The Best Life Insurance Riders And Ones You Don’t Need

Updated: April 12, 2024 at 9:38 am

Many life insurance companies offer life insurance riders for policyholders. Life insurance riders allow policyholders to customize their policy to their needs and wants. Like a knot, they attach to your base life insurance policy.

Of course, the more you customize, the more your policy costs. Carriers charge an additional cost for some of these riders.

What?

Yes, many riders come with an extra cost. Sometimes, the cost is worth it. Other times, it is not.

We at My Family Life Insurance like life insurance riders for only the RIGHT reasons as you will see. In this article, we discuss, in our opinion, the best life insurance riders and ones you probably don’t need.

Knowing what these are and what they mean could save you thousands over your lifetime. You may have been blindly told by other insurance agents that you need (insert such and such) rider because it is “the best”.

Here’s what we will discuss:

- Life Insurance Riders On Term Life Insurance

- Riders On Whole Life Insurance & Universal Life

- Free, No-Cost Life Insurance Riders

- Life Insurance Riders That May Not Be Worth The Money

- Riders That Could Be Worth It

- FAQs About Life Insurance Riders

- Final Thoughts

One thought before we get into the article: there is no such thing as the “best” riders. The “best” life insurance riders are those that meet your specific needs and enhance your financial situation and goals. All of these we discuss here can be the best, as long as they meet your needs.

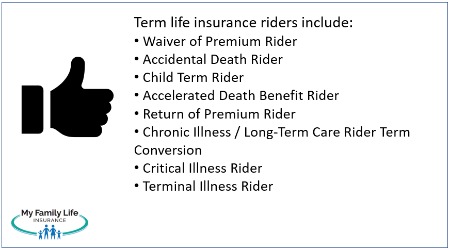

Life Insurance Riders On Term Life Insurance Policies

Here are some common life insurance riders available on a typical term life insurance policy:

- Waiver of Premium Rider – this rider will waive the premium should the insured become disabled for a period of time. It is important to understand what the life insurance carrier’s definition of disability is.

- Accidental Death Rider – this rider will pay, usually double the death benefit up to a certain limit, if the insured dies or becomes dismembered from an accident. It is important to understand what the carrier’s definition of an accident is.

- Child Term Rider – this rider will add your children as an insured on their own term life insurance policy, usually at guaranteed issue or simplified underwriting

- Accelerated Death Benefit Rider – Allows the owner/insured to receive some of the sooner while living for a covered event. Usually for a covered critical illness, chronic illness, or a terminal illness.

- Return of Premium Rider – will return part of or all of your premiums if you outlive the term period

- Chronic Illness / Long-Term Care Rider – will allow you to advance the death benefit sooner if you meet the policy’s definition of a chronic illness / long-term care event

- Term Conversion Rider – allows the owner/insured to convert the term life insurance to a permanent life insurance policy per the carrier’s requirements

- Critical Illness Rider – allows the owner/insured to advance the death benefit for covered illness such as a heart attack

- Terminal Illness Rider – allows the owner/insured to advance most of the death benefit sooner if the insured has a life expectancy of 12 months or less

These are just some of the common term life insurance riders. Others may exist specific to a particular carrier.

Let’s discuss riders found on many permanent life insurance policies.

Life Insurance Riders On Whole Life And Universal Life

Here are common riders found on permanent life insurance policies (whole life and universal life).

- Guaranteed Insurability Rider – will allow you to purchase more insurance at specified ages, usually up to $50,000 or $100,000, with no evidence of health insurability

- Paid-Up Insurance (PUI) – will allow you to purchase additional insurance and build cash value quicker (whole life only)

- Term Rider – will allow you to attach a term life insurance policy to the permanent policy

- Waiver of Premium Rider – this rider will waive the premium should the insured become disabled for a period of time. It is important to understand what the life insurance carrier’s definition of disability is.

- Accidental Death Rider – this rider will pay, usually double the death benefit up to a certain limit, if the insured dies or becomes dismembered from an accident. It is important to understand what the carrier’s definition of an accident is.

- Child Term Rider – this rider will add your children as an insured on their own term life insurance policy, usually at guaranteed issue or simplified underwriting

- Accelerated Death Benefit Rider – Allows the owner/insured to receive some of the sooner while living for a covered event. Usually for a covered critical illness, chronic illness, or a terminal illness.

