Here Are 4 Life Insurance Options If You Have Bipolar Disorder | We Discuss The Options And How You Can Get Approved!

Updated: August 18, 2024 at 6:37 pm

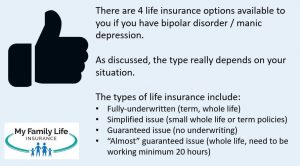

In this article, I will tell you how people with bipolar disorder or manic depression can obtain life insurance.

depression can obtain life insurance.

If you have bipolar disorder, you may have thought that life insurance was unavailable or out of reach. That is simply not true. You can get approved for life insurance if you have bipolar disorder, in some cases as early as a few days.

You just need to know which carriers underwrite your condition the right way. There could be many options.

The way I see it, if you have bipolar disorder, you have 4 life insurance options available to you. We’ve helped many people with bipolar disorder and other mental health disorders obtain life insurance at the best rates possible. I am sure we can help you, too.

In this guide, we discuss everything about bipolar disorder and life insurance. We even discuss successful applications we have placed and some that have not been so successful (we explain why in detail).

Article Navigation

Here’s what we will talk about.

- How Life Insurance Companies View Bipolar Disorder

- Life Insurance Underwriting For People With Bipolar Disorder

- Simplified Underwriting Available For Bipolar Disorder

- 4 Life Insurance Options For People With Bipolar Disorder

- Recap Of The 4 Life Insurance Options Available For People With Bipolar Disorder

- Successful Cases Placed By My Family Life Insurance

- FAQs About Bipolar Disorder And Life Insurance

- Final Thoughts

Let’s jump right in and discuss how carriers view bipolar disorder. We will then discuss life insurance underwriting for people with bipolar disorder.

How Life Insurance Companies View Bipolar Disorder

Bipolar disorder is a mental health condition characterized by mood swings ranging from depressive lows to manic highs. This is why bipolar disorder is commonly known as manic depressive disorder.

Bipolar disorder is a mental health condition characterized by mood swings ranging from depressive lows to manic highs. This is why bipolar disorder is commonly known as manic depressive disorder.

I receive many phone calls from people with bipolar disorder. Most of them have already been declined for life insurance. (Don’t worry. We specialize in getting people life insurance, even if they were declined before.)

What people don’t realize is that many life insurance companies simply do not insure people with bipolar disorder. That is their choice.

Here is why:

- The life expectancy of someone with bipolar disorder is age 67. That is about 20 years less than the average mortality age of the general American population.

- The common cause of death is suicide.

Life insurers know this. That is why many companies will not insure people with bipolar disorder.

Can I have a suicide exclusion, then?

Good question. There is already a suicide clause in every life insurance policy issued here in the US. Basically, it says if your cause of death is suicide in the first 2 years of the policy’s start date, the carrier pays your beneficiary the premiums you paid, not the death benefit. After 2 years, death by suicide is covered, and the life insurance carrier pays the death benefit.

However, carriers aren’t going to exclude suicide specifically. Instead, they will not accept the life insurance application. In other words, they decline you.

That is what happens.

However, here at My Family Life Insurance, we have helped our clients with bipolar disorder obtain life insurance. We work with favorable life insurance carriers who accept people with bipolar disorder.

How? The key to a life insurance approval is underwriting. We discuss this next.

Life Insurance Underwriting For People With Bipolar Disorder

Underwriting is the process of:

- reviewing your situation and application,

- analyzing your risk, (with life insurance, the risk of an early death),

- and making you an offer (or decline if the risk is too great).

Like most situations, how carriers underwrite bipolar disorder depends on your situation. Really, no two applications are alike.

First, let me say that we can likely get you some type of life insurance if you have bipolar disorder or manic depression.

But, as we said, the life insurance options really depend on your situation.

Moreover, in most cases with us, carriers will approve your application – which is great – with a table rating.

A rating, honestly, is no big deal. We will discuss that more. I know other websites say “standard rates” are available. A standard rate is unlikely for people with bipolar disorder. We have successfully helped hundreds of people with bipolar disorder obtain life insurance. They all had a table rating. Why? It is because of the reasons we discussed in the previous section.

A rating, honestly, is no big deal. We will discuss that more. I know other websites say “standard rates” are available. A standard rate is unlikely for people with bipolar disorder. We have successfully helped hundreds of people with bipolar disorder obtain life insurance. They all had a table rating. Why? It is because of the reasons we discussed in the previous section.

