Best Low Cost Burial Insurance For Seniors 2024 | Your Guide To Selecting The Right Burial Insurance For Your Situation

Updated: April 12, 2024 at 9:38 am

Many people and seniors ask me if we have low cost burial insurance available.

Many people and seniors ask me if we have low cost burial insurance available.

We do, and we at My Family Life Insurance have more options compared to other agents or brokers.

You see, many seniors go online or see an ad on TV about burial insurance and think that is the right carrier.

They then find out the burial insurance is going to be very expensive (for a variety of reasons we will discuss later). They then stop looking for this important insurance because they think burial insurance is all the same.

Burial insurance isn’t the same. Although the end result (paying a death benefit for your funeral expenses and final needs) is the same, how burial carriers asses your situation is different. No two carriers are the same.

This means many low cost burial insurance carriers exist. Additionally, many agents and brokers overlook these valuable, low-cost options.

In this article, we will discuss:

- What Is Burial Insurance?

- How To Find Low Cost Burial Insurance?

- Popular Burial Insurance Carriers

- The Best Low Cost Burial Insurance Options

- Low Cost Burial Insurance For Seniors In Their 50s and 60s

- Low Cost Burial Insurance For Seniors In Their 70s

- Low Cost Burial Insurance For Seniors In Their 80s

- How To Apply

- FAQs Low Cost Burial Insurance

- Now You Know Low Cost Burial Insurance Exists

Let’s jump in and level set about burial insurance.

What Is Burial Insurance?

Here is a secret. Burial insurance is simply a whole life insurance policy (typically. More on that in a minute.) with a small death benefit like $15,000 or $25,000. The life insurance industry calls it “burial insurance” because it is an easy way to describe its main intention – to pay for your burial expenses and final expenses upon your death.

That is all it is.

Consequently, you may hear or read different terms describing burial insurance. Some other names describing burial insurance include:

- final expense insurance

- funeral insurance

- final expense life insurance

- end-of-life insurance

- final expense policy

- burial policy

- senior life insurance

- burial life insurance

These all mean the same thing. These policies are typically whole life policies designed to pay for:

- funeral costs including your memorial service, if any

- burial plot and headstone

- medical bills

- your outstanding debts

- other end-of-life expenses

How Burial Insurance Works

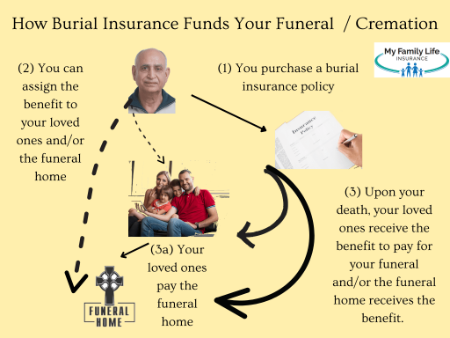

These burial insurance plans have some key advantages. First, they pay a lump

sum death benefit amount directly to your named beneficiary who can pay for your funeral. Additionally, many of these carriers allow you to assign all or part of the death benefit to a funeral home, mortuary, etc. That is a nice option. This brings us to the final advantage. Burial insurance policies help ease the financial burden placed on your loved ones and family members after your death.

As we discussed, the death benefit usually runs up to $25,000. Some policies allow for a greater death benefit.

According to the National Funeral Directors Association, the average cost of a funeral is about $7,500. As such, these burial insurance plans work well to pay for your funeral, final arrangements, and other related costs.

Additionally, applying for these burial insurance plans is easy. Carriers don’t require a medical exam. We discuss more in our underwriting section.

How To Find Low Cost Burial Insurance – Underwriting!

The key to finding low cost burial insurance is underwriting. Underwriting is simply the process of analyzing risk. In your case, the risk is too early of death.

Oh geez, John. Am I going to have to go through exams and take a blood test?

No. The great news is that burial insurance traditionally has an easy underwriting process. The list below shows what burial insurance carriers look at when assessing your risk (i.e. the risk of dying too soon):

- age

- gender

- nicotine use status (note: marijuana use is usually OK)

- any health issues – carriers cover many medical conditions such as heart issues, bipolar disorder, diabetes, etc.

They do this by:

- looking up your medical history through the MIB

- prescription drug history

- a possible phone interview

- answers to a health questionnaire (i.e. an application)

Essentially, the better your health, the more low cost burial insurance options you will have. We will show more in a minute.