- Chronic Illness / Long-Term Care Rider – will allow you to advance the death benefit sooner if you meet the policy’s definition of a chronic illness / long-term care event

More Life Insurance Riders On Permanent Plans

- Critical Illness Rider – allows the owner/insured to advance the death benefit for covered illness such as a heart attack

- Terminal Illness Rider – allows the owner/insured to advance most of the death benefit sooner if the insured has a life expectancy of 12 months or less

- Premium Recovery Rider – like a return of premium rider, but designed for universal life policies

- Guaranteed Death Benefit Rider – common on universal life policies, this rider guarantees the death benefit for a certain number of years

- Disability Insurance Rider – pays a monthly benefit, up to a maximum amount such as $2,000, if you can’t do your job and meet the carrier’s definition of disability

OK. We mentioned before that some life insurance riders are free while the rest cost money. Let’s discuss the free, no-cost riders next.

Free, No-Cost Life Insurance Riders

Most life insurance carriers offer some of the riders as a free, no-cost, add-on. They are automatically included in the policy. Here are the typical riders that carriers generally include in the policy at no additional fee:

They are automatically included in the policy. Here are the typical riders that carriers generally include in the policy at no additional fee:

- Accelerated Death Benefit Rider – if the carrier has living benefits on their policies. Honestly, it could be worth the extra money to go with a carrier that has living benefits compared to a carrier that does not.

- Terminal Illness Rider – the terminal illness rider is a very common rider among all policies. If your policy doesn’t offer a terminal illness rider, you should consider a new policy (assuming you don’t have a plan in force yet)

- Guaranteed Death Benefit Rider – common on universal life policies, this rider guarantees the death benefit for a certain number of years

- Term Conversion Rider – on term life policies only

Again, carriers typically include these riders in the policy.

Next, Let’s discuss some life insurance riders that may not be worth the money.

Life Insurance Riders That May Not Be Worth The Money

As we mentioned, you have to spend additional costs for many of these riders. They increase your life insurance premiums. You want to make sure that these riders meet your needs and goals, especially with how costs and inflation have risen here in the US.

I am not saying these riders are “bad”. You may want them. I am just saying to really take a second look and determine if they are worth it to you.

Waiver Of Premium Rider

I know many agents who automatically include this rider, saying it is important. “What happens if you get disabled and can’t work?”, they ask. “How will you pay for this important life insurance?” A waiver of premium rider “waives” the life insurance premium if you are disabled. They sign you up without even blinking.

These are legitimate questions, but the answer is not the waiver of premium rider. Why?

First is that the waiver of premium rider is very expensive for the value you receive. Look at this example of a 30-year-old woman wanting $250,000 of term life insurance. Assuming a standard rating, she could purchase a plan for $26 per month. If she adds the waiver of premium, her premiums increase to $30.

John, it’s only a $4 additional cost. That’s not expensive.

It’s not, but what is the value you are receiving? You are spending an additional $4 to insure $26. In this example, the woman increased her premium by 15%.

Moreover, typically, the:

- waiting period is long, like 6 months or longer,

- disability has to be a total disability (not partial), and

- carrier says the disability definition has to be “any occupation”, which means the carrier only waives your life insurance premium if you can’t do ANY job suited by your education and experience. That means, for example, if you are a massage therapist and hurt your arm, but you can still work at Walmart as a greeter, then the carrier won’t waive your life insurance premiums.

Just look at this example from a real carrier. It is a 6 month waiting period (way too long) and only waives the premiums on a total disability. Although there is no mention of the definition of disability, I bet it is the any occupation definition.

A Better Option – A Disability Insurance Policy

A better use of your hard-earned money and the waiver of premium is to purchase a disability insurance policy. A disability insurance policy has more flexible terms and benefits. Moreover, it is much cheaper.

A better use of your hard-earned money and the waiver of premium is to purchase a disability insurance policy. A disability insurance policy has more flexible terms and benefits. Moreover, it is much cheaper.

A disability insurance policy with a $500 monthly benefit, a 30-day waiting period, and own occupation definition could cost $9.18 per month.

That is right. $9.18 for a $500 benefit versus $4 for a $26 benefit. Moreover, the disability insurance policy has better benefits.

You can see the premium is about $5 more for a 1,823% increase in benefit.