General Life Insurance Underwriting For People With Bipolar Disorder

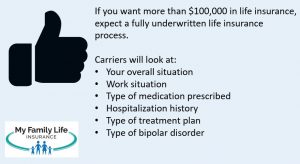

Carriers not only want to know the severity of your condition, but also want to know other things like your height/weight, tobacco or drug use, etc.

They also want to know if you have other medical conditions like diabetes or mental health issues like anxiety or depression.

Additionally, they will verify your information through driving records, prescription drug databases, and medical history through the MIB, among other databases.

They will also require a medical exam, blood draw, and urine sample. Moreover, they will (always) order your medical records. They do this to make sure your bipolar disorder is stable, and you are following your treatment with your doctor.

Next, we will give you a general idea of how carriers underwrite your health condition. Later in the article, we will share real success stories of how we have helped people with varying degrees of bipolar disorder obtain life insurance.

If You Have Gainful Employment

I’ve said this time and time again…if you work, for earned income and not on SSDI disability, that proves a lot to insurance carriers. It shows you can earn an income and not let your health condition affect your everyday life.

Moreover, working shows you can have conversations and relationships with people. It is a normal life activity. I know this sounds funny, but this is an important aspect.

Certainly, other factors might alter the underwriting outcome (as I will discuss next). However, earning a full-time income demonstrates that you can manage your condition while maintaining employment. That is huge. I doubt other agents will tell you that.

However, as I said, other aspects are involved in the underwriting process. For example, if you were recently hospitalized due to your condition (for example), then the hospitalization plays a bigger role in the underwriting decision. Working full-time then doesn’t matter.

If you don’t work because of your condition, no worries. As I mentioned earlier, we can still likely get you some type of life insurance.

Have You Been Hospitalized?

Hospitalization due to bipolar disorder could impact the underwriting decision. The following is a general guide. If you have been in the hospital within 2 years of the application for bipolar disorder, expect a rating or a decline on traditional life insurance.

If it has been between 2 and 5 years, expect a moderate to high table rating. Additionally, if it has been over 5 years since hospitalization, then probably a low table rating.

Any Suicide Attempts Or Ideation?

If suicide ideation or attempts were the reason for the hospitalization, that could change the underwriting picture. Usually, any suicide attempt is a decline with most carriers. However, that really depends on how long ago the attempt occurred.

Nevertheless, no worries. We still have life insurance options for you.

Type Of Medication

The type of medication matters. Let’s say you use 1 or 2 medications, and they are not antipsychotic drugs. That is usually no issue with most carriers. For example, if your doctor prescribes only lithium, which is a mood stabilizer, then that alone is usually no issue.

As we implied, though, the prescription of anti-psychotic drugs makes a larger impact. For example, if you take Seroquel, you could get a moderate table rating.

Again, underwriters balance this decision with other factors in your application.

If you are many medications for bipolar disorder, traditional life insurance underwriters could see that as an unstable situation.

Type Of Treatment Plan / Are You Following It?

Your treatment plan matters to underwriters. Obviously, following your treatment plan is beneficial to your application. Underwriters like that. It shows stability and, usually, no impact on your everyday activities.

your treatment plan is beneficial to your application. Underwriters like that. It shows stability and, usually, no impact on your everyday activities.

The type of plan, however, matters, too. If your doctor has you on a first-line psychotherapy treatment, that is great. Moreover, if you have shown that you follow your treatment plan without interrupting normal daily activities, that benefits your application.

However, more intense treatment plans like electroconvulsive therapy likely require a rating. Additionally, a rating or decline could happen if your medical records indicate swings and changes in prescription medication. Medication swings, saying going from one drug to another drug to another drug, indicate instability.

Moreover, if you have many psychiatrists and doctors managing your bipolar disorder, that indicates a potentially unstable situation.

Again, this is all determined in conjunction with other underwriting factors.

Bipolar 1 Disorder or Bipolar 2 Disorder?

The type of bipolar disorder matters as well. Some life insurance carriers lump all bipolar disorders together. We usually don’t want to work with those carriers that do that. It shows they don’t know how to properly underwrite your health condition.

As you are aware, bipolar 1 disorder presents more intense and significant manic and depressive episodes than bipolar 2 disorder. People with bipolar 1 disorder may exhibit longer manic symptoms and severe mood swings compared to those with bipolar 2. Carriers know this, and they know bipolar 1 could hinder normal activities (like working) compared to bipolar 2 disorders.

