A Better Option For Life Insurance Waiver Of Premium Rider

Updated: April 12, 2024 at 9:39 am

You know that life insurance is important coverage. However, did you know that you still have to pay your life insurance premiums even if you are disabled, not working, and not making money? Therefore, many carriers offer a waiver of premium rider on their life insurance.

The life insurance waiver of premium rider waives your premiums if you are disabled and can’t pay the premiums on your policy.

Sounds great, right?

But, is it worth it? Have you checked? Do you know?

Moreover, do you know there are plenty of other affordable options?

Before you ask, where do I sign up, we feel you have a better option. In this article, we describe the waiver or premium and discuss a better option for the waiver of premium for life insurance.

We will discuss:

- What Is The Life Insurance Waiver Of Premium?

- Why Is It Not Worth The Money?

- What’s The Better Option?

- Now You Know An Affordable Option For The Life Insurance Waiver Of Premium

Let’s jump in and discuss what is the life insurance waiver of premium

What Is The Life Insurance Waiver Of Premium Rider

If you are reading this article, then likely an agent has presented to you a waiver of premium.

The waiver of premium is a rider, and it is just as it sounds. The life insurance waiver of premium rider waives your payment of life insurance premiums upon a covered disability.

Pretty simple, right?

While this sounds good, let’s analyze this rider in more detail. Is it worth your money?

Why The Life Insurance Waiver Of Premium Is Not Worth The Money

Many carriers offer a waiver of premium.

Many carriers offer a waiver of premium.

But, in my opinion, the life insurance waiver of premium rider usually is not worth the money.

As with anything, it’s important to analyze your own, specific situation. However, I always come to the same conclusion that your money is better spent elsewhere.

Why, John, you ask? Can you give me some specifics?

Yes! First, let’s analyze the cost. Let’s use an example.

Let’s assume a female named Laura, age 40, is a non-smoker and in standard health. She wants $500,000 of life insurance coverage and works as a dental hygienist, a very specialized profession. She is looking for a 20-year term life insurance policy.

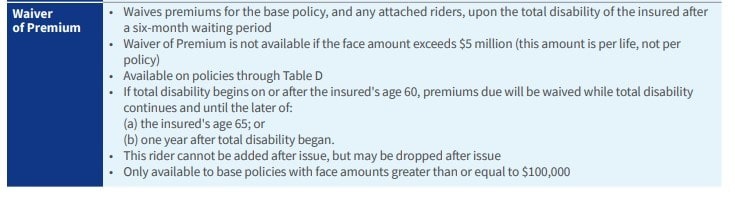

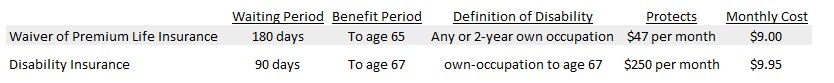

Her agent tells her about the waiver of premium and how 1 in 4 20-year-olds in their lifetime face a long-term disability. That has her worried, especially since she uses her hands a lot. The agent quotes her a $56 per month life insurance rate including the waiver of premium. Without the waiver, the life insurance premium is $47 per month. The waiver of premium costs an extra $9 per month. She feels good about it.

Is The Life Insurance Waiver Of Premium Rider A Good Decision?

Did Laura make a good decision?

In our opinion, no.

The agent should have told her what the waiver of premium’s definition of disability is. Additionally, the agent should have specified what grounds the carrier waives the premiums. In this case, the carrier’s definition of disability is the following:

- totally disabled (not partially, as we discuss next),

- meet a 6-month waiting period/elimination period,

- and, total disability means your inability to do any job for which you are fit by education, training, or experience (although some riders do have a 2-year own occupation definition).

What does this all mean? We discuss that next. After reading the next sections, you will have the power and understanding that most waivers of premium offered by life insurance companies are a waste of money. Yes, that is right! Even $9 per month!

What does this all mean? We discuss that next. After reading the next sections, you will have the power and understanding that most waivers of premium offered by life insurance companies are a waste of money. Yes, that is right! Even $9 per month!

Another way to look at this: Laura is spending $9 per month to protect $47 per month. Kind of costly from that point of view.

A Disability Insurance Policy Is The Better Option

We feel Laura is out of luck. The carrier likely won’t waive her life insurance premiums unless she has a catastrophic illness or injury.

Moreover, she has to wait 6 months to even be eligible for the benefit.

Chances are, her agent isn’t even aware of the detail behind the waiver of premium. If he or she did, maybe it would not have been offered.

Thankfully, she has a better option. What is it?

Simply enrolling in a long-term disability insurance plan.

Yes, it is that simple. Let’s discuss this further.

Why Long-Term Disability Insurance Is A Better Option?

For the same $9 per month, let’s see what kind of long-term disability options Laura has.

Instead of the life insurance waiver of premium that protects only $47, she could enroll in a long-term disability plan for a benefit of $250 per month. Her elimination period would be 90 days (instead of 6 months). She would have an own occupation definition (instead of the any occupation definition).

Her benefit period would last to age 67. Additionally. she will have the important partial disability benefit. This means she will receive a benefit if she can work, but not full-time.

You might be thinking, Ugh, John. I don’t want to enroll in another plan and go through underwriting.

Most disability insurance plans do not require full medical underwriting at this benefit level. The carrier looks up your background through the MIB and prescription drug databases. They may also require a phone interview. That’s about it.

See the comparison grid above. All decisions lead to disability insurance.

See the comparison grid above. All decisions lead to disability insurance.

Affordability Of Disability Insurance

All told, if Laura chose the above disability insurance plan, the premiums cost $9.95 per month. After paying for her life insurance premiums, Laura will have $203 left per month to spend on other important things. Think about that.

For the same cost as the life insurance waiver of premium rider.

If Laura felt she needed $1,000, she might be looking at $39 per month, give or take. Just over $1 per day. Less than a cup of coffee at your favorite coffee shop.

Whereas most people do not have proper disability insurance coverage anyway, we feel a long-term disability insurance plan is the prudent choice.

Look at the comparison grid again.

Now You Know A Better Option For The Life Insurance Waiver Of Premium

We feel a better option for the life insurance waiver of premium is a simple long-term disability insurance plan. The long-term disability insurance plan will offer more benefits and more coverage for potentially the same price or less. Sure, you have to fill out another application, but the underwriting is simplified.

Do you need assistance in determining the right disability insurance? We can help. Feel free to contact us or use the form below. As with everything we do, we only work with your best interests first and foremost.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".