So, on this one, I recommend you take a pass and purchase a disability insurance policy instead.

Accidental Death Benefit Rider

These policies pay an additional benefit if you die from an accident. Let’s say your base life insurance policy has a death benefit of $250,000. An accidental death rider may double the death benefit to $500,000. If you pass away from an accident, your beneficiary receives $500,000. If you die any other way, they receive $250,000.

The thing is, while we hear all the time about people dying in car accidents, etc., most people don’t die from an accident.

It can be a rather expensive option. For example, our 30-year-old woman could spend $26 on that $250,000 policy. If she wants accidental death coverage, she’ll have to pay an additional $18 per month for an additional death benefit. Kind of expensive when the probability of dying from an accident is low.

If you want accident coverage, it is better to obtain accident insurance. Accident insurance will not only pay a benefit for an accidental death, but also pay a benefit for accidental injuries including dismemberment. It offers additional protection beyond a death benefit. It will also pay for accidental injuries and some policies pay for accidental ingestion of poison (think small children).

A solid accident insurance policy could cost about $25 per month, offering more value and benefits.

Disability Insurance Rider

This type of rider provides extra coverage if you are disabled and can’t work. The rider won’t accelerate your death benefit like the accelerated death benefit rider. Instead, the carriers pay a separate benefit upon a disability. It is kind of like a separate policy from your life insurance policy.

We are huge proponents of disability insurance. However, this isn’t the way to obtain it.

Carriers that offer the disability insurance rider usually limit the benefits in several ways. For example, most of them cap the monthly benefit to a low amount, like $2,000. Or, the waiting period is too long, like 6 months.

They also limit the benefit period to 2 years. Additionally, they tend to have limited definitions of disability and benefits.

A better choice, as indicated earlier, is to have your own, separate disability insurance policy.

Return Of Premium Rider

A few carriers offer a return of premium rider on their term life insurance policies. Basically, if you outlive the term, you get all your premiums back (some carriers allow you to purchase extended term life insurance at that point, guaranteed issue).

Sounds great, but it may not be worth the extra cost.

What, John? My agent put this on my policy!

I am not a big fan of return of premium term plans except for the case of critical illness policies.

Let’s go back to our 30-year-old woman. We know that the $250,000, 30-year term costs $26 per month.

If she added a return of premium rider, her cost is now $40 per month.

So, if she takes the return of premium option and lives throughout the term, she will receive $14,400 back.

If she doesn’t take the return of premium rider, she won’t receive anything back, but she would have spent $9,360.

So, the total cost of this option (in this case) is $5,040.

She will spend $5,040 for $14,400.

Does that make sense? Can she do better?

Yes. If she invested that $14 per month in an IRA with an average annual growth of 8%, should could have about $21,000 in 30 years.

Yes, I know that $14 is subject to market risk and the extra cost of the life insurance is not.

Investing the extra cost on your own is an option.

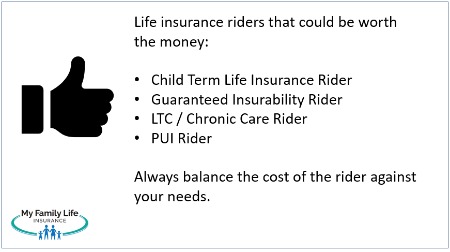

Life Insurance Riders That Could Be Worth The Money

Let’s discuss some riders that could be worth the extra cost. I believe these are the “best” life insurance riders available. However, as I said earlier, the best life insurance riders are those that meet your needs.

Child Life Insurance Rider

Children Life Insurance – As you might be aware, we are proponents of life insurance on children. Many financial planners (I have my CFP) are not. They will tell you it is a waste of money, and that you are better off getting more life insurance on yourself. That is true; you should. However, when you think about it, having some coverage on your child makes sense. While we can’t see the future, some children do develop health conditions later in life which could render them uninsurable.

will tell you it is a waste of money, and that you are better off getting more life insurance on yourself. That is true; you should. However, when you think about it, having some coverage on your child makes sense. While we can’t see the future, some children do develop health conditions later in life which could render them uninsurable.

Typically, the children’s life insurance option is a term rider of up to $25,000. The term usually is up to age 26 or if the owner cancels the policy sooner. Usually, all policies that offer a child term life insurance rider give the child or parent the ability to convert the term life insurance to a permanent life insurance plan.