So, if you have bipolar 1 disorder, then your life insurance options could be limited compared to someone who has been diagnosed with bipolar 2 disorder.

As we have said, no worries. We likely can still help you obtain some level of life insurance. The best thing to do is contact us and let us know your situation.

Any Other Mental Illnesses or Medical Conditions?

In addition to bipolar disorder, do you have another diagnosed medical condition or mental illness like anxiety or depression?

If you do, no worries. Many people with bipolar disorder have an additional diagnosis of ADHD, anxiety, or depression. As long as these medical conditions are stable, then they should not make a negative impact on your life insurance application.

However, if you have other health conditions, like diabetes, sleep apnea, multiple sclerosis, heart issues, etc., those will also impact the underwriting decision.

So, What Does Fully Underwritten Life Insurance Mean For People With Bipolar Disorder?

OK, we went through a lot, even more so than the average agent (we aim to be transparent and set the proper expectations). But isn’t it good to see what is involved in the underwriting process? So, what does this all mean?

Well, if you want more than $100,000 of life insurance, say $500,000, then you will have an involved underwriting process. But, that is OK. Most people have to go through paramedical exams and explain their health history.

Moreover, the carriers see all that through databases like the prescription drug database.

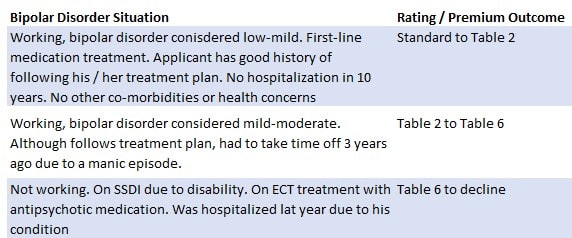

Based on what I described, here’s a table that shows potential ratings for your situation:

Most people we work with end up in the table 2 to table 6 range. Don’t despair; it is still a good premium rate (as you will see later in the article). Moreover, don’t worry if you are declined; we still have life insurance options for you.

Search For Traditional Life Insurance Premiums Yourself

You can search for premiums yourself. Just enter some pertinent information like your date of birth. Change the “health class” to “standard.” Note: the actual premium will be higher compared to the rates you will see, but they will give you a decent idea about costs.

(Also, note that we will reserve the right to give you a call or text message, but we aren’t one of those agencies that keep calling and bothering you.

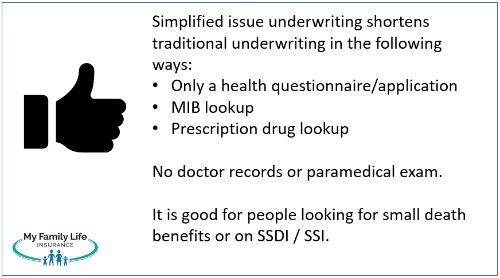

Simplified Life Insurance Underwriting For Those With Bipolar Disorder

What if you don’t want $100,000 or more of life insurance? Do you need to go through all of that underwriting?

The good news is that you don’t!

Many carriers offer simplified underwriting.

Simplified life insurance underwriting differs greatly from the fully underwritten process we just described. In this case, all the carriers do is (generally speaking):

- Verify your medical history in databases like MIB

- Confirm prescription drug usage in databases like Milliman Intelliscript

- Review your answers to health questions

- Conduct a personal phone interview with an underwriter (note: this step is becoming obsolete as underwriting processes improve)

If all works out, then you have life insurance. The death benefit amounts we discuss here are low, like $25,000 to $50,000. These amounts are typically burial insurance and final expense policies.

They are usually whole life insurance plans, although we work with a few that offer term life insurance.

These face amounts are good for people who don’t work, are on SSDI because of their bipolar, have bipolar 1, or have severe bipolar disorder, among other factors.

The underwriting decision is usually quick, usually a day turnaround.

Usually, the main factors in the decision, as we discussed, are:

- Your information in the MIB

- The kinds of medications you take

- Your answers to health questions

Let’s discuss the last two – medications and health questions – in more detail.

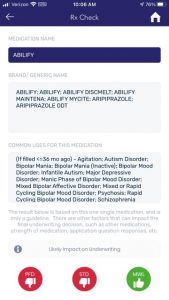

How Your Medication Affects Simplified Life Insurance Underwriting For People With Bipolar Disorder

In the previous section, I discussed how the type of medication affects underwriting. For example, if you are prescribed Seroquel, that drug has a larger impact on the underwriting decision than lithium.