The application is probably one of the easiest components of the burial insurance process. Every carrier has a list of health questions to answer related to specific health conditions. The great thing about burial insurance underwriting is that all of the carriers don’t usually consider common ailments like high blood pressure or high cholesterol. If you have these ailments only, you can obtain burial insurance rather easily.

Additionally, carriers will cover serious health problems. People with or who have had cancer, heart problems, stroke, sleep apnea, COPD, surgeries, or other major illnesses or health conditions can obtain low cost burial insurance.

Burial Insurance Application And Process

The application and approval process is simple. You just answer and fill out an application containing a “yes/no” health questionnaire and then the carrier looks up your medical history. If all checks out, you are approved for burial insurance.

A typical question on the application could go something like this.

Within the past 2 years, has the proposed insured been diagnosed with, prescribed medication for, or had or been advised to have treatment for chronic obstructive pulmonary disease or emphysema?

You just answer “yes” or “no” on the application. They will then look up your medical history through the MIB and your prescription drug history. Most burial insurance carriers have eliminated the phone interview (although a handful still requires it).

If all checks out, then you will likely obtain immediate coverage burial insurance.

What do you mean by “immediate coverage” burial insurance, John?

This might be a good time to introduce the types of burial insurance.

Types Of Burial Insurance Plans For Seniors

A few types of burial insurance exist for seniors.

The types available to you are directly proportional to your health and how carriers underwrite. It is that simple.

The first one is called an immediate death benefit. Some carriers call it a level benefit plan.

They mean the same thing. It means if you pass away, anytime, your family receives the death benefit. It doesn’t matter if you pass away 3 months after your policy is in force or 20 years later.

They mean the same thing. It means if you pass away, anytime, your family receives the death benefit. It doesn’t matter if you pass away 3 months after your policy is in force or 20 years later.

An immediate death benefit plan is what you want. Not only is the full death benefit available to you (more on that in a minute), but also it is likely the lowest-cost option. Immediate death benefit plans are available for those people in good health.

The second is called a graded death benefit plan. People with recent, serious health conditions usually get graded benefit plans. For example, people who have had a stroke or heart attack within the last couple of years usually only qualify for a graded death benefit plan.

Graded benefit means that your beneficiary receives a percentage of the death benefit if you pass away from natural causes or illnesses in the first couple of years. For example, if you die from a heart attack in the first year, your beneficiary may receive 10% of the death benefit.

Guaranteed Issue Whole Life Insurance For Seniors

Finally, the remaining plan is called guaranteed issue whole life insurance. Only the seriously ill are eligible for this type of policy. Guaranteed issue is just how it sounds. You apply and have life insurance. No underwriting exists.

However, it is also the most expensive option (usually). Additionally, because carriers do not underwrite, they place a waiting period on the death benefit, which is usually 2 years. That means if you die from any natural causes or illnesses during the waiting period, then your beneficiaries receive the premiums you paid + any interest. These plans cover accidental death during the waiting period.

Note: if you have a terminal illness, then really no burial insurance option is right for you. You are best to save your money or work directly with a funeral home.

Popular Burial Insurance Carriers For Seniors

We aren’t going to belabor what’s been written on the internet already. You came here for low cost burial insurance, not the same-old-same-old information. Look up “low cost burial insurance” in Google or anywhere else, and you will find “guides”, “best of”, “best companies”, and “top 10 lists” of these supposedly “low cost” burial insurance policies.

You will see lists containing Mutual of Omaha, Transamerica, Royal Neighbors, etc, etc. These are all very good and well-capitalized carriers. They offer traditional whole life insurance policies that are the common structure of burial insurance. We offer these carriers to our clients as well.

Other popular carriers include the ads you see on TV. Colonial Penn, in particular, advertises a lot on TV.

These TV options may not be in your best interest. As we wrote in our article about Colonial Penn, they may not be worth the money. For example, Colonial Penn’s “995” plan is strictly a guaranteed acceptance life insurance policy. It is guaranteed issue. Their commercials sound and look good. However, they do not offer the lowest rates and may not be the best option for your situation. What if you are generally healthy? If you purchase Colonial Penn, you will be spending (likely) thousands of dollars more per year than you have to. Moreover, you have the waiting period to contend with.

