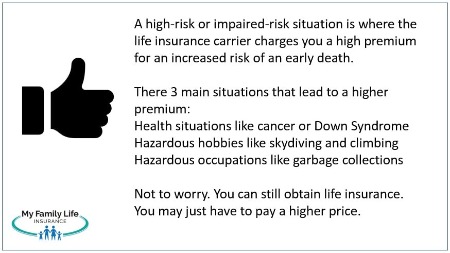

A high-risk or impaired risk situation is where the insurance carrier charges you a higher rate for the life insurance policy because of some type of health condition, lifestyle situation, or occupation.

They charge a higher premium rate because of the increase in risk; in this case, the probability of an earlier-than-expected death.

(Related: see our article on life insurance table ratings which discusses these higher rates.)

If you are a high-risk applicant, no worries. We at My Family Life Insurance have helped many high-risk applicants obtain life insurance.

High Risk Or Impaired Risk Situations

There are many situations that are considered high risk and yield a higher premium. Note: this doesn’t mean you won’t obtain life insurance. It just means you will likely have to pay a higher premium.

Here are some examples of high-risk or impaired risk situations (not an exhaustive list).

Health Situations

- Bipolar and Schizophrenia

- Recent Cancer

- Uncontrolled “anything” (sleep apnea, diabetes, etc. Note: many controlled health conditions, maintained with medication, are acceptable)

- Recent heart surgeries or stents

- Neuropathy and other complications related to diabetes

- Someone who suffers / diagnosed with PTSD

- Severe neurological disorders like ALS, cerebral palsy, or primary progressive MS

- Someone of working age, but on SSDI

- People with Down Syndrome or Severe Autism

Lifestyle Situations

- Recent felony or crime

- History of substance abuse

- Hazardous activities or hobbies like skydiving or hang gliding (contact us if you feel you participate in a high-risk activity. Riding a motorcycle isn’t high risk unless you actively race.)

- Many speeding tickets or accidents

- Daily marijuana usage (Note: a couple of times a week or month usually isn’t a big deal with most carriers today.)

Occupational Situations

The bureau of labor statistics lists some of the most dangerous occupations. These occupations include:

- Fishing and hunting occupations

- Logging / Tree workers

- Roofers

- Construction workers

- Airline pilots (note: private pilots a higher risk)

- Trash collectors / drivers

- Steelworkers

- Truck drivers / delivery drivers

- Law enforcement / firefighters

- Oil fields / mineral extractions

It’s important to note again that just because you may have a high risk or impaired risk health condition, hobby/activity, or occupation, you can still obtain life insurance.

And, we discuss how to do so next.

The Process For A High-Risk Applicant To Obtain Life Insurance

If you are a high-risk applicant, you can obtain life insurance. No question about it.

However, depending on your situation, certain types of life insurance may not be available. For example, guaranteed issue life insurance is really the only type of life insurance for someone with severe autism.

We discuss this further in the article.

Nevertheless, we can help you obtain life insurance. Here is our process.

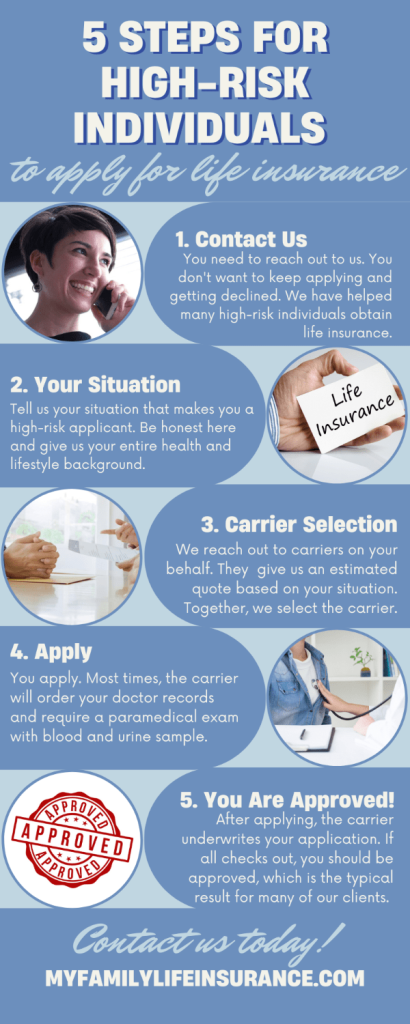

#1 Contact Us

#1 Contact Us

You need to reach out to us, either by phone, the form at the end of this article, or by the “contact us” link at the top bar menu.

Individuals who blindly apply to carriers may ultimately prevent themselves from obtaining life insurance.

Also, unlike other brokers or agencies, we don’t buy leads or anything like that. All of our clients have made contact with us first.

What this means is that we aren’t going to spam or call you 1,000 times per day like other brokers or agencies.