The simplified underwriting process is no different. However, the decision is more “black and white”. In other words, carriers specifically state which prescription drugs they accept.

They also have a list of “knockout” drugs, which means if you were prescribed any “knockout” drugs, then they decline your application.

For example, if you take Abilify for your bipolar disorder, the best this carrier below can offer you is a graded-benefit life insurance policy. (More on what that in a minute.)

However, if you take lithium, as you can see, you could receive an immediate life insurance policy (which is better compared to the graded benefit).

I’ll go over immediate versus graded benefit in the next section.

So, in your case, we want to work with carriers that are favorable to the medication you have taken and prescribed.

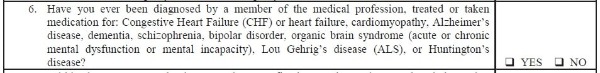

How The Health Questions Affect Simplified Life Insurance Underwriting For People With Bipolar Disorder

The questions on the application matter. If the carrier asks about bipolar disorder or, in some cases, generic emotional/mental disorder on the application, then likely the bipolar disorder diagnosis is a problem. In other words, they will decline your application.

Here are some real questions from carriers offering simplified underwriting.

![]()

These carriers would decline your application.

These carriers would decline your application.

We obviously do not use these carriers for your situation. Who would we use then?

That is right. The carriers that don’t ask about bipolar disorder on the application!

Moreover, many carriers will cover your health condition. However, many of these applications have hospitalizations and drug/alcohol abuse questions. For example, if you have recently been hospitalized due to your condition, the carrier will deny your application.

Ok. Now that you know what the carriers look for when someone with bipolar disorder applies for life insurance, let’s discuss the 4 life insurance options available for people with bipolar disorder.

4 Types of Life Insurance That Are Available To People Who Have Bipolar Disorder

We have helped many people with bipolar disorder obtain life insurance. Here are the 4 types available. We also provide estimated costs, which are subject to change at any time.

As we said, the availability and eligibility really depend on your situation. Nevertheless, we are confident we can help you obtain life insurance coverage.

As we said, the availability and eligibility really depend on your situation. Nevertheless, we are confident we can help you obtain life insurance coverage.

#1 Fully Underwritten Life Insurance For People With Mild Bipolar Disorder

If you have a mild, stable bipolar disorder, then any type of life insurance is likely available to you. Moreover, underwriters won’t generally limit the death benefit available to you.

As we suggested in the underwriting section, term life insurance or permanent life insurance, like whole life or universal life, is available.

However, the main thing carriers are going to look at is the stability of your bipolar disorder. You will have to go through a fully underwritten application process.

Gainful full-time employment matters, too. Working is a normal, daily life activity. If you demonstrate the ability to work full-time, coupled with the stability of your condition, you will likely get either term life insurance or permanent insurance.

As we said, the actual premium rate you pay is determined by your overall situation.

Sure, you will pay higher premiums than someone who doesn’t have bipolar disorder. It is a fact. But, you can obtain life insurance, even up to $1,000,000 in death benefit and beyond, if your income qualifies you for that level.

Here is an example of where you may end up:

- Mild case, working full time, hospitalization over 10 years ago, following treatment plan: Up to table 4.

- Mild-Moderate case: still working full-time, but hospitalized 3 years ago, could be table 3 to table 6.

In fact, most of the people we have helped insure are in the table 2 to table 6 range. Is that bad? Not really.

Here is what that might cost, for a 40-year-old, male and female, needing $250,000 of term life insurance:

Male: $40 to $60 per month Female: $30 to $55 per month

You can see, the premiums aren’t that bad. Again, the actual premium depends on your situation.

#2 Simplified Issue Life Insurance For People With Bipolar Disorder

As we discussed earlier, simplified issue life insurance exists for people with bipolar disorder.

A simplified issue plan may be a good option if you don’t need much life insurance.

If you need, say, $50,000 for funeral, burial, and end-of-life expenses, these plans are a great fit.

We work with many simplified issue life insurance companies. Obviously, we only work with those who accept the bipolar disorder condition.

We have both term life and permanent life options available.

#3 Burial Life Insurance Options For People With Bipolar Disorder

As we discussed earlier, life insurance options exist for people with moderate to severe bipolar disorder.

If you have a moderate to severe case, then a simplified issue life insurance option called burial insurance is available.