If you are considering life insurance for your children through a rider on your policy, make sure the rider gives you the ability to convert that insurance to permanent insurance or continue it as a term policy when your child is an adult.

These plans don’t cost a lot. Moreover, many plans cover all children for a flat fee.

You typically have to answer a few health questions regarding your child. Carriers really want to make sure your child doesn’t have any moderate or severe health conditions. However, we have helped many families with children who have autism, down syndrome, and other severe ailments obtain life insurance. We are one of the few brokers that have access to guaranteed issue life insurance for children (subject to state availability).

Guaranteed Insurability Rider

Guaranteed Insurability Riders allow you to purchase additional coverage in the future with no evidence of health insurability. In other words, future purchases are guaranteed issue. Usually, you can purchase an additional $25,000 to $50,000.

These riders are common on whole life insurance plans.

We are a proponent of guaranteed insurability riders. They typically do not cost a lot of money and will give you the option, should you become table-rated or uninsurable, to purchase more insurance at no evidence of insurability. These options are a nice fit for permanent life insurance on the lives of children as the rider fee is usually very low. We recommend that you make sure the policy offers several age windows to purchase the additional insurance. If not, then the cost may not be worth it.

Chronic Illness Rider / Long-Term Care Rider

The chronic illness and long-term care rider are worth considering. Why? Because people 65 and over have a 7 out of 10 chance of needing some type of long-term care service.

But, John. I’m young. I don’t need long-term care!

Think again. While you are indeed young, many young adults such as yourself need long-term care services.

Getting some type of coverage now (while young and healthy) for long-term care or chronic illness / care services proves extremely beneficial.

It is definitely worth the extra cost. Note: plans that have the accelerated death benefit rider typically include long-term care coverage as “chronic care” or “chronic illness” coverage. Without getting into the details, long-term care insurance has to meet several requirements to be called “long-term care insurance” including how benefits are paid out. Both chronic illness and long-term care coverage typically have similar triggers for a benefit payout (i.e. can’t do 2 out of 6 activities of daily living or have cognitive impairment).

If you have any questions about any of the riders, please contact us.

FAQs About Life Insurance Riders

We answer common questions about life insurance riders.

Are Riders Included in My Life Insurance Policy by Default, or Do I Have to Add Them Separately?

Some riders are automatically included, like the terminal illness rider. Others, you will have to add at the time of application, such as a child term rider.

Can I Add Multiple Riders to My Life Insurance Policy?

Yes. It is common to have multiple riders on one policy.

How Much Does It Cost to Add a Rider to My Life Insurance Policy?

It really depends on the rider. We illustrated a couple of examples earlier in the article. A rider could add $5 to $10 or more to a monthly premium depending on the type of rider, the insured’s age, and the insured’s health condition.

Can I Remove a Rider from My Policy if I No Longer Need It?

You probably can, but then you have to ask yourself if you needed the rider in the first place.

Can I Add a Rider to My Existing Life Insurance Policy, or Do I Need to Purchase a New Policy?

You would need to purchase a new life insurance policy. Once a policy is in force, you can’t change it.

Are There Age Restrictions for Adding Certain Riders to a Life Insurance Policy?

Some riders do have age restrictions.

Do Riders Affect the Overall Premium Cost of My Life Insurance Policy?

Yes. Life insurance riders will increase the cost of your policy unless the rider is automatically included.

Are There Any Tax Implications Associated with Life Insurance Riders?

Generally speaking, no tax implications exist with life insurance riders. A common question we get is if the accelerated death benefit is taxable. It is not because the death benefit itself is not taxable. Please reach out to a qualified accountant or attorney for specific questions.

Can I Customize the Coverage Amount for Each Rider I Add?

With some riders, you can customize coverage.

What Happens to My Riders If I Lapse or Surrender My Life Insurance Policy?

If you lapse or surrender your policy, you also lose your life insurance riders. Make sure you stay timely with your life insurance payments.

Final Thoughts About Life Insurance Riders

We at My Family Life Insurance take a different approach when it comes to your situation. Unlike other agencies and agents, we tailor your insurance to meet YOUR needs, goals, and situations, not the other way around. We hope you found value and education with the most common and “best” life insurance riders and the ones you don’t need.

Feel free to call, text, or email us or use the form below. We only work in your best interests and are happy to answer any questions you have.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".