Our goal in working with you is to find the lowest cost, immediate coverage burial insurance policy you can find for your given situation. For example, your choices of carriers are very limited if you have type 1 diabetes or had cancer 2 years ago.

Additionally, if your monthly premium is $100, and you have immediate coverage, then that is the best choice.

Having said all this, we introduce 2 low cost burial insurance options for seniors.

The Best Low Cost Burial Insurance For Seniors

We have two different, low cost options for seniors looking to save money on their burial insurance.

Yes, that is right. Low cost burial insurance does exist.

We describe them next.

The application process is a bit similar to that of traditional burial insurance. Both options offer a simplified application process where you likely won’t need to submit a paramedical exam.

Some of these aren’t final expense policies in the traditional sense. However, they are life insurance policies. Remember, burial insurance is simply a whole life insurance policy that pays a small, lump sum death benefit.

Guaranteed Universal Life Insurance

Often overlooked as burial insurance, guaranteed universal life (GUL) is an interesting option. Guaranteed universal life insurance is considered a permanent life insurance plan like whole life. However, guaranteed universal life operates much differently than whole life, specifically with the cash value.

The cash value in a comparable whole life policy, increases over time. It is a stable policy with guaranteed cash value and non-guaranteed cash value. Carriers guarantee the monthly premiums, too. As we said before, traditional burial insurance is a whole life policy with a small death benefit.

Without getting in the weeds, however, a traditional universal life insurance policy doesn’t have all those guarantees. You can pay as little as you want or more than the “target” premium. While paying little sounds great, doing so has potentially dire consequences with your universal life policy. If not enough cash value exists to support the cost of insurance, and you aren’t going to pay more into the policy, the policy itself terminates.

Without getting in the weeds, however, a traditional universal life insurance policy doesn’t have all those guarantees. You can pay as little as you want or more than the “target” premium. While paying little sounds great, doing so has potentially dire consequences with your universal life policy. If not enough cash value exists to support the cost of insurance, and you aren’t going to pay more into the policy, the policy itself terminates.

However, not with guaranteed universal life insurance! As long as you pay the target premium, the GUL keeps going, even if there is no cash in the policy. The fact there is limited cash provides a low cost burial insurance option.

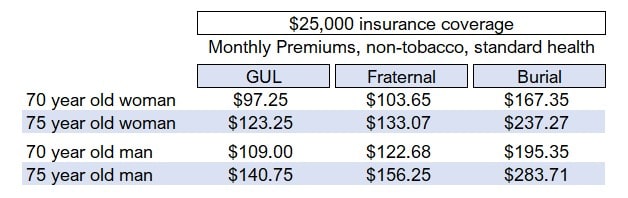

Here is a premium comparison for $25,000 of burial insurance for a healthy, 60 year old non-smoking woman.

With whole life insurance, she could expect to pay, at minimum, around $98 per month.

With a GUL, the same woman could pay around $70 per month – a $28 difference per month.

Guaranteed Universal Life Insurance Helps With Medicaid

Additionally, since there is likely no cash value in the later years of the policy, she likely won’t have to worry about losing her burial insurance through the Medicaid spend down process.

The underwriting process is simplified, but a little more stringent. I would say you have to be more “healthy” than someone who can qualify for traditional burial insurance. However, even if you take a couple of basic medications and have good height/weight, you will qualify.

We have helped many people enroll in GULs for burial insurance. I am sure we can help you, too.

Not-For-Profit Life Insurance

Why pay more when you can get the same product, essentially, for less?

Let’s compare two cars. They are the same. Same engine. Same color. The suspension is the same. The safety rating is also the same. Same radio, too. Maybe with the exception of a few nuances, they are essentially the same. Would you spend an extra $15,000 on one of the cars? Yeah, likely not! The same goes for burial insurance. There are a lot of burial insurance carriers available. They are all essentially the same. We discussed that nuances among carriers exist, usually with underwriting, but they all are generally the same. If you could purchase your burial insurance for less money, wouldn’t you? Yeah, that is right, you would.

Many people don’t realize that there are life insurance carriers that are “not-for-profit”. I know. Crazy, right?

What Are Not-For-Profit Life Insurance Carriers?