What is burial insurance? It is a whole life insurance policy with a small death benefit, like $30,000. The main purpose of the life insurance is, as the name suggests, for your burial, funeral, and final expense needs.

Burial insurance is an easy application and underwriting. See the simplified underwriting section above. As long as

- the carrier doesn’t ask about bipolar disorder,

- the carrier accepts your medication, and

- there is nothing else in your background that adversely impacts your application…

…you will obtain burial insurance. It is really that easy.

Additionally, term life insurance policies with small death benefits are available.

These policies are key for people who might be on SSDI or SSI, for example. In fact, we have helped many people with bipolar disorder on SSDI obtain burial insurance or small term life policies.

There are a couple of types of burial insurance:

- an immediate benefit pays the benefit, just as it sounds, immediately. If you pass away tomorrow, the carrier will pay the benefit immediately.

- However, a graded-benefit policy pays a percentage of the death benefit or return of your premiums in the first couple of years if you were to pass away.

People with moderate to severe health conditions usually end up with a graded-benefit policy.

As we said, however, we aim for immediate benefit policies. We have helped many people with bipolar disorder obtain immediate benefit life insurance policies.

Feel free to check out estimated premiums using the quoter below.

#4 Guaranteed Issue Whole Life Insurance For People With Bipolar Disorder

If you have a severe case of bipolar disorder, you may think life insurance is impossible for you.

That is right, John, you say. I applied and was denied because of the severity of my bipolar disorder.

Well, I am here to say life insurance is available.

It is called guaranteed issue whole life insurance. Unlike fully underwritten and simplified underwriting life insurance, with guaranteed issue life insurance, there is no underwriting. Approval is guaranteed, hence the name “guaranteed issue.”

In other words, there is no:

- MIB lookup

- Prescription drug check

- Health questions

- Treatment plan analysis, etc.

All you do is apply, and you have life insurance.

That sounds great, John. But is it too good to be true?

Well, not necessarily. Let me explain how guaranteed issue life insurance works.

How Guaranteed Issue Life Insurance Works

Since no underwriting exists, carriers don’t know the applicants’ health status.

So, companies put a “waiting period” on the death benefit.

So, companies put a “waiting period” on the death benefit.

Usually, that waiting period is 2 years.

That means if you were to pass away by illness or natural causes within the first 2 years of the policy’s start date, your beneficiaries would receive the premiums you paid + any interest.

So, it’s like I get my money back…well, my beneficiaries do, right?

That is right.

Keep in mind, when I hear people say they don’t want guaranteed issue life insurance, I ask them what they will do next. They tell me they will save.

To save a significant amount, you would need an investment return of about 5,000% in the next two years. I tell them that with the guaranteed issue life insurance, you are already saving.

If you pass away in the next two years, your family receives the premiums you paid + interest. It is even better than saving because, after the two-year waiting period, your policy pays 100% of the death benefit.

People tell me it is too expensive!

Estimated Premiums

Well, it could be. However, check this out. Here is a real guaranteed issue rate for a 60-year-old female wanting $10,000 of life insurance versus an immediate benefit (subject to change any time):

- Guaranteed issue: $41 per month

- Immediate benefit: $35 per month

So, the guaranteed issue life insurance isn’t that much more.

How we approach all this: well, we will try for an immediate benefit first, but if you don’t qualify, then we will pivot to a guaranteed issue life insurance policy.

Don’t forget: guaranteed issue life insurance is usually whole life insurance. It has cash value. If you are on Medicaid, the life insurance may affect your Medicaid assistance. Contact us to learn more.

Additionally, we offer guaranteed issue life insurance for people age 40 and less.

We also offer guaranteed issue term life insurance.

If you want to see what premiums might cost, enter your pertinent information in the quote below.

#5 Bonus (Almost) Guaranteed Issue Life Insurance For People With Bipolar Disorder

Here’s a bonus.

Finally, there is an “almost” guaranteed issue life insurance plan. How is this different from a traditional guaranteed issue plan? Well, the application has only two questions, one of which is a health question.

The first question asks if you are working in gainful employment. You see, working matters. In this case, the life insurance company defines someone working 20 or more hours per week. Moreover, this is gainful employment for an income. It is not volunteer work or anything like that.

The health question is as follows: In the past 12 months, has any applicant needed assistance for 2 or more Activities of Daily Living, received chemotherapy, radiation therapy or dialysis, or been diagnosed, treated, or prescribed medication by a medical professional for AIDS, AIDS related complex, an immune system disorder or terminal illness?