Moreover, there’s no risk in contacting us. If we can’t help you, we will put you in the right direction as best we can. You can always reach out to us if your situation changes. Additionally, if you just don’t want our help, just let us know, anytime.

#2 Tell Us Your Situation

You have to tell us your situation. Moreover, you have to tell us everything and be honest. Since we are dealing with a high-risk / impaired risk situation, we need to know your complete health, lifestyle, and/or occupational background to offer an informed quote.

As we stated earlier, we’ve helped many high-risk individuals obtain life insurance. However, we have had declined applications, too. In looking at the reasons why, the reasons all boil down to not telling us the whole background.

There’s no need to lie on a life insurance application. For example, we had a client who did not disclose her bariatric surgery or her obesity. She had another health condition that we were assessing. We had a carrier that accepted the application, but ultimately the carrier declined her through the underwriting process because of the recent surgery. If she were truthful about her obesity (we asked), it would have saved everyone a lot of time.

#3 Let Us Reach Out To Carriers

Additionally, you need to be truthful about your situation. Do you think your health condition is mild, but your doctor thinks it is moderate or severe? Most times in these cases, underwriters will request your doctor’s records. If your doctor indicates a more severe diagnosis than what you told us, there will likely be an adverse decision.

There’s no need for you to call 100 life insurance carriers and apply. Applying with the wrong carrier actually could have a damaging impact on future applications. Carriers can see you applied through the MIB. If they see many applications and no acceptances, they will likely decline you based solely on that.

The right thing to do is contact us and let us talk to the carriers. When we speak with you, we will ask you some health and lifestyle questions. However, it is important that you tell us everything that is going on with you. Even if you don’t think something is significant, it could be to a carrier.

Once we have your information, we ask the carriers for a preliminary quote.

#4 Apply

We work with over 70 life insurance carriers (there are thousands here in the US). They reply back to us with estimated quotes. Truthfully, some carriers will tell us your situation will lead to a decline. That is just how it is. For example, some carriers simply don’t insure people with bipolar disorder or schizophrenia.

However, other carriers will accept an application.

We review the quotes with you and then offer our recommendations. When you are ready, you will apply with us, either over the phone or through video conference. There’s no need to meet face-to-face.

In some cases, we even write a cover letter explaining your situation better to the underwriter. Admittedly, life insurance applications are words on paper. Sometimes, they just don’t convey your unique situation. That is where a properly constructed cover letter helps.

#5 Approval

We have helped many high-risk applicants obtain life insurance. You should be no different if you work with us. If everything you told us checks out, the carrier will approve you. Sometimes, the rate might be a tad higher or lower compared to the initial quote.

As mentioned, we’ve had declines as well. Those unfortunate situations stem from not knowing your complete background for the carrier to make an informed decision (steps #2 and steps #3).

3 Life Insurance Options Available For High Risk And Impaired Risk Individuals

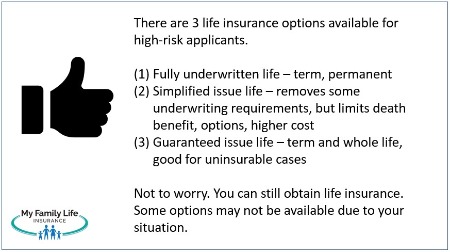

There are 3 life insurance options available to you.

However, depending on your situation, some options may not be available.

For example, let’s say you just had a heart attack. The situation has you shaken and now you want term life insurance. Unfortunately, term life insurance carriers will decline your application. Your only option is a guaranteed issue life insurance plan.

Let’s go into the 3 life insurance options available to high-risk individuals.

Fully Underwritten Life Insurance – Whole Life, Term, Universal Life

In most cases, fully underwritten life insurance is available. What does “fully underwritten” mean? It means you go through the complete underwriting process. In other words, there are no shortcuts.

A fully underwritten plan is arguably the cheapest option for you. However, keep in mind the following. Carriers will likely want:

- Your doctor records

- A paramedical exam with blood and urine samples

- Your MIB report

- To review your prescription drug history

- To review your driving records and bankruptcy history

- Other tests as required (like an EKG)

The carrier pays for all of this.

You can obtain up to an unlimited amount of life insurance, subject to your annual income, assets/liabilities, and underwriter/company writing limits.

For example, if you are a doctor making $500,000 annually, carriers will allow coverage up to $5,000,000 or more. However, if you are an accountant making $50,000, the same carriers may only allow up to $1,000,000.

We have helped many high-risk applicants obtain life insurance through a fully underwritten process. Products include term life, whole life, and universal life.

Again, as mentioned before, expect a table rating due to your high-risk / impaired risk situation.

Your specific situation determines the table rating. Feel free to search for rates on your own below:

Contact us to learn more.

Simplified Issue Life Insurance

Simplified issue life insurance is an option.