Carriers that offer not-for-profit life insurance are called fraternal benefit societies. These societies were initially established for a certain sect of people. For example, many European immigrants established these societies here in the US to help their fellow kind as well as to create social events. Over time, some religions developed fraternal benefit societies (for example, the Catholic Order of Foresters). Today, while these societies exist, many have evolved and opened to anyone with a common, social goal.

The American Fraternal Alliance has more information about fraternal benefit societies. They are not-for-profit. Any profits they make, within IRS guidelines, must be issued back through the fraternal society, back to its members and communities. In other words, the profits go back to you in the form of member benefits, charitable giving, and other social events.

Additionally, the not-for-profit status makes, in general, life insurance rates comparatively less than their for-profit counterparts. Why? They are not beholden to profits, but rather that not-for-profit, social mission. Let’s use that example again of the 60 year-old, non-smoking woman looking for $25,000 of burial insurance.

She could purchase that $25,000 through a for-profit carrier at $98 per month. Or…

She could purchase that $25,000 through one of the fraternal carriers we work with for $61 per month!!!

Wow!!

Moreover, the above fraternal premium assumes dividend-paying paid-up additions. Most fraternal benefit societies offer paid-up additions on their whole life insurance. This means the fraternal life insurance certificate is dividend-paying. You receive dividends back and can elect to purchase more life insurance with these dividends.

What could you do with $37 per month savings? I bet a lot.

More On Fraternal Life Insurance And Fraternal Societies

A lot of agents like to disparage fraternal societies. They say their financials aren’t strong, they are smaller (in asset size), and they can’t serve customers, or their AM Best rating is inadequate.

Many of these anecdotes are completely not true. Many of these societies have been around since the mid and late 1800s and have seen every economic crisis in the United States. War. The Great Depression. Economic Growth. Recessions. You name it. They have paid their claims and haven’t skipped a beat.

Additionally, many of them are conservative with their member’s money. Don’t you want your money to be there when you need it the most? Of course, you do. And, yes, some of their AM Best ratings aren’t “A” like the for-profit carriers. They might be B+. Is that a bad thing? Some agents say “yes”; however, many of these fraternals have stronger solvency ratios, liquidity, and reserves/surplus than their for-profit counterparts. That is something these agents don’t talk about. They are just small carriers.

It is important to note that we are neither for nor against fraternal benefit societies. We are for YOU! If that means a for-profit serves your situation better, that is what we will recommend. If a fraternal carrier does, then obviously that is what we will recommend. We are not beholden to any life insurance carrier or commission. We are beholden to serving you.

However, we do work with many more fraternal carriers than the average broker. Contact us if you would like to learn more.

We introduce premium comparisons next. Of course, premiums are examples and subject to change.

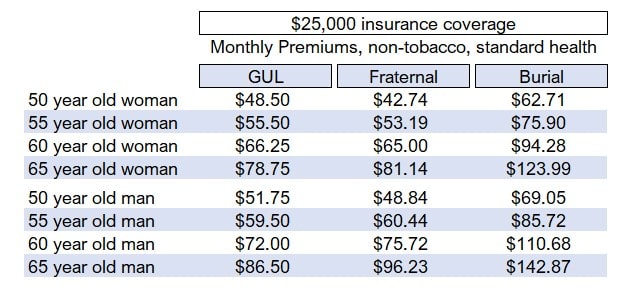

Low Cost Burial Insurance For Seniors In Their 50s And 60s

Here are some low cost burial insurance comparisons for seniors in their 50s and 60s. These are example purposes only and premiums are subject to change. Additionally, available burial insurance options depend on your specific situation. If you would like to quote your own burial insurance, feel free to use the quoter below:

As you can see, the GUL and fraternal carriers are more competitive on average compared to traditional burial insurance:

Low Cost Burial Insurance For Seniors In Their 70s

Here are additional comparisons for burial insurance for seniors in their 70s.

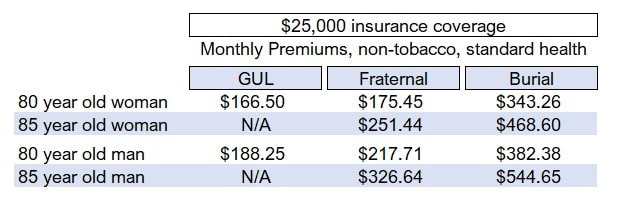

Low Cost Burial Insurance For Seniors In Their 80s

As seniors age, the cost of burial insurance increases. GULs and fraternal carriers remain competitive, assuming seniors qualify.