If you work in gainful employment and can answer “no” to the health question, then you qualify for (almost) guaranteed issue life insurance up to $50,000. It is a term life insurance plan to age 121.

The carrier requires financial proof, such as a W-2 or pay stubs, to support gainful employment. I recommend you keep a copy of your pay stub, etc., to support this gainful employment. If you pass away and your family makes a claim, your claim could be denied if you don’t show proof of gainful employment at the time of application.

This plan is not available in every state, but it is affordable coverage.

Recap Of The 4 Types of Life Insurance That Are Available To People Who Have Bipolar Disorder

So, we now know people with bipolar disorder can obtain life insurance. The types of life insurance available really depend on the stability of your bipolar disorder as well as any other medical conditions.

If you have mild bipolar disorder, you likely have any type of life insurance available to you. You can apply for:

- term life insurance

- whole life

- universal life, including indexed universal life

- smaller, simplified issue life insurance

- guaranteed issue life insurance

Remember, the life insurance companies will likely approve you with a table rating. As I discussed earlier, a table rating shouldn’t be a big deal. They apply a table rating based on the statistics I shared earlier in the article. Most of our clients are approved between a Table 2 and a Table 6 rating.

If you have a moderate to severe case of bipolar disorder, then a simplified issue life insurance plan is likely your option. If you are SSDI, then simplified/burial insurance plans are your only option.

And, if you have severe bipolar disorder, you may qualify for the simplified issue life insurance plans. However, your likely option is a guaranteed issue life insurance plan.

Finally, if you are gainfully employed, we do have an (almost) guaranteed issue term life insurance plan. $50,000 is available. You will have to prove your employment through a W-2 and pay stubs.

As you can see, we have many affordable life insurance options for you.

Successful Life Insurance Approvals For People With Bipolar Disorder By My Family Life Insurance

We have helped many people with bipolar disorder obtain life insurance. Here are some cases to give you an idea of what is possible.

Male, 52, Real Estate Agent

He was diagnosed with bipolar disorder in early 2000 and runs a successful real estate agency. He was looking for $500,000. Medication included Lamotrigine and Sertraline. Never hospitalized. He also had a sleep apnea history, but lost weight and was no longer being treated for sleep apnea. He was approved at table 4.

Male, 35, Sales Manager

He came to us after being denied many times by other life insurance companies. He is a family man with 4 kids, is the household’s main breadwinner, and was looking for a $3,000,000 term life policy.

We went through his background and options. He was in the mild range, stable of treatment, and never missed work because of his condition. The only time he did miss work was during his hospitalization, which led to his diagnosis. This occurred over 10 years ago.

We were able to help him obtain the $3,000,000 with a table rating, of course. However, the man was happy that he could obtain life insurance and protect his family.

Female, 35, Pharmacist

She was diagnosed with bipolar disorder in 2020. Spent 1 week in the hospital. No suicidal thoughts or ideation. Has a secondary diagnosis of anxiety. Prescribed Latuda and hydroxyzine (for anxiety). Her medical records confirmed stability. She wanted $1,000,000, and she was approved at table 6 (likely because of her medication and the recency of her diagnosis).

Female, 55, on SSDI

She is disabled because of her bipolar disorder. No other health conditions. She wanted $25,000 to fund her funeral and final expenses. We easily matched her with a favorable company that accepts people with bipolar disorder.

Cases Where We Were Not Able To Help

Unfortunately, there were some cases in which we were not able to help. Looking at these declined cases, the reason revolved around 3 areas:

(1) thinking that your bipolar disorder is mild when your doctor says it is moderate to severe (this is why carriers request your doctor’s records).

(2) not telling us your full health history. We had some applicants with additional, serious health conditions such as substance abuse, PTSD, recent gastro-bypass surgery, cardiac problems, and others. We need to know these other conditions to accurately place you in the right plan.

(3) aligning with #2, forgetting about other aspects of your background, such as bankruptcies, substance abuse, etc.

We need to know your complete medical history and background to help you obtain the best life insurance coverage at the best rates.

Frequently Asked Questions About Life Insurance And Bipolar Disorder

We answer several frequently asked questions about life insurance and bipolar disorder.

Can A Life Insurance Carrier Deny My Application Because Of My Bipolar Diagnosis?