It means there’s limited, or simplified, underwriting. In other words, the carrier takes some shortcuts with underwriting your application.

takes some shortcuts with underwriting your application.

Usually, the underwriting is limited to:

- MIB report

- Prescription drug check

- Phone interview with an underwriter (possibly, many carriers nowadays don’t require it anymore).

The application process is quick and easy.

Typically, the carrier makes a decision instantly or within a couple of days.

Well, John, you say, that is easy. So, what is the catch?

There’s no catch; however, carriers that offer simplified issue life insurance do provide limits on:

- The death benefit,

- The application age, and/or

- The types of life insurance available

Whole life insurance dominates simplified issue life insurance although there are a few carriers offering simplified issue term life insurance.

Many carriers have minimum application ages. For example, many carriers have a minimum application age of 50, which means if you are age 46, you can’t apply (with that particular carrier). Some life insurance plans, however, start at age 0 and are good for young adults in high-risk situations.

The application is a “yes/no” questionnaire. If you can truthfully say “no” on the application, the carrier will likely approve you.

Some carriers will only offer up to $25,000 of simplified life insurance. However, we work with carriers that will offer up to $150,000.

The simplified underwriting makes this type of life insurance ideal for high-risk applicants. These applicants can quickly obtain coverage provided they meet the questionnaire, MIB, and other underwriting requirements.

Burial insurance, final expense insurance, and funeral insurance are all examples of simplified issue life insurance.

Guaranteed Issue Life Insurance

If your high-risk situation prevents you from obtaining fully underwritten or simplified issue life insurance, then the next option is guaranteed issue life insurance.

This type of insurance requires no underwriting.

In other words, no paramedical exam, MIB lookup, etc.

None of that.

You just submit an application, and you then have life insurance.

Sounds great!

Sure. But, there are limitations.

Because the carrier doesn’t underwrite, it doesn’t know the health status of applicants. So, it places a 2-year waiting period on the death benefit if you pass from illness or natural causes.

That is not as bad as it sounds.

If death happens in those first 2 years by illness or natural causes, the carrier pays back the premiums you paid + interest to your beneficiaries.

However, if you pass away from an accident, like a car accident, then the carrier pays 100% including in the first 2 years of the policy.

Guaranteed issue life insurance works well for those situations like recent cancer, severe autism, a person on parole, etc.

Like simplified issue life insurance, guarantee issue life has limitations including:

- Limited death benefit

- Age restrictions

- Not available in most states

Thankfully, we at My Family Life Insurance work with many guaranteed issue life insurance carriers. We probably have more to work with compared to other brokers and agencies.

For example, we work with a guaranteed issue life insurance option for young children (age 0) and young adults.

We also offer a guaranteed issue term life insurance. You can even apply on your own.

Feel free to check rates on your own in the quoter below. Select “poor health” in the health status field and know that we offer more than what is shown in the quote.

What Are The Best Life Insurance Carriers That Insure High-Risk Individuals?

People always ask me what are the carriers that will insure them.

People always ask me what are the carriers that will insure them.

I let them on a secret.

There isn’t one.

What I mean is that every carrier is different. One carrier isn’t the “best”. Moreover, every high-risk situation is different.

The “best” carrier is the one that will insure your specific situation.

We work with over 70 life insurance carriers. As I mentioned earlier, we reach out to them to see which ones will accept an application from you. They provide an estimated premium, too. We then discuss with you the available carriers, select the right one in your situation, and have you apply.

So, be careful what you read elsewhere. These websites aren’t necessarily listing the “best” carriers for your situation.

What If You’ve Been Declined Before?

If you’ve been declined before, no worries. We have gotten life insurance for many individuals who were declined life insurance.

Most times, the person simply applied with the wrong carrier.

This brings us to this important point: before you apply again, contact us or use the form at the end of this article.

The more you apply and receive declines, the harder it could be to obtain life insurance.

Why? Carriers can see where you’ve applied on your MIB report.

If an underwriter sees a long list of carriers with no approval, that says something.

So, an underwriter might err on the side of caution and simply decline your application.

When you work with us, we ask if you’ve been declined before. If you can let us know with whom, we let the other carriers know.

They will then inform us if they can accept an application from you. Of course, any application is still subject to underwriting.

Nevertheless, it does save everyone time. Moreover, it shows that you are upfront and mitigates surprises with underwriting.

Final Thoughts For High-Risk Individuals Needing Life Insurance

We hope you learned a lot about life insurance options for high-risk individuals. If you are in a high-risk situation, we can help you obtain life insurance.

As discussed, three life insurance options are available for high-risk or impaired-risk individuals:

- Fully underwritten life insurance

- Simplified issue life insurance

- Guaranteed issue life insurance

How can we help? Contact us or use the form below. There’s no risk in contacting us. We only work in your best interests. If we can’t help you, we will point you in the right direction as best we can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".