Note: not many options exist for seniors in their 90s.

How To Apply For Low Cost Burial Insurance

Applying for burial insurance is easy. All you need to do is:

(1) contact us

(2) tell us your situation, including any health conditions and medication

(3) we prequalify you with carriers, many which are low cost

(4) you apply with us over the phone

It is really that simple.

Frequently Asked Questions About Low Cost Burial Insurance For Seniors

Here are some frequently asked questions about low cost burial insurance.

Can I Buy Burial Insurance For My Parents?

Yes, you can buy burial insurance for your parents. You and your parents just need to be on the phone with us during the application process. You can always contact us beforehand and prequalify your parents. We just need to know your parent’s health history including any medication they are on.

We then get on a call to enroll your parents over the phone.

As said before, as long as you are transparent with your parent’s health conditions and medication, we should be able to get them the burial insurance they need, including options from the low cost carriers we discussed.

What Are The Age Limits To Buy Burial Insurance?

The age limits usually are between 50 and 80; however, some carriers go as low as age 18. Only very few carriers offer burial insurance after the age of 85. Contact us for more information.

Does Burial Insurance Pay For My Funeral?

Yes, burial insurance can pay for your funeral and burial costs. You select a trusted loved one as the beneficiary who will pay for your funeral or assign all or part of the death benefit to the funeral home.

Does Burial Insurance Cover Accidental Death?

Yes, burial insurance (and the other life insurance plans we discussed) all cover accidental death. As we discussed, Immediate or level benefit plans pay a benefit on day 1 for any type of death. Graded and guaranteed issue plans are set up differently. They have a waiting period. These plans will always pay for an accidental death, anytime. If you pass away during the waiting period from illness or natural causes, your beneficiary receives a percentage of the death benefit or the premiums you paid + interest. After the waiting period, the carrier pays 100% of the death benefit.

Do Pre-Need Plans Work?

Pre-need plans are funeral or burial plans purchased directly from the funeral home. They can work, but I believe having some type of life insurance in your name offers way more flexibility than working directly with a funeral home. We discuss many of the advantages and disadvantages of pre-need plans in our guide to having life insurance pay for your funeral. We also discuss many of the advantages life insurance contains over these pre-need plans.

What Are Plans That I Should Not Buy?

Many life insurance products exist that do not work well. Here are a few plans that you should not buy unless these are your only options based on your situation:

(1) term life insurance policy – these policies are great for your unexpected death. Additionally, they only last a term, like 20 years. What happens if you are still living after the term expires? Your family gets no death benefit.

However, if you want coverage for your funeral, a permanent life insurance policy like the ones we discussed in this article works. As long as you pay the premium, the death benefit coverage amount is guaranteed and goes right to your beneficiaries.

(2) pre-need plans – we discussed this previously. Pre-need plans lack the flexibility of burial insurance policies or permanent life insurance policies. Moreover, they are generally more expensive. We discuss many of the disadvantages of pre-need plans.

(3) guaranteed issue life policies – These are good policies, but are reserved for people who have severe health conditions or lifestyle situations. The reason why I say you should not buy them is because most people qualify for something better. However, as I said, if this is all you can get, then these are good policies.

Can I Lie On The Life Insurance Application?

No. Carriers have ways of finding out if you lie nowadays. Don’t even think about lying on the life insurance application. As one underwriter told us, paraphrasing, if we feel the applicant is conscientiously lying, we will decline. Carriers have ways of finding out things, so be truthful.

Now You Know Seniors Can Get Low Cost Burial Insurance

We hope you enjoyed this article on low cost burial insurance options for seniors. While traditional burial insurance is available, we have helped many individuals obtain low cost burial insurance through:

- guaranteed universal life insurance and

- whole life insurance policies issued through fraternal carriers

What is the right choice for you? That is where we can help. In every case, the right solution is the one that fits your needs and situation. Not someone else’s and definitely not the life insurance agent’s interest.

We at My Family Life Insurance pride ourselves on serving our clients with their best interests first. It is the only way we know how. If you were presented with a burial insurance plan and want to know your other options, or want to work with an agency that values you and your family, contact us, or use the form below. We would be happy to help and serve you in any way we can.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".