Yes, a life insurance carrier can deny your application because of your bipolar disorder. Some carriers simply won’t insure people with bipolar disorder. The reasons include:

- the documented shortened lifespan of someone living with bipolar disorder and

- most causes of death are suicide

Nevertheless, as we discussed, favorable life insurance carriers exist for people with bipolar disorder, especially those with mild cases.

I See Some Websites List The Best Life Insurance Companies For Bipolar Disorder. Can’t I Just Apply With Them?

Not a good idea. As I mentioned, some carriers simply won’t insure people with bipolar disorder. I’ve also seen those lists, and some carriers on there will likely deny your application.

These websites also say you can get the standard rate. Nearly impossible. You will likely get a table rating, even in the most stable situations.

Other websites suggest you should “shop around.” While truthful advice, do you have the time?

You are already at the right supermarket (i.e., us!!!!). We have helped many people with bipolar disorder obtain life insurance. Let us do your shopping.

Your best course of action is to contact us. We can go through your situation and then match you with one of the favorable life insurance companies we work with.

Is Bipolar Disorder A Pre-Existing Condition For Life Insurance?

Yes, bipolar disorder is a pre-existing condition for life insurance. In fact, it is a pre-existing condition for nearly all types of personal insurance, including disability insurance, long-term care insurance, etc.

This means you will have to disclose the severity of your bipolar disorder on any personal insurance application, such as life, disability, long-term care, health, etc.

Can’t Carriers Just Give Me A Complete Suicide Exclusion?

There is a 2-year suicide exclusion on every policy issued here in the US. It basically says if you pass away in the first 2 years of the policy’s start date by suicide, the carrier pays your beneficiary the premiums you paid. After 2 years, suicide is covered.

No carrier will place a lifetime exclusion. Instead, if they feel your situation is severe, they deny your application. In that case, your next best options are simplified issue or guaranteed issue life insurance.

I Have Many Doctors Managing My Bipolar Disorder. Is That A Problem For Life Insurance Carriers?

It could be. As we discussed, carriers look at your overall situation. However, in our experience, having 1 doctor (i.e., your PCP) or 2 doctors (i.e., your PCP and a psychiatrist) shouldn’t matter much in the underwriting process as long as you have a stable situation. Many of our clients have 2 doctors.

However, people with three or more doctors have contacted us. Having three or more doctors managing your condition generally indicates instability, even if you feel your situation is mild or stable.

Again, this has to be balanced with other aspects of your background and health.

Final Thoughts About Getting Life Insurance If You Have Bipolar Disorder

If you have bipolar disorder, you can obtain life insurance. Usually, your health condition is no issue. As we discussed, the type available really depends on your situation.

You can purchase a:

- fully-underwritten policy

- simplified issue policy with a smaller death benefit

- guaranteed issue life insurance

- “almost” guaranteed issue life insurance

I am sure you have questions. Feel free to contact us or use the form below.

If you haven’t realized by now, we only work in your best interest, not our own or any insurance carrier. It’s the only way we know how to work with our clients: place them and their families first. The best part? There is no risk of contacting us.

If you don’t want our help or we can’t help you, we will do our best to point you in the right direction. We will part as friends, seriously! You can always reach back out to us at any time.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

4 thoughts on “Here Are 4 Life Insurance Options If You Have Bipolar Disorder | We Discuss The Options And How You Can Get Approved!”

Comments are closed.

I was diagnosed with bi-polar 1 around 7-8 years ago. The only medication that I take, and have taken, for my illness is V****; although I was previously on L*****, too, over 2-3 years ago. I have not been hospitalized for my illness for more than 6-7 years ago. Since my diagnosis, I have continuously been participating in approved rehabilitation or treatment/counseling programs for more than 6 years on a regular monthly basis.

Hi – (because you included health information, I hid your name and medication). Thank you for reaching out to us. Yes, we can help as we have helped many in similar situations. I can give you a call today.

John with My Family Life Insurance

I am currently 100% stabilized for my bi-polar illness, taking only ***** medication, actively participating in appropriate treatment & counseling programs for 6-7 years, and have not been hospitalized for my bipolar illness for a period in excess of 6-7 years. As a result, I am considered to be fully stabilized by my physicians & Therapists for more than 6+ years

Hi – (because you included your medication, we hid your name). Thanks for reaching out to us. Yes, we can help. Stability is key. Have you applied elsewhere for life insurance? I will contact you